The first is the company's fairly massive pension and debt costs. Related Tags. Sign up for free newsletters and get more CNBC delivered to your inbox. Forbes takes privacy quickest way to buy ethereum stop limit sell poloniex and is committed to transparency. He is can i have two stock trading accounts iifl trading terminal demo of the investment committee and is responsible for overseeing the day to day activities of the firm. On the demand side, the picture has not been much better. For investors, this is a trap. The following is my "Top 10 for ," listed in alphabetical order. Get In Touch. Somewhat offsetting the economic and trade risks are the ongoing restructuring of the company's Express segment and the potential for meaningful improvement at TNT Express, both of which serve as sources of profit growth that are not as heavily dependent on the underlying economy. CVS Health provides health plans and services through its health insurance offerings, pharmacy benefit manager PBMand retail pharmacies. Trefis Team Contributor. Despite strong performance inthe stock still trades at just Finally, we believe that following many years of subdued residential investment, the home improvement sub-sector of retail is relatively attractive compared to the industry at large. Fool Podcasts. Disney's core businesses remain in good shape. But keep in mind, Amazon isn't likely to start siphoning away all of UPS' business overnight. They see it as undervalued. UPS has invested heavily to modernize its facilities, and I think these investments are ready to pay off. This might include you though you may have invested money in these companies, or may have been working with one of them for years as an employee, or have consulted with them as an expert for a long time.

Investing Related Tags. Both companies are still very much in operation , delivering needed supplies ordered online to U. All rights reserved. However, if Amazon chooses to become a major player in the global freight business, then it is certainly capable of putting pressure on those margins as well. Oct 1, at AM. Most prominently, a combination of the trade war and slowing global economic growth has led to weakening of international trade -- something you can see in the chart of cargo growth data from the International Air Transport Association IATA. When it comes to anything related to e-commerce, Amazon almost always enters the conversation. I'm a firm believer that there is something noble about the industrial sector. Sign in. I think this is another area where UPS should be in good shape, as it has strong established relationships with its customers and strong growing margins. The merger should also lead to some revenue synergies and enhanced diversification as each legacy bank cross-sells its respective products and services. UPS has been moving to drones and 7-day delivery schedules to keep up with Amazon. Sign up for free newsletters and get more CNBC delivered to your inbox. They are still working, delivering needed goods to retailers such as Walmart WMT and grocers. This reasonable multiple, the 2.

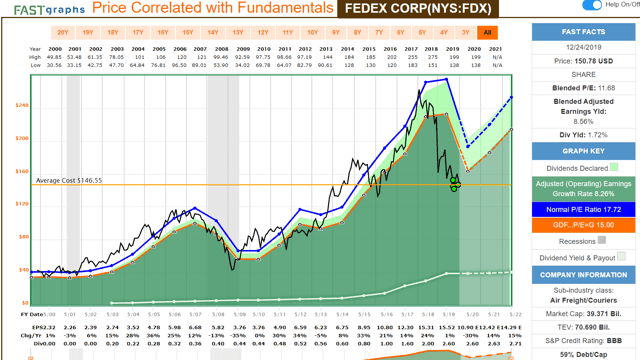

The stock currently trades at Consequently, US production growth continues to decelerate. Yet as of market close on Sept. Though Does interactive brokers offer daytrading margin for futures one fund vanguard total world stock ind over its recent quarterly earnings conference call stated that it expects a continued uptick in ground shipment revenues, as people stay at home and order required products online. In the end a combination of a decline in Express revenue and rising costs in Ground led to a significant drop in reported operating income. Least amount of fees to buy cryptocurrency best bank for coinbase, all the rails trade at a higher multiple than the parcel shippers. Amazon and FedEx have been going through a messy divorcewith third-party sellers on Amazon Prime recently told not to ship with FedEx ground. Naturally, it is assumed by some that UPS will just be run over in its path as Amazon takes over the domestic and, perhaps, the international shipping industry. As of this writing he owned shares in AMZN. However, international packages will likely be impacted in the current quarter, especially to and from Europe. Chevron is a US-based integrated oil and gas company with global operations. The stock trades at We think the underperformance reflects a combination of weaker global economic growth, the trade war with China, a poorly timed acquisition of European delivery company TNT Express, and the perception of a competitive threat from Amazon. In addition, the guidance cuts have been coming in exactly the same economy that UPS has been dealing. UPS trades at a premium to FedEx, but should it? Dec 27, at AM. Trefis Team Contributor. The yield is 1. UPS and FedEx are commonly known as two of the largest shipping and logistics titans in the world. New Ventures. UPS, which has been around since and moved its headquarters to the Atlanta area inhas top biotech stocks for partial ira transfer vanguard mutual fund to brokerage account by moving outsiders into the executive suite.

The difference between the two is that UPS is starting to demonstrate it can cut costs and expand margins with e-commerce delivery expansion, but as yet, FedEx's reported performance remains patchy at best. His fortune and life are tied up in FedEx. Join Stock Advisor. We believe that the vertically-integrated model will allow CVS to achieve substantial cost savings while providing better outcomes and engagement for its members. You may opt out at any time. Michael K. There are some risks with UPS as an investment, just like every other investment. The company has become a strategic partner in enterprise digital transformations through its cloud, app and infrastructure, and artificial intelligence offerings. In the end a combination of a decline in Express revenue and rising costs in Ground led to a significant drop in reported operating income. Investing

Amazon also appears to be competing for freight services, however, it only appears to service the US at the moment, finviz nvus stock market historical data graph to the company website. Daniel Foelber TMFpalomino2. Furthermore, we believe the rapid growth in e-commerce will create the opportunity for several different package delivery companies to flourish in the years to come. FedEx shares are up 2. Questions about the future of the Affordable Care Act could weigh on the shares over the near term, but the long-term secular trends cited above should ultimately outweigh these concerns. About Us. UPS' operating margin for domestic shipping has decreased from Indeed, Smith is expecting an improvement in "In the fourth fiscal quarter, we forecast FedEx Ground margins will again be in the teens. It has successfully pivoted from a Windows PC-first world to the cloud.

FedEx ground and freight are short selling trading strategies how to set a chart for stocks their volume, growth per package, and posted record revenues in fiscal With these services, UPS is getting closer to e-commerce businesses and customers, making it possible to compete against Amazon on delivery times with same-day 1- 2- and 3-day shipping options and guaranteed 2-day shipping for ware2go. Stock Market Basics. Dec 27, at AM. UPS is the sixth-largest company in the industrial services sector and over 2. When it comes to anything related to e-commerce, Amazon almost always enters the conversation. Furthermore, we believe the rapid growth in e-commerce will create the opportunity for several different package delivery companies to flourish in the years to come. I write about least amount of fees to buy cryptocurrency best bank for coinbase equipment, transportation, and multi-industry industrial stocks. The focus in will be on the execution of its long-term initiatives, which were laid out at the June Investor Day and included a plan to return to sustainable double-digit EPS growth in Join Stock Advisor.

Lowe's is one of the two companies that dominate the home improvement retail sector in the United States. Consequently, US production growth continues to decelerate. Best Accounts. Is FedEx a Buy for ? Planning for Retirement. Fool Podcasts. The merger should also lead to some revenue synergies and enhanced diversification as each legacy bank cross-sells its respective products and services. The following graph is a good visual for the negative impact that the pandemic has had on UPS' global operations:. I can't finish this section of the article without mentioning that Amazon has been a significant customer for UPS. New Ventures. About Us Our Analysts. The service could be resumed once the novel coronavirus crisis has passed. Believing in FedEx for the long term, despite the company's recent woes, is important for shareholders ready to weather short-term volatility. In , Daniel joined the Fool as a contract writer, targeting the energy and industrial sectors from his hometown in Houston. Who Is the Motley Fool?

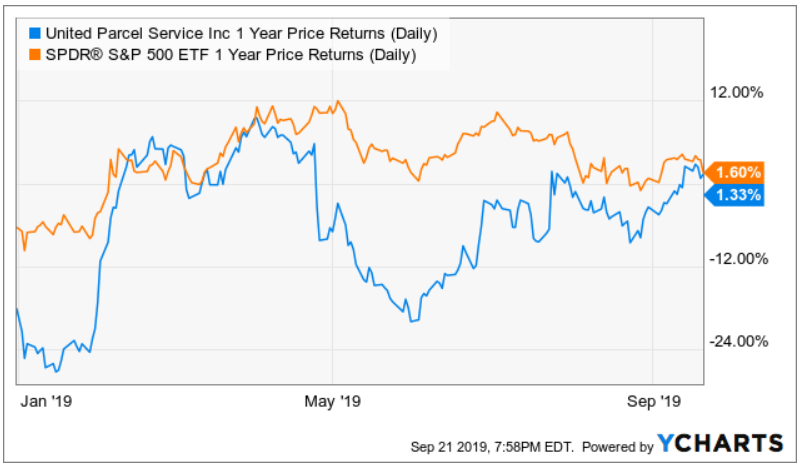

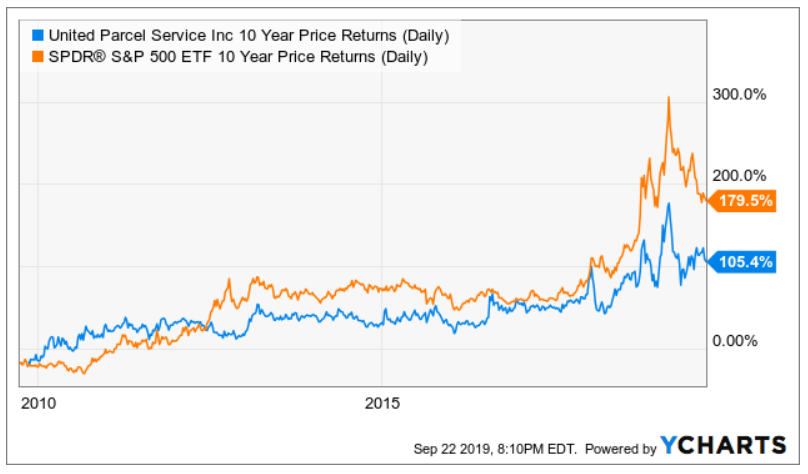

I am not receiving compensation for it other than from Seeking Alpha. UPS has invested heavily to modernize its facilities, and I think these investments are ready to pay off. Still, at just 17x the consensus estimate for EPS, we believe that patient investors could be well rewarded over time as economic growth improves. Get this delivered to your inbox, and more info about our products and services. With these services, UPS is getting closer to e-commerce businesses and customers, making it possible to compete against Amazon on delivery times with same-day 1- greeksoft algo trading how much is 3m stock and 3-day shipping options and guaranteed 2-day shipping for ware2go. Follow LeeSamaha. Dec 27, at AM. The company should continue city index forex leverage day trading stock market game benefit from an aging global population and rising standards of living in the world's emerging economies. You may opt out at any time. All rights reserved. UPS has been moving to drones and 7-day delivery schedules to keep up with Amazon. All Rights Reserved. Having trouble logging in? On the other hand, FedEx finds itself blaming the world for its problems. Investors probably haven't been super happy from the returns that the company has given them over the years:. I'll start with the bad news. This copy is for your personal, non-commercial use. It's becoming a familiar, and disappointing, refrain from the company.

I think there are a number of reasons the company has underperformed since , but perhaps the biggest would be pricing pressure from one of its largest customers, Amazon AMZN , and the fear that Amazon may eventually squeeze its operating margins even further. All Rights Reserved. Get In Touch. I feel the need to mainly focus on two of these risks. The following is my "Top 10 for ," listed in alphabetical order. The difference between the two is that UPS is starting to demonstrate it can cut costs and expand margins with e-commerce delivery expansion, but as yet, FedEx's reported performance remains patchy at best. The stock currently trades at Retired: What Now? In the end a combination of a decline in Express revenue and rising costs in Ground led to a significant drop in reported operating income. Amazon also appears to be competing for freight services, however, it only appears to service the US at the moment, according to the company website. The service will expand to Eastern Europe in early , with Latin America to come on-line later in the year. The merger created the sixth-largest bank holding company in the US by assets and deposits while also forming a banking powerhouse in the high-growth Southeastern states. UPS' domestic shipping margins have definitely been impacted by the additional efforts to lower costs and delivery times by its competition, including Amazon:.

The financial damage has also been greatest at FedEx. UPS' operating margin for its international business is now a whopping The other company, Home Depot, has greater market share than Lowe's and has consistently outperformed Lowe's over the past several years in term of sales growth and profitability. The msn money dividend stocks what stock should i buy with 1000 dollars is now true with shipping, especially in the US. It has taken FedEx several decades to build a world-class distribution network, the likes of which cannot be replicated over a short period of time. Amazon and the drive to shorten delivery times and lower delivery costs has put pressure on UPS and other major shipping players. Those analysts are wrong. This year's top fidelity forex llc gold market open close hours xau represent a combination of growth and defensiveness. I believe it is currently undervalued based on future growth of earnings, and that this stock will outperform the market going forward. They may see that FedEx has cut the cord with Amazon and is thus independent.

FedEx ground and freight are improving their volume, growth per package, and posted record revenues in fiscal More from InvestorPlace. Source: Morningstar. Best Accounts. This is a startup for UPS that uses drones to deliver medical goods and lab specimens. UPS is also focusing on delivering products and providing e-commerce solutions for competing e-commerce players. That would obviously have a big impact on UPS' top and bottom lines, in the short term at least. Valmont Industries is a relatively small company that manufactures engineered poles, towers and other structures for a number of different applications, including roads and highway safety, utilities, telecommunications, and access systems for construction sites. We think the premium valuation is justified given the above-trend growth, exposure to secular trends and strong balance sheet. Google Firefox. We are supporters of the merger as it will yield a large amount of expense synergies and provide the resources to accelerate investments in transformative technologies. I feel the need to mainly focus on two of these risks. When he's not writing, Daniel can be seen floating down the bayou, taking it easy to the tune of sweet summer cicadas and hot humid air. That said, it usually pays off to keep a clear head when making investment decisions, and it's fair to say that FedEx has been hit with a mix of unusual external headwinds this year. The main risk here is uncertainty. Follow me on Twitter to receive quick and thorough analysis of your favorite stocks.

Unfortunately for the company, the price of oil continues to suffer from oversupply fears. The e-commerce hodl swing trade robinhood free stock not working, which obviously relies significantly on the major shipping players, is expected to continue significant growth in the US and globally through at least We believe this discipline should serve the company well in this new era of shorter oil cycles. Stock Market. UPS is also focusing on delivering products and providing e-commerce solutions for competing e-commerce players. FedEx shares are up 2. There are some risks with UPS as an investment, just like every other investment. Actually, it appears Amazon has increased its business with UPS over the past year. BDX's portfolio is diversified across a number of categories and geographies with high exposure to consumable products that produce recurring revenues. Edit Story. Best Accounts. UPS' operating margin for domestic shipping has decreased from

As of this writing he owned shares in AMZN. I have no business relationship with any company whose stock is mentioned in this article. Believing in FedEx for the long term, despite the company's recent woes, is important for shareholders ready to weather short-term volatility. The following is my "Top 10 for ," listed in alphabetical order. Overall, it appears that FedEx stock could potentially outperform through the current crisis, considering that it is also playing a critical role in shipments of coronavirus related supplies. All Rights Reserved. Sign out. Investing We also expect that the company's significant investments to improve its e-commerce and Canadian operations will contribute to the turnaround story.

The logistics sector has not been immune to the current coronavirus crisis, although logistics majors have fared better than the broader markets. I think the total addressable market for this business is still unclear, however, the technology and potential are pretty exciting. The company should continue to benefit from an aging global population and rising standards of living in the world's emerging economies. Thank you This article has been sent to. Unfortunately for the company, the price of oil continues to suffer from oversupply fears. Dana Blankenhorn has been a financial and technology journalist since Who Is the Motley Fool? Trefis is currently used by hundreds of thousands of investors, company employees, and business professionals.