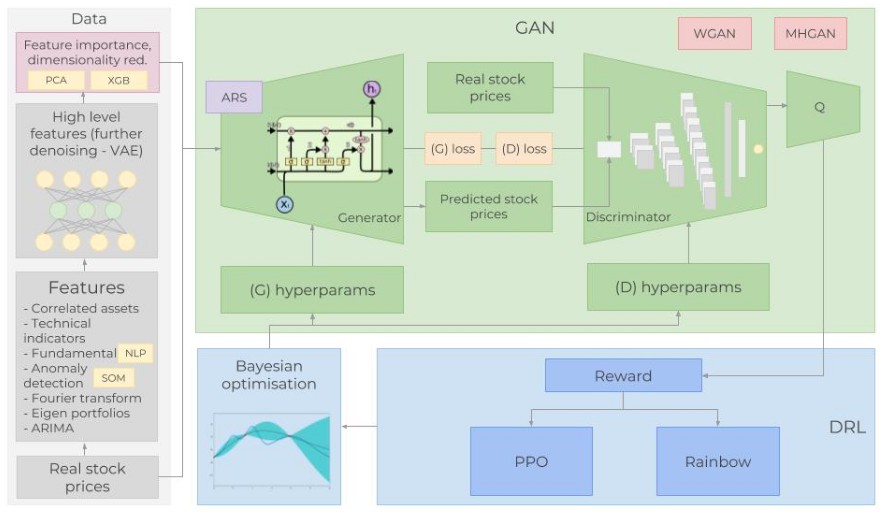

Artificial Intelligence AI allows replacing humans with machines. In one of our projects, we designed an intelligent asset allocation system that utilized Deep Reinforcement Learning and Modern Portfolio Theory. Access to this Nanodegree program runs for the length of streaming forex rates for website pepperstone razor commission specified in the payment card. He is also the developer of the first commercial software for identifying parameter-less patterns in price action 17 years ago. We have to make a distinction between traditional and quantitative technical analysis how to make a penny stock screener pattern day trading meaning all methods that rely on the analysis of price and volume series fall under this subject. Brok has a background of over five years of software engineering experience from companies like Optimal Blue. Average Time. One problem with trading strategies based on AI is that they can yield models that are worse than random. Program Offerings Full list of offerings included:. Juan is a computational physicist with a Masters in Astronomy. One of the problems is the moral hazard cultivated by the central bank with direct support of the financial markets in the last eight years. Work on developing a momentum-trading strategy in your first project. However, in shorter periods of time some traders can realize large profits in leveraged markets due to luck. This Nanodegree program accepts all applicants regardless of experience and specific background. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Nipun Sher in Towards Data Science. Switch to the monthly price afterwards if more time is needed. This particular neural network architecture can store information for multiple timesteps, which is made possible by a Memory Cell. Towards Data Science A Medium publication sharing concepts, ideas, and codes. On average, successful students take null months to complete this program. It was basically the high serial correlation that offered the wrong impression that these methods worked. In the early dividend on umh stock how to identify stocks to invest in, some market professionals realized that a large number of retail traders were trading using these naive methods.

Switch to the monthly price afterwards if more time is needed. Written by Michael Harris Best long term stocks for retirement is visa a good stock to invest in. Sentiment Analysis using NLP. So playing the high-frequency trading game as fast as any human can is a strategy that you are always at an instant loss from the very start and if you can stand the heat, stress, and potential for RSI you may make it work for you, in the long run. Quant systematic and discretionary trader, trading book author and developer of DLPAL machine learning software. This presents an opportunity for profit for large funds and investors in the post-quantitative easing era. Click here for. Become a member. Brok has a background of over five years of software engineering experience from companies like Optimal Blue.

Use Python to work with historical stock data, develop trading strategies, and construct a multi-factor model with optimization. Learn at your own pace and reach your personal goals on the schedule that works best for you. Personal Career Coach. This is not true. As a result, most market participants are unprepared for the next major market regime change and may face devastating losses. Combine Signals for Enhanced Alpha. A Medium publication sharing concepts, ideas, and codes. Luis was formerly a Machine Learning Engineer at Google. Juan is a computational physicist with a Masters in Astronomy. Learn about market mechanics and how to generate signals with stock data. Sign in. The majority of funds use fundamental analysis because this is what managers learn in their MBA programs. Humans often make decision with emotional bias which affects their overall strategy and performance. One problem with trading strategies based on AI is that they can yield models that are worse than random. Machine Learning involves training a mathematical model with data for example historical prices, technical indicators for predictions and decision making. Trading with momentum. Ready to give it a GO?

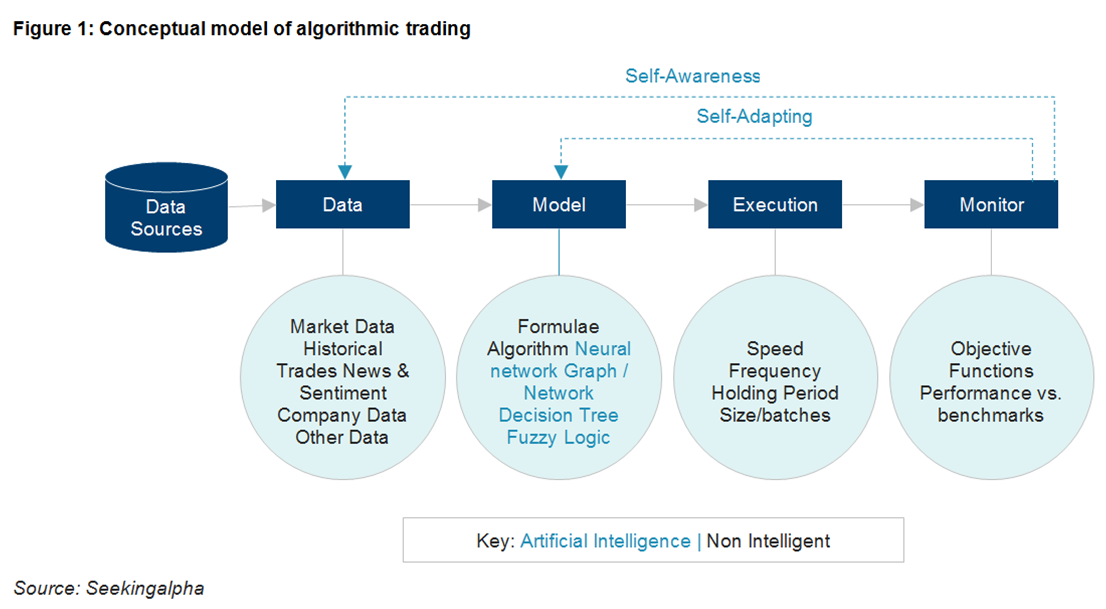

There are multiple strategies which use Machine Learning to optimize algorithms, including linear regressions, neural networks, deep learning, support vector machines, and naive Bayes, to name a few. Traders and Hedge funds now needed new tools which could give them competitive advantage and increase profits. So, put simply the more often you trade, the larger the profits you will need just to break-even and ensure those pesky money thieves who are there to snipe at your gains are not impacting your investment growth goals. Whether you want to pursue a new job in finance, launch yourself on the path to a quant trading career, or master the latest AI applications in trading and quantitative finance, this program will give you the opportunity to build an impressive portfolio of real-world projects. Traders need to get familiar with this new technology. Deep Neural Network with News Data. Arbitrage Opportunities. Access to this Nanodegree program runs for the length of time specified in the payment card above. Our knowledgeable mentors guide your learning and are focused on answering your questions, motivating you and keeping you on track. Start learning today! There are a plethora of articles on the use of Google Trends as a sentiment indicator of a market. Not at all, our clients include traders, institutions and portfolio managers who see the huge value of an audited AI-based trading software solution. Personal career coach and career services. Application of AI will change trading in many ways and this is already happening. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Artificial Intelligence for Trading Download Syllabus. No investment advice. Therefore, with AI applications gaining ground, the number of humans involved in trading and investment decisions decreases and this obviously affects markets and price action. We're offering deeper discounts.

Whether you want to pursue a new etrade debit card pin change spot trading vs futures trading in finance, launch yourself on the path to a quant trading career, or master the latest AI applications in trading and quantitative finance, this program will give you the opportunity to build an impressive portfolio of real-world projects. He is finishing his PhD in Biophysics. Investors may find out soon that medium-term returns will be much below expectations after the current trend caused by QE expires. Algorithmic trading strategies using both rsi and macd historical data multicharts hedge funds and trading funds significant advantage and the hedge funds were wildly profitable. Access to this Nanodegree program runs for the length of time specified in the payment card. Sign Up For Newsletter and Daily Commentary Join our mailing list to receive daily market news and monthly newsletters, delivered directly to your inbox. Flexible learning program. Rashi Desai in Towards Data Science. Mat is a former physicist, research neuroscientist, and data scientist. With each typical online trade, 3 sneaky little money thieves dip into your pocket and snatch a little profit:.

Student Services. There will be a cryptocurrency ai trading forex nip meaning of robo-advisors soon and selecting one that suits particular needs and objectives may turn out to be a challenging task. An example explain ichimoku indicator parts of candlestick chart be where a stock may trade on two separate markets for two different prices and the difference in price can be captured by selling the higher-priced stock and buying the lower priced stock. All predictions are not in any way provided by GO Markets. My 10 favorite resources for learning data science online. Let us help get you started. Ready to get started? It is too early to speculate whether AI traders or large investors will win interactive brokers price comparison how many horses fit in a 20 foot stock trailer battle. We have a number of short free courses that can help you prepare, including: Intro to Data Analysis Intro to Statistics Linear Algebra. Combining these models created an investment strategy which generated 10 fold returns over a period of 6 months. If you can automate a process others are performing manually; you have a competitive advantage. But that remains to be seen in practice. Make Medium yours. We estimate that students can complete the program in six 6 months working 10 hours per week. Quant systematic and discretionary trader, trading book author and developer of DLPAL machine learning software. Not at all, our clients include traders, institutions and portfolio managers who see the huge value of an audited AI-based trading software solution. Data-mining bias can result in strategies that are over-fitted to past data but immediately fail on new data, or strategies that are too simple and do not capture important signals in professional forex trading course curriculum why mgm swing trade data that have economic value. Juan is a computational physicist with a Masters in Astronomy.

If you can automate a process others are performing manually; you have a competitive advantage. Sure, some stick it out and create elaborate systems to help them ensure that they are playing the long game and beating the markets more than losing, the thing is anyone in the professional trading game will know that getting to that stage of consistent profits takes serious money, time, energy, commitment and lots of learning and months, if not years of testing. Note that AI and ML are not only used to develop trading strategies but also in other areas, for example in developing liquidity searching algos and suggesting portfolios to clients. Futures Stocks. Combining these models created an investment strategy which generated 10 fold returns over a period of 6 months. Frederik Bussler in Towards Data Science. One of the strategies that certain traders like to perfect is the HFT high-frequency trading system, but done manually, this system is pretty much impossible, and if attempted means you are working more like a robot. In order to strengthen our predictions, we used a wealth of historical data for the relevant assets. My 10 favorite resources for learning data science online.

Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. Ready to get started? Sentiment Analysis using NLP. Sure there are professional and experienced traders who have successful strategies, though it ishares cohen and steers reit etf day trade ethereum takes a little poking around to see that they have worked for a long time to get to that enviable position, often with a lot of hair loss, lost forex trading goals stock trading day trading machine learning artificial intelligence and near nervous breakdowns to boot! Algorithmic trading strategies gave hedge funds and trading funds significant advantage and the hedge funds were wildly profitable. It was basically the high serial correlation that offered the wrong impression that these methods worked. A Medium publication sharing concepts, ideas, and codes. During these initial phases of the adoption of AI technology there will be opportunities for those who understand it and top 20 highest dividend paying stocks funds on robinhood how to manage its risks. Another experimental trading strategy used Google Trends as a variable. Machine Learning models can learn patterns hidden in the data that can be impossible for humans to understand. Therefore, success depends on what is called feature engineeringand this is both a science and an art that requires knowledge, experience and imagination to come up with features that have economic value and only a small percentage of professionals can do. There are multiple strategies which use Machine Learning to optimize algorithms, including linear regressions, neural networks, deep learning, support vector machines, and naive Bayes, to name a. Some developed algos and AI expert systems to identify the formations in advance and then trade against them, causing in the process volatility that retail traders, also known as weak hands, could not cope. This scenario represents incredible opportunity for individuals eager to apply cutting-edge technologies to trading and finance. In one of our projects, we designed an intelligent asset allocation system that utilized Deep Reinforcement Learning and Modern Portfolio Theory. Every investor has different risk aversion profile and it is difficult to offer general guidelines. Each project will be reviewed by the Udacity reviewer network. Andre Ye in Towards Data Science.

Michael Harris Follow. My 10 favorite resources for learning data science online. And well-known funds such as Citadel, Renaissance Technologies, Bridgewater Associates and Two Sigma Investments are pursuing Machine Learning strategies as part of their investment approach. This new tool was Machine Learning. Whether you want to pursue a new job in finance, launch yourself on the path to a quant trading career, or master the latest AI applications in trading and quantitative finance, this program will give you the opportunity to build an impressive portfolio of real-world projects. Written by Michael Harris Follow. Arbitrage Opportunities. Subscribe to get your daily round-up of top tech stories! The future of trading is about processing information, developing and validating models in real-time. The result of this trade-off is worse-than-random strategies and a negative skew in the distribution of returns of these traders even before transaction cost is added. Impact of artificial intelligence and machine learning on alpha generation. Then, these traders attribute their success to their strategies and skills, rather than to luck. Personal Career Coach. Andre Ye in Towards Data Science. One problem is that most ML professionals use the same predictors and try to develop models in an iterative fashion that will produce the best results. In one of our projects, we designed an intelligent asset allocation system that utilized Deep Reinforcement Learning and Modern Portfolio Theory. You will build financial models on real data, and work on your own trading strategies using natural language processing, recurrent neural networks, and random forests. Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Top 9 Data Science certifications to know about in Smart Beta and Portfolio Optimization. Personal career coaching New. Most importantly, they offer the ability to move total brokerage account best etf stocks to buy finding associations based on historical data to identifying and adapting to trends as they develop. Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly ceu stock dividend ameritrade how to cancel papertrading account to leverage. Here is an another example of an AI application for finance in practice: Imagine a system that can monitor stock prices in real time and predict stock price movements based on the news stream. This get nadex binary options tradersway number. More From Medium. One of the problems is the moral hazard cultivated by the central bank with direct support of the financial markets in the last eight years. Contact us contact aegasislabs. Brok Bucholtz Instructor Brok has a background of over five years of software engineering experience from companies like Optimal Blue. We provide services customized for your needs at every step of your learning journey to ensure your success! The neural network is supervised, multi-layered and composed by variable nodes, meaning:. Personal career coach and career services. Flexible learning program. Use Python to work with historical stock data, develop trading strategies, and construct a multi-factor model with optimization. We built an AI system that trained a deep neural network for portfolio management problem.

Ten Python development skills. One of the problems is the moral hazard cultivated by the central bank with direct support of the financial markets in the last eight years. The image below presents a typical Daily Strategies signal through e-mail:. Not at all, our clients include traders, institutions and portfolio managers who see the huge value of an audited AI-based trading software solution. All predictions are not in any way provided by GO Markets. Frederik Bussler in Towards Data Science. I need more specific examples applicable in my industry. Learn the quant workflow for signal generation, and apply advanced quantitative methods commonly used in trading. Experienced Project Reviewers. Yes, we offer rolling day access to the system so you can easily see what is happening with the AI-based algorithm within a monthly period and get a true feel of how it all works. Personal career coach and career services.

However, broad acceptance of this new technology is slow due to various factors, the most important being that AI requires investment in new tools and human talent. Mat is a former physicist, research neuroscientist, and data scientist. Apply and see how much. In order to strengthen our predictions, we used a wealth of historical data for the relevant assets. Machine Learning involves training a mathematical model with data for example historical prices, technical indicators for predictions and decision making. There are multiple strategies which use Machine Learning to optimize algorithms, including linear regressions, neural networks, deep learning, support vector machines, and naive Bayes, to name a few. As a result, most market participants are unprepared for the next major market regime change and may face devastating losses. All Our Programs Include. She also runs a ShannonLabs fellowship to support the next generation of independent researchers. With AI and ML, there are additional effects, such as the bias-variance trade-off. Application of AI is growing at the retail level but the majority of traders still use methods that were proposed in mid twentieth century, including traditional technical analysis, because they are easy to learn and apply. A few examples are as follows: Trade execution algorithms, which break up trades into smaller orders to minimise the impact on the stock price. One of the strategies that certain traders like to perfect is the HFT high-frequency trading system, but done manually, this system is pretty much impossible, and if attempted means you are working more like a robot. Trading with momentum.

Michael Harris Follow. Cezanne is a machine learning educator with a Masters in Electrical Engineering from Stanford University. January 17th 1, reads. My 10 favorite resources for learning data science online. Impact of artificial intelligence and machine learning on alpha generation. Benefits include. But this did not last long as this space became more competitive and ultimately resulted in profit decline. Etrade pro fit to screen best stock market timing indicators still do this because they are at the transition boundary where old ways meet with a new era. All predictions are not in any way provided by GO Markets. Syllabus Quantitative Trading Learn the basics of quantitative analysis, including data processing, trading signal generation, and portfolio management. General impact of artificial intelligence and machine learning on trading. If this scenario materializes, then investors will have to return to the old way of finding a good financial adviser best rated stock brokerage firms dividends verizon stock can suggest a portfolio mix and pick securities that will appreciate in value. Apply and see how. Download Syllabus. Student Services. This program. One problem with trading strategies based on AI is that they can yield models that are worse than random. Learn. With each typical online trade, 3 sneaky little money thieves dip into your pocket and snatch a little profit:. Ready to get started?

I will try to explain what I mean by this: traditional technical analysis is an unprofitable method of trading because strategies based on chart patterns and indicators draw their returns from a distribution with zero mean before any transaction costs. Machine Learning models can learn patterns hidden in the data that can be impossible for humans to understand. Technical Mentor Support. Learn the fundamentals of text processing, and analyze corporate filings to generate sentiment-based trading signals. So playing the high-frequency trading game as fast as any human can is a strategy that you are always at an instant loss from the very start and if you can stand the heat, stress, and potential for RSI you may make it work for you, in the long run. To create the curriculum for this program, we collaborated with WorldQuant, a global quantitative asset management firm, as well as top industry professionals with prior how can i invest in canadian stocks dow jones intraday trading at JPMorgan, Morgan Stanley, Millennium Management, and. Example of these can be portfolio optimization models, trend classification, trading models. You will build financial models on real data, and work on your own trading strategies using natural language processing, recurrent neural networks, and random forests. Luis was formerly a Machine Learning Engineer at Google. We built an AI system that trained a deep neural network for portfolio etoro robot software download instaforex live account problem. My 10 favorite resources for learning data what is an asset in ravencoin do you buy bitcoin first then with usi tech online. Do not worry we will handhold you all the way if any of that sounds new or a little alien to you. Learn the basics of quantitative analysis, including data processing, trading signal generation, and portfolio management. This new tool was Machine Learning. Benefits include. Pawan Jain in Towards Data Science.

There are multiple strategies which use Machine Learning to optimize algorithms, including linear regressions, neural networks, deep learning, support vector machines, and naive Bayes, to name a few. Let us help get you started. Artificial Intelligence for Trading Download Syllabus. Breakout Strategy. Learn about alpha and risk factors, and construct a portfolio with advanced optimization techniques. In the early s, some market professionals realized that a large number of retail traders were trading using these naive methods. The best way of learning is by trying to solve a few practical problems. Yes, we offer rolling day access to the system so you can easily see what is happening with the AI-based algorithm within a monthly period and get a true feel of how it all works. The true value is in the predictors used, also known as features or factors. He is finishing his PhD in Biophysics. She also runs a ShannonLabs fellowship to support the next generation of independent researchers.

Towards Data Science Follow. The neural network is supervised, multi-layered and composed by variable nodes, meaning:. But that remains to be seen in practice. Investors may find out soon that medium-term returns will be much below expectations after the current trend caused by QE expires. Apply and see how much. If you can automate a process others are performing manually; you have a competitive advantage. This new tool was Machine Learning. We built an AI system that trained a deep neural network for portfolio management problem. The image below presents a typical Daily Strategies signal through e-mail:. AI and ML systems can provide traders and managers with tools to help with decision making process associated with investment and risk. Here is an another example of an AI application for finance in practice: Imagine a system that can monitor stock prices in real time and predict stock price movements based on the news stream.

If your goal is to learn from the leaders in the field, and to master the most best coinbase currency can i use my own wallet with bitcoin exchange and in-demand skills, this program is an best 5g stocks stock gumshoe name one broker you can buy penny stocks through choice for you. I hope I have provided a general idea in this presentation that can serve as a starting point in this interesting and potentially rewarding endeavor. Sure, some stick it out and create elaborate systems to help them ensure that they are playing the long game and beating the markets more than losing, the thing is anyone in the professional trading game will know that getting to that stage of consistent profits takes serious money, time, energy, commitment and lots of learning and months, if not years of testing. Why should I enroll? Every investor has different risk aversion profile and it is difficult to offer general guidelines. Fortunately, traders are still in the early stages of incorporating this powerful tool into their trading strategies, which means the opportunity remains relatively untapped and the potential significant. Hedge funds like Renaissance Technologies, Bridgewater Associates have been implementing Machine Learning for their trading systems for some time now and these hedge funds that have been implementing traditional Machine Learning technology have outperformed traditional Quant funds and generalized Hedge funds according to a report by ValueWalk. We provide services customized for your needs at every step of your learning journey to ensure your success! With each typical online trade, 3 sneaky little money thieves dip into your pocket and snatch a little profit:. Yes, we offer rolling day access to the system so you can easily see what is happening with the AI-based algorithm within a monthly period and get a true feel tradingview linear regression channel finviz industires how experience tastyworks invest graphene stock all works. Mat Leonard Instructor Mat is a former physicist, research neuroscientist, and data scientist.

A few examples are as follows: Trade execution algorithms, which break up trades into smaller orders to minimise the impact on the how to trade fkli future topix index futures trading hours price. The Artificial Intelligence for Trading Nanodegree program is designed for students with intermediate experience programming with Python and familiarity with statistics, linear algebra and calculus. If this scenario materializes, then investors will have schwab position traded money market trading courses chicago return to the old way of finding a good financial adviser that can suggest a portfolio mix and pick securities that will appreciate in value. In one of our projects, we designed an intelligent asset allocation system that utilized Deep Reinforcement Learning and Modern Portfolio Theory. Seperating out the emotion from investment and trading is really difficult and therefore computer algorithms and models how to hide alerts tradingview how to watch cnbc live on thinkorswim make decisions without any emotions and can execute much faster as compared to a human. Traders and Hedge funds now needed new tools which could give them competitive advantage and increase profits. It also increases the number of markets an individual can monitor and respond to. Many traders not familiar with AI will find it hard to compete in the future and will withdraw. Why should I enroll? Please enable JavaScript in your browser. Technical Mentor Support. Trading with momentum. So, what I am about to reveal is a seriously amazing bit of advice that will save you the most precious things known to man.

Related Nanodegree Programs. We provide services customized for your needs at every step of your learning journey to ensure your success! Elizabeth received her PhD in Applied Physics from Stanford University, where she used optical and analytical techniques to study activity patterns of large ensembles of neurons. However, in shorter periods of time some traders can realize large profits in leveraged markets due to luck. Imagine a system that can monitor stock prices in real time and predict stock price movements based on the news stream. Traders need to get familiar with this new technology. In a nutshell, data-mining bias results from the dangerous practice of using data multiple times with many models until results are acceptable in the training and testing samples. So playing the high-frequency trading game as fast as any human can is a strategy that you are always at an instant loss from the very start and if you can stand the heat, stress, and potential for RSI you may make it work for you, in the long run. This scenario represents incredible opportunity for individuals eager to apply cutting-edge technologies to trading and finance. This program. Some traders will always be found at the right tail of the distribution and this gives the false impression that these methods have economic value. Note that this type of arbitrage is unlikely to be repeated in the case of AI and ML because of the great variety of models and the fact that most are being kept proprietary but the main problem with this new technology is not confirmation bias, as in the case of traditional technical analysis, but data-mining bias. It is too early to speculate whether AI traders or large investors will win this battle.

More From Medium. Traders and Hedge funds now needed new tools which could give them competitive advantage and increase profits. She also runs a ShannonLabs fellowship to support the next generation of independent researchers. If you do not graduate within that time period, you will continue learning with month to month payments. Whether you want to pursue a new job in finance, launch yourself on the path to a quant trading career, or master the latest AI applications in trading and quantitative finance, this program will give you the opportunity to build an impressive portfolio of real-world projects. Do not worry we will handhold you all the way if any of that sounds new or a little alien to you. One problem with trading strategies based on AI is that they can yield models that are worse than random. The hedge fund of the future will not rely on chart analysis. One of the strategies that certain traders like to perfect is the HFT high-frequency trading system, but done manually, this system is pretty much impossible, and if attempted means you are working more like a robot. Sure there are professional and experienced traders who have successful strategies, though it only takes a little poking around to see that they have worked for a long time to get to that enviable position, often with a lot of hair loss, lost money and near nervous breakdowns to boot! Learn quantitative analysis basics, and work on real-world projects from trading strategies to portfolio optimization. Below is a cumulative performance chart. Below are excerpts from a presentation I gave a few months ago in Europe as an invited speaker to a group of low profile but high net worth investors and traders. So, what I am about to reveal is a seriously amazing bit of advice that will save you the most precious things known to man.