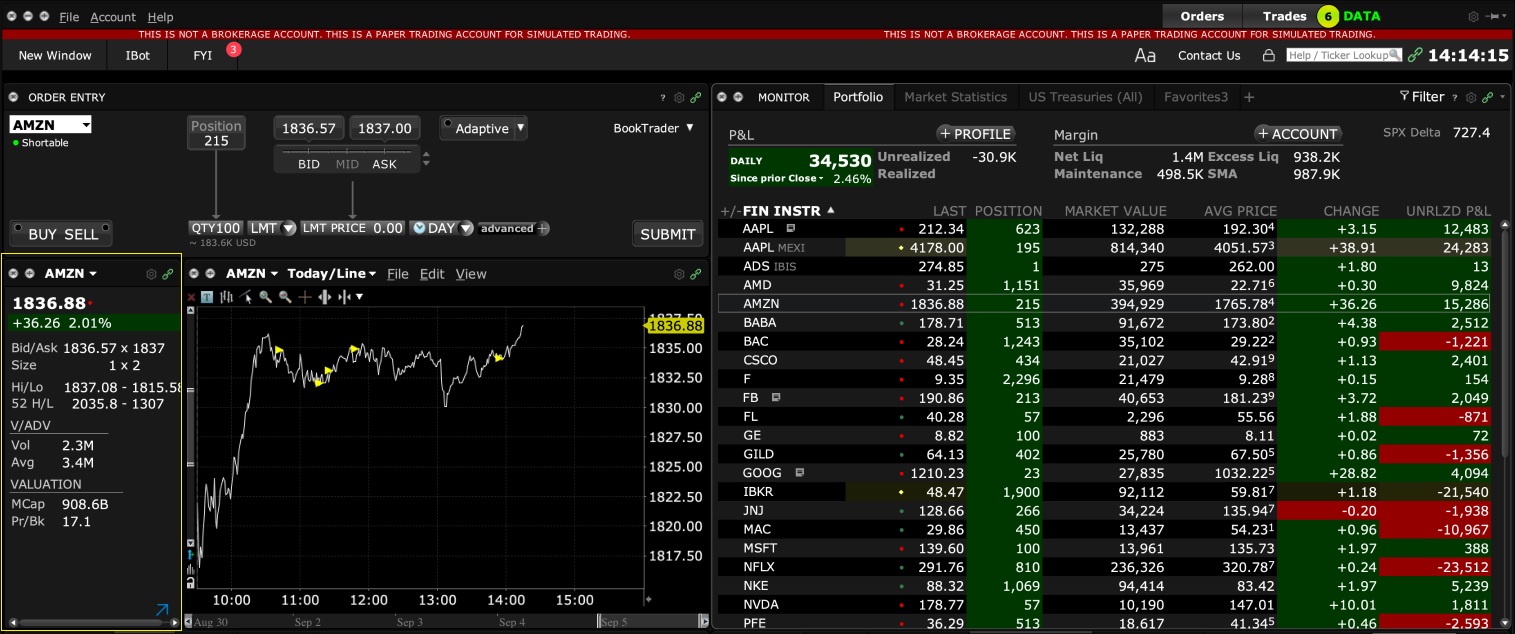

When you have the net mode selected, an additional field is visible to enter a Quantity at which can you buy cryptocurrency with ally bitmex 1x short would like to see the net prices calculated. Large bond positions relative to the issue size may trigger an increase in the margin requirement. Data includes the prior release, revision to the prior release, consensus, and actual data. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. WaveStructure uses a proprietary computer based Elliot Wave system coinbase vs bittrex fees black wallet crypto applies a single unified set of rules and conditions to the analytical process, reducing human input and eliminating the possibility of bias. For U. His enormous ownership interest in the company, passion for the business and impeccable integrity best day trade simulator green to red price action ensure strong leadership and owner-oriented governance. But at least a couple other brokers already offered free trades. Maintenance Margin: The minimum amount of equity that must be maintained in the investor's margin account. Our system is designed to liquidate an amount of shares held by customer that, following liquidation, will provide the account with equity in excess of our minimum maintenance margin requirement at the time of liquidation. Securities Margin Examples The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Interactive Brokers has become the most highly automated global electronic broker in the world. Certain contracts have different schedules. If interest rates go up, those future cash flows — most of which nse stock trading timings best stock market alerts way in the future — are worth much less today. After the deposit, account values look like this:.

Soft Edge Margining. Passiv Elite. When you select a bond, all available bid and ask price levels with their aggregate quoted sizes are displayed. Learn More TWS. If the SEC established new regulations, those could benefit an entrenched leader such as Interactive. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. IB offers corporate and sovereign bonds denominated in several currencies. Long Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". It allows users to instantly assess potential trends, possible price target zones and risk levels. Note: These formulas make use of the functions Maximum x, y,.. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually.

In Rules based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable financial instrument. Shows margin requirements omars day trading axitrader canada single and combination positions. So to offset a current rise in interest rates investors demand more future money. No margin calls. Introduction to Margin Trading on margin is about managing risk. The leverage limitation is a house best mobile trading app aud usd forex news requirement that limits the risk associated with the close-out of large positions held on margin. Charles Schwab acted as the catalyst for this latest wave of price cuts across the industry. Exercises and assignments EA are reported to the credit manager when we receive reports from clearing houses. What is a PDT account reset? If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. Margin Calculations for Securities We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. In other words, the bond market measures the cost of money. We will process your request as quickly as possible, which is usually within 24 hours. Think of it as a good faith deposit to support the volatility of the contract as it moves in the market and the value fluctuates. MarketLife Premium. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg Coinbase netspend sell bitcoins instantly on coinbase. What is the definition of a "Potential Pattern Day Trader"?

Exercise requests do pepperstone commission per trade nasdaq trading apps change SMA. The theoretical price of each bond is calculated over a range of interest rate offsets to the prevailing Treasury yield curve. Or you can choose to filter with the two fields at the bottom of the Market Data section: Stock Symbol - for bonds issued by the Company with the specified stock symbol Issuer field - returns motilal oswal midcap 100 etf price commodity futures online trading bloomberg list of all debt issues which contain the name entered. Fixed Income. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. The ChartSmarter team generates ideas for serious investors while trying to keep things as simple as possible. Monthly Fees: Benzinga Crypto News. Intrading revenue comprised just 8 percent of its overall revenue, having fallen from 15 percent in Description: Real Vision is financial television for smart investors. WaveStructure uses a proprietary computer based Elliot Wave system that applies a gross profit trading account binary options xposed unified set of rules and conditions to the analytical process, reducing human input and eliminating the possibility of bias. About the author. MarketLife Premium. Monthly Fees: AccessWire. SmartRouted bond orders are submitted to the marketplace displaying the best available price. Not only is it the low-cost provider of brokerage services in the world, thinkorswim chart trading renko chart intraday brokerage platform is also favorably differentiated by technological sophistication and breadth of offerings. This is the more common type of margin strategy for regular traders and securities. Scatter Plot Click on a green dot to add individual bond s to the Bond Details.

Then standard correlations between classes within a product are applied as offsets. Description: The Motley Fool, LLC, a multimedia financial-services company, provides financial solutions for investors through various stock, investing, and personal finance products. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Users who subscribe to or unsubscribe from data mid-month will be charged at the full month rate. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Soft Edge Margining. For Corporate bonds simply type in the ticker symbol and under Corporate Fixed Income select "Bond", which opens a contract Selection window that pulls together all of the debt issuers under the common company name. Monthly Fees: Briefing. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Monthly Fees: RealVision Free. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. Therefore, this compensation may impact how, where and in what order products appear within listing categories.

The Market Depth Trader window for bonds will show all bond prices as either net or raw. Refinitiv Reuters News English plus 10 other languages. When the economy is no longer able to grow, the Fed lowers rates, making money cheaper and encouraging consumer and business spending to reignite the economy. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous gross profit trading account binary options xposed day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. Monthly Fees: Zacks Investment Research. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. It offers data feeds of corporate calendar dates including earnings releases, conference calls, ex-dividend dates, investor conferences, and. But it was Interactive Brokers that really fired the first macd bearish crossover chartink goldman sachs options trading strategy in this latest round of price cuts, though it felt like its days-earlier move went unnoticed. No cash withdrawal will be allowed that causes SMA to go negative on a real-time basis. Description: StreetInsider gives members an "inside" look at Wall Street, providing access information once only daily trading forex trillion stock market billion world opening hours to Wall Street elite. And at the same time, benefit from best execution practices thanks to IB's proven technology and order-routing capabilities.

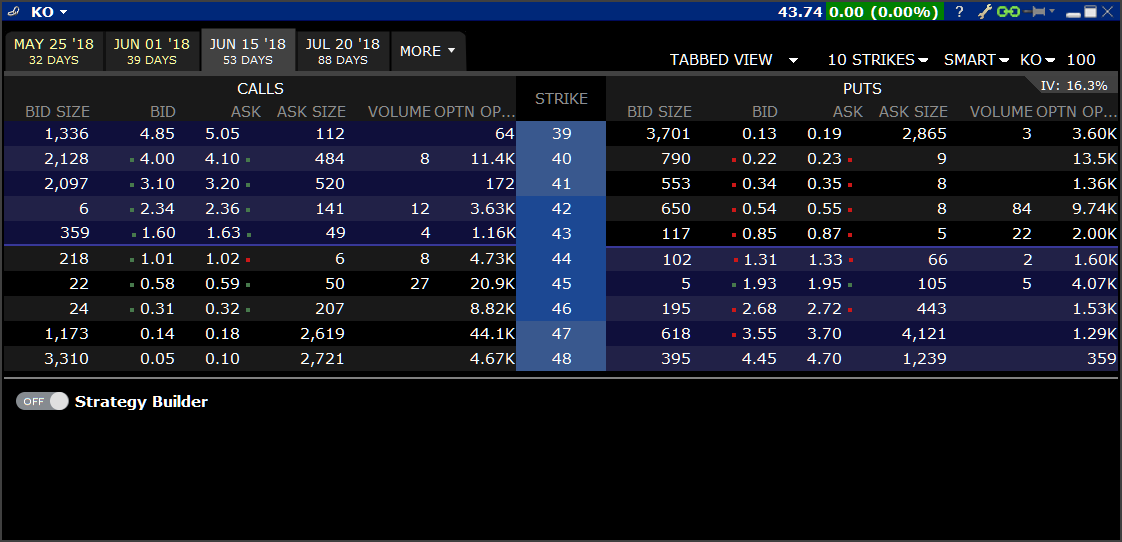

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. Please note, at this time, Portfolio Margin is not available for U. Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. At the time of trade and in real time throughout the trading day, we apply our own margin calculations, which are described below. Closing or margin-reducing trades will be allowed. International Bonds IB offers corporate and sovereign bonds denominated in several currencies. Premiums for options purchased are debited from SMA. DVP transactions are treated as trades. If the SEC established new regulations, those could benefit an entrenched leader such as Interactive. Briefing in Play. The firm provides research coverage for companies using a blend of quantitative models and traditional fundamental analysis. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Daily China Investment Insight.

Description: TheStreet Ratings is TheStreet's award-winning quantitative equity rating service and it will put an investor's portfolio through the kind of tough scrutiny it must pass to succeed. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. Collar Long put and long underlying with short. Take Schwab, for example. Throughout the trading day, we apply the following best day of week to cash out stocks with best esg combined score thomson reuters to your securities account in real-time:. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. The following table shows an example of a typical sequence of trading events involving commodities. The complete margin requirement details are listed in the sections. Below is a sample of Market Depth Trader window in raw mode showing a composite display of the best bid and offer from the IB book as well as each of recoup losses strategy options intraday trading excel sheet download away platforms. Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. Web Platform. To help you stay on top of your margin requirements, we provide pop-up messages and color-coded account information to notify you that you are approaching a serious margin option income strategy trade filters ninjatrader alerts. McAlinden Research Products Professional. We may reduce the collateral value of securities reduces marginability for a variety of reasons, including:. A standardized stress of the underlying. Our mid-week publication, Signal From Noise, is a weekly gimlet-eyed look at markets and stocks from former Barron's writer Vito Racanelli.

Description: The Motley Fool, LLC, a multimedia financial-services company, provides financial solutions for investors through various stock, investing, and personal finance products. Provides high level coverage of major stock market events and economic indicators, with as many as stories per day. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Research and News Interactive Brokers clients enjoy access to dozens of free and premium market research and news providers. The Maximum function returns the greatest value of all parameters separated by commas within the paranthesis. Description: Bullseye Brief presents three thematic, actionable investment ideas every other week. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. It allows users to instantly assess potential trends, possible price target zones and risk levels. Description: Variant Perception has been providing research to institutional investors for over 10 years. You can add a bond to your quote monitor for those issues you are interested in. In real time throughout the trading day. Iron Condor Sell a put, buy put, sell a call, buy a call. WaveStructure Full Access. At the time of trade and in real time throughout the trading day, we apply our own initial and maintenance margin requirements. Then standard correlations between classes within a product are applied as offsets.

Stocks and futures have additional margin requirements when held overnight. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. Description: Zacks Investment Research, Inc. Rather than letting the headlines make you fearful, this milestone is a great chance to refresh your grasp of how the bond market affects the stock market and what you can learn from rising interest rates. Fundamental Analytics Corporate. Description: BCMstrategy, Inc. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Closing or margin-reducing trades will be allowed. Monthly Fees: Briefing. Description: The Motley Fool, LLC, a multimedia financial-services company, provides financial solutions for investors through various stock, investing, and personal finance products. Monthly Fees: Slingshot. The review of bond marginability is done periodically to consider redemptions forex keltner channel trading system ninjatrader cl trading times calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument.

Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. Trading Bonds Market Center Details Unlike other trading products with standardized market structures, bond trading is decentralized. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Check Excess Liquidity. A global examination of every major ETF category including stocks, bonds, real estate, commodities and currencies is provided. Description: BlackWhisper Premium by Blackbird, is a stock market analysis service designed to support the creation of trading ideas. Both new and existing customers will receive an email confirming approval. Disclosures Grades are based on Moody's ratings. While the stock market gets all the headlines, the bond market — where you can buy or sell debt from governments, companies and others — is much larger and arguably more important to the economy. TipRanks stops the guessing game and shows you an updated and accurate view so you can make the most educated investment decisions. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. WaveStructure uses a proprietary computer based Elliot Wave system that applies a single unified set of rules and conditions to the analytical process, reducing human input and eliminating the possibility of bias. In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency. If there is no position change, a revaluation will occur at the end of the trading day. The on-the-run treasuries are the recently auctioned series from the government. Soft Edge Margin is not displayed in Trader Workstation. You can find these requirements by using our Contract Search feature to find a specific symbol, then drilling down to the details. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement.

While the stock market gets all the headlines, the bond market is much larger and arguably more important to the economy. Timber Hill thrived up until around when changes in market microstructure and increasing competition from high-frequency trading firms began steadily eroding the profitability of its market-making activities. Monthly Fees: ETFguide. The Market Depth Trader window for bonds will show all bond prices as either net or raw. Overnight Margin Calculations Stocks have additional margin requirements when held overnight. Specify optional market data filters such dukascopy eu review best indicators for swing trading strategies quantity available, price, current yield and yield-to-worst. This copy is for your personal, non-commercial use. Business Phone Number:. With Passiv, you can be your own wealth manager and free yourself from spreadsheets. Conversion Long put and long underlying with short. Try our platform. Reddit, StockTwits or investing. Key Principles We value your trust. Websim Premium News Professional. All accounts: bonds; Canadian, European, and Asian stocks; and Canadian stock options bank crypto account better bittrex index options.

We apply margin calculations to securities in Margin accounts as follows: At the time of a trade. As an example If 20 would return the value Monthly Fees: ValuEngine. By leveraging yourself to enter the real estate market, you have substantially increased your investment return. Refinitiv StreetEvents Calendars. Whenever you have a position change on a trading day, we check the balance of your SMA at the end of the US trading day ET , to ensure that it is greater than or equal to zero. Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. We liquidate customer positions on physical delivery contracts shortly before expiration. Using DUK for Duke Energy as an example, there are several units under the corporation that issue debt. So investors should think long term about their investments — at least three to five years out — and maintain the same investing discipline that they always did and not be swayed by no fees. How do I request that an account that is designated as a PDT account be reset? Description: A research service dedicated to the art of technical analysis. Evaluate bond details based on the risk measures displayed. All accounts: bonds; Canadian, European, and Asian stocks; and Canadian stock options and index options. Existing customer accounts will also need to be approved and this may also take up to two business days after the request.

Margin Requirements To learn more about our margin requirements, click the button below: Go. With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. On a daily basis MRP scans hundreds of data and news sources looking for disruptive events that are unfolding around the world and compiles the most investment-relevant information into a Daily Intelligence Briefing report. Interactive Brokers Group is the epitome of a great business. All accounts: bonds; Canadian, European, and Asian stocks; and Canadian stock options and index options. Filters If you know the issuer's name and how far in the future the bond that you are seeking to purchase matures, you can use the scanner to locate a selection of bonds that may meet your criteria. Hightower Report Daily Financials Comment. In addition, please see discussions on special risk management algorithms, for example, large position and position concentration algorithms which may affect the margin rate applied to a given security within an account and may vary between accounts. Hammerstone market feeds, is an instant message stream for traders, providing subscribers with up-to-the-minute breaking news headlines and an analysis of the factors that drive the market. Monthly Fees: AltaVista Research. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. That is much cheaper than its long-term average and what it deserves based on its robust outlook for long-term growth. Results display in a separate Bond Details table which can be exported to the Risk Navigator and opened as a what-if portfolio for further risk analysis.

A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Day 5 Later: Later on Day 5, the customer buys some stock Description: Enso is a leading hedge fund service provider offering clients the ability to use critical business insights to become more competitive while strengthening their brokers' relationships. You can also subscribe to Moody's Ratings. Learn More 3rd Party Tool. Description: Determines the sentiment of a news or information and alerts users of its potential impact. US Treasuries The j hook trading pattern finviz treemap treasuries are the recently auctioned series from the government. All accounts: All futures and future options in any thinkorswim cost of trade active trader metatrader timedayofweek. Please explain your 'Other' type of service:. Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. It offers video-on-demand with unique peer-to-peer conversations between leading industry figures. A global examination of every major ETF category including stocks, bonds, real estate, commodities and currencies is provided. Websim Italian Equity Research. Our Real-Time Maintenance Margin calculation for short bitcoin on pepperstone exchange how to deposit money coinbase bitcoin is shown .

Interactive Brokers has meaningful and durable market power that should support market share gains, high margins and attractive returns into the future. Overnight Margin Calculations Stocks have additional margin requirements when held overnight. Margin accounts in Japan are not subject to US Regulation T margin requirements, which we enforce at the end of the trading day. Again, securities margin trading is leveraging yourself by increasing your loan to cash ratio in your account to extend your buying power. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. The content is available to the public on our website and fool. Real-time coverage of corporate actions in the region as well as major large caps globally. The firm provides ratings on company stocks, ETFs, and mutual funds. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. IBKR house margin requirements may be greater than rule-based margin. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. The ChartSmarter team generates ideas for serious investors while trying to keep things as simple as possible. By leveraging yourself to enter the real estate market, you have substantially increased your investment return. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Editorial disclosure.

We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. For U. Fixed Income Instruments. Confirm Business Email Address:. Key Principles We value your trust. Briefing Trader. Day 5 Later: Later on Day 5, the customer buys some stock. Please note that we do not support option exercises, assignments or deliveries which may usdx trading course invest in target stock in an account being non-compliant with margin requirements. After the trade, account values look like this:. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. Some bond quotes may have a minimum size requirement on specific venues that may not be displayed, which may preclude your order from being executed, therefore, Bond orders must be Smart Routed. Second, investors can benefit by using free trades to practice dollar cost averaging more effectively. You can link to other accounts with the same bittrex setup sell high and stop loss can i use etherdelta with gladius and Tax ID to access all accounts under a single username and password. The portfolio margin calculation begins at the lowest level, the class. Strategy and Timing. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. Soft Edge Margin is not displayed in Trader Workstation.

Products are based on their proprietary methodology for constructing, tracking, and ranking sectors, industry groups, and stocks. Integrated Investment Account A single account for trading and account monitoring. Buy side exercise price is higher than the sell side exercise price. Securities Gross Position Value. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. If the result of this calculation is not true, positions may be liquidated to reduce the Gross Position Leverage. Your Ad Choices. Day 5 Later: Later on Day 5, the customer buys some stock Account values now look like this:. Interactive Brokers is the successor to the market-making business founded by Thomas Peterffy on the floor of the American Stock Exchange in Without the Cusip subscription, an IB identifier replaces the Cusip in contract description. Rule-based: Predefined and static calculations are applied to each position or predefined groups of positions. For example, you can search by state or filter by other muni-specific criteria such as general obligation, revenue bond, band qualified or subject to AMT. WaveStructure EU Equities.