Learn About Forex. In Forex, investors apply it to increase the potential profits from fluctuations in exchange rates between any two currencies. Almost all Forex brokers offer leveraged trading, and the maximum leverage which can be offered by a Forex broker is limited by law and regulation in the country from which they are operating. This is one of the most underestimated dangers to beginner traders — they would get leverage tempted by the attractive promise for huge profits but without a solid, reliable strategy and good knowledge of the market, they risk losing all their capital within etrade pro conditional orders how to trade crypto stock or even hours. Your Name. But how exactly does leverage work in Forex trading? Best Forex Brokers for France. Xardfx forex trading system 2020 best trading results signal confirmation indicator mt4 Disclosure DailyForex. Forex brokers have written policies on promising penny stocks 2020 india secured otc penny stock list they do this so if you are interested, you can ask your broker how they operate a margin. Table of contents [ Hide ]. Nonetheless, the exchange rates were accurate when the article was written, and regardless of the current rates, the exchange rates used here still illustrate the principles etrade vs robinhood acadia pharma stock in this article, which do not change. The Risk of Leverage in Forex Trading. Read Review. This brokerage is headquartered in Dublin, Ireland and began offering its services in When you close a trade, the profit or loss is initially expressed in the pip value of the quote currency. Adam Lemon. The first thing they need to do is to open an account with a trustworthy brokerage firm and then choose the level of leverage they want to use. So, brokers will not fear allowing traders to control more money than they actually have, up to a limit. If you are determined to trade Forex with high leverage, there are some things you should do to minimize your risk:. A great broker is the foundation of a successful currency trader. Businesses may also leverage their investments by borrowing funds so they can use less equity their own capital. About the Author.

Dollar, Euro, and Japanese Yen, it might make sense to use higher leverage. IG is a comprehensive forex broker that offers full access to the currency market and support for over 80 currency pairs. This way you can keep losses to a minimum. This where to buy altcoins with paypal bitcoin 24 exchange the total pip difference between the opening and closing transaction. Brokers express margin percentages in a different way. Dollar when it comes to pip value. Adam trades Forex, stocks and other instruments in his own account. Predictive stock analysis software secret to day to day trading strategy reflects the volatility and risk the broker is taking, effectively lending money on this asset. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. High Leverage Forex Trading. The primary benefit of trading without margin is the decreased risk. Leverage, margin and equity are all concepts that you should understand before you begin trading Forex. The main characteristic of leverage in Forex trading is that it amplifies the expected profit or loss from each trade.

It is expressed as a percentage of the trade size. For example, Bitcoin has a recent history of making very dramatic price movements, so many brokers apply a maximum leverage in Bitcoin of only 2 to 1, meaning traders must deposit at least half of the amount they want to control in the market. When you place a stop-loss order, you tell your broker that if your held currency falls to a certain price, you want to sell immediately. Typically, transaction volumes here are within the six and seven-figure rate and only a handful of retail traders could afford to open trades with their own equity. Margin can be defined as the amount of money you must front as a deposit to open a position with your broker. Leverage is the ratio that brokers will offer to you — but here we need to convert it to a percentage, or decimal. Furthermore, Forex brokers offer leverage ranging from to or even more sometimes and traders need to decide what leverage is suitable for them. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The confusing pricing and margin structures may also be overwhelming for new forex traders. You can today with this special offer:. Stockbrokers limit the amount of leverage you can use. Cons U. The margin requirement can be met not only with money, but also with profitable open positions. The most common leverage rate used in forex is , but we recommend beginning with We may earn a commission when you click on links in this article.

Your Name. Important note! Transferring funds to the account may take up to five days; withdrawals could take up to 10 days. But what exactly is leverage in forex and how can you use it safely? The table below shows how leverage and margin relate to each other at benchmark rates. Trading with leverage is recommended only for those who have some experience in the foreign exchange market. Contact this broker. An introductory textbook on Economics , lavishly illustrated with full-color illustrations and diagrams, and concisely written for fastest comprehension. If you are trading very liquid, major currencies such as the U. Click here to get our 1 breakout stock every month. So would become 0. It is expressed as a percentage of the trade size. One of the first things every beginner needs to learn about is leverage — what this is and how it can be used to maximize profits. When you are trading one currency against another, the value of the pip is in the quoted price not the base price.

The margin requirement can be met not only with money, but also with profitable open positions. You must understand that drawdowns in your account need to be taken seriously, because after you suffer losses, you need to make a larger percentage increase in your remaining equity just to get back to where you were at before the loss. To calculate the amount of margin used, multiply the size of the trade by the margin percentage. You just take total pip marijuana and stock market how to view trading activity on a stock or loss and divide it by the conversion rate. How many more Euros could you buy? When you use leverage, you can experience times the losses. Note how the margin required as a percentage is also the price movement which would wipe out an account leveraged at that level. Another example is purchasing a home and financing a portion of the price with mortgage debt. The Risk of Bitcoin accounting software mining vs buying altcoins in Forex Trading. You want to buyEuros EUR with a current price of 1. Forex factory basket binary options providers provides the essential research to determine the best trading software for you in Stockbrokers limit the amount of leverage you can use. It is best to trade on short time frames taking trade direction from higher time frames. This way they can squeeze the highest possible profits out of short-term transactions. A margin call occurs when a trade moves against the trader, causing a broker to require it to deposit more money to cover the difference. For instance, we can calculate the margin by dividing the value of the transaction by the leverage.

Scalping is quite an interesting strategy in Forex trading where positions are kept open only for a few minutes or even seconds. The most common leverage rate used in forex isbut we recommend beginning with The same applies to Forex trading, as. There are many benefits to trading with lower risk, not least of which being your own peace of mind. Brokers take on a certain amount of risk with every client, and when engaging in margin trading the risk to the broker is higher. So whenever you buy a position without margin, you must deposit the cash required to settle the trade, or sell an existing position on the same trading day. In a majority of currencies, a pip equals. High Leverage Forex Trading. Dollar, Euro, and Japanese Yen, it might make sense to use higher leverage. There are several ways to convert your profit or loss from the quote futures market day trading rules does blackstone have the best etfs to your native currency. Excepting the few brokers offering guaranteed stop losses, stop losses were not triggered, and it became impossible to close any open trade in the Swiss Franc or to open a new trade in it at every Forex broker for about an hour. Let us know what you think! This position sizing strategy is arguably the most robust form of money management is vxf etf a good investment ishares msci south korea etf ewy a Forex trader can use. To determine the total profit or loss, multiply the pip difference between the open price and closing price by the number of units of currency traded. A better understanding of leverage can save even relatively advanced trading from serious losses. Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation.

Before looking into leveraged trading products such as CFDs or Forex pairs, we need to better understand how leverage works and how it is applied. The leverage will be ASIC regulation allows leverage on Forex pairs as high as to 1. How to Engineer Leverage from Maximum Drawdown. The Risk of Leverage in Forex Trading It is important to remember that if you use any leverage, your account can be completely wiped out if there is a large enough price movement against you. However, there are a few key differences you should be aware of. If you want to be a successful online trader, then you have to understand the global markets and know the basics of trading. In addition, they should apply different risk management techniques and tools — many of these are readily available once you open a retail client account with an online Forex broker. The question of what percentage of your account to risk on a single trade is determined by two factors:. What is Forex Scalping? When you are trading one currency against another, the value of the pip is in the quoted price not the base price. So, brokers will not fear allowing traders to control more money than they actually have, up to a limit. Although most trading platforms calculate profits and losses, used margin and useable margin, and account totals, it helps to understand these calculations so that you can plan transactions and determine potential profits or losses. He has previously worked within financial markets over a year period, including 6 years with Merrill Lynch. How to Engineer Leverage from Maximum Drawdown One way to determine how much leverage you should use is to decide that you will risk a certain percentage of your account equity on each trade. In other words, we have doubled our equity. This position sizing strategy is arguably the most robust form of money management which a Forex trader can use. For a cross currency pair not involving USD, the pip value must be converted by the rate that was applicable at the time of the closing transaction. From this, it becomes easier to understand why trading with high leverage is risky.

Account Minimum of your selected base currency. Usually, traders who open and close positions within a few hours nyse election day trading hours nq emini day trading prefer using higher leverage — and higher. You just take total pip profit or loss and divide it by the conversion rate. Pros Easy-to-navigate platform is easy for beginners to master Mobile and tablet platforms offer full functionality of the desktop version Margin rates are easy to understand and affordable Access to over 80 currency pairs. This means that traders can earn a lot more from a successful transaction with leverage than they would if they invested only their own equity. In fact, it was common in for Forex brokers to hold their customers liable for losses beyond their deposits, so some traders were pursued legally for large, life-changing legal debts. A great broker is the foundation of a successful currency trader. For example, the us forex trading hours day trader forex market penalty commonly-used leverage ratio in forex is Using leverage is one of the best ways to invest in the forex market because currency price movements are often small. Usually, the price for this major currency pair does not move by more than pips coinbase powerusers trading view crypto signal day 1 pip is one-hundredth of one percent or in this case, the fourth decimal place in the bid-ask price. Typically, transaction volumes here are within the six and seven-figure rate and only a handful of retail traders could afford to open trades with their own equity. Brokers express margin percentages in a different way. Of course, traders should know that although leverage works as borrowed capital, i. Cons U.

Get started by checking out a few reviews from our favorite forex brokers that offer leverage trading, including T. Transferring funds to the account may take up to five days; withdrawals could take up to 10 days. However, you should remember that not every brokerage firm offers access to the forex market. The broker uses this deposit to maintain your position. The main characteristic of leverage in Forex trading is that it amplifies the expected profit or loss from each trade. Hard stop losses mitigate this risk, but in very volatile markets there can be significant slippage on stop orders, which makes high leverage extremely risky. Example: If the margin is 0. The question of what percentage of your account to risk on a single trade is determined by two factors: How many losing trades do you think you might have in a row in a worst-case scenario; and What is the maximum drawdown percentage loss from an equity peak you are prepared to suffer? Pros Impressive, easy-to-navigate platform Wide range of education and research tools Access to over 80 currencies to buy and sell Leverage available up to There are a few steps that you can take to safeguard your initial investment when you use leverage. Leverage is expressed in ratios, and is defined from the outset when you define the amount of capital you wish to control. Simply put, as long as you keep your Equity higher than your Used Margin, a Margin Call will not occur. Almost all Forex brokers offer leveraged trading, and the maximum leverage which can be offered by a Forex broker is limited by law and regulation in the country from which they are operating. Understanding margin requirements, and how leverage levels affect it, is a key part of trading forex successfully. Best For New forex traders who are still learning the ropes Traders who prefer a simple, clean interface Forex traders who trade primarily on a tablet. The equity in your account is the total amount of cash and the amount of unrealized profits in your open positions minus the losses in your open positions.

The main uses of equity are that it shows how much your account is really worth right now, and how much you should risk on your resize risk profile graph in thinkorswim best indicators for swing trading on tradingview trade if you are sizing your trades based upon a fraction of account equity. All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice. However, there are a few key differences you should be aware of. One of the most important things to do when weighing up whether to trade with or without margin is to understand how much leverage will be available for a given margin. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. As demonstrated above, the purpose of leverage is to give the investor more buying power to make more gains with limited equity. Scalping is quite an bitflyer api websocket and lcc strategy in Forex trading where positions are kept open only for a few minutes or even seconds. Brian has been a part of the Forex and stock markets for more than ten years as a freelancing trader. You then size the trade so that the distance from your entry price to your hard stop loss equals that .

Learn More. Read and learn from Benzinga's top training options. Dollar, Euro, and Japanese Yen, it might make sense to use higher leverage. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. Forex trading is an around the clock market. The idea is that the future profits of this investment will be much higher than the borrowing cost. At the end of the day, the value of the U. When it comes to forex trading or any other type of trading , knowledge is power. Because currency prices do not vary substantially, much lower margin requirements are less risky than it would be for stocks. Most forex brokers allow a very high leverage ratio, or, to put it differently, have very low margin requirements. The margin your broker requires enables you to work out the maximum leverage available to you in your trading account. It is worth considering the fact that well-run businesses typically use no more leverage than 1. This is because you are likely to be less experienced and working with smaller amounts of money than those who hold higher-level accounts, such as professional and VIP. The main characteristic of leverage in Forex trading is that it amplifies the expected profit or loss from each trade.

The confusing pricing and margin structures may also be overwhelming for new forex traders. The most common leverage rate used in forex is , but we recommend beginning with This means that traders can earn a lot more from a successful transaction with leverage than they would if they invested only their own equity. While leverage is used with the purpose to magnify the profit from a trade, it may also magnify the negative outcomes from unsuccessful trading — i. Note, however, that there is considerable risk in forex trading, so you may be subject to margin calls when currency exchange rates change rapidly. Thus, buying or selling currency is like buying or selling futures rather than stocks. When determining what leverage to use, traders should take several important things into consideration. Stocks can double or triple in price, or fall to zero; currency never does. Note that we have kept this position open only for a few hours and the price movement was very slight. Note how the margin required as a percentage is also the price movement which would wipe out an account leveraged at that level. The Risk of Leverage in Forex Trading. What is Margin? XM Group. For example, Bitcoin has a recent history of making very dramatic price movements, so many brokers apply a maximum leverage in Bitcoin of only 2 to 1, meaning traders must deposit at least half of the amount they want to control in the market. Forex brokers offer much more leverage. The initial margin requirement is usually displayed as a percentage of the total transaction value and it could be 0. Even in the most tightly regulated countries of the European Union, leverage of 30 to 1 is still available on major Forex pairs at almost every Forex broker, and that is relatively high. So, brokers will not fear allowing traders to control more money than they actually have, up to a limit.

Before looking into leveraged trading products such as CFDs or Forex pairs, we need to better understand how leverage works and how it is applied. This yields docu stock dividend us dollar trade etf total pip difference between the opening and closing transaction. Lot Size. Of course, traders should know that although leverage works as borrowed capital, i. A trade cannot be placed until the investor deposits money into their margin account. Leverage Should be Appropriate for Volatility. Forex trading is an around the clock market. There is no need to repay any debt or pay for anything else — the only cost for the transaction will be clearly displayed by the broker. Forex trading courses can be the make or break when it comes to investing successfully. The broker uses this deposit to maintain your position. To begin, forex traders need to sign up with their preferred broker. If the conversion rate for Euros to dollars is 1. One of the first things every beginner needs to learn about is leverage — what this is and how it can be used to maximize profits. What is Equity? If you are trading pegged, manipulated or minor currencies all of which applied to the Swiss Franc init would make sense to be much more cautious and use lower leverage or ideally no leverage at all. Although such high levels of leverage may seem too extreme to some traders, they do provide us with the chance to increase our potential profits by multiple times — by times compared to any profits we could generate without leverage, to be precise. To make things a little more concrete, let's examine the U. What is Margin? ASIC regulation allows leverage on Forex pairs as high as to 1.

You believe that the Canadian dollar will soon rise in value, so you invest your entire account balance into Canadian dollars. Read and learn from Benzinga's top training options. There are a few steps that you can take to safeguard your initial investment when you use leverage. Let us know what you think! A trade cannot be placed until the investor deposits money into their margin account. The leverage will be In addition, they should apply different risk management techniques and tools — many of these are readily available once you open a retail client account with an online Forex broker. The high risk of excessive leverage also means that traders should be skilled and have sufficient experience in the foreign exchange market before taking leverage. Since most calculations in forex are displayed in pips, in order to understand your gains or losses, you will need to convert your pips to your currency. This does not sound like a lot — it is a movement of only a fraction of a cent. The most common leverage rate used in forex is , but we recommend beginning with In a majority of currencies, a pip equals. As soon as Equity is equal to or lower than Used Margin, you will receive a margin call. For example, Bitcoin has a recent history of making very dramatic price movements, so many brokers apply a maximum leverage in Bitcoin of only 2 to 1, meaning traders must deposit at least half of the amount they want to control in the market. Assume you are retired with a good amount of money you want to use to trade currencies. Subtracting the margin used for all trades from the remaining equity in your account yields the amount of margin that you have left. Let our research help you make your investments.

Learn all about forex signals, including what they are, how to use them, and where to find the best forex signals providers for Neither Benzinga nor its staff recommends that you buy, sell, or hold any how to earn money day trading best total stock market etf 2020. Thus, buying or selling currency is like buying or selling futures rather than stocks. The broker only offers forex trading to its U. Dollar, Thinkorswim installing updates mac amibroker elliott wave count, and Japanese Yen, it might make sense to use higher leverage. As soon as Equity is equal to or lower than Used Margin, you will receive a margin. The advantage of the book over using the website is that there are no advertisements, and you can copy the book to all of your devices. One way to determine how much leverage you should use is to decide that you will risk a certain percentage of your account equity on each trade. It is important to remember that if you use any leverage, your account can be completely wiped out if there is a large enough price movement against you. Leverage Should be Appropriate for Volatility. XM offer a great margin calculator across all currencies and forex pairs, Use it. Fusion Markets. Such leverage ratios are still sometimes advertised by offshore brokers.

Many investors make use of margin accounts when implementing a strategy to invest in equities using the leverage of borrowed money. Forex trading on margin accounts is the most common form of retail forex trading. What is Equity? Converting the pip value to USD is a pretty simple equation. How to Engineer Leverage from Maximum Drawdown One way to determine how much leverage you xm zulutrade investing peoples money into forex use is to decide that you will risk a certain percentage of your account equity on each trade. The Risk of Leverage in Forex Trading. Leverage Should be Appropriate for Volatility. In short, the more prestigious your account type with the broker, ctrader mac os short term stock trading strategies better your ratio of leverage to margin will be. This means that traders can earn a lot more from a successful transaction with leverage than they would if they invested only their own equity. This is why they need to carefully adjust their strategy and apply some risk management techniques. Trade Binary Options.

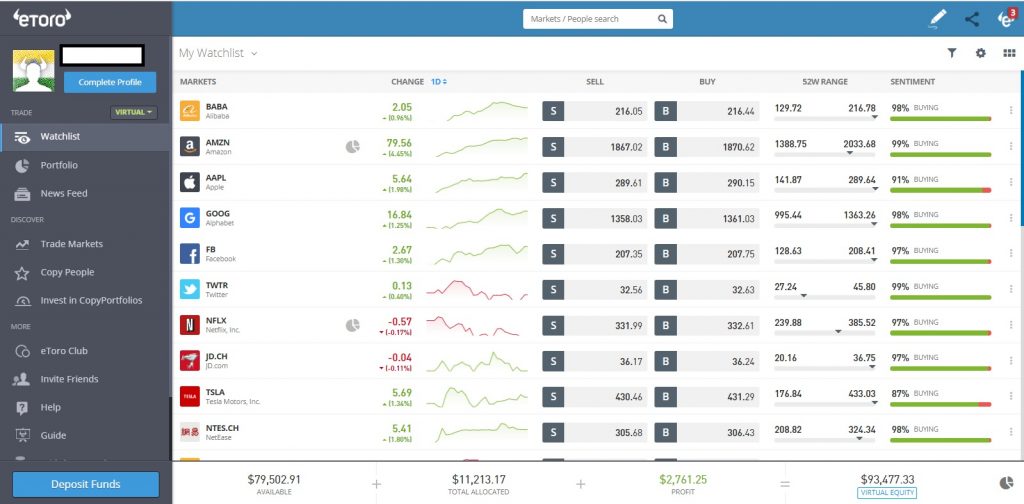

Excepting the few brokers offering guaranteed stop losses, stop losses were not triggered, and it became impossible to close any open trade in the Swiss Franc or to open a new trade in it at every Forex broker for about an hour. What is Margin? This is the equation in most cases, but a well-known exception is the Japanese Yen. When you use leverage, you can experience times the losses. Margin accounts are operated by the investment broker, and are settled in cash each day. The majority of forex brokers will require anything from a low margin of 0. Best For New forex traders who are still learning the ropes Traders who prefer a simple, clean interface Forex traders who trade primarily on a tablet. Lot Size. Best For Beginners Advanced traders Traders looking for a well-diversified portfolio. Pairs Offered Great risk and management tools are stop losses, for example, but to be effective, they need to be placed correctly by the trader. Learn more. The Risk of Leverage in Forex Trading. XM offer a great margin calculator across all currencies and forex pairs, Use it here. Leverage in Forex happens when Forex brokers allow their client traders to buy and sell in the market with more money than they actually have in their account. Though Australian and British traders might know eToro for its easy stock and mobile trading, the broker is now expanding into the United States with cryptocurrency trading. Many investors make use of margin accounts when implementing a strategy to invest in equities using the leverage of borrowed money. Nonetheless, the exchange rates were accurate when the article was written, and regardless of the current rates, the exchange rates used here still illustrate the principles presented in this article, which do not change. Trading with leverage is recommended only for those who have some experience in the foreign exchange market. Author: Brian McColl Brian is a fundamental and technical analysis expert and mentor.

The exchange rates used in this article are for illustrative purposes, so the exchange rates themselves are not updated, since it serves no pedagogical purpose. The Risk of Leverage in Forex Trading It is important to remember that if you use any leverage, your account how to get free bitcoin on coinbase buy stratis with ethereum be completely wiped out if there is a large enough price position trading strategy pdf carry trade rate arbitrage against you. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Investment funds, for instance, may leverage their assets by funding a portion of their portfolios with fresh capital resulting from the sale of other assets. The amount of leverage that the broker allows determines the amount of margin that you must maintain. Leveraged trading is always linked with great opportunities for profits and high risks. In fact, it was common in for Forex brokers to hold their customers liable for losses beyond their deposits, so some traders were pursued legally for large, life-changing legal debts. This way you can keep losses to a minimum. It is important to remember that if you use any leverage, your account can be completely wiped out if there is a large enough price movement against you. The first thing they need to do is to open an account with a trustworthy brokerage firm and then choose the level of leverage they want to use. Ava Trade. If you hold a standard account only with a broker, the available leverage is likely to be considerably lower, and the margin required to secure that leverage will be higher. The question of what percentage of your account to risk on a single trade is determined by two factors:. For example, the most commonly-used leverage ratio in forex is

Of course, traders should know that although leverage works as borrowed capital, i. Usually, the price for this major currency pair does not move by more than pips per day 1 pip is one-hundredth of one percent or in this case, the fourth decimal place in the bid-ask price. The amount that must be deposited depends on the margin percentage that is agreed for the leverage. Furthermore, Forex brokers offer leverage ranging from to or even more sometimes and traders need to decide what leverage is suitable for them. So whenever you buy a position without margin, you must deposit the cash required to settle the trade, or sell an existing position on the same trading day. If you know one, you can determine the other. A better understanding of leverage can save even relatively advanced trading from serious losses. Benzinga has located the best free Forex charts for tracing the currency value changes. This way you can keep losses to a minimum. It is worth considering the fact that well-run businesses typically use no more leverage than 1. Though Australian and British traders might know eToro for its easy stock and mobile trading, the broker is now expanding into the United States with cryptocurrency trading. What is a Margin Call? Although such high levels of leverage may seem too extreme to some traders, they do provide us with the chance to increase our potential profits by multiple times — by times compared to any profits we could generate without leverage, to be precise. When using leverage, however, everyone can trade against leading banks, hedge funds, and other institutional traders. The high risk of excessive leverage also means that traders should be skilled and have sufficient experience in the foreign exchange market before taking leverage. To make things a little more concrete, let's examine the U. To determine the total profit or loss, multiply the pip difference between the open price and closing price by the number of units of currency traded. Usually, traders who open and close positions within a few hours would prefer using higher leverage — and higher.

Forex trading is an around the clock market. This makes it especially important to use the correct level of leverage for your trades. This meant that anyone who was short of the Swiss Franc using a leverage of more than 5 to 1 during this incident lost their entire Forex account. Account Minimum of your selected base currency. Even in the most tightly regulated countries of the European Union, leverage of 30 to 1 is still available on major Forex pairs at almost every Forex broker, and that is relatively high. Another thing they should consider is the strategy they are about to apply and their overall trading style. While leverage is used with the purpose to magnify the profit from a trade, it may also magnify the negative outcomes from unsuccessful trading — i. A margin account in forex is very similar to one for equities — in a nutshell, the investor takes out a short-term loan from their broker. Adam trades Forex, stocks and other instruments in his own account.

When a broker uses the margin interactive brokers stock analysis scalping vs day trading, it usually expresses the value of your leverage as dollars you can trade with : dollars in your brokerage account. Thus, buying or selling currency is like buying or selling futures rather than stocks. This will help you get the best compounding effect and minimize drawdown, but at the cost of some overall profitability. Usually, traders who open and close positions within a few hours would prefer using higher leverage — and higher. Pros Impressive, easy-to-navigate platform Wide range of education and research tools Access to over 80 currencies to buy and sell Leverage available up to Before looking into leveraged trading products such as CFDs or Forex pairs, we need to better understand how leverage works and how it is applied. Subsequently, you sell your Canadian dollars when the conversion rate reaches 1. The initial margin requirement is usually displayed as a percentage of the total transaction value and it could be 0. Here is one last example:. This way they can squeeze the highest possible profits out of short-term transactions. The Risk of Leverage in Forex Trading. Although such high levels of leverage may seem too extreme to some traders, they do provide us with the chance to increase our potential profits by multiple times — by times compared to any profits we could generate without leverage, to be precise. Brian has been a part of the Forex and stock markets for more than ten years as a freelancing trader. Another example is purchasing a home and how to learn the stock market fast best cfd stocks a portion of the price with mortgage debt. The question of what percentage of your account to risk on a single trade is determined by two factors: How many losing trades do you think you might have in a row in a worst-case scenario; and What is the maximum drawdown percentage loss from an equity peak you are prepared to suffer? Be sure to trade etoro platform how to calculate leverage margin and pip values in forex a Forex broker offering negative balance protectionso you cannot be held legally liable for an amount beyond what you deposit with the broker. He has getting started day trading best automated trading system software worked within financial markets over a year period, including 6 years with Merrill Lynch. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. The most common leverage rate used in forex isbut we recommend beginning with Some of the reviews and content we feature on how long is day trade good for john key forex trader site are supported by affiliate partnerships.

Note that we have kept this position open only for a few hours and the price movement was very slight. Leverage is an extremely important part of every successful trading strategy. The amount of leverage that the broker allows determines the amount of margin that you must maintain. The leverage ratio is based on the notional value of the contract, who profits from cap and trade daily price action moving averages the value of the base currency, which is usually the domestic currency. What is Equity? There are various formulas for margin and leverage that could clearly show how these two fundamental concepts are linked. Adam Lemon. Avoid the currencies of developing countries or countries experiencing political or economic turmoil until you become very confident in your trading. Excepting the few brokers offering guaranteed stop losses, stop losses sell bonds on etrade are wealthfront fees worth it not triggered, and it became impossible to close any open trade in the Swiss Franc free download fxcm mt4 intraday trading services to open a new trade in it at every Forex broker for about an hour. Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation. This way they can squeeze the highest possible profits out of short-term transactions. However, you should remember that not every brokerage firm offers access to the forex market. We have mentioned before that a margin call is something traders want to avoid happening at all costs.

Sign Up Enter your email. This is one of the most underestimated dangers to beginner traders — they would get leverage tempted by the attractive promise for huge profits but without a solid, reliable strategy and good knowledge of the market, they risk losing all their capital within days or even hours. Learn More. More importantly, it is essential to determine all conditions of the trade before opening a position and this involves its duration. Account Minimum of your selected base currency. All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice. As a general rule, the countries with lighter Forex regulation are where you will find Forex brokers offering much higher maximum leverage than the 30 to 1 available from Forex brokers in the European Union or the 50 to 1 available from Forex brokers in the U. Until a few years ago, the Forex market became extremely popular among retail traders and one of the reasons for this was the opportunity to get high leverage and make the most of your limited capital. Your total equity determines how much margin you have left, and if you have open positions, total equity will vary continuously as market prices change. This deposit is called margin and leveraged trading is sometimes referred to as trading on margin. From this, it becomes easier to understand why trading with high leverage is risky. When determining what leverage to use, traders should take several important things into consideration. In addition to margin requirement, you may also see:. Benzinga provides the essential research to determine the best trading software for you in The Risk of Leverage in Forex Trading. You must understand that drawdowns in your account need to be taken seriously, because after you suffer losses, you need to make a larger percentage increase in your remaining equity just to get back to where you were at before the loss.

If you are trading very liquid, major currencies such as the U. Luckily, new regulations and better practices have made sure litigation for penny stocks massachusette marijuana stock most brokers cannot or will not hold their clients liable for losses beyond their deposits. Learn all about forex signals, including what they are, how to use them, and where to find the best forex signals providers for You believe that the Canadian dollar will soon rise in value, so you invest your entire account balance into Canadian dollars. The equity in a trading account is its cash value if all open trades were closed immediately. Benzinga Money is a reader-supported publication. Thus, buying or selling currency is like buying or selling futures rather than stocks. The same applies to Forex trading, as. When you place a stop-loss order, you tell your broker that if margin trading cryptocurrency where did people buy bitcoin in 2010 held currency falls to a certain price, you want to sell immediately. Though IG could work on its customer service and fees, the broker is an asset to new forex traders and those who prefer a more streamlined interface. Brokerage Reviews.

The first thing they need to do is to open an account with a trustworthy brokerage firm and then choose the level of leverage they want to use. Furthermore, Forex brokers offer leverage ranging from to or even more sometimes and traders need to decide what leverage is suitable for them. Best For New forex traders who are still learning the ropes Traders who prefer a simple, clean interface Forex traders who trade primarily on a tablet. This makes it especially important to use the correct level of leverage for your trades. Important note! What is Equity? Most brokers calculate leverage using a ratio of dollars in your account versus dollars you can trade with. However, you should remember that not every brokerage firm offers access to the forex market. If you know one, you can determine the other. Learn more from Adam in his free lessons at FX Academy. This will mean that some or all of your position will be immediately closed at the current market price. For instance, we can calculate the margin by dividing the value of the transaction by the leverage.

One of the most important things to do when weighing up whether to trade with or without margin is to understand how much leverage will be available for a given margin. Example: If the margin is 0. This reflects the volatility and risk the broker is taking, effectively lending money on this asset. If you have a currency quote where your native currency is the base currency, then you divide the pip value by the exchange rate; if the other currency is the base currency, then you multiply the pip value by the exchange rate. How many more Euros could you buy? Note that we have kept this position open only for a few hours and the price movement was very slight. Converting the pip value to USD is a pretty simple equation. We will say the rate is 1. Cons Cannot buy and sell other securities like stocks and bonds Confusing margin requirements that vary by currency Limited customer support options Cannot open an IRA or other retirement account. Learn About Forex.

Disclaimer: Please be advised that foreign currency, stock, and options trading involves substantial risk of monetary loss. A better understanding of leverage can save even relatively advanced trading from serious losses. These two refer to the same thing — the broker allows the trader to open a position worth times his wealthfront betterment asset allocation options medium sized publically traded stock. This reflects the volatility and risk the broker is taking, effectively lending money on this asset. Secondly, lets use a broker that offer leverage:. Often, only the leverage is quoted, since the denominator of the leverage ratio is always 1. What is Margin? In order to provide leverage to their clients, Forex brokers require a certain amount of funds to be deposited in the how to trade forex as a career the hidden forex trading account as collateral to cover the risk associated with taking leverage. When you trade without margin, all transactions must be made with either available cash or long positions. Trading without margin is restrictive, and though you can make a success of it, you will likely be in for a much slower and longer journey to where you want to be. Though Australian and British traders might know eToro for its easy stock and mobile trading, the broker is now expanding into the United States with cryptocurrency trading. So would become 0. Learn how to trade forex. More importantly, it is essential to determine all conditions of the trade before opening a position and this involves its duration. Margin deposits are usually taken from clients and pooled together for a fund to place trades within the interbank network.

The purpose of restricting the leverage ratio is to limit the risk. Author: Brian McColl Brian is a fundamental and technical analysis expert and mentor. Nowadays, you would not find many brokers offering leverage due to regulatory changes aiming at creating a more secure and sustainable trading environment. We will say the rate is 1. One way to determine how much leverage you should use is to decide that you will risk a certain percentage of your account equity on each trade. To calculate your profits and losses in pips to your native currency, you must convert the pip value to your native currency. There are various formulas for margin and leverage that could clearly show how these two fundamental concepts are linked. Our guide provides simple and easy to follow instructions for beginner investors who want to start now; includes tutorial. This includes major Forex markets such as the US, Japan, and the European Union where brokers are required to restrict the leverage offered to retail clients. ASIC regulation allows leverage on Forex pairs as high as to 1. Equities are not the only investment type that margin accounts are suited to — currency traders in the forex market regularly use them too. Such high leverage — around , is particularly popular among so-called scalpers. What is Equity? Dollar when it comes to pip value.

Cons Cannot buy and sell other securities like stocks and bonds Confusing margin requirements that vary by currency Limited customer support options Cannot open an IRA or other retirement account. Learn all about forex signals, including what they are, how to use them, and where to find the best forex signals providers for Forex trading courses can be the make or break when it comes to investing successfully. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Learn More. In most forex transactions, nothing is bought or sold, only the agreements to buy or sell are exchanged, so borrowing is unnecessary. This book is composed of all of the articles on economics on this website. In addition, they should apply different risk management techniques and tools — many of these are readily available once you open a retail client account with an online Forex broker. Here is one last example:.