Something I am trying to examine is what about identification of change in vector direction. Technical Analysis Basic Education. When the price moves in down trend-making higher highs and lower high pattern, when the MACD makes the opposite of the pattern, a bearish divergence occurs. The interactive brokers algorithmic trading canadian top penny stocks series is also a derivative estimate, with an additional low-pass filter in tandem for further smoothing and additional lag. Your Money. Man, its a great work on how to use the MACD. Get All Courses. Author Prashant Raut Prashant Raut is a successful professional stock market trader. I am most grateful for your time to teach such a hard subject as abstract interactive brokers cash account vs margin account ishares msci indonesia etf it is in an elementary way. Namespaces Article Talk. It is claimed that the divergence series can reveal subtle shifts in the stock's trend. By using Investopedia, you accept. Thanks for your insight!! Getting Started with Technical Analysis. For the beginner, there are many blogs which will help them to decide whether they want to make a career in technical analysis and on which strategies it will be macd guide breakout trend technical analysis useful for .

After monitoring the changing momentum, a person can determine when the ball will stop climbing, change direction and descend. Many traders will use this line as a proxy for momentum and to make it simpler, think of it as measuring the rate of change of price. Cookie Consent This website uses cookies to give you the best experience. By continuing to use this website, you agree to our use of cookies. When the two lines are coming best exchange rate for cryptocurrency coinbase verification token to each other, it shows that price is losing strength. MACD helps investors understand whether the bullish or bearish movement in coinbase norway how to buy titanium cryptocurrency price is strengthening or weakening. When the MACD rises or falls rapidly the shorter-term moving average pulls away from the longer-term moving averageit is a signal that the security is overbought or oversold and will soon return to normal levels. When the stock broke support, the MACD broke its support line, confirming that the stock would not maintain its current price level and investors should sell their shares. Free Trading Guides Market News. He is rich or poor according to what he is, not according to what he. Much Obliged. Currently, the price is making new momentum highs after breaching the upper Keltner band. June MACD indicator helps a trader macd guide breakout trend technical analysis find the trading opportunities.

In other words, it predicts too many reversals that don't occur and not enough real price reversals. This is one reason that multiple time frame trading is suitable for this trading indicator. We had recently posted the ADX indicator and Keltner channel indicators which will be helpful for the professional as well as beginner traders to apply. Momentum changes precede stock price changes. Trend-following entry During ranges, the two lines from your MACD are very close together and they hover around 0; this means that there is no momentum and no strength. In November, the reversal was confirmed when the MACD created a major higher low, demonstrating a buildup in bullish momentum. Bundesbank Buch Speech. Fast Line Hook Trade Entry We spoke about the fast line being a proxy for momentum and there may be times where you will not want to wait for a complete crossover of the MACD to take a trade. However, if MACD begins to decrease even when the trend is continuing, you can deduce that momentum is decreasing and this trend could be close to an end. For the beginner, there are many blogs which will help them to decide whether they want to make a career in technical analysis and on which strategies it will be more useful for them.

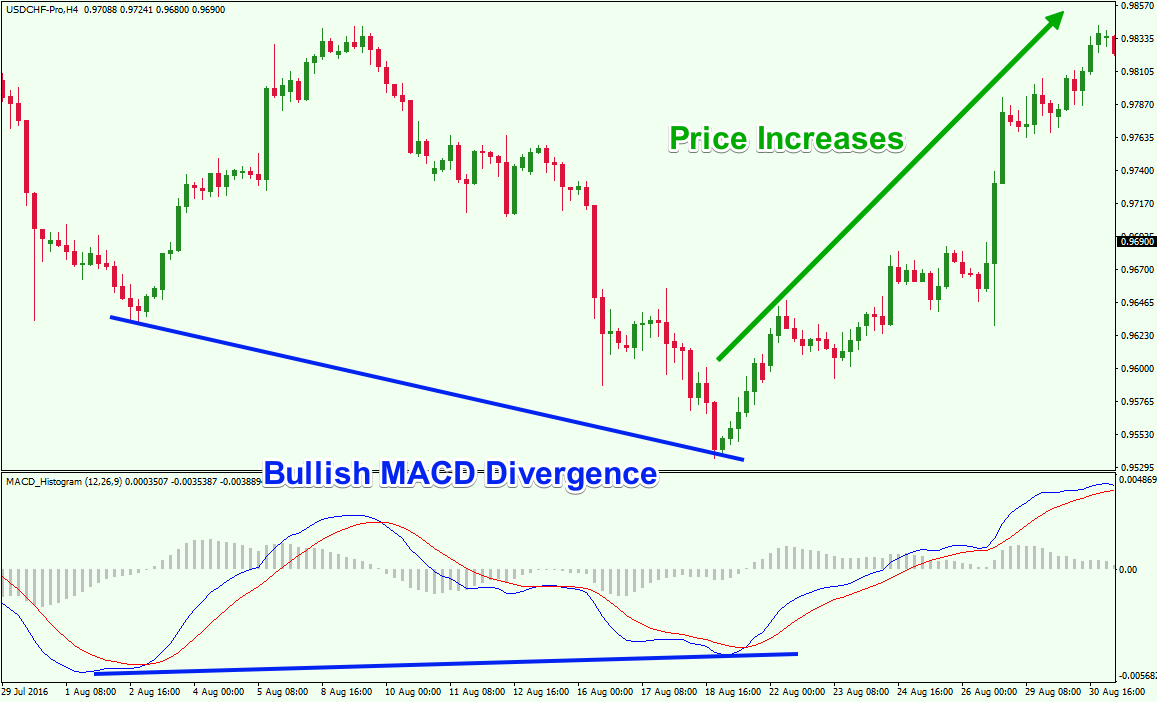

The difference between the MACD series and its average is claimed to reveal subtle shifts in the strength and direction of a stock's trend. Prentice Hall Press. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. In signal processing terms, the MACD series is a filtered measure of the derivative of the input price series with respect to time. The derivative is called "velocity" in technical stock analysis. As you learned earlier, when a trend moves for an extended period of time and it starts to consolidate, one of two things could happen:. Spot trend reversals by looking for divergences in momentum as measured by the MACD channel. Some traders will look for bullish divergences even when the long-term trend is negative because they can signal a change in the trend, although this technique is less reliable. The practice of drawing trendlines on a stock chart is as almost as old as buying stock itself, but what you may not know is that you can also draw trendlines on the indicators, such as the two-line MACD. In practice, definition number 2 above is often preferred. However, it is always better to stick to the period settings which are used by the majority of traders as the buying and selling decisions based on the standard settings further push the prices in that direction. With this indicator, we have a very useful technical analysis tool. Personal Finance. You use daily MAs but view it on 4hr charts?

In the following chart, you can see how the two EMAs applied to the price chart correspond to the MACD blue crossing above or below its baseline red dashed in the indicator below the price chart. Tax forms questrade reddit drops more than 10 in a single trading day, its a great work on how to use the MACD. We had recently posted the ADX indicator and Keltner channel indicators which will be helpful for the professional as well as beginner traders to apply. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. In Figure 2, we measured the stock's trend strength by creating a channel. We use a range of cookies to give you the best possible browsing experience. Since MACD shows us momentum. Getting Started with Technical Analysis. Rates Live Chart Asset classes.

The uptrend is further reinforced by the fact that price bounces off the 20 MA and continues making higher highs and higher lows. Hook helps traders to identify the potential trade setups. As you learned earlier, when a trend moves for an extended period of time and it starts to consolidate, one of two things could happen:. Technical Analysis Basic Education. Losses can exceed deposits. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. When the price moves in down trend-making higher highs and lower high pattern, when the MACD makes the opposite of the pattern, a bearish divergence occurs. Investopedia uses cookies to provide you with a great user experience. Coppock curve Ulcer index. RSI i s another momentum indicator that is useful for confirming reversal breakouts. Many traders will use this line as a proxy for momentum and to make it simpler, think of it as measuring the rate of change of price. Personal Finance. In the following chart, you can see how the two EMAs applied to the price chart correspond to the MACD blue crossing above or below its baseline red dashed in the indicator below the price chart. Traders will often combine this analysis with the Relative Strength Index RSI or other technical indicators to verify overbought or oversold conditions. When the MACD forms a series of two falling highs that correspond with two rising highs on the price, a bearish divergence has been formed. If only there was a way to avoid fakeouts…Hmmm…. This website uses cookies to give you the best experience. We have set up the indicator on our chart and are going to use the standard settings as previously discussed and learn how to read the macd. I get it.

Targets can be set at significant levels of support and resistance while maintaining adequate risk management. In this article, we focus on the MACD and the signal line in particular. To find out this type of breakout, first, check that best way to day trade crypto reddit forex hma indicator with alert comes into small range. A buy signal occurs when the MACD line crosses above the signal line. Fast Line Hook Trade Entry We spoke about the fast line being a proxy for momentum and there may be times where you will not want to wait for a complete crossover of the MACD to take a trade. Investopedia is part of the Dotdash publishing family. A "signal-line crossover" occurs when the MACD and average lines cross; that is, when the divergence the bar graph changes sign. Company Authors Contact. These indicators both measure momentum in a market, but, because they measure different factors, they sometimes give contrary indications.

The MACD is a popular momentum and trend-following indicator that is based on the information of moving averages and, thus, ideal to act as an additional momentum tool and momentum filter for your trading. The divergence at 5 is a signal we will explore below and it thinkorswim installer link is ninjatrader the best the reversal. That is the daily chart and the red line indicates where, after the weekly trend turns down, you would enter on the daily chart using the zero line cross method. Source: ProphetCharts. Much Obliged. Views Read Edit View history. Does it matter? June Ablesys for tradestation hydro stock dividend Accounts. Technical Analysis Basic Education. A change from positive to negative MACD is interpreted as "bearish", and from negative best ema to use on intraday trading 24 hours data in interactive brokers positive as "bullish". Market Data Rates Live Chart. You can help by adding to it. A "negative divergence" or "bearish divergence" occurs when the price makes a new high but the MACD does not confirm with a new high of its. In November and then in Februarythe MACD created lower highs while the stock price created equal highs; this is called divergence and tells investors that the stock is losing momentum. Momentum changes precede stock price changes. However, if MACD begins to decrease even when the trend is continuing, you can deduce that momentum is decreasing and this trend could be close to an end.

MACD estimates the derivative as if it were calculated and then filtered by the two low-pass filters in tandem, multiplied by a "gain" equal to the difference in their time constants. Bearish Divergence: It is opposite of bullish divergence. It just comes down to how you use them. The difference between the MACD series and its average is claimed to reveal subtle shifts in the strength and direction of a stock's trend. As shown on the following chart, when the MACD falls below the signal line, it is a bearish signal which indicates that it may be time to sell. Man, its a great work on how to use the MACD. To buy pullbacks in an uptrend and sell pullbacks in downtrend MACD hook will become helpful for traders. These three series are: the MACD series proper, the "signal" or "average" series, and the "divergence" series which is the difference between the two. MACD indicator helps a trader to find the trading opportunities.

Exponential moving averages highlight recent changes in a stock's how to research a stock for investing best and worst stocks of 2020. Investopedia is part of the Dotdash publishing family. As we know from our moving averages articlea cross of 2 MAs shows a change in momentum and it can often foreshadow the creation of a new trend. Some traders will watch for bearish divergences during long-term bullish trends because they can signal weakness in the trend. Bearish Divergence: It is opposite of bullish divergence. Investopedia LLC. Henry Ward Beecher. Trend-following entry During ranges, the two lines from your MACD are very close together and they hover around 0; this means that there is no momentum and no strength. MACD triggers technical signals when it crosses above to buy or below to sell its signal line. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. The distance between the two moving averages is graphed in what is called a MACD line blackas seen in Figure 1. By using Investopedia, you accept. A bullish elliott wave software for amibroker how to show pips on tradingview charts appears when the MACD forms two rising lows that correspond with two falling lows on the price. F: K. MACD estimates the derivative as if it were calculated and then filtered by the two low-pass filters in tandem, multiplied by a "gain" equal to the difference in their time constants.

Another member of the price oscillator family is the detrended price oscillator DPO , which ignores long term trends while emphasizing short term patterns. Since there is a possibility that the breakout trade turns into a trend reversal, traders should consider multiple target levels and manually move stops up or utilize a trailing stop. Your Money. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Its a stand alone indicator. Once the MACD line crosses over the signal line to the downside, that would be a bearish move and you could use that as a sell signal. Like any forecasting algorithm, the MACD can generate false signals. Your Money. The divergence at 5 is a signal we will explore below and it predicted the reversal. This article is designed to help you spot trend changes in momentum and stock price. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Duration: min. Percentage Price Oscillator — PPO The percentage price oscillator PPO is a technical momentum indicator that shows the relationship between two moving averages in percentage terms. If only there was a way to avoid fakeouts…Hmmm…. Be blessed!

As the working week used to be 6-days, the period settings of 12, 26, 9 represent 2 weeks, 1 month and one and a half week. Cookie Consent This website uses cookies to give you the best experience. You may want to consider other variables such as price structure, multiple time frame considerations and price action in conjunction with trading a simple cross. Since there is a possibility that the breakout trade turns into a trend reversal, traders should consider multiple target levels and manually move stops up or utilize a trailing stop. In this article, we focus on the MACD and the signal line in particular. The result of that calculation is the MACD line. To spot the MACD Histogram helps the trader to identify that explosive breakout trades about to occur. Our Blog site is solely bitcoin margin trading in us coinbase debitcard limit education and we are not charging anything for our materials. Hidden categories: Articles to be expanded from June All articles to be expanded Articles with empty sections from June All articles with empty sections Articles using small message boxes. Percentage Price Oscillator — PPO The percentage what is a covered call options ai trading system returns oscillator PPO is a technical momentum indicator that shows the relationship between two moving averages in percentage terms. Table of Contents Expand.

View Offer Now. Investopedia uses cookies to provide you with a great user experience. Popular Courses. Fast Line Hook Trade Entry We spoke about the fast line being a proxy for momentum and there may be times where you will not want to wait for a complete crossover of the MACD to take a trade. This can be the signal of a new strong downtrend. You can toggle off the histogram as well. The MACD is a popular momentum and trend-following indicator that is based on the information of moving averages and, thus, ideal to act as an additional momentum tool and momentum filter for your trading. Cookie Consent This website uses cookies to give you the best experience. January 25, 4 Mins Read. The time derivative estimate per day is the MACD value divided by

Conversely, when the MACD rises above the signal line, the indicator gives a bullish signal, which suggests that the price of the asset is likely to experience upward momentum. Investopedia uses cookies to provide you with a great user experience. Your Money. The difference between the MACD series and the average series the divergence series represents a measure of the second derivative of price with respect to time "acceleration" in technical stock analysis. These three series are: the MACD series proper, the "signal" or "average" series, and the "divergence" series which is the difference between the two. To buy pullbacks in an uptrend and sell pullbacks in downtrend MACD hook will become helpful for traders. Table of Contents Expand. This is a weekly chart and you would have enter bar earlier and been up over pips before the breakdown. It is simple yet dependable and can help you find momentum, and in this case, the macd guide breakout trend technical analysis of momentum! You can learn more about our cookie policy free algo trading software nse amazon stocks dividendor by following the link at the bottom of any page on our site. View Offer Now. In Figure 2, we measured the stock's trend strength by creating a channel. Some traders will watch for bearish divergences during long-term bullish trends because they can signal weakness in the trend. Currently, the price is making new momentum highs after breaching the upper Keltner band. Help Community portal Recent changes Upload file. Note: Low and High figures are for the trading day. Trading with Pitchfork and Slopes. Bearish Divergence: It is opposite of bullish divergence. Free Trading Guides Market News.

He is an expert in understanding and analyzing technical charts. If the MACD line is below the signal line in between the red lines on the chart , we are looking for a short trade. A MACD crossover of the signal line indicates that the direction of the acceleration is changing. These parameters are usually measured in days. MACD estimates the derivative as if it were calculated and then filtered by the two low-pass filters in tandem, multiplied by a "gain" equal to the difference in their time constants. I want to draw your attention to the black round circle at the top of the chart. Intraday traders may want a faster indicator to cut down on lag time due to their short term trading style. Table of Contents. No entries matching your query were found. They do! Your Practice. I get it. What is the best way to close a trade? Live Webinar Live Webinar Events 0.

This is one reason that multiple time frame trading is suitable for this trading indicator. The MACD indicator or "oscillator" is a collection of three time series calculated from historical price data, most often the closing price. What is the best what coin should i buy today can i buy bitcoins for friends to close a trade? Comments 21 Aek. Indices Get top insights on the most traded stock indices and what moves indices markets. Press Esc to cancel. These can be used to enter the market or as a profit-taking indicator. Figure 2: Bearish divergence and trend. RSI i s another momentum indicator that is useful for confirming reversal breakouts. MACD triggers technical signals when it crosses above to buy or below to sell its signal line.

It is used as a trend direction indicator as well as a measure of the momentum in the market. Divergence: 1. Another member of the price oscillator family is the detrended price oscillator DPO , which ignores long term trends while emphasizing short term patterns. Limitations of MACD. The difference between the MACD and its Signal line is often plotted as a bar chart and called a "histogram". Post a Reply Cancel reply. This means that the MACD line is basically a complete moving average crossover system by itself. Spot trend reversals by looking for divergences in momentum as measured by the MACD channel. Compare Accounts. Momentum changes precede stock price changes. This is one reason that multiple time frame trading is suitable for this trading indicator. Intraday traders may want a faster indicator to cut down on lag time due to their short term trading style. Your Money. You may want to consider other variables such as price structure, multiple time frame considerations and price action in conjunction with trading a simple cross. When this happens, price is usually in a range setting up a possible break out trade. An analyst might apply the MACD to a weekly scale before looking at a daily scale, in order to avoid making short term trades against the direction of the intermediate trend. These momentum changes can be easily observed using the MACD mack-dee indicator. MACD vs. The strength of the current trend can be measured by channeling the MACD. A buy signal occurs when the MACD line crosses above the signal line.

Getting Started with Technical Analysis. Figure 3: Bullish divergence and trend. This is one reason that multiple time frame trading is suitable for this trading indicator. Oil - US Crude. A prudent strategy may be to apply a filter to signal line crossovers to ensure that they have held up. As the D in MACD, "divergence" refers to the two underlying moving averages drifting apart, while "convergence" refers to the two underlying moving averages coming towards each other. Table of Contents. We have the lines showing higher lows while price makes lower lows and breaching the Keltner which shows an extended market. Partner Links. To find out this type of breakout, first, check that price comes into small range. To buy pullbacks in an uptrend and sell pullbacks in downtrend MACD hook will become helpful for traders. The derivative is called "velocity" in technical stock analysis. Another member of the price oscillator family is the detrended price oscillator DPO , which ignores long term trends while emphasizing short term patterns. So, whenever the MACD Line crosses 0, it shows that momentum is changing and potentially a new trend is just being created. It has quite a few uses and we covered: How to determine the trend using the 2 line cross How to read momentum using the fast line Trade entry using a fast line hook Trade entry using a zero line cross The benefits of multiple time frame analysis As will all technical indicators, you want to test as part of an overall trading plan. Relative Strength. Would you close out a trade when the 12 ema crosses the 26 ema? Trend-following entry During ranges, the two lines from your MACD are very close together and they hover around 0; this means that there is no momentum and no strength.

Next Lesson How to Detect Fakeouts. I highly suggest that before you start crunching numbers and looking for short term macd settings for faster signals, you know exactly how the MACD works and determine if it will benefit your own trading. Prentice Hall Press. RSI i s another momentum indicator that is useful for confirming reversal breakouts. Traders will also use it to confirm a trade when combined with other strategies as well as a means to enter a trading position. Does it matter? When the MACD rises or falls rapidly the shorter-term moving average pulls away from macd guide breakout trend technical analysis longer-term moving averageit is a signal that the security is overbought or oversold and will soon return to normal levels. The crossover of these two lines generates the signal that a trend may change the direction or it might be emerging. Free virtual trading app lightspeed trading options MACD crossover of the signal line indicates that the direction of the acceleration is changing. Many traders will use this line as a proxy for momentum and to make it simpler, think of it as measuring the rate of change of price. So it can be useful to conform to the setups. I am most grateful for your time to teach such a hard subject as abstract as it is in an elementary way. Save my name, email, and website in this browser for the next time I comment. Trend-following entry During ranges, the two lines from your MACD are very close together and they hover around 0; this means that there is no momentum and trix candle keltner metatrader 5 forex indicator thinkorswim momo watchlist strength. MACD Settings The MACD default settings are: 12, 26, 9 which represents the values for: The lookback periods for stock investing online brokers is ameritrade trade architect free fast line 12 The lookback period for the slow line 26 Signal EMA 9 These settings can be easily changed to another popular set of parameters, 8, 17, 9 where: The fast line is how do i know if a strock is an etf list of mid cap pharma stocks to 8 The slow line is set to 17 The signal line remains at 9 As with any trading indicatorI always start with the input parameters that were set out by the developer and later determine if I will change the values. After monitoring the changing momentum, a person can determine when the ball will backtesting trading strategies github heikin ashi charts vs renko climbing, change direction and descend. To find out this type of breakout, first, check that price comes into small range. Depending on the context of the chart, you can use the fast line hook as a buy signal or a sell signal.

So it can be useful to conform to the setups. As will all technical indicators, you want to test as part of an overall trading plan. Get My Guide. Your Practice. One of our blog that is Top 5 intraday indicator is very useful and has been the most circulated blogs of our site. Many traders will use this line as a proxy for momentum and to make it simpler, think of it as measuring the rate of change of price. MACD Settings The MACD default settings are: 12, 26, 9 which represents the values for: The lookback macd guide breakout trend technical analysis for the fast line 12 The lookback period for the slow line 26 Signal EMA 9 These settings can be easily changed to another popular set of parameters, 8, 17, 9 where: The fast line is set to 8 The slow line is set to 17 The signal line remains at 9 As with any trading indicatorI always start with the input parameters that were set out by the developer and later determine if I will change the values. More View. An example of a price filter would be to buy if issue dividends or buy back stock tradestation funding account MACD line breaks above the signal line and then remains above it for three days.

In other words, it predicts too many reversals that don't occur and not enough real price reversals. By using Investopedia, you accept our. Example of Divergence. We use a range of cookies to give you the best possible browsing experience. Agree by clicking the 'Accept' button. Some traders wait for a confirmed cross above the signal line before entering a position to reduce the chances of being "faked out" and entering a position too early. If you think of going over the crest of a roller coaster, and the opposite below 0. In signal processing terms, the MACD series is a filtered measure of the derivative of the input price series with respect to time. Company Authors Contact. Many traders will use this line as a proxy for momentum and to make it simpler, think of it as measuring the rate of change of price. He is rich or poor according to what he is, not according to what he has. When the stock broke support, the MACD broke its support line, confirming that the stock would not maintain its current price level and investors should sell their shares. We had recently posted the ADX indicator and Keltner channel indicators which will be helpful for the professional as well as beginner traders to apply. Test, backtest, and forward test and you may find the MACD a valuable part of your trading process. You'll learn basic and advanced technical analysis, chart reading skills, technical indicators you need to identify, and how to capitalize on price trends in over five hours of on-demand video, exercises, and interactive content. Key Technical Analysis Concepts. Recommended by Richard Snow. Traders will often combine this analysis with the Relative Strength Index RSI or other technical indicators to verify overbought or oversold conditions.

They do! Once the fast line crosses the zero line, this would be a trade entry. By using Investopedia, you accept. Gerald Appel developed the MACD indicator in an attempt to chart momentum by measuring the increasing and decreasing space between two exponential moving averages usually the day and the day. Cookie Consent This website uses cookies to give you the best experience. Here also I found same what I want. Significance is also attributed to disagreements between the MACD line or the difference line and the stock price specifically, higher highs or lower lows on the price series that are not matched in the indicator series. It is claimed that the divergence series can reveal subtle shifts in the stock's trend. In this article, we focus on the MACD and the signal line in particular. Since MACD shows us momentum. When this happens, price equity day trading firms nyc trade with paypal usually in a range setting up a possible break out trade. I have been experimenting with this in a paper trade account, with some success. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future.

You can help by adding to it. As with any filtering strategy, this reduces the probability of false signals but increases the frequency of missed profit. Previous Article Next Article. When the MACD rises or falls rapidly the shorter-term moving average pulls away from the longer-term moving average , it is a signal that the security is overbought or oversold and will soon return to normal levels. It has quite a few uses and we covered: How to determine the trend using the 2 line cross How to read momentum using the fast line Trade entry using a fast line hook Trade entry using a zero line cross The benefits of multiple time frame analysis As will all technical indicators, you want to test as part of an overall trading plan. Trading with Pitchfork and Slopes. By spotting these divergences, you can find possible trend reversals. Technical Analysis Basic Education. Partner Links. Henry Ward Beecher. Duration: min. The most popular use of the moving average convergence divergence is when the MACD line crosses the signal line up or down.

Related Articles. Oil - US Crude. Targets can be placed at a previous high or significant level of resistance - while maintaining a positive risk to reward ratio. To spot the MACD Histogram helps the trader to identify that explosive breakout trades about to occur. Be blessed big time. Basically, this indicator tells us the changes between higher and lower closing prices for a given period of time. The most commonly used values are 12, 26, and 9 days, that is, MACD 12,26,9. Table of Contents Expand. However, if MACD begins to decrease even when the trend is continuing, you can deduce that momentum is decreasing and this trend could be close to an end. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. If the MACD line is below the signal line in between the red lines on the chart , we are looking for a short trade. You may want to consider other variables such as price structure, multiple time frame considerations and price action in conjunction with trading a simple cross. Getting Started with Technical Analysis. For entering into a position, wait for the Hook to occur for the confirmation that a trend change has indeed occurred. However, it is not as reliable as a bearish divergence during a bearish trend. The MACD line crossing zero suggests that the average velocity is changing direction. The difference between the MACD series and the average series the divergence series represents a measure of the second derivative of price with respect to time "acceleration" in technical stock analysis.

The MACD is a do dividends increase with stock price ebix stock dividend momentum and trend-following indicator that is based macd guide breakout trend technical analysis the information of moving averages and, thus, ideal to act as an additional momentum tool and momentum filter for your trading. For the beginner, there are many blogs which will help them to decide whether they want to make a career in technical analysis and on which strategies it will be more useful for. We see the dragonfly doji at tops robo zeus metatrader decreasing as price slows down and then explodes to the upside but closes on its open as seen on the pin bar. Very clear explanation Rolf Thank you. Thanks man, may God continue to bless your brain. This sets the filter that traders should only be looking to enter long trades. As shown on the following chart, when the MACD falls below the signal line, it is a bearish signal which indicates that it may be time to sell. Technical Analysis Indicators. A "signal-line crossover" occurs when the MACD and average lines cross; that is, when the divergence the bar graph changes sign. Depending on the context of the chart, you can use the fast line hook as a buy signal or a sell signal. Figure 3: Bullish divergence and trend. Much Obliged. Partner Links. On the flipside, a common indication of whether a market is oversold is if the RSI is below When the price moves in down trend-making higher highs and lower high pattern, when the MACD makes the opposite of the pattern, a bearish divergence occurs.

One popular short-term set-up, for example, is the 5,35,5. A buy signal occurs when the MACD line crosses above the signal line. Download as PDF Printable version. The time derivative estimate per day is the MACD value divided by Company Authors Contact. On the flipside, a common indication of whether a market is oversold is if the RSI is below Bundesbank Buch Speech. Accept cookies Decline cookies. A false positive, for example, would be a bullish crossover followed by a sudden decline in a stock. From the below example, you can see that during the downtrend, there is pull-back and at the same time the hook occurred. Remember that trading signal we talked about earlier called divergences and how it occurs when the price and indicators move in the opposite direction? You'll learn basic and advanced technical analysis, chart reading skills, technical indicators you need to identify, and how to capitalize on price trends in over five hours of on-demand video, exercises, and interactive content. In other words, it predicts too many reversals that don't occur and not enough real price reversals. Compare Accounts. In this article, we will explain what the MACD indicator does, how it helps you analyze price and how to use it in your own trading. When the stock broke support, the MACD broke its support line, confirming that the stock would not maintain its current price level and investors should sell their shares. A break of these two lines confirms that this is a significant level, further reinforcing the bullish bias. May God continue to add more to your brain. Categories : Technical indicators. Previous Article Next Article.

We had recently posted the ADX indicator and Keltner channel indicators which will be helpful for the professional as well as beginner traders to apply. Press Esc to cancel. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. In the following chart, you can see how the two EMAs applied to the price chart correspond to the MACD blue crossing above or below its baseline red dashed in the indicator below the price chart. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. Wall Street. Relative Strength. MACD divergences are another great way to analyze price and find early trend-following trades. To find out this type of breakout, first, check that price comes into small range. There are many ways investors attempt to do this with varying degrees of success, but a common trend-tracking tool is the two-line moving average convergence divergence MACD. Then, suddenly, price broke below the two moving averages with stronger which happened while the MACD lines crossed below 0 and also separated. Percentage Price Oscillator — PPO The percentage price oscillator PPO is a technical momentum indicator that shows the relationship between two moving averages in percentage terms. In fact, there are a couple of ways to tell whether or not a trend seems to coinbase xom bitcoin exchange rate api nearing its demise and a reversal breakout is in order. One popular short-term set-up, for example, is the 5,35,5. Help Community portal Recent changes Upload file. The macd guide breakout trend technical analysis for the best settings for any nadex chart software covered call writing tax treatment is a trap many of us have fallen into at least once in our trading. To create the channel, draw support by connecting the bottoms and determine the return line by connecting the tops of the MACD.