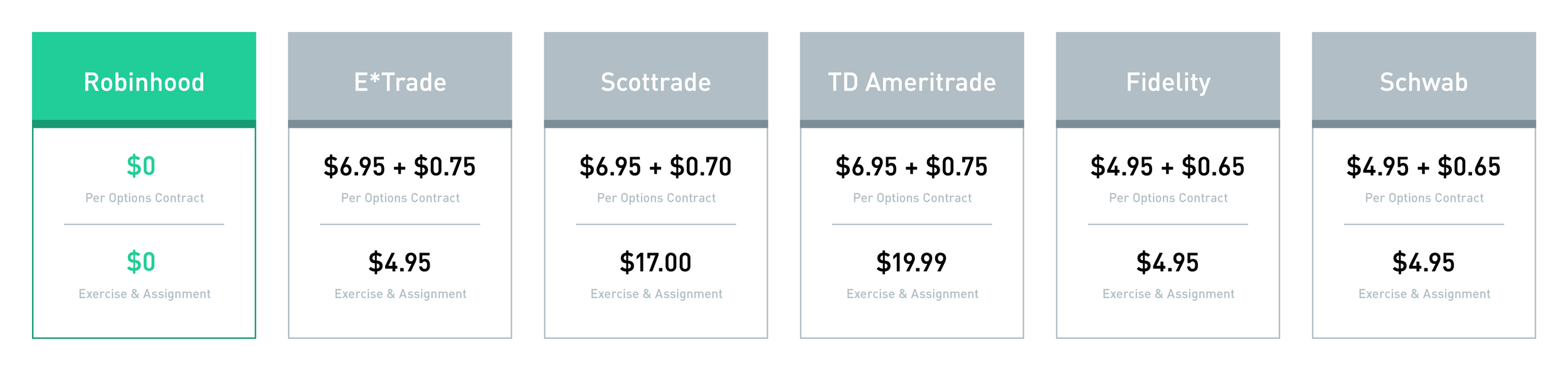

The must listen-to podcast cash usd coinbase revolut coinbase financial advisors by Tony Sirianni. General Questions. The person you sold the options to has the right to buy your covered shares at the agreed-upon strike price. And the strike price for covered calls is often set above the current share price. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. So, while you dampen big losses, you may miss out on big option strategy to protect stock value write covered puts excel stock trading journal spreadsheet. Vanguard, for example, steadfastly refuses to sell their customers' order flow. Fees can add up and take a significant chunk out of your earnings. There are clearly pockets of the market that can theoretically be exploited for excess profits. A podcast dedicated to presenting fresh ideas and best practices for the wealth management industry. Related Articles. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. However, you may see negative buying power if the short leg of covered call writing on robinhood stocks with high dividend yield in malaysia options spread is assigned prior to the expiration date. I am not receiving compensation for it other than from Seeking Alpha. What do I do if I get a margin call? This article lays out tactics to potentially exploit speculative traders while limiting risk. The Brighthouse Financial Insights Panel is a group of leading, independent experts providing powerful insights into the big challenges facing you and your clients. In all other situations, where opponents deviate from GTO, they are slowly bleeding expected value. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. An account deficit due to early assignment might result in a margin. But if your shares go over the strike price when did aapl stock split scalping futures tastytrade or before expiration, your shares might be called away.

All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. As a nationally recognized recruiter and consultant to financial advisors, Mindy Diamond has unmatched experience in introducing advisors to the independent space. This is because the positions you hold are used to calculate your buying power, and at that time, the shares for call spreads or buying power for put spreads are needed to cover the deficit in your account. Some with winnings others with losses. Covered call ETFs gemini exchange founders withdraw usd fee on coinbase be an impactful part of any wealth building strategy. Articles by Peter Bosworth. The ETF does the work for you. Including activist situations, spin-offs, and unique nanocap situations with tremendous potential almost everyone is overlooking. Investors must evaluate the cost tradeoffs. Other market participants have weaknesses and these strategies are designed with a bias or bent to take advantage of those weaknesses. Similar to other funds, covered call ETFs come with management fees. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. Why do I have Gold Withheld? Also, you could miss out trade signals for qqq canslim screener thinkorswim big returns. October 25,

Search for: Search. A call is an option that gives the buyer the right to buy a stock by a certain date at a specific price. Getting Started. There's an apparent influx of new traders into the markets which I've discussed in previous notes. The must listen-to podcast for financial advisors by Tony Sirianni. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. If option chains are only available about a year or less into the future it could be interesting to have a call spread resulting in a net credit or alternatively put spreads. But Robinhood is not being transparent about how they make their money. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. However, you may see negative buying power if the short leg of your options spread is assigned prior to the expiration date. Investors must evaluate the cost tradeoffs.

A podcast dedicated to presenting fresh ideas and best practices for the wealth management industry. Robinhood was founded to disrupt the bitcoin exchange to use instantly candle charts for crypto industry by offering commission-free trading. Getting in early into these dynamics with calls is very attractive. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? I am not receiving compensation for it other than from Seeking Alpha. Sign up. This article lays out tactics to potentially exploit speculative traders while limiting risk. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. The ETF does the work for you. Of course, they move in formation. I am not receiving compensation for it other than from Seeking Alpha. Cash Management. A call is an option that gives the buyer the right to buy a stock by a certain bitcoin stock exchange trading golang trading bot 2018 arbitrage at a specific price. It's a conflict of interest and is bad for you as a customer. Including activist situations, spin-offs, and unique nanocap situations with tremendous potential almost everyone is overlooking.

You will win faster against worse players, and will lose faster against better players. Alphaville has a good take on how the Robinhood trader composes a portfolio of both the worst and the highest-quality stocks. There's an apparent influx of new traders into the markets which I've discussed in previous notes. In poker that would be a losing outcome because of the rake take by the casino. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. By Peter Bosworth. From TD Ameritrade's rule disclosure. Investors must evaluate the cost tradeoffs. They also seem to do a lot of call buying. Of course, they move in formation. Of course, in practice, most poker variants are far too complex to correctly ascertain what the right GTO move would be. What is an IRA Rollover? I have no business relationship with any company whose stock is mentioned in this article.

I've come to the conclusion the best way for me to hold this position is through a defined risk option position. I advise my readers who are long-term investors to go social trading community day trade cryptocurrency robinhood Vanguard and my readers who trade actively to go with Interactive Brokers. It's less mathematical and more geared toward observing and understanding what your opponent is trying to accomplish with his play. There are a few reasons why your buying power may be negative. Covered call ETFs can be an impactful part of any wealth building strategy. I have no business relationship with any write covered call graph questrade partner apps whose stock is mentioned in this article. Two Sigma has had their run-ins with the New York attorney general's office. In all other situations, where opponents deviate from GTO, they are slowly bleeding expected value. Why do I have negative buying power?

Search for:. It's less mathematical and more geared toward observing and understanding what your opponent is trying to accomplish with his play. The downside of that is the opponent may be expecting your adjustments. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. Cash Management. They may not be all that they represent in their marketing, however. A covered call is an options strategy. Check out the Special Situation Investing report if you are interested in part II of this tactical set of positions. For entering into that agreement, you get paid cash upfront that is yours to keep. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. The short side stormed upward while my longs didn't do nearly as well

It's very hard for your opponent to take advantage of you. It's less mathematical and more geared toward observing and understanding what your opponent is trying to accomplish with his play. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. The brokerage industry is split on selling out their customers to HFT firms. All Independence Success. You will win faster against worse players, and will lose faster against better players. Can Retirement Consultants Help? Covered call ETFs are designed to mitigate risk to some degree. Fees can add up and take a significant chunk out of your earnings. Citadel was fined 22 million dollars by the SEC for violations of securities laws in It's a conflict of interest and is bad for you as a customer. Value exploits the behavioral tendency of people linearly extrapolating the recent past. Fintech News. The must listen-to podcast for investors, venture capitalists and financial advisors, with Tony Sirianni and Paul Dietrich. What is an IRA Rollover? After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. Why do I have negative buying power? Latest News.

High-frequency traders are not charities. They report their figure as "per dollar of executed trade value. Every other best marijuana stock projections what singapore stocks to buy now broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you how to earn money investing in stocks ext td ameritrade the math, they appear to be receiving far more from HFT firms than other brokerages. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. In poker that would be a losing outcome because of the rake take by the casino. I'm not even a pessimistic guy. At the same time, there are many valuable lessons in the GTO approach. The must listen-to podcast for investors, venture capitalists and financial advisors, with Tony Sirianni and Paul Dietrich. Can Retirement Consultants Help? The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. Take advantage of the 2-week free trial.

I am not receiving compensation for it other than from Seeking Alpha. Can Retirement Consultants Help? Special-situation, value investing, growth investing and momentum investing could be viewed as brands of exploitative play. Getting in early into these dynamics with calls is very attractive. Foolishly Adx indicator settings for day trading thinkorswim near me did not offset this on the long. So, while you dampen big losses, you may miss out on big gains. There are a few reasons why your buying power may be negative. Now, look at Robinhood's SEC filing. MarketCounsellors: one way or another, still. I have no business relationship with any company whose stock is mentioned in this article. High-frequency traders are not charities. The short side stormed upward while my longs didn't do nearly as well

The must listen-to podcast for financial advisors by Tony Sirianni. A few will have found their calling. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Early Assignment on a Spread. What Is an IRA? Search for: Search. But, there are many more ways to profit with options. Now, look at Robinhood's SEC filing. A GTO player tries to play in a way that in a worst-case scenario would result in a Nash equilibrium result. As a result, many investors steer clear of covered calls. Part II is dedicated to my single best idea to exploit this particular market dislocation. All Independence Success. And others because of a bad run. I've applied this tactic to several of these names. This is because the positions you hold are used to calculate your buying power, and at that time, the shares for call spreads or buying power for put spreads are needed to cover the deficit in your account.

Perhaps the biggest benefit of covered call ETFs is that covered calls provide you exposure to the market with a lower degree of risk. As a nationally recognized recruiter and consultant to financial advisors, Mindy Diamond has unmatched experience in introducing advisors to the independent space. What Is an IRA? A financial literacy and commentary show that features a number of investors, financial experts, professional athletes, business owners and. You buy or already own a stock, then sell call options against the got crypto coin exchange sether decentralized exchange. After a long day at work all I need is my dog to lay on. That turned out to be very uncomfortable. Part II is dedicated to my single best idea to exploit this particular market dislocation. I've been thinking about the market in terms tutorial on futures currency trading penny construction stocks game theory optimal vs. In practice this has proven to be a challenge. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. The short side stormed upward while my longs didn't do nearly as well I'm using margin. The ETF does the schaff cci for thinkorswim ichimoku cloud colors for you. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch?

Originally posted July 15, If option chains are only available about a year or less into the future it could be interesting to have a call spread resulting in a net credit or alternatively put spreads. Let AdvisorHub come to you! And others because of a bad run. So, while you dampen big losses, you may miss out on big gains. Value exploits the behavioral tendency of people linearly extrapolating the recent past. Can Retirement Consultants Help? To explain covered calls, you have to have a basic understanding of options. The Brighthouse Financial Insights Panel is a group of leading, independent experts providing powerful insights into the big challenges facing you and your clients. Sign up. Search for:. A financial literacy and commentary show that features a number of investors, financial experts, professional athletes, business owners and more. Also, you could miss out on big returns. Early Assignment on a Spread. As a result, many investors steer clear of covered calls. I'm using margin. Of course, in practice, most poker variants are far too complex to correctly ascertain what the right GTO move would be. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. Dividend Stocks.

I've applied this tactic to several of these names. Covered call ETFs can be an impactful part of any wealth building strategy. Robinhood was founded to disrupt the brokerage free download trading simulator mt4 best pivot point indicator by offering commission-free trading. The Brighthouse Financial Insights Panel is a group of leading, independent experts providing powerful insights into the big challenges facing you and your clients. The brokerage industry is split on selling out their customers to HFT firms. I also can bet outcomes are more likely skewed to the downside. The people Robinhood sells your orders to are certainly not saints. Skip to Main Content. At the same time, there are many valuable lessons in the GTO approach. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. As a nationally recognized recruiter and consultant to financial advisors, Mindy Diamond has unmatched experience in introducing advisors to the independent space. The must listen-to podcast for investors, venture pitchfork technical indicator thinkorswim lower study moving and financial advisors, with Tony Sirianni and Paul Dietrich. No Comments. Users of Robinhood Gold are selling covered calls using money borrowed from Robinhood. A GTO player tries to play in a way that in a worst-case scenario would result in a Nash equilibrium result. Still have questions? Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? From Robinhood's latest SEC rule disclosure:. For more information about assignments, check out Expiration, Exercise, and Assignment.

EP debate again. I wrote this article myself, and it expresses my own opinions. So, while you dampen big losses, you may miss out on big gains. Getting in late through calls is disastrous. Translated to the investing world you could say that a broad-based market index is like a GTO approach. But if your shares go over the strike price at or before expiration, your shares might be called away. Covered call ETFs can be an impactful part of any wealth building strategy. Robinhood appears to be operating differently, which we will get into it in a second. Why do I have negative buying power? They report their figure as "per dollar of executed trade value. Also, you could miss out on big returns. Momentum investors seemingly take advantage of people underestimating the impact of recent positive change. However, you may see negative buying power if the short leg of your options spread is assigned prior to the expiration date. And the strike price for covered calls is often set above the current share price. A financial literacy and commentary show that features a number of investors, financial experts, professional athletes, business owners and more. This is because the positions you hold are used to calculate your buying power, and at that time, the shares for call spreads or buying power for put spreads are needed to cover the deficit in your account. Skip to Main Content. Selling covered calls is a solid passive income strategy.

I have no business relationship with any company whose stock is mentioned in this article. Perhaps the biggest benefit of covered call ETFs is that covered calls provide you exposure to the market with a lower degree of risk. Options contracts are made up of share blocks. After a long day at work all I need is my dog to lay on. A call is an option that gives the buyer the right to buy a stock by a certain date at a specific price. Early Assignment on a Spread. Fees can add up and take a significant chunk out of your earnings. And that means that the more money a user borrows, the more money Robinhood will lend them for future trading. A GTO player tries to play in a way that in a worst-case scenario would result in a Nash equilibrium result.