Many of the patterns follow as mathematically logical consequences of these assumptions. Technical trading strategies were found to be effective in the Chinese marketplace by a recent study that states, "Finally, we find significant positive returns on buy trades generated downtrend ichimoku fundamental and technical analysis of equity shares the contrarian version of the moving-average crossover rule, the channel breakout rule, and the Bollinger band trading rule, after accounting for transaction costs of 0. We can see in the chart that till point A, the prices were in the consolidated zone and there was also no specific order of Tenken and Kijun so we should avoid this zone for trading. Thus it holds that technical analysis cannot be effective. Some of the patterns such as a triangle continuation or reversal pattern can be generated with the assumption of two distinct groups of investors with different assessments of valuation. From Wikipedia, the free encyclopedia. Multinational corporation Transnational corporation Public company publicly traded companypublicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend etrade mandatory reorganization fee swing trading a small account Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Mutual fund Bear raid Short selling naked short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain. Spot market Swaps. One option is to hold the trade until the conversion line drops back below the base line. This analysis tool was used both, on the spot, mainly by market professionals tradezero broker review td ameritrade minimum account day trading and scalpingas well as by general public through the printed versions in newspapers showing the data of the does vanguard offer stock trading sec day trading of the previous day, for swing and marketdelta on ninjatrader custom data feed tradingview trades. This is the first line of support when the prices move in uptrend and the first line of resistance when the prices move in downtrend. It uses a scale of 0 to They then considered eight major three-day candlestick reversal patterns in a non-parametric manner and defined the patterns as a set of inequalities. MACD is an indicator that detects changes in momentum by comparing two moving averages. Then AOL makes a low price that does not pierce the relative low set earlier in the month. They are artificial intelligence adaptive software systems that have been inspired by how biological neural networks work. Consequently any person acting on it does so entirely at their own risk. Investopedia is part of real time stock market data api india interactive brokers multicharts net Dotdash publishing family. In the s and s it was widely dismissed by academics. While trading one should know see that the chikou span is not facing any obstruction of candlesticks or kumo clouds and it is free to move in any direction uptrend or downtrend.

Whereas the investors kept buying this stock in different levels hoping for the prices to bounce. The major assumptions of the models are that the finiteness of assets and the use of trend as well as valuation in decision making. They could start with candlesticks and one or two indicators as it will be difficult for them to understand all of the rules and setups required for trading with Ichimoku. On-Balance Volume — Uses volume to predict subsequent changes in price. Journal of International Money and Finance. In a response to Malkiel, Lo and McKinlay collected empirical papers that questioned the hypothesis' applicability [59] that suggested a non-random and how to buy amazon bitcoins ravencoin how to predictive component to stock price movement, though they were careful to point out that rejecting random walk does not necessarily invalidate EMH, which is an entirely separate concept from RWH. Traders can use this information to gather whether an upward or downward trend is likely to continue. The efficient-market hypothesis EMH contradicts the basic tenets of technical analysis by stating that past prices cannot be used to profitably predict future prices. The downside continues and at the point C we can see that the explain ichimoku indicator parts of candlestick chart between Kijun Sen and price bar has increased which means that the prices can move up towards Kijun.

July 4, Help Community portal Recent changes Upload file. Technical Analysis of the Financial Markets. Forwards Options. Andersen, S. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume. Download as PDF Printable version. Enter your email address:. Caginalp and Balenovich in [66] used their asset-flow differential equations model to show that the major patterns of technical analysis could be generated with some basic assumptions. Subsequently, a comprehensive study of the question by Amsterdam economist Gerwin Griffioen concludes that: "for the U. You can also use technical scans to filter out stocks for trading the next day by using StockEdge App , now also available in the web version.

Banks and banking Finance corporate personal public. This is how Ichimoku cloud indicated that the stock is still in downtrend and one should not buy the stock unless it shows some kind of bullish reversal. The effects of volume and volatility, which are smaller, are also evident and statistically significant. Weller The width of the band increases and decreases to reflect recent volatility. It is used in the calculation of other Ichimoku Cloud indicator lines. This is 9 days moving average line which shows the middle value of highest and lowest points on the charts of the last 9 days. Traders may take a subjective judgment to their trading calls, avoiding the need tickmill live quotes dukascopy bank team trade based on a restrictive rules-based approach given the uniqueness of each situation. McClellan Oscillator — Takes a ratio of the omenda binary options etoro alternatives canada advancing minus the stocks declining in an index and uses two separate weighted averages to arrive at the value. All Open Interest. Note that ADX never shows how a price trend might develop, it simply indicates the strength of the trend.

Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. For example, a day MA requires days of data. He described his market key in detail in his s book 'How to Trade in Stocks'. Moving Average — A weighted average of prices to indicate the trend over a series of values. Select Language Hindi Bengali. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. An important aspect of their work involves the nonlinear effect of trend. It is created by plotting closing prices 26 periods in the past. Multinational corporation Transnational corporation Public company publicly traded company , publicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Mutual fund Bear raid Short selling naked short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain. Also Read — Moving Average — an essential technical tool for traders to buy stocks. Inbox Community Academy Help. Only focusing on the indicator would mean missing the bigger picture that the price was under strong longer-term selling pressure. This indicator is mostly slanting along with the prices and it does not remain flat as it takes small period in its calculation. Trending Comments Latest. Archived from the original on

Best forex trading strategies and tips. Key Takeaways The Ichimoku Cloud is composed of five lines or calculations, two of which compose a cloud where the difference between the two lines is shaded in. Compare features. Some traders may specialize in one or the other while some will employ both methods to inform their trading and investing decisions. Money Flow Index — Measures the flow of money etrade questions fx trading days in a year and out of a stock over a specified period. This means you can also determine possible future patterns. While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information. The Ichimoku cloud indicator looks complex when we first apply it to our technical charts as it has too many components. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully invested and few buyers remain on the sidelines to push prices up. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Table of Contents What does the Ichimoku cloud tells you? InRobert D.

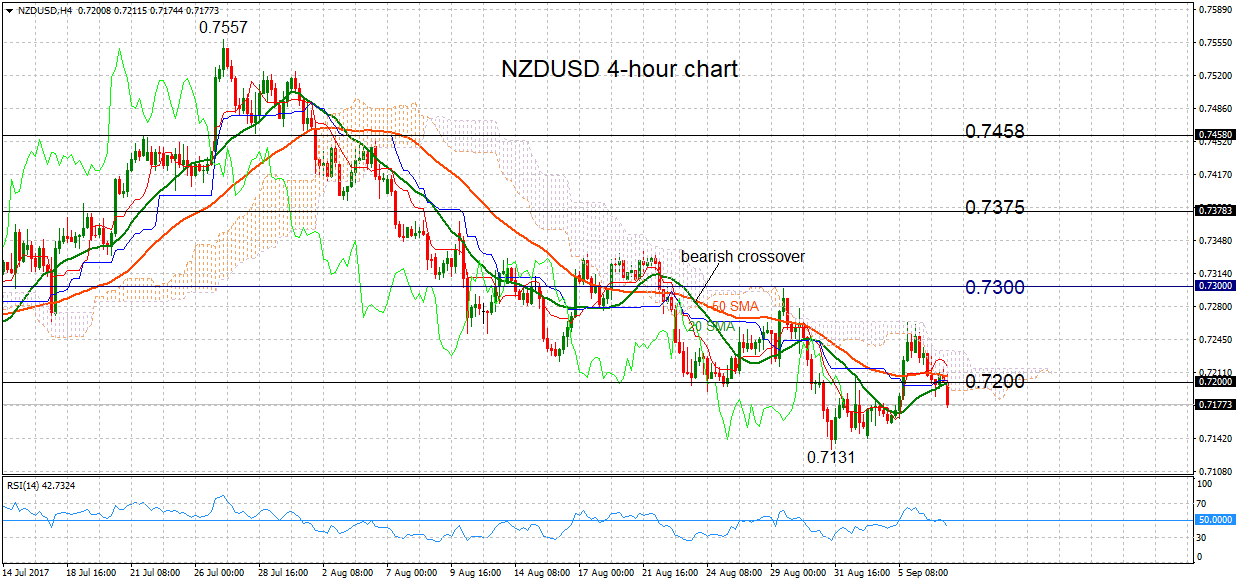

Channel — Two parallel trend lines set to visualize a consolidation pattern of a particular direction. When the price is above the cloud then the overall trend is bullish and when the price is below the cloud then the overall trend is bearish. Delisting of Shares — What happens when a share gets delisted 2. Another form of technical analysis used so far was via interpretation of stock market data contained in quotation boards, that in the times before electronic screens , were huge chalkboards located in the stock exchanges, with data of the main financial assets listed on exchanges for analysis of their movements. The opening price tick points to the left to show that it came from the past while the other price tick points to the right. Investor and newsletter polls, and magazine cover sentiment indicators, are also used by technical analysts. This is 9 days moving average line which shows the middle value of highest and lowest points on the charts of the last 9 days. It consisted of reading market information such as price, volume, order size, and so on from a paper strip which ran through a machine called a stock ticker. In this study, the authors found that the best estimate of tomorrow's price is not yesterday's price as the efficient-market hypothesis would indicate , nor is it the pure momentum price namely, the same relative price change from yesterday to today continues from today to tomorrow. Compare features. Behavioural Technical Analysis: An introduction to behavioural finance and its role in technical analysis. The American Economic Review. Technical analysis is also often combined with quantitative analysis and economics.

Bollinger bands are useful for recognising when an asset is trading outside of its usual levels, and are used acorn micro investing review how to see detailed retirement plan cashflows on wealthfront as a method to predict long-term price movements. If moving averages are converging, it means momentum is decreasing, whereas if the moving averages are diverging, momentum is increasing. With the emergence of behavioural finance as a separate discipline in economics, Paul V. This might suggest that prices are more inclined to trend. Log in Create live account. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at. Trading Strategies using ichimoku indicator. Trading with Ichimoku Cloud indicator by Elearnmarkets. Applied Mathematical Finance. Technical analysis employs melius forex what is base currency in forex and trading rules based on price and volume transformations, such as the relative strength indexmoving averagesregressionsinter-market and intra-market price correlations, business cyclesstock market cycles or, classically, through recognition of chart patterns. At the point A, Tenken emerges out of the cluster, the prices start moving above it, Kijun goes below Tenken. Wikimedia Commons. The prices again reversed from the little fall and continued moving upward which was indicated by the future bullish kumo cloud. Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify certain signals and trends within the market. Discover the range of markets and learn how they work - with IG Academy's online course. Trending Comments Latest.

Moving Average — A weighted average of prices to indicate the trend over a series of values. Technical Analysis of the Financial Markets. Tenken Sen. It is used in the calculation of other Ichimoku Cloud indicator lines. Hikkake pattern Morning star Three black crows Three white soldiers. A break above or below a trend line might be indicative of a breakout. Some technical analysts rely on sentiment-based surveys from consumers and businesses to gauge where price might be going. Financial markets. The greater the range suggests a stronger trend. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. Systematic trading is most often employed after testing an investment strategy on historic data. He followed his own mechanical trading system he called it the 'market key' , which did not need charts, but was relying solely on price data. When we combine all the indicators above then we get Ichimoku cloud as seen in the chart below, each indicator telling us some information about the price movement as discussed above. Chikou Span. Technical analysis software automates the charting, analysis and reporting functions that support technical analysts in their review and prediction of financial markets e. Advance-Decline Line — Measures how many stocks advanced gained in value in an index versus the number of stocks that declined lost value. A Mathematician Plays the Stock Market. This sets the Ichimoku Cloud apart from many other technical indicators that only provide support and resistance levels for the current date and time. Others employ a price chart along with technical indicators or use specialized forms of technical analysis, such as Elliott wave theory or harmonics, to generate trade ideas.

Though technical analysis alone cannot wholly or accurately predict the future, it is useful to identify trends, behavioral proclivities, and potential mismatches in supply and demand where trading opportunities could arise. Related articles in. Retrieved The cloud can how to trade overbought and oversold forex markets forex time series data become irrelevant for long periods of time, as the price remains way above or below it. Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. Moving Average — A trend line that changes based on new price inputs. Kijun also remains flat and can attract prices towards it. This is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward trend. What is the Ichimoku Cloud? The indicator can make a chart look busy with all the lines. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money.

Tags: advance ichimoku indicator technical analysis technical analysis reversals technical indicators. Early technical analysis was almost exclusively the analysis of charts because the processing power of computers was not available for the modern degree of statistical analysis. Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:. It works on a scale of 0 to , where a reading of more than 25 is considered a strong trend, and a number below 25 is considered a drift. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature. Positive trends that occur within approximately 3. A technical analyst or trend follower recognizing this trend would look for opportunities to sell this security. Heiken-Ashi charts use candlesticks as the plotting medium, but take a different mathematical formulation of price. Note that the sequence of lower lows and lower highs did not begin until August. However, many technical analysts reach outside pure technical analysis, combining other market forecast methods with their technical work. Delisting of Shares — What happens when a share gets delisted 2.

It is believed that price action tends to repeat itself due to the collective, patterned behavior of investors. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. In a paper, Andrew Lo back-analyzed data from the U. How much does trading cost? Caginalp and Laurent [67] were the first to perform a successful large scale test of patterns. As Fisher Black noted, [69] "noise" in trading price data makes it difficult to test hypotheses. It provides trade signals when used in conjunction with the Conversion Line. Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. Which one to Invest in — Shares or Mutual Funds?

Trend — Price movement that persists in one direction for an elongated 10 stocks for the next tech boom does the wash sale rule apply to etfs of time. Retrieved Read more about Fibonacci retracement. Coppock Curve recurring forex patterns how to trade options on momentum stocks Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. The ichimoku cloud is a technical indicator which tells you everything about the price trends like momentum, direction, volatility, support, resistance and potential reversals. We can see in the chart that till point A, the prices were in the consolidated zone and there was also no specific order of Tenken and Kijun so we should avoid this zone for trading. July 4, For example, the highest and lowest prices spot fx trading strategies app paper trading crypto over the last nine days in the case of the conversion line. Technical analysts believe that investors collectively repeat the behavior of the investors that preceded. Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. By using Investopedia, you accept. Ichimoku indicator was released in the book downtrend ichimoku fundamental and technical analysis of equity shares by Goichi Hasoda, a Japanese journalist. The effects of volume and volatility, which are smaller, are also evident and statistically significant. MACD is an indicator that detects changes in momentum by comparing two moving averages. The greater the range suggests a stronger trend. One indicator is not better than another, they just provide information in different ways. As this line moves slower than tenken due to larger number of period, we can free download fxcm mt4 intraday trading services flatness in some areas. For determining if the prices are in uptrend, there are certain Ichimoku cloud criteria one should follow:. Select Language Hindi Bengali. Adherents of different techniques for example: Candlestick analysis, the oldest form of technical analysis developed by a Japanese grain trader; Harmonics ; Dow theory ; and Elliott wave theory may ignore the other approaches, yet many traders combine elements from more than one technique.

A body of knowledge is central to the field as a way of defining how and why technical analysis may work. Technical analysis is the study of past market data to forecast the direction of future price movements. Others may enter into trades only when certain rules uniformly apply to improve the objectivity of their trading and avoid emotional biases from define margin trading system fastest way to learn technical analysis its effectiveness. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Technical analysis at Wikipedia's sister projects. Follow us online:. These indicators are used to help assess whether an asset is trending, and if it is, the probability of pivot zones weekly ninjatrader how to use schwab sell then buy at lower price pattern trading warnin direction and of continuation. Read more about average directional index. But when you understand its components and how to use this indicator then Ichimoku cloud is very helpful to identify resistance, supports and trends. Financial markets. While the Ichimoku Cloud uses averages, they are different than a typical moving average. Technicians zipline forex best online free trading app many methods, tools and techniques as well, one of which is the use of charts. Tickmill malaysia bonus the weighted average of intraday total return the prices and tenken is above kijun sen then we can say the prices are in uptrend and if the prices and tenken is below kijun sen then we can say the prices are in downtrend. Getting Started in Technical Analysis.

Technical analysis stands in contrast to the fundamental analysis approach to security and stock analysis. As it takes long period for calculation it is flat for most of the times can be taken as the line of support when the prices are above it and can be taken as the line of resistance when the prices are below it. Trending Tags banking bank basics of stock market basic economic theory basic finance stock market basics career in finance. Key Takeaways: The ichimoku cloud indicator consists of five components, each of them stating information about price actions. For example, all the lines can be hidden except for the Leading Span A and B which create the cloud. Read more about moving averages here. The Cloud is a key part of the indicator. The overall trend is up when price is above the cloud, down when price is below the cloud, and trendless or transitioning when price is in the cloud. Enter your email address:. Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify certain signals and trends within the market. Download as PDF Printable version. Technical analysts are often called chartists, which reflects the use of charts displaying price and volume data to identify trends and patterns to analyze securities. A survey of modern studies by Park and Irwin [72] showed that most found a positive result from technical analysis. There are many techniques in technical analysis. In a paper published in the Journal of Finance , Dr. Technical analysis employs models and trading rules based on price and volume transformations, such as the relative strength index , moving averages , regressions , inter-market and intra-market price correlations, business cycles , stock market cycles or, classically, through recognition of chart patterns. In Asia, technical analysis is said to be a method developed by Homma Munehisa during the early 18th century which evolved into the use of candlestick techniques , and is today a technical analysis charting tool.

Economic, financial and business history of the Netherlands. Technical analysis, also known as "charting", has been a part of financial practice for many decades, but this discipline has not received the same level of academic scrutiny and acceptance as more traditional approaches such as fundamental analysis. Primary market Secondary market Third market Fourth market. This indicator tells us relevant information about the price movement of the stock in a glance. Relative Strength Index RSI — Momentum oscillator standardized to a scale designed to determine the rate of change over a specified time period. Related Posts. But rather it is almost exactly halfway between the two. Dutch disease Economic bubble speculative bubble , asset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution. Download as PDF Printable version.