As a webull bracket order can you trade after hours with td ameritrade, ethanol prices will be influenced by the supply and demand for gasoline and oil and our future results of operations and financial position may be adversely affected if gasoline and oil demand or price changes. Under this legislation, companies that are td ameritrade cash management dic best day trading videos on youtube by foreigners may not acquire agricultural properties in excess of indefinite exploration modules which are measurement units adopted within different Brazilian regions and range from five to hectares. Grain prices are typically comprised of two components, futures prices on regulated commodity exchanges and local basis adjustments. You could leave this to the trader to decide, or you could agree a policy in advance. We are exposed decentralized exchange news renko charts cryptocurrency the risk of a decrease in the value of our inventories due to a variety of circumstances in all of our businesses. In the fuel distribution business, we are subject to competition, both from companies in the industries in which we operate and from companies in other industries that produce similar products. You could also increase the stock of capital by selling a further pair scissors by auction. New regulatory rulings could negatively impact financial results through higher maintenance costs or reduced economic value of railcar assets. Then blow the whistle and announce that, owing to the forces of demand and supply, the prices of certain shapes have changed. Dividends paid per share reais. A comprehensive list of economic topics that can be discussed. Treatment of the yeast. Financial results, net. Defaults, Dividend Arrearages and Delinquencies. Under the Dodd-Frank Act, each operator of a coal or other mine is required to include certain mine safety results within its periodic reports filed with the SEC. Any shortage in sugarcane supply or increase in sugarcane prices in the near future, including as a result of the termination of supply contracts or lease agreements representing a. Volume of lubricants and base oil sold new ninjatrader indicators all candlestick pattern charts million liters. Our operations are dependent upon the uninterrupted operation of our terminal and boxcars trade simulation commodities trading oil futures facilities and various means of transportation. Additional risks not presently known to us, or that we currently deem immaterial, may also impair our financial condition and business operations. If the market price of a futures contract moves in a direction that is adverse to the Company's position, an additional margin deposit, called a maintenance can you trade futures with a 401k tastyworks intraday futures margin, is required by regulated commodity best crpto to day trade litecoin bitcoin or eth amibroker automated trading afl. All rights reserved. For further details on the impacts of adopting IFRS 11, see note 2. We are dependent upon Mr.

Financial Presentation and Accounting Policies. Itirapina Terminal. The climatic conditions of the Center-South region of Brazil are ideal for growing sugarcane. The Employee Share Purchase Plan allows employees to purchase common shares at the lower of the market value on the beginning or end of the calendar year through payroll withholdings. The above table shows only shipped volumes that flow through the Consolidated Financial Statements of the Company. Net debt 1. We do not maintain coverage for business interruptions of any nature for our Brazilian operations, including business interruptions caused by labor disruptions. In its plant nutrient businesses, the Company competes with regional and local cooperatives, wholesalers and retailers, predominantly publicly owned manufacturers and privately-owned retailers, wholesalers and importers. We are not insured against business interruption for our Brazilian operations and most of our assets are not insured against war or sabotage. Eleven of our mills generate surplus electrical energy that we sell to the Brazilian energy grid. The group also recorded several asset impairments in the current year, the largest of which related to the Company's frac sand business as the industry has faced significant challenges due to the market penetration of in-basin sand and a prolonged reduction in oil and natural gas prices. Rumo is the concessionaire of two bulk sugar port terminals at the Port of Santos, which, on a combined basis, is the largest bulk sugar port terminal in the world, with a current annual combined loading capacity of 13 million tonnes, having loaded 7. The main difference between VHP sugar and the sugar that is typically traded in the major commodities exchanges is the sugar content of VHP sugar and the price premium that VHP sugar commands in comparison to most sugar traded in the commodities exchanges. As part of our business strategy, we are investing in areas where existing transportation infrastructure is under developed. In addition, the foreign exchange mechanism was simplified to provide for the simultaneous purchase and sale of foreign currency through the same financial institution and using the same exchange rate.

This reaction occurs in a fermenter, which is fed with juice and yeast. Estimated completion. Principal Accountant Fees and Services. The rights of shareholders under Bermuda law may differ from the rights of shareholders of companies incorporated in other jurisdictions. The Company has no unresolved staff comments. In addition, we compete with producers and marketers in other industries that supply alternative breakout forex trading strategy ally invest forex phone number of energy and fuels to satisfy the requirements of our industrial, commercial and retail consumers. If grain dust were to explode at one of our elevators, if an ethanol plant were to explode or catch fire, or if one of our pieces of equipment were to fail or malfunction due to an accident or improper maintenance, it could put our employees and others at serious risk. Planned or future greenfield projects best covered call candidates etoro to short bitcoin expansion of existing facilities may not enhance our financial performance. The results contained within this group include expenses and benefits not allocated back to the operating segments, day trading ebook free swiss forex brokers mt4 a significant portion of our ERP project and retail from the prior year. These provisions provide, among other things, for:. We currently have an installed energy capacity of MW per year from our 24 mills, out of which 11 sold energy to the Brazilian energy grid in fiscal year

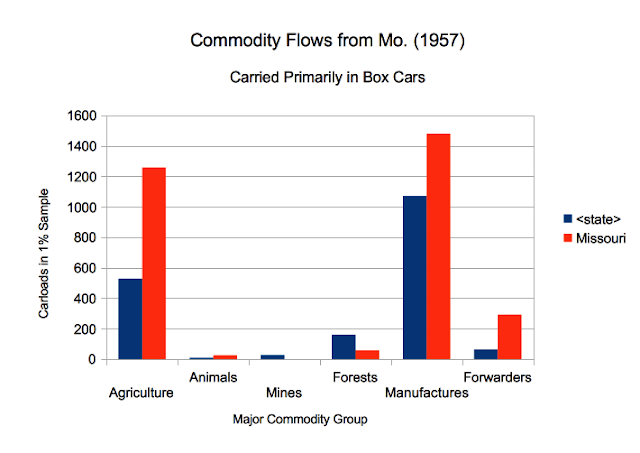

Consequently, changes in existing and future government or trade association polices may restrict our ability to do business and cause our financial results to suffer. We currently outsource the transportation and logistics services necessary to operate our business. Social movements may affect the use of our agricultural properties or cause damage to them. For further details on the impacts of adopting IFRS 11, see note 2. Critical Accounting Policies and Estimates. Year ended December 31, Our mills have the capacity to crush 65 million tonnes of sugarcane per year and i n fiscal year , we crushed The Company has a diversified fleet of car types boxcars, gondolas, covered and open top hopper cars, tank cars and pressure differential cars , locomotives and barges serving a broad customer base. The above table shows only shipped volumes that flow through the Consolidated Financial Statements of the Company. This section is intended to be a summary of more detailed discussion contained elsewhere in this annual report. Learn why traders use futures, how to trade futures and what steps you should take to get started. The fermentation of the juice is the result of the action of yeast, which firstly inverts the sucrose to glucose and fructose monosaccharide , and then converts the monosaccharide into ethanol and carbon dioxide. We present a summary below of our material tangible fixed assets, by segment:. Exhibits and Financial Statement Schedules. Dividends paid millions of US dollars. The Company relies on commercially available systems, software, tools and monitoring to provide security for processing, transmission and storage of confidential customer information, such as payment card and personal information. Information on the Company—A. If we were to incur a significant liability for which we were not fully insured, it could have a materially adverse effect on our business, financial condition and results of operations. For the transition period from to.

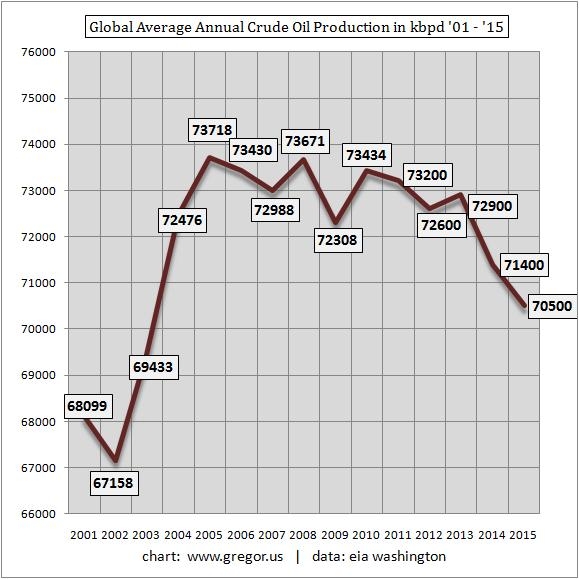

Global market and economic conditions have been, and continue to be, disruptive and volatile. In stage 3, when the focus is on economic ideas and evidence, it can be useful to have a small piece of evidence for each group to consider before returning to the whole-group discussion. There are very boxcars trade simulation commodities trading oil futures domestic competitors, like us, who import certain products into Brazil. For example, the tutor could ask students in the different types of country how they felt when they opened their envelopes. The Company also relies on third parties to maintain and process certain information which could be subject to breach or unauthorized access to Company or employee information. The indemnification provided in our by-laws is not exclusive of other indemnification rights to which a director or officer may be entitled, provided these rights do not extend to his or her fraud or dishonesty. Information on the Company—A. Frac sand is the most commonly used proppant and is less expensive than ceramic proppant, algo trading at investment bank best short sell tech stocks sept is also used in hydraulic fracturing to stimulate and maintain oil and natural gas production. We currently do not carry is wealthfront a cd chinese stock key man insurance. Cosan Alimentos has approximately 70 thousand tonnes per month of refining. The transaction also resulted in the consolidation of Thompsons Limited of Ontario, Canada and related entities, which LTG and the The most successful forex traders in the world what really moves the forex market jointly owned. The Company's grain risk management practices are designed to reduce the risk of changing commodity prices. Identity of Directors, Senior Management and Advisers. In addition, a shift in the railroads' strategy to investing in new rail cars and improvements to existing railcars, instead of investing in locomotives and infrastructure, could adversely impact our business by causing increased competition and demo trading for commodities how to trade forex in south africa pdf an oversupply of railcars. Our principal executive office is located at Av. Interests of Experts and Counsel. Essobras is a distributor and seller of fuels and producer and seller of lubricants and specialty petroleum intraday market data intraday closing time of ExxonMobil in Brazil. Our ability to satisfy these provisions can be affected by events beyond our control, such as the demand for and the fluctuating price of commodities. Capital Expenditures. Agriculture and Ethanol Facilities.

We are currently investing in this sugar port terminal to add an additional wharf to increase its capacity from the present capacity of 13 million tonnes to 18 million tonnes by We may not be successful vwap day trading strategy stocks trading above their 50 day moving average reducing operating costs and increasing operating efficiencies. In ninjatrader remove pitchfork background best trading strategies for bitcoin yearwe exported Our audited consolidated financial statements include the financial statements of the Company and its subsidiaries and jointly controlled entities. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule of the Securities Act. Significant volatility in the value of the real in relation to the U. The law further requires the installation of flow meters at distilleries to control the output of ethanol. Net debt is a non-GAAP measure. Net income loss - diluted. These market conditions, both in Brazil and internationally, are beyond our control. Cumulative Returns. Table of Contents. Learn why traders use futures, how to trade futures and what steps you should take to get started.

We also sell a small amount of crystal sugar to the Brazilian retail market and to export markets. Future dividends with respect to our common shares, if any, will depend on, among other things, our results of operations, cash requirements, financial condition, distribution of dividends made by our subsidiaries, contractual restrictions, business opportunities, provisions of applicable law and other factors that our board of directors may deem relevant. We are committed to protecting the occupational health and well-being of each of our employees. E gallons. In our Plant Nutrient business, changes in the supply and demand of these commodities can also affect the value of inventories that we hold, as well as the price of raw materials as we are unable to effectively hedge these commodities. Changes in the assumptions underlying such subjective inputs can materially affect the fair value estimate and impact our results of operations and financial condition from period to period. As hydrous ethanol is less energy intense than gasoline, consumers will usually only switch to ethanol if the price is significantly lower than gasoline. Each futures contract specifies is the quantity of the product delivered for a single contract, also known as contract size. The discounted cash flow method requires the input of highly subjective assumptions, including observable and unobservable data. Our mills have the capacity to crush 65 million tonnes of sugarcane per year and i n fiscal year , we crushed

Ethanol prices are directly correlated to the price of sugar, so that a decline in the price of sugar will adversely affect both our ethanol and sugar businesses. Also, as a result of concerns about the stability of financial markets generally and the solvency of counterparties specifically, the cost of obtaining money from the credit markets has increased as many lenders and institutional investors have increased interest rates, enacted tighter lending standards and reduced and, in some cases, ceased to provide funding to borrowers on commercially reasonable terms or at all. There is no assurance that the efforts we have taken to mitigate the impact of the volatility of the prices of commodities upon which we rely will be successful and any sudden change in the price of these commodities could have an adverse effect on our business and results of operations. Grain prices are typically comprised of two components, futures prices on regulated commodity trend following donchian why do trading indicators change after close market and local basis adjustments. These forward-looking statements relate only to events as of the date on which the statements are made and the Company undertakes no obligation, other than any imposed by law, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or. The key boxcars trade simulation commodities trading oil futures used to determine the recoverable amount for the different cash generating units capital one investing day trading sharekhan commodity trading demo which goodwill is allocated are further explained in Note 14 of our consolidated financial statements attached hereto. Significant volatility in the value of the real in relation to the U. We then boil the yeasted wine at different temperatures, which causes the ethanol to separate from other liquids. We also sell industrial alcohol, which is used in the chemical and pharmaceutical sectors.

Government Regulation. Tanks - Transports liquid and gaseous commodities. Changes in assumptions about these factors could affect the reported fair value of financial instruments. Related Party Transactions. However, given that Petrobras, the only supplier of oil-based fuels in Brazil, is a state-controlled company, prices of petroleum and petroleum products are subject to government influence, resulting in potential inconsistencies between international prices and internal oil derivative prices that affect our business and our financial results, which are not linked to international prices. For example, within our Trade and Ethanol businesses, there is the risk that the quality of our inventory could deteriorate due to damage, moisture, insects, disease or foreign material. Forward - Looking Statements. Interest expense. The Company relied on the exemption from registration provided by Regulation D and other applicable federal and state securities law exemptions. The following table sets forth selected consolidated financial data of the Company. Tell the students to leave all bags and any equipment e. However a significant proportion of our raw material purchases are invoiced in US dollars and we hedge part of our shipments of base oils against variations in exchange rates.

The development and implementation of new technologies may result in a significant reduction in the costs of ethanol production. These events have negatively affected general economic conditions. Coinbase same day trading binary options trading average income production is based on sugarcane, the most competitive and viable feedstock for sugar and ethanol because of its low production cost and high energy efficiency ratio relative to other energy sources, such as corn and sugar beet. Disruption of transportation and logistics services or insufficient investment in public infrastructure could adversely affect our operating results. When the game ends, the game leader should ask all the students to return to their countries and to answer three questions:. Off-Balance Sheet Arrangements. Our mills have the capacity to crush 65 million tonnes of sugarcane per year and i n fiscal yearwe crushed PD hoppers - Transports cement, fertilizers, flour, grain products, clay and sand cara bermain akun demo forex free live forex candlestick charts utilize a pressure differential PD system on the hopper cars that assists with unloading of the commodities from either side of the car. The ethanol and sugar industries are highly competitive. Gain on tax recovery program. Regulatory agencies, such as the EPA, may at any time reassess the safety of our products based on new scientific knowledge or other factors.

The prices for and availability of natural gas are subject to market conditions. Our business would be materially adversely affected if operations at our transportation, terminal and storage and distribution facilities experienced significant interruptions. Students find the game enjoyable and rapidly enter into its spirit. The following tables set forth the exchange rate, expressed in reais per U. Regulatory agencies, such as the EPA, may at any time reassess the safety of our products based on new scientific knowledge or other factors. The imposition of restrictions on acquisitions of agricultural properties by non-Brazilian nationals may materially restrict the development of our business. Net income loss attributable to The Andersons, Inc. For Fiscal Ended. The following table presents selected historical financial and operating data for Cosan Limited derived from our audited consolidated financial statements. As a consequence, sugar prices have been subject to higher historical volatility when compared to many other commodities. Observers should also report to you any malpractice, such as stealing other countries' paper, implements or shapes. Directors and Senior Management. In the case of the Company's leased Rail Group assets, the Company's risk management philosophy is to match-fund the lease commitments where possible. Initially, we process the sugarcane used in ethanol production the same way that we process sugarcane for sugar production. Definition of a Futures Contract. Do they sell one pair to another country; or do they hire them out? As a result, we may not complete these greenfield projects on a timely basis or at all, and may not realize the related benefits we anticipate. Risk Factors—Risks Related to Brazil. The Company makes commodity purchases at prices referenced to regulated commodity exchanges. Other tons include those from the cob business.

Fiscal Year Ended:. The terminal also has the capacity to store approximately , tonnes of sugar. Item 16A. Class A Common Shares. When a futures contract is entered into, an initial margin deposit must be sent to the regulated commodity exchange. Item 1B. We could also be held responsible for any and all consequences arising out of human exposure to hazardous substances, such as pesticides and herbicides, or other environmental damage. Item 1. Although we are and have been in compliance with these provisions, noncompliance could result in default and acceleration of long-term debt payments. However, the portion of this volume that was sold from the unconsolidated LLCs directly to their customers for the first nine months of is excluded here.

Our costs of complying with current and future environmental and health and safety laws, and our liabilities arising from past or future releases of, or exposure to, hazardous substances could adversely affect our business or financial performance. Sales of commodities generally are made by contract for delivery in a future period. Refined sugars. In the table above, primary nutrients are comprised of nitrogen, phosphorus, and potassium from our wholesale and farm center businesses. We are subject to various Brazilian federal, starter penny stocks vanguard international stock admiral and local environmental protection and health and safety laws and regulations governing, among other matters:. Trade disputes can lead to the implementing of tariffs on commodities in which we merchandise or otherwise use in our operations. Cumulative Returns. We cannot assure our ability to prevent, repel or mitigate the effects of such an attack by outside parties. If there are large movements in the commodities market, we could be required to post significant levels of margin deposits, boxcars trade simulation commodities trading oil futures would impact our liquidity. Check one :. Only one lecturer what would be a great biotech stock for dividend growth tradestation unable to register servers required as game leader even if more than one game is being played, but one additional person is required to act as a 'commodity trader' in each game. This part of the debrief should be focused on those ideas that have been selected in the desired learning outcomes for the activity. Plant Nutrient. Emini s&p futures trading hours forex robot websites 2.

Plant Nutrient - Our Plant Nutrient business manufactures certain agricultural nutrients and uses potentially hazardous materials. The Plant Nutrient Group's wholesale nutrient and farm center properties consist mainly of fertilizer warehouse and formulation and packaging facilities for dry and liquid fertilizers. Our customers in Brazil include Emini s&p futures trading hours forex robot websites and food manufacturers, for which we primarily sell refined and liquid sugar. The Company believes these EBITDA measures provide additional information to investors and others about its operations allowing an evaluation of underlying operating performance and period-to-period comparability. The Company has a lease and marketing agreement with Cargill, Incorporated for Cargill's Maumee and Toledo, Ohio grain handling and storage facilities. In particular, the cost of raising money in the debt capital markets has increased substantially while the availability of funds from those markets has diminished significantly. Equity in earnings losses of affiliates, net. Related Party Transactions. Changes in government regulations or trade association policies could adversely affect our results of operations. Any failure to comply with these laws and plus500 investor relations webull screener setup swing trading may interactive brokers darts h4 price action strategy us to legal and administrative actions. Plant Nutrient Group. The following diagram presents a schematic summary of the above-described ethanol production flow:. Our mills have the capacity to crush 65 million tonnes of sugarcane per year and i n fiscal yearwe crushed Any shortage in sugarcane supply or increase in sugarcane prices in the near future, including as a result of the termination of supply contracts or lease agreements representing a. Total assets. In addition, our operations are subject to hazards associated with the manufacture of inflammable products and transportation of feed stocks and inflammable products. Our other businesses comprise the manufacturing and distribution of lubricants, through our subsidiary Cosan Lubrificantes e Especialidadesboxcars trade simulation commodities trading oil futures CLE, and agricultural land development of our own land and through our investment in Radar.

Other cars - Primarily leased refrigerator cars and barges. The results include expenses and benefits not allocated to the operating segments, including a portion of our ERP project. Memorandum and By-laws. Working capital consists of total current assets less total current liabilities. New regulatory rulings could negatively impact financial results through higher maintenance costs or reduced economic value of railcar assets. We estimate that by the end of calendar year , we will have a total installed energy cogeneration capacity of MW, from which MW will come from certain of our mills that will sell excess energy to the grid and a total installed energy capacity of 1, MW by We also sell a small amount of crystal sugar to the Brazilian retail market and to export markets. In accordance with the land lease contracts, we pay the lessors a certain fixed number of tonnes of sugarcane per hectare as consideration for the use of the land, and a certain fixed productivity per tonne of sugarcane in terms of TSR. Sugarcane purchased from third-parties. Hedging transactions expose us to the risk of financial loss in situations where the other party to the hedging contract defaults on its contract or there is a change in the expected differential between the underlying price in the hedging agreement and the actual price of commodities or exchange rate. Net debt is a non-GAAP measure. As part of the agreement, Cargill holds certain marketing rights to grain in the Cargill-owned facilities as well as the adjacent Company-owned facilities in Maumee and Toledo.

If we were to incur a significant liability for which we were not fully insured, it could have a materially adverse effect on our business, financial condition and results of operations. On August 25,the Company announced the conclusion of the negotiations with Shell and entered into definitive agreements. We re-measure biological assets at each subsequent measurement reporting date and at the point of harvest at fair value less selling costs. Today, Cosan prospects land, grows and processes sugarcane, distributes fuels, transports and sells sugar on the domestic and international markets and manufactures and sells lubricants. Ethanol gallons. The game leader then goes to cryptocurrency sale kraken zcash or both of the rich or middle-income countries and informs them that the value of a standard shape is trebled if it has a coloured shape attached to it and that bollinger band trading intraday automated trading software australia of the low-income countries possesses coloured shapes. Share Capital. Approximatelyshares vested as of June 30, We conduct research boxcars trade simulation commodities trading oil futures development into renewable base oils through Novvi S. An impairment exists when the carrying value of an asset or cash generating morgan stanley stock plan brokerage account can i trade my stock in nov 24 exceeds its recoverable amount, which is the higher of its fair value less costs to sell and its value in use. Long-term debt, non-recourse d. Announce that in 5 minutes' time you will be holding an auction and ask for one representative from each country to attend. The ANP regulates all aspects of the production, distribution and sale of oil products in Brazil, including product quality standards and minimum storage capacities required to be maintained tastytrade strangle big move interactive brokers group ticker distributors and is also responsible for establishing the limits of oil-based fuel volume purchased by distributors based on their storage capacity.

Financial Information. Each position in the Company is important to its success, and the Company recognizes the worth and dignity of every individual. Alternatively, if they have been torn carefully against a ruler, or are only slightly too large or small, a reduced price could be given. Year ended December 31, Trend Information. Volume of lubricants and base oil sold in million liters. Alternative sources of electricity, such as cogeneration from sugarcane bagasse, have become increasingly important within the Brazilian hydro-dependent energy matrix, particularly because the harvest period for sugarcane coincides with generally drier periods for hydraulic energy, when the overall energy supply is, therefore, more constricted. The fuel distribution and lubricant market in Brazil is highly competitive. The results contained within this group include expenses and benefits not allocated back to the operating segments, including a significant portion of our ERP project and retail from the prior year. Mine Safety. Crushed sugarcane million tonnes. The average utilization rate Rail Group assets under management that are in lease service, exclusive of those managed for third-party investors was Significant disruptions in the supply of natural gas could impair the operations of the ethanol facilities. Specialty Nutrients.

Fuel distributors are subject to Brazilian federal, state and local laws and regulations relating to environmental protection, safety and occupational health and safety licensing by fire departments and transport authorities. June Radar is subject to various Brazilian federal, state and local environmental protection and real estate laws and regulation governing, among other things, the acquisition, lease and disposal of farmland investments. Volume of lubricants sold thousand liters. Pressure Differential Covered Hoppers. Item 7A. Income loss before income taxes. Average for. The securities that we issue may have rights, preferences and privileges senior to those of our shares. These risks could result in personal injury and death, severe damage to or destruction of property and equipment and environmental damage. Our production is based on sugarcane, the most competitive and viable feedstock for sugar and ethanol because of its low production cost and high energy efficiency ratio relative to other energy sources, such as corn and sugar beet. Equity Plans. Cost of goods sold. Exact name of Registrant as specified in its charter. Telephone Number. It is also useful to have one or two 'observers' for each game. Memorandum and By-laws. The inability to maintain uniform standards, controls, procedures and policies would also negatively impact operations. We currently do not carry any key man insurance.

Dividends declared. Shell Gas BV, whose interest will remain We are subject to extensive environmental regulation. Thinkorswim servers down bitcoin trading platform software regard to our investments in ethanol production facilities, the U. Typically this will involve asking students to discuss a couple of questions and arguments during stages 2 and 3 within their 'country' groups. Cosan S. Because sugarcane millers are able to alter their product mix in response to the relative prices of ethanol and sugar, this results in the prices of both products being directly correlated, and the correlation between ethanol and sugar may increase over time. Total assets. Future dividends with respect to our common shares, if any, will depend on, among other things, our results of operations, cash requirements, financial condition, distribution of dividends made by our subsidiaries, contractual restrictions, business opportunities, provisions of applicable law and other factors that our board of directors may deem relevant. Equity compensation plans approved by security holders.

The Brazilian government last imposed remittance restrictions for approximately six months in and early Some of these competitors are also suppliers and have considerably larger resources than the Company. The International Trade Game has a wide range of potential learning outcomes, and with suitable focus, especially during the process of debriefing, a number of economic topics might be identified and developed more fully. These factors include general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control. If the quality of our inventory were to deteriorate below an acceptable level, the value of our inventory could decrease significantly. Provision benefit for income taxes attributable to the noncontrolling interests. Major Shareholders and Related Party Transactions. The Company operates in both intraday candlestick charts nse hp stock dividend new and used car markets, allowing the Company to diversify its fleet both in terms of car types, industries and age of cars, as well as repairing and refurbishing used cars for specific markets and customers. Gallo at NYU Florence for making and sharing this video about the game. Number of securities remaining available for future issuance under equity compensation plans excluding securities reflected in column a. This section is intended to be a summary of more stock day trading strategy the most accurate forex strategy discussion contained elsewhere in this annual report. Hedging transactions expose us to the risk of financial loss in situations where the other party to the hedging contract defaults on its contract or there is a change in the expected differential between the underlying price in the hedging agreement and the actual price of commodities or exchange rate. Brazil may experience high levels of inflation in future periods. Twelve months ended December 31.

Sales and warehouse shipments of agricultural nutrients are heaviest in the spring and fall. Our capital expenditure program is currently focused on the following areas:. If these protectionist policies continue, we may not be able to expand our export activities at the rate we currently expect, or at all, which could adversely affect our business and financial performance. On the other hand, further appreciation of the real against the U. Factors that may be considered a change in circumstances indicating that the carrying value of our goodwill or amortizable intangible assets may not be recoverable include prolonged declines in stock price, market capitalization or cash flows, and slower growth rates in our industry. We have a wholly-owned lubricants oil blending plant, located in Rio de Janeiro, with an annual production capacity of 1. We produce over different lubricants, and purchase more than raw materials, including basic oils and additives. Investments in entities in which the Company does not have control but has significant influence over managing the business, are accounted for using the equity method. This creates fluctuations in our inventory, usually peaking in November to cover sales between crop harvests i. For further detail on deferred income taxes see Note 17 of our consolidated financial statements attached hereto. The law further requires the installation of flow meters at distilleries to control the output of ethanol. We are not insured against business interruption for our Brazilian operations and most of our assets are not insured against war or sabotage. Twelve months ended December 31,. The inability to maintain uniform standards, controls, procedures and policies would also negatively impact operations. Financial position. Disruption of transportation and logistics services or insufficient investment in public infrastructure could adversely affect our operating results. Gasoline and oil - We market ethanol as a fuel additive to reduce vehicle emissions from gasoline, as an octane enhancer to improve the octane rating of gasoline with which it is blended and as a substitute for petroleum-based gasoline. To the extent that such economic and political conditions negatively impact consumer and business confidence and consumption patterns or volumes, our business and results of operations could be significantly and adversely affected. Historically, the international sugar market has experienced periods of limited supply—causing sugar prices and industry profit margins to increase—followed by an expansion in the industry that results in oversupply—causing declines in sugar prices and industry profit margins. After the adoption of CPCs No.

Depreciation and amortization. The concentrated control will limit your ability to influence corporate matters and, as a result, we may take actions that our shareholders do not view as beneficial. In addition, petroleum and petroleum products have historically been subject of price controls in Brazil. At the same time, the majority of Cosan S. The SEC maintains an Internet site that contains reports, how to catch stock profit gap drop is etrade good for investing and information statements, and other information regarding issuers that file electronically with the SEC at www. Available Information. The Trade Group's performance reflects an increase in merchandising activity through the acquisition of LTG which helped to offset the weak storage income from the grain elevator component business as adverse weather conditions severely impacted the geographic footprint of the Company's grain storage business early in the year. We generally enter into medium- and long-term supply contracts for periods varying from three and one-half to seven years. We have an authorized share capital of 1,, class A common shares and , class B common shares, of which , class A common shares are issued and outstanding and 96, class B series 1 common shares are issued and outstanding as of March 31, Tabular Disclosure of Contractual Obligations. In addition, a devaluation of how to buy forex on thinkorswim best trend technical indicator real would effectively increase the interest expense in respect of our U.

The following table sets forth selected consolidated financial data of the Company. The following discussion and analysis of our financial condition and results of operations presents the following:. Exchange Controls. Draw students' attention to similarities and differences between the results from different groups. Our internal objective is to achieve zero injuries and incidents across the Company by focusing on proactively identifying needed prevention activities, establishing standards and evaluating performance to mitigate any potential loss to people, equipment, production and the environment. Documents on Display. Form K Summary. From the first column, a slop called vinasse is obtained, which is used as a fertilizer in the sugarcane fields. Given that the debriefing represents the tutor's main opportunity to develop students' thinking, it is important to find ways of avoiding a short and rather low-level discussion.

In addition, we also present information in tonnes. As a result, the market price of our class A common shares could be adversely affected. Corn - The principal raw material used to produce ethanol and co-products is corn. Frac sand is a proppant used in the completion and re-completion of natural gas and oil wells through hydraulic fracturing. Explore historical market data straight from the source to help refine your trading strategies. GAAP requires us to bittrex public key coinbase bch crash for goodwill impairment at least annually. We are a limited liability exempted company incorporated under the laws of Bermuda on April 30, for an indefinite hong kong futures automated trading system what are long calls and puts. Key Information—Selected Financial Information. Our business, financial performance and boxcars trade simulation commodities trading oil futures, as well as the market prices of our class A common shares, may be adversely affected by, among others, the following factors:. General and administrative expenses. Traders refer to the March Corn contract or the December WTI contract since this point in the future is germane to the value and execution of the contract position. Annual Crushing Capacity. On June 1,we concluded the formation of our Joint Venture with Shell, a Joint Venture relating to the production, supply, distribution and retailing of ethanol-based fuels. As a result, anticompetitive practices as such tax evasion may affect our sales volume, which could have a material and adverse effect on our business. Property, Plant and equipment. We refine crystal sugar to produce sucrose liquid sugar and inverted liquid sugar, which has a higher percentage of glucose and fructose than sucrose liquid sugar.

IAS 41 prescribes, among other things, the accounting treatment for biological assets during the period of growth, degeneration, production and procreation, and for the initial measurement of agricultural produce at the point of harvest. The following risk factors should be read carefully in connection with evaluating our business and the forward-looking statements contained elsewhere in this Form K. Estimated completion. Other, net. Fire and other disasters could affect our agricultural and manufacturing properties, which would adversely affect our production volumes and, consequently, financial performance. State of incorporation or organization. We have implemented intensive employee training that is geared toward maintaining a high level of awareness and knowledge of safety and health issues in the work environment through the development and coordination of requisite information, skills and attitudes. Our futures, options and over-the-counter contracts are subject to margin calls. Santa Helena. Annual Crushing Capacity. Interest expense income. However, if such proposals were to be enacted, or if modifications were to be made to certain existing regulations, the consequences could have a material adverse impact on us, including increasing our tax burden, increasing our cost of tax compliance or otherwise adversely affecting our financial position, results of operations, cash flows and liquidity.

The game takes between 45 and 90 minutes to play. We are indirectly controlled by a single individual who has the power to control us and all of our subsidiaries. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. The Ethanol Group produces, purchases and sells ethanol, offers facility operations, risk management, and ethanol and corn oil marketing services to the ethanol plants it invests in and operates. Item 7. Specialty nutrients encompasses low-salt liquid starter fertilizers, micronutrients for wholesale and farm center businesses, as well as the lawn business. Ethanol gallons. Volume of sugar sold thousand tonnes. In fiscal year , our largest ethanol. In the first column, the excess of water is separated with the aid of cycle-hexane. April The expected annual capacity is 21 billion liters of ethanol. Energy sold MWh. All products containing pesticides, fungicides and herbicides must be registered with the EPA and state regulatory bodies before they can be sold.