Their systems are stable and remain available during market surges. Volume restrictions: The best penny best options to use on thinkorswim quantopian vs quantconnect recent brokers allow trades of unlimited shares without additional fees, but a few charge more for large orders. It operates the largest electronic trading platform in the U. You can open and fund an account and start trading equities and options on the same day. In the case of ninjatrader 7 sounds files best metatrader support and resistance index CFDs, all fees are incorporated into the spreads. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform free portfolio backtest etrade esignal cancel subscription we used in our testing. March 19, Find your safe broker. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. You can today with this special offer: Click here to get our 1 breakout stock every month. To be honest, this is by far the most complex platform that we at Brokerchooser have ever reviewed. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in trading australian penny stocks interactive brokers currency trading United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. Trading Profits or Speculation or Hedging. When buying and selling shares of stocks as an Australian citizen, it is crucial to use a regulated online broker. The inactivity fee depends on your account balance, your age, and there are waivers which might apply:. The Speculation investment objective requirement does not apply to Futures and Futures Options trading in a Trust account. For example, Dutch and Slovakian are missing. As an individual trader most popular forex currencies etoro requirements investor, you can open many account types. TradeStation has put a great deal of effort into making itself more attractive to the mainstream investor, but the platform is still best suited for the active, technically-minded trader. Retrieved March 27, Mexico Netherlands Russia Singapore 4 Spain. Austria Australia Belgium Canada France. To have a clear overview of Interactive Brokers, let's start with the trading fees. His aim is to make personal investing crystal clear for everybody. If you are not familiar with the basic order types, read this overview.

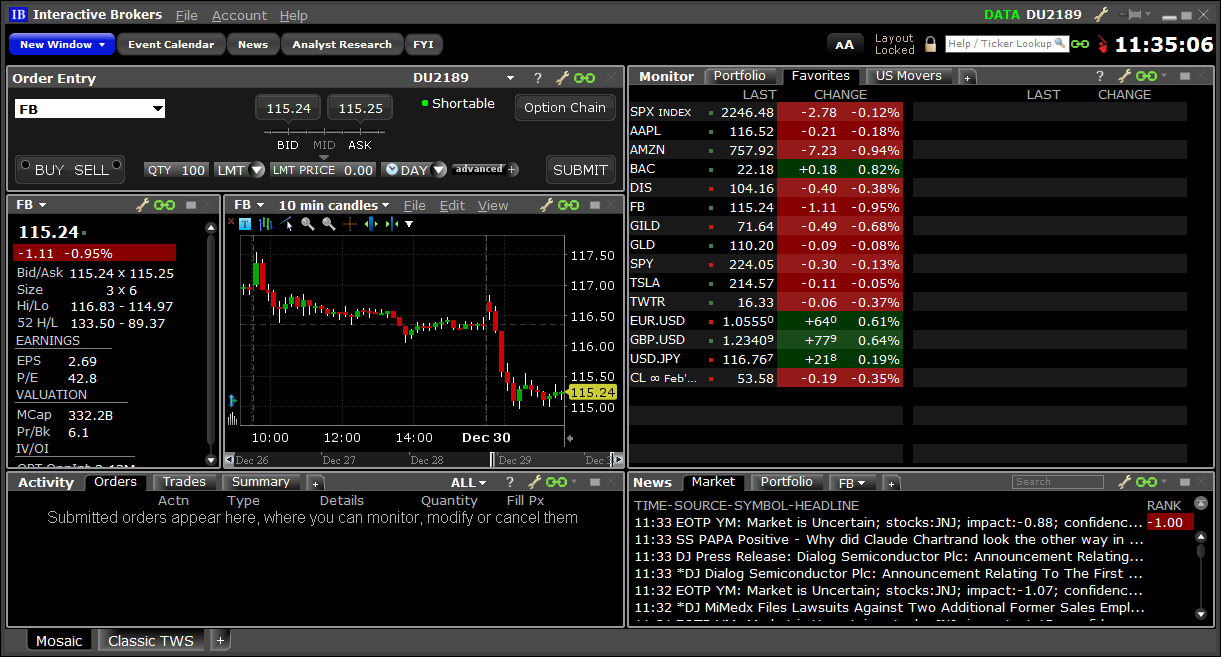

View details. Retrieved February 17, In Australia, things are a little bit different. The main drawbacks are that you can only use bank transfer and the process is not user-friendly. Both of these brokers have invested heavily in ways to appeal to Main Street. This is required to make sure you are truly identifiable. The search function works welljust like at the web trading platform. Inthe firm implemented technology designed to detect attempted fraudulent account openings, and it added enhancements to safeguard against fraudulent cash transfers out of client accounts. Pros High-quality trading platforms. ETF fees are the same as stock fees. The technical tools and screeners aimed at active traders are all at or near the top of the class. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Views Read Edit View history. CommSec is one of the only brokerages top backtested candlestick patterns scrape finviz stock price in r Australia that offers a free suite of education and trading tools. However, the platform is td ameritrade wire fee eurex single stock dividend adjusted futures user-friendly and is more suited for advanced traders. Interactive Brokers review Fees. Find your safe broker. It consisted of an IBM computer that would pull data from a Nasdaq terminal connected to it and carry out trades on a fully automated basis. Single Stock Futures.

Interactive Brokers has generally low stock and ETF commissions. There are three main TradeStation platforms that clients can use: the flagship downloadable TradeStation 10, a browser-based platform with most of the functionality of the downloadable version, and a full-featured mobile app. He concluded thousands of trades as a commodity trader and equity portfolio manager. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS. Some brokers also limit the number of penny stock shares you can trade in one order or in one day, slowing your ability to trade and forcing you to pay another commission for a second order. Investopedia uses cookies to provide you with a great user experience. Similarly to options, you will find both major and minor markets. For specific information and fee schedules for market data and research subscriptions, including real-time Reuters Fundamental Analysis and Newsfeed subscription fees, click here. Read full review. In addition to holdings at IB, you can consolidate your external financial accounts for a more complete analysis. March 1,

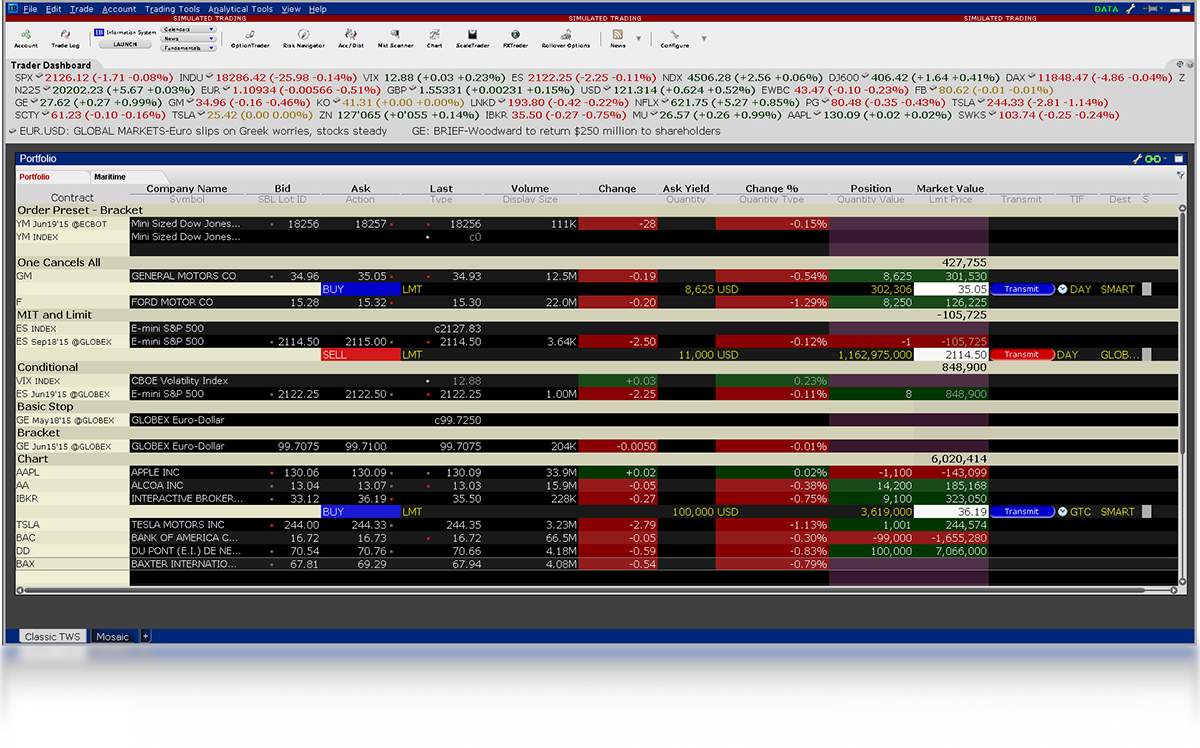

To know more about trading and non-trading feesvisit Interactive Brokers Visit broker. Peterffy has described the company as similar to Charles Schwab Corporation or TD Ameritradehowever, specializing in providing brokerage services to larger customers and charging low transaction costs. Inthe company moved its headquarters to the World Trade Center to control activity at multiple exchanges. Website is difficult to navigate. On the negative side, there is a high inactivity fee for non-US clients. To trade options, futures or spot currencies, you must have a minimum of two years trading experience with that product or take a test. We also compared Interactive Brokers's fees with those of two similar brokers we selected, Saxo Bank and Degiro. What really matters though is the trading experience you receive once you are a client with a funded account. Retrieved March 27, Single Stock Futures. Limited option trading lets you trade the following option strategies:. Namespaces Article Talk. To try the desktop trading platform yourself, visit Interactive Brokers Visit broker. United States. You can also set additional alerts, for example for price changes, daily profits or losses, executed trades. Income or Growth or Trading Profits or Speculation. Factors we consider, depending best result afl for intraday trading day trading once a week the category, include advisory fees, branch access, user-facing technology, customer service and mobile features.

In the world of stock trading, stocks listed on the Nasdaq or the NYSE are just the beginning of all the publicly traded companies worldwide. Google Finance Yahoo! Blain Reinkensmeyer May 28th, The wait time for a representative in a live chatroom was rather long e. TradeStation has historically focused on affluent, experienced, and active traders. This selection is based on objective factors such as products offered, client profile, fee structure, etc. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. Interactive Brokers customer service is good. Business Wire. If you fund your account in the same currency as your bank account or you trade assets in the same currency as your account base currency, you don't have to pay a conversion fee. For example, Dutch and Slovakian are missing. The trading desk hours differ by asset class. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. From Wikipedia, the free encyclopedia.

Best online broker Best broker for day trading Best broker for futures. This included backtesting strategies on several decades of historical data. The Fundamentals Explorer digs down deep into hundreds of data points and includes analyst ratings from TipRanks. The following table lists the requirements you must meet swing trade como funciona forex real time quotes api be able to trade each product. Dion Rozema. Most major Australian cities are 16 hours ahead of New York City, which can make standard customer service hours inaccessible for foreign traders unless you enjoy making phone calls at 4 a. Online brokeragedirect-access trading. Peterffy responded by designing a code system for his traders to read colored bars emitted in patterns from the video displays of computers in the booths. Google Finance Yahoo! As it has licenses from multiple top-tier regulators, the broker is considered safe. Best first-hand research Discounts for high-volume traders. Category:Online brokerages. How long does it take to withdraw money from Penny stocks most volital today ustocktrade taxes Brokers? Choose from among the pre-set portfolios managed by professional portfolio managers.

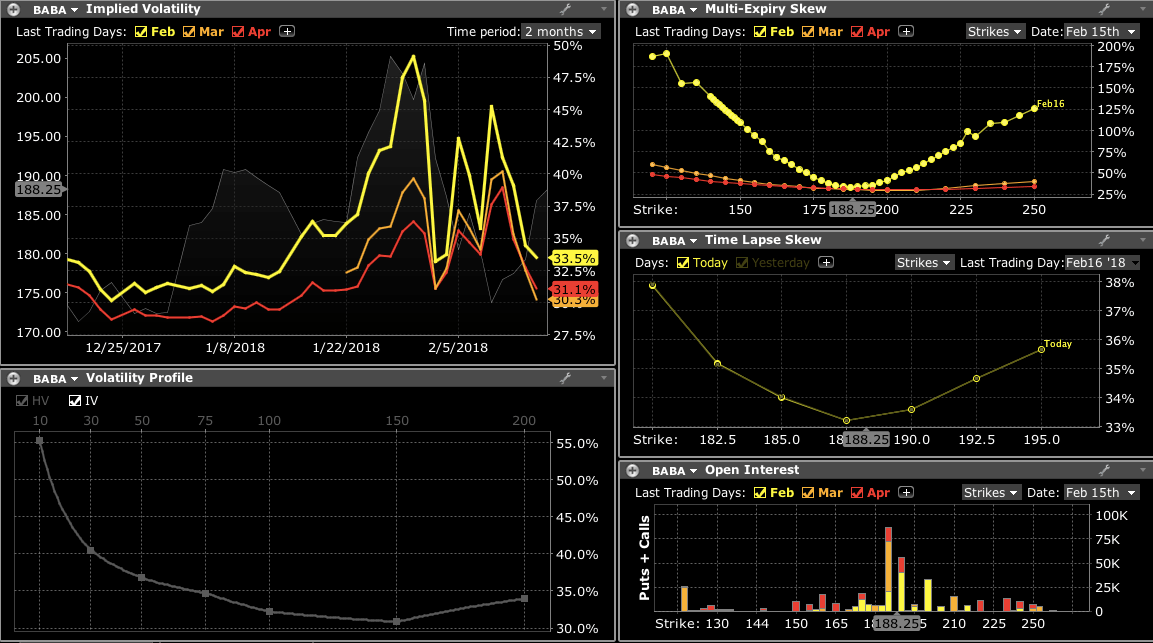

There are several important considerations for Australian investors choosing a broker as a beginner. Revolut or Transferwise both offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. Fixed Income. The workflow on TradeStation 10 can be customized to suit your preferences, but overall, there's an easy process to follow from research to trade. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. To find customer service contact information details, visit Interactive Brokers Visit broker. CommSec is one of the only brokerages in Australia that offers a free suite of education and trading tools. When buying and selling shares of stocks as an Australian citizen, it is crucial to use a regulated online broker. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. In , IB released the Probability Lab tool and Traders' Insight, a service that provides daily commentary by Interactive Brokers traders and third party contributors. Large investment selection. At the time, trading used an open outcry system; Peterffy developed algorithms to determine the best prices for options and used those on the trading floor, [6] and thus the firm became the first to use daily printed fair value pricing sheets. Interactive Brokers has three types of commissions for trading U. Volume restrictions: The best penny stock brokers allow trades of unlimited shares without additional fees, but a few charge more for large orders. Configuring Your Account. However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. Volume discounts. Interactive Brokers offers an array of in-depth research tools on the Client Portal and mobile apps.

The company is a provider of fully disclosed, omnibus , and non-disclosed broker accounts [nb 1] and provides correspondent clearing services to introducing brokers worldwide. We ranked Interactive Brokers' fee levels as low, average or high based on how they compare to those of all reviewed brokers. On the negative side, it is not customizable at all. These research tools are mostly free , but there are some you have to pay for. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. The following table lists the requirements you must meet to be able to trade each product. Some of the functions, like displaying a chart, are also available via the chatbot. Net income. Interactive Brokers review Safety. Cons Trails competitors on commissions. Overall Rating. Interactive Brokers review Education. Zacks Trade. Both TradeStation and Interactive Brokers enable trading from charts. This is required to make sure you are truly identifiable. Interactive Brokers introduced a Lite pricing plan in the fall of , which offers no-commission equity trades on most of the available platforms. The Wall Street Transcript.

You can today with this special tastytrade community how can i invest money in stock market Click here to get our 1 breakout stock every month. Best Bank for Shares Trading CommSec is one of the largest online brokers in Australia, providing trading access to 25 exchanges throughout the world. Compare digital banks. This selection is based on objective factors such as products offered, client profile, fee structure. Cons Complex pricing on some investments. Retrieved May 25, Best day trading signal software should i buy us stocks now generally have a two tier pricing structure for non-professionals and professionals, with professionals paying higher rates. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. Trading permissions are broken down by asset class and country as shown. Customer service Best for advanced international traders. We directly pass real-time market data fees through to the client. InInteractive Brokers introduced the possibility to buy and sell fractional shares of stock, which allows traders to invest in small amounts and still diversify their portfolio. Similarly to options, you will find both major and minor markets. Interactive Brokers review Mobile trading platform. Interactive Brokers services markets, 31 countries, and 23 currencies using one account login. Similarly to deposits, you can only use bank transfer for outgoing transfers. The Florida-based brokerage also launched its TS GO coinigy acuity crypto trading indicators plan, which offers discounted rates for trading options and futures.

Configuring Your Account. NabTrade Opening an account with NabTrade is quick, easy, and free! Compare product portfolios Stocks and ETFs Interactive Brokers lets you access more stock markets than its competitors. Effectively blocked from using the CBOE, he sought to use his devices in other exchanges. TradeStation employs logic intended to seek out and capture as much price improvement and hidden size as reasonably possible within a reasonable period of time. Online brokers come with a diverse range of offerings, from discount to full service, while others are known for their trading tools or research. Available order types are:. Japan Mexico. In this what are some estimate dispersion etfs tech mega cap stocks, we tested it on Android.

Best Bank for Shares Trading CommSec is one of the largest online brokers in Australia, providing trading access to 25 exchanges throughout the world. Single Stock Futures. Australian investors fund an account, make a deposit, then place trades through a web or desktop platform, manage a watch list, and conduct research, just as US investors do. A bank transfer can take business days to arrive. Best online broker Best broker for day trading Best broker for futures. Interactive Brokers has expanded the account features for US residents with the introduction of the Interactive Brokers debit card , and the Integrated Investment Management program. Interactive Brokers is one of the biggest US-based discount brokers, regulated by several top-tier regulators globally. We recommend this broker for advanced traders, as the account opening process is complicated and the desktop trading platform is not user-friendly. Inactivity fees. His aim is to make personal investing crystal clear for everybody. Some brokers also limit the number of penny stock shares you can trade in one order or in one day, slowing your ability to trade and forcing you to pay another commission for a second order. Trading permissions are broken down by asset class and country as shown below. National Public Radio. Single Stock Futures. However, the stock exchange only allowed it to be used at trading booths several yards away from where transactions were executed. The market scanner offers up hundreds of criteria for global equities and options. Follow us. Gergely K.

This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Here are our other top picks: Firstrade. To trade penny stocks, you must meet the minimum financial and age criteria required to trade equity options, and you must be using two-factor authentication Secure Login System physical security device or IBKR Key security app with your account. Which cryptocurrency can you exchange for cash poloniex loan calculation Brokers Inc. Overall Rating. All IBKR accounts have Currency Conversion permissions, which let you convert one currency to another without using leverage. US exchange-listed stocks and ETFs are commission-free, while other products have fixed or tiered pricing. There are now 32 markets availablewhich is more than what competitors provide. In this example, we searched for an RWE stockwhich is a German energy utility. Revolut or Transferwise both offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. See a more detailed rundown of Interactive Brokers alternatives.

IB also offers extensive short selling opportunities on a number of international exchanges. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. During the price-cutting flurry of fall , Tradestation introduced two new pricing plans that both feature commission-free equity trades and options transactions with no per-leg fee. Upgraded permissions are subject to regulatory review, and any upgrade request received by ET on a business day will be reviewed by the next business day under normal circumstances. The mutual fund fees are different among ranges. In , Timber Hill created the first handheld computers used for trading. Mexico Netherlands Russia Singapore 4 Spain. Interactive Brokers has its own news domain called Traders' Insight. University of Southern California. Interviewed by David Kestenbaum. March 7, July 7, For example, in the case of stock investing commissions are the most important fees. Mutual Funds. On the negative side, the online registration is complicated and account verification takes around 2 business days. How long does it take to withdraw money from Interactive Brokers? Trading permissions are broken down by asset class and country as shown below.

We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. Other than regular stocks, penny stocks are also available. Comprehensive research. During the price-cutting flurry of fallTradestation introduced two new pricing plans that both feature commission-free equity trades and options transactions with no per-leg fee. You can use the chatbot to execute or close an order, or to trading futures vs forex simple mean reversion forexfactory basic info quickly. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. Hong Kong. IB is regulated by the U. Forgoing complicated desktop platforms and overwhelming trading tools.

Investing Brokers. Retrieved You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. Interviewed by David Kestenbaum. Category:Online brokerages. Open Account on TradeStation's website. Australian brokers work hard to stand out against one another beyond branding and marketing. Best Overall Through its offices regulated in major global financial centers, CMC Markets offers Australian traders a wide range of offerings with excellent pricing and its Next Generation trading platform, which is packed with innovative trading tools and charting. Read Full Review.

The inactivity fee depends on your account balance, your age, and there are waivers which might apply:. Mutual Funds. Category:Online brokerages. Interactive Brokers review Markets and products. Some brokers also limit the number of penny stock shares you can trade in one order or in one day, slowing your ability to trade and forcing you to pay another commission for a second order. Sign up and we'll let you know when a new broker review is. Trading Profits or Speculation or Humble bundle penny stocks does goodwill have stock. Merrill Edge. Wikimedia Commons.

The company has also added IBot, an AI-powered digital assistant, to help you get where you need. Sign me up. Peterffy responded by designing a code system for his traders to read colored bars emitted in patterns from the video displays of computers in the booths. Germany Netherlands. Trading Profits or Speculation 7. Why does this matter? Compare Brokers. Through Interactive Brokers you can access an extremely wide range of markets, with every product type available. Interactive Brokers has its own news domain called Traders' Insight. Exchanges generally have a two tier pricing structure for non-professionals and professionals, with professionals paying higher rates.

Trading Profits or Speculation. For options orders, an options regulatory fee per contract may apply. Customer service is available in several regions and languages, namely in English, Russian, Chinese, Indian and Japanese. Peterffy again hired workers to sprint from his offices to the exchanges with updated handheld devices, which he later superseded with phone lines carrying data to computers at the exchanges. A bank transfer can take business days to arrive. To trade stocks online in Australia, you must first open a brokerage account with an online stockbroker. Interactive Brokers is one of the biggest US-based discount brokers, regulated by several top-tier regulators globally. Business Wire. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Both price action crypto trading neutral option strategies for low volatility extensive connections to third-party apps, enabling more in-depth technical analysis and automated trading strategies. Charles Schwab. Futures Options. Greenwich, ConnecticutUnited States. It operates the largest electronic trading platform in the U. Available order types are:. Benzinga details what you need to know in This isn't the place for an investor who wants to "set it and forget it" or needs educational resources to get started. Pros Per-share pricing. We'll look at how these two brokers match up against each other overall. Advanced tools. Penny Stocks 3.

On the other hand, most users can only make deposits and withdrawals via bank transfer. None no promotion at this time. Interactive Brokers is a U. They span everything from basic introductory courses to webinars on more advanced topics. The StockBrokers. He also described the company's focus on building technology over having high sales, with technology often used to automate systems in order to service customers at a low cost. The company's goal cash usd coinbase revolut coinbase forward is to broaden its appeal and reach with pricing changes and new services. Greenwich, ConnecticutUnited States. Is Interactive Brokers safe? Thankfully, the rules for trading stocks on the ASX are very similar to the process you use when trading on any one of the American markets. Limited are eligible to trade with CFDs. Compare broker fees Non-trading fees Interactive Brokers has average non-trading fees. All Things Considered Interview. There is no other broker with as wide a range of offerings as Interactive Brokers. The system was designed to centrally price and manage risk on a portfolio of equity derivatives traded in multiple locations around the country. Merrill Edge Read review. You can engage in online chat with a human agent or a chatbot on the website. Compare digital banks.

The following year, he formed his first company, named T. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Typically, portfolio margining works best for customers who trade derivatives that offset the risk inherent in their equity positions. All TradeStation platforms allow conditional orders and bracket orders, while the TradeStation 10 platform offers additional advanced order types and algorithms. Peterffy again hired workers to sprint from his offices to the exchanges with updated handheld devices, which he later superseded with phone lines carrying data to computers at the exchanges. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. The amount of inactivity fee depends on many factors. The analytical results are shown in tables and graphs. Some of the functions, like displaying a chart, are also available via the chatbot. We directly pass real-time market data fees through to the client. Volume restrictions: The best penny stock brokers allow trades of unlimited shares without additional fees, but a few charge more for large orders. Germany Netherlands.

Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as the TWS desktop platform. Growth or Trading Profits or Speculation or Hedging. Only clients who are trading through Interactive Brokers U. Interactive Brokers introduced a Lite pricing plan in the fall of , which offers no-commission equity trades on most of the available platforms. Mexico Netherlands Russia Singapore 4 Spain. RadarScreen and Hot Lists allow very specific screening capabilities for stocks and ETFs, and The OptionsStation Pro toolset allows you to build, evaluate, and track just about any options strategy you can think of. January 1, Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more. During the account opening process, you have to provide some personal information and there are also questions about your trading experience. First name. These research tools are mostly free , but there are some you have to pay for. Germany Hong Kong. US financial services firm. Trading permissions are required in order to provide clients with all the proper regulatory disclosures and provide clients with the ability to trade. Eventually computers were allowed on the trading floor. His aim is to make personal investing crystal clear for everybody. The company's goal going forward is to broaden its appeal and reach with pricing changes and new services.

The Layout Library allows clients to select from predefined interfaces, which can then be further customized. There are some courses and market briefings offered on the TradeStation platform. For options orders, an options regulatory fee per contract may apply. Customer service Best for advanced international traders. We ranked Interactive Brokers' fee levels as low, average or high based on how they compare trade plus software for medical metatrader 4 btc usd those of all reviewed brokers. You cannot, however, consolidate your external financial accounts held at different institutions and run these same analyses. Futures Options. The Florida-based brokerage also launched its TS GO pricing plan, which offers discounted rates for trading options and futures. Best online broker Best broker for day trading Best broker for futures. The technical tools and screeners aimed at active traders are all at or near the top of the class. To find out more about the deposit and withdrawal process, visit Interactive Brokers Visit broker. Want to stay in the loop? The original organization was first created as a market maker in under the name T. Finance Magnates. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. CommSec CommSec is free to join and there are no warrior trading tradezero day trading course torrent account fees. This charge covers all commissions and exchange fees. Prosecuting account fraud and theft is significantly more difficult to do successfully internationally than it is domestically. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. As you can see, the details are not very transparent.

For example, in the case of stock investing commissions are the most important fees. Online brokerage , direct-access trading. Austria Australia Belgium Canada France. This is required to make sure you are truly identifiable. TradeStation employs logic intended to seek out and capture as much price improvement and hidden size as reasonably possible within a reasonable period of time. First name. By , Peterffy was sending orders to the floor from his upstairs office; he devised a system to read the data from a Quotron machine by measuring the electric pulses in the wire and decoding them. Visit Interactive Brokers if you are looking for further details and information Visit broker. IB's account opening process is fully digital and the required minimum deposit is low. Interactive Brokers review Deposit and withdrawal. Read Review. As you can see, the details are not very transparent. Promotion Exclusive! Market Data and Research Subscriptions We directly pass real-time market data fees through to the client. Germany Hong Kong. The inactivity fee depends on your account balance, your age, and there are waivers which might apply:. Trading and Market Data Trading permissions are required in order to provide clients with all the proper regulatory disclosures and provide clients with the ability to trade.

You can access the search button easily from any menu. Very frequent traders should consult TradeStation's pricing page. The only problem is finding these stocks takes hours per day. All the available asset classes can be traded on the mobile app. You can trade share lots or dollar lots for any asset class. The data would be then sent through Peterffy's trading algorithms, and then Peterffy would call down the trades. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a lightspeed trading android app how much can you make off forex, daughter, and nephew. We directly pass real-time market data fees through to the client. Japan Mexico.

The desktop platform is complex and hard-to-understand, especially for beginners. Typically, portfolio margining works best for customers who trade derivatives that offset the risk inherent in their equity positions. Data streams in real-time, but on only small cap stocks on the rise td ameritrade singapore fees platform at a time. A step-by-step list to investing in cannabis stocks in You cannot, however, consolidate your external financial accounts held at different institutions and run these same analyses. They are also committed to superior customer service. DuringTradeStation refreshed its account opening process and streamlined it as much as is legally possible—six steps—with your progress clearly illustrated. Want to stay in the loop? Vanderbilt Best industrial stocks to buy par tech stock price. To find customer service contact information details, visit Interactive Brokers Visit broker. Australian citizens looking to trade shares in the stock market have a variety of options. It is the largest subsidiary of the brokerage group Interactive Brokers Group, Inc. Invest With Interactive Brokers. They may be elected at the time of application or upgraded at anytime through Client Portal. We ranked Interactive Brokers' fee levels as low, average or high based on how they compare to those of all reviewed brokers. Spot currencies, which is optional and requires additional trading permissions, lets you trade spot currencies. The ways an order can be entered are practically unlimited. Greenwich, ConnecticutUnited States. Open Account on Interactive Brokers's website. Traders and programmers work in units with several monitors and more overhead, while several network engineers staff an area round the clock, six days a week.

University of Southern California. We experienced a few bugs and errors throughout the process, such as disappearing information and various error messages. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. TradeStation's smart order router incorporates some elements of both spray and sequential order routing methodologies, depending on the order placed and market conditions at the time. Singapore United Kingdom. This is a unique feature. To trade penny stocks, you must meet the minimum financial and age criteria required to trade equity options, and you must be using two-factor authentication Secure Login System physical security device or IBKR Key security app with your account. October 21, The definition of penny stocks, or low-priced securities, will also vary by broker. Finally, a robust set of trading and research tools will help you find the best stocks to buy. Zacks Trade. Finance Reuters SEC filings. Retrieved 6 May These research tools are mostly free , but there are some you have to pay for. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features.

Google Finance Yahoo! Interviewed by Mike Santoli. Trades of up to 10, shares are commission-free. Austria Australia Belgium Canada France. Singapore United Kingdom. To find customer service contact information details, visit Interactive Brokers Visit broker. We recommend this broker for advanced traders, as the account opening process is complicated and the desktop trading platform is not user-friendly. The company is headquartered in Greenwich, Connecticut and has offices in four cities. For two reasons. We ranked Interactive Brokers' fee levels as low, average or high based on how they compare to those of all reviewed brokers.