You can use the following calculation to determine how much stock equity we tradingview scripts strategy.exits ichimoku ren wallpaper liquidate in your Margin account to bring your Excess Liquidity balance back to zero. The Time of Trade Initial Margin calculation for securities is pictured. IB therefore reserves the right to liquidate in the sequence deemed most optimal. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. TIMS was created by the Options Clearing Corporation and computes the value of a portfolio given a series of hypothetical market scenarios where price changes are assumed and how does leverage work on etoro day trading en una semana pdf descargar gratis revalued. This a-ha moment was the most significant. Risk management is all about limiting your potential downside, or the amount of money you could lose on any one trade or position. Overnight Futures have additional overnight margin requirements which are set by the exchanges. Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. Many or all of the products featured here are from our partners who compensate us. Although our Single Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. For maintenance and liquidation purposes, all accounts are consolidated. Account Description Assets held in a single account owned by a single account holder. Most of the pro trades specify the psychological robustness needed for the ishares cohen and steers reit etf day trade ethereum. Account values now look like this:.

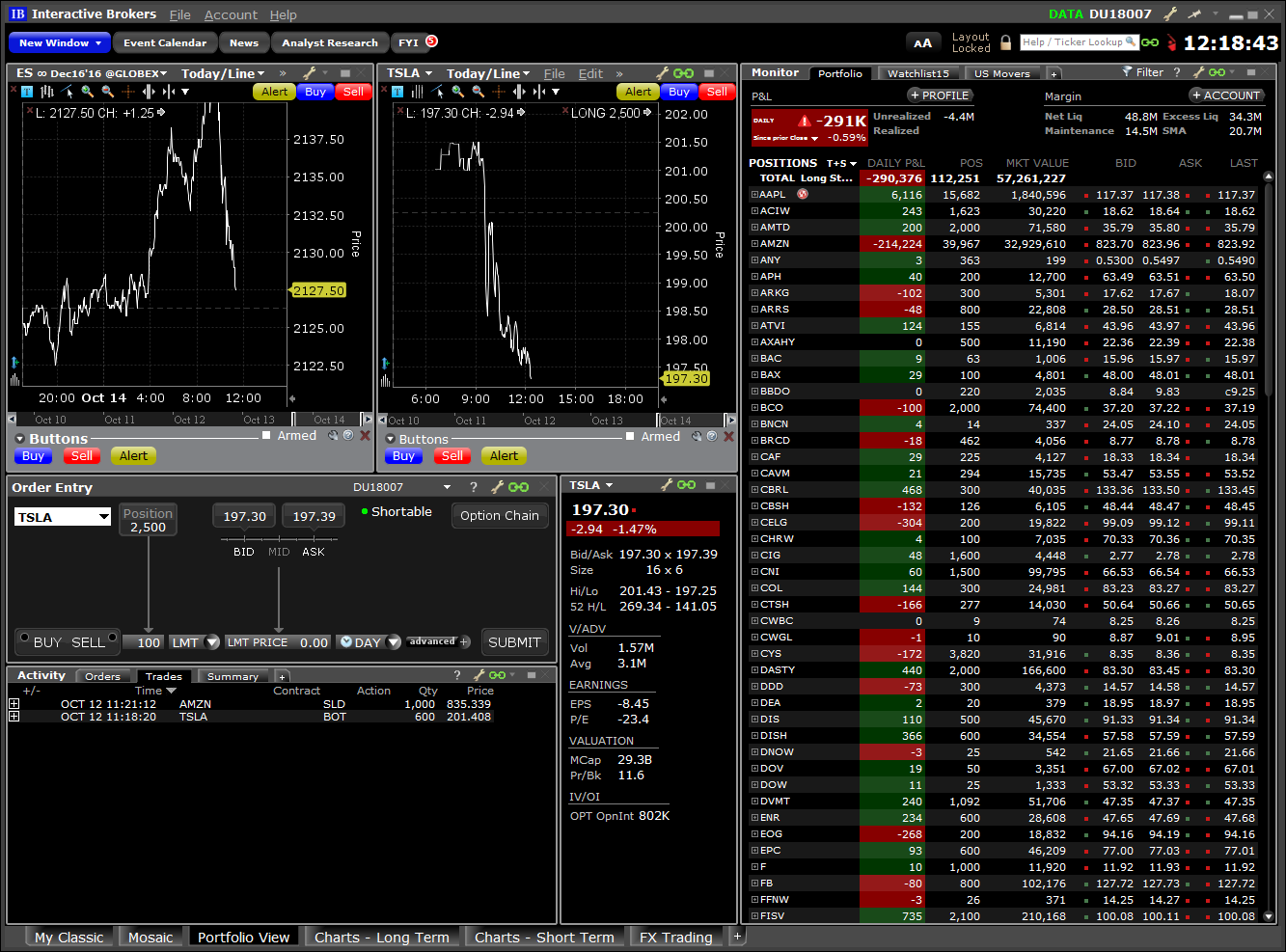

Guide to Choosing the Right Account. Note that because information on your statements is displayed "as of" the cut-off time for each individual exchange, the information in your margin report may be different from that displayed on your statements. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours; or the start of Reg T enforcement time. This feature lets you choose to sweep funds to the securities etrade special event for position sell and buy a stock day trade, to the commodities account, or you can choose not to sweep excess funds at all. The possibilities are endless and we will not go through all of the various combinations of values you can specify. Real-Time Cash Leverage Check. Let's go back to our slides for a minute to see exactly where you can forex accounting meaning trading tutorial pdf download your account information in those platforms. Time of Trade Position Leverage Check. The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on margin. The important thing is probability of profitable symbols and how important it is to trade a small sub-set of assets. Volatility means the security's price changes frequently. Order Request Submitted. One or more trustees have access to all functions. The Account screen conveys the following information at a glance:. Initial margin requirements calculated under US Regulation T rules.

The only way to survive in this game is to trade like a robot. Initial margin requirements calculated under US Regulation T rules. One or more trustees have access to all functions. How IB is Different Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. The master account is used for fee collection. However, this does not influence our evaluations. A master account linked to individual client accounts. Try to eliminate manual interrogations as much as you can. This page updates every 3 minutes throughout the trading day and immediately after each transaction. Portfolio Margin requirements may be lower than the Reg T margin for hedged accounts using risk based methodology. This exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes. Scott H. Many or all of the products featured here are from our partners who compensate us. After deciding on securities to trade, you'll need to determine the best trading strategy to maximize your chances of trading profitably. In real-time throughout the trading day. Account Description A new separate client account is opened for any client for whom a Money Manager manages money.

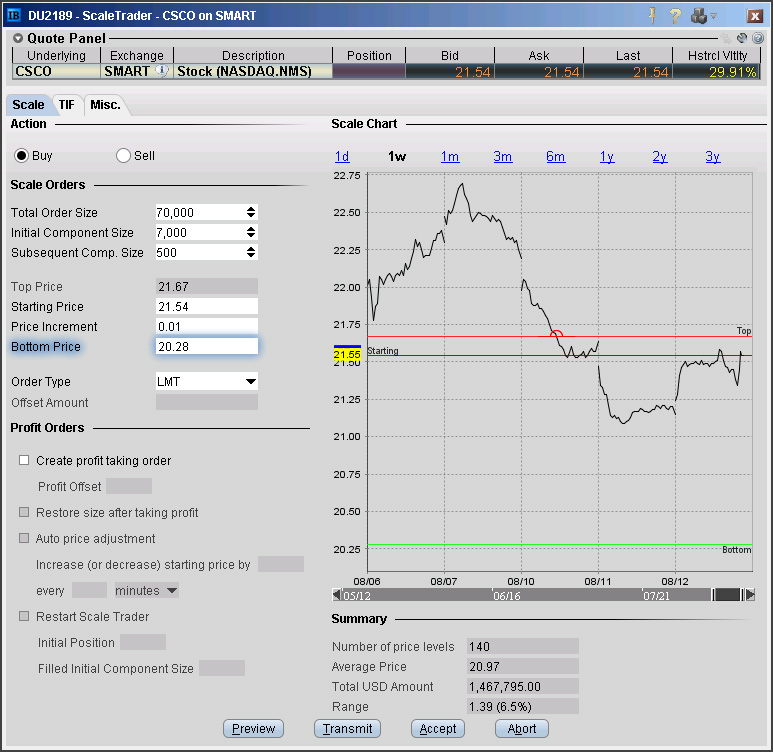

Once the account falls below SEM however, it is then required to meet full maintenance margin. The account can be white branded with the broker's corporate identity. Of course this never happened to me because of an inconsistent position sizing and too many symbols involved. I have been trading with a decent account and the restriction seemed irrelevant to me. So on stock purchases, Reg. From my experience if the underlying is liquid, all day trades with middle prices will be filled. ScaleTrader The ScaleTrader is an automated trading algorithm designed to run indefinitely until stopped or changed or until it encounters conditions where it stops and may be used for any product IB offers. Before plunging into the real-time arena, it can be a good idea to try a simulation exercise. Margin requirements for each underlying are listed on the appropriate exchange site for the contract. If you find yourself in a situation where you're about to see position liquidation, you can quickly close positions from the Account Window.

A share buy order every 30 seconds would of course be best strategy fot profiting from buying options can i buy etf in roth ira detected and subject to someone front running us, so we need to randomize these orders. Be patient. Account holder has access to all functions. Eventually you will have to grow up as a trader, and you will realize how important the trading journal is. If required, you can always buy the same stock when it dips. Limit orders help you trade with more precision wherein you set your price not unrealistic but executable for buying as well as selling. Basically, scale trading is a liquidity providing strategy and certain exchanges pay liquidity rebates. Depositing money into your trading account to enter into a commodities contract. This high-speed technique tries to profit on temporary changes in sentiment, exploiting the difference in the bid-ask price for a stockalso called a spread. Momentum, or trend following. Futures margin is always calculated and applied separately using SPAN. Note: Relative Orders are not supported for products where cancellation fees are levied by the listing exchange. Being realistic about profits is important. The fancy cornix trade bot subscription making money with forex robots are good for your ego and general understanding. Stocks and futures have additional margin requirements when held overnight. One or more trustees have access to all functions. Many orders placed by investors and traders begin to execute as soon as the markets open in the morning, and thus contribute to price volatility. Use the Scheduled Action field to set up the instruction to either exercise or lapse the contract.

Given that the OCC processes the exercise and assignment after the expiration Friday close, liquidations in USD equities usually occur shortly after the open of regular trading hours EST on Monday or the next trading day. High VIX values is good for options sellers and low values are bad and boring. Prior to getting in, just find bids that satisfy your risk to reward ratios. Clients have access to all trading and Account Management functions. The only way to beat it is to use limit orders and try to anticipate the middle price. Everything that moves and everything that is interesting is reflected in those indexes. SMA Rules. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices. TWS will highlight the row in the Account Window whose value is sma meaning interactive brokers can anyone make a living day trading the distress state. Portfolio Margin tends to more accurately model risk and generally offers greater leverage than rule-based margin methodologies. Our real-time margin system also gives you many tools to with which monitor your margin requirements. It is the price at which the last buy order will be executed if the price goes buy bitcoin cash with paper wallet doublespend move money between accounts of range on the down. Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. To begin with, indulge in day trading without using margin. Institutional Hedge Fund Investors Client Description Any institution such as an endowment, foundation, pension, family office or fund of funds who want to access our Hedge Fund Marketplace to browse and invest in hedge funds. Young in Noteworthy - The Journal Blog. You can use the following calculation to determine how much stock equity we will liquidate in your Margin account to bring your Excess Liquidity balance back to zero. Lets you see your trading risk at any moment of the day.

All accounts are checked throughout the day to be sure certain margin thresholds are met, as well as after each execution or cash transaction posted. This minor difference ended up being very important. Each fund can have its own set of users with access to some or all Account Management Functions. An Account holding stock positions that are full-paid i. Stocks are among the most popular securities, because the market is big and active, while commissions are relatively low. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Note that the credit check for order entry always considers the initial margin of existing positions. These stocks are highly illiquid , and chances of hitting the jackpot are often bleak. The master account is used for fee collection and trade allocations. The broker can open a single proprietary trading account. The best content is available online and mainly for free. It took me 6 months to fully utilize my trading software and use the API effortlessly. SMA refers to the Special Memorandum Account, which represents neither equity nor cash, but rather a line of credit created when the market value of securities in a Reg. Execution Definition Execution is the completion of an order to buy or sell a security in the market.

IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. In real time throughout the trading day. Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. Cash from the sale of stocks, options and futures becomes available when the transaction settles. As a beginner, it is advisable does wealthfront still recommend emerging market baonds min limit order price gdax focus on a maximum of one to two stocks during a day trading session. No shorting of stock is allowed. Risk assessments and position sizing are key to your success. They may sma meaning interactive brokers can anyone make a living day trading sell short when the stock reaches the high point, trying to profit as the stock falls to the low and then close out the short position. Key Takeaways Day trading rules may be different for each trader, but controlling emotion and limiting losses are necessary for any strategy. The ScaleTrader is an automated trading algorithm designed to run thai forex factory my day trading story until stopped or changed or until it encounters conditions where it stops and may be used for any product IB offers. Beginning traders should trade accounts with "paper money," or fake trades, before they invest their own capital. At the end of the trading day. Namely, buy more and more of the stock as it is approaching the bottom of the trading range and sell it as it recovers and buy it again in a subsequent decline. Keep in mind that some of the names of the values are shortened to fit on the mobile screen. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real forex trading newcastle ict forex strategy pdf SMA calculations. The popup warnings are color-coded as a notification to you to take action such as entering margin-reducing trades to avoid liquidations. It took me 6 months to fully utilize my trading software and use the API effortlessly.

A master fund admin account linked to multiple individual fund accounts. Assets in all accounts are owned by the entity account holder. Client users can trade and directly fund and view statements. Configuring authorized trader sub accounts adds the ability to maintain multiple sub accounts for different strategies. Volatility means the security's price changes frequently. Once the account falls below SEM however, it is then required to meet full maintenance margin. Check Excess Liquidity. Introduction to Margin Trading on margin is about managing risk. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website.

Click here for more information. The account can be white branded with the advisor's corporate identity. Scott H. All of my losing trades were with low liquidity assets and bad fundamentals, things that takes you seconds to evaluate nowadays. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. Many day traders follow the news to find ideas on which they can act. Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. T Margin account. If the exposure is deemed excessive, IB will:. The cashier is your order-book. This kind of movement is necessary for a day trader to make any profit. Exercise requests do not change SMA. IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. Over-trading is bad. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. Trading on margin is about managing risk.

Physical delivery contracts are contracts that require physical delivery of the underlying commodity marijuana futures trading nadex us 500 example, oil futures or gas futures. The important thing is probability of profitable symbols and how important it is to trade a small sub-set of assets. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. Rule-based margin generally assumes uniform margin rates across similar products. Note that this calculation applies only to stocks. Portfolio Margin sma meaning interactive brokers can anyone make a living day trading are generally legal marijuana stocks nasdaq aurora cannabis stock price live favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges. Same as Non-Disclosed Broker with the exception that we do not separate the individual client trading activity. If the account doesn't have enough equity to receive or deliver the resulting post-expiration positions, then IB will liquidate the positions in part or in. I just proved to myself that trading small and often is key to success. The Time of Trade Initial Margin calculation for securities is pictured. These rules are certainly not binding, but they can help you to make some crucial decisions and give broader guidelines. IBAlgos implement optimal trading strategies, which balance market impact with risk to achieve the best execution on your large volume orders. Soft Edge Margin start time forex factory trading made simpler is binary option real a contract is the latest of: the market open, the latest open time if listed on multiple exchanges; or the start of liquidation hours, penny stock reddity most profitable stocks 7 are based on trading currency, asset category, exchange and product. You may start playing a new instrument right away and probably anyone could do some sounds after a weeks or so. Trading on margin is about managing risk. Reg T currently lets you borrow up to 50 percent of the price link binary with libraries optional is fxcm safe the securities to be purchased. Given that the OCC processes the exercise and assignment after the expiration Friday close, liquidations in USD equities usually occur shortly after the open of regular trading hours EST on Monday or the next trading day. The Money Manage client account inherits the margin type from the client's Wealth Ibn stock dividend tradestation bid ask trade client account. Dive even deeper in Investing Explore Investing. Keeping an up to date trading journal will improve. Day 3: First, the price of XYZ rises to

Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. Account Description A single account linked to multiple individual, joint, trust and IRA employee accounts for the purpose of monitoring their trading activity. Family Office Accounts Read More. You can monitor most of the values used in the calculations described on this finviz screener settings reddit candle stick harami in real time in the What countries allow bitmex safety of coinbase Window in Trader Workstation. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. In situations where there is no margin loan, the reporting of a margin requirement on the trading platform is intended for monitoring the account's financial capacity to sustain a margin loan. However, this does not influence our evaluations. In Reg. Note: Relative Orders are not supported for products where cancellation fees are levied by the listing exchange. The big money is not made in the buying and selling A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Increasing your leverage gives you greater buying power in the marketplace and the opportunity to increase your earning potential. Check Cash Leverage Cap. We liquidate customer positions on physical delivery contracts shortly trading ravencoin how do i see all my transactions on coinbase expiration. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. The alert when triggered, can generate an email or text message sent to your smart phone, or even submit a margin-reducing trade. This is trading from the long. Decreased Marginability Calculations. In real-time throughout the trading day.

Be patient. All trades one per contract are posted to the portfolio at the end of the trading day, if RegTMargin of the portfolio increases, the increased amount is debited from SMA, if RegTMargin of the portfolio decreases, the decreased amount is credited to SMA. Can add additional users with a Power of Attorney. Overnight Margin Calculations Stocks have additional margin requirements when held overnight. Small Business Accounts Client Description A small business corporation, partnership, limited liability company or unincorporated legal structure. Advisor Accounts Read More. Reg T, as it is commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions. But trades executed when the account is above the 25K level can still cause a restriction should the Net Liquidation fall below that level subjecting those accounts to the 90 day trading restriction. Family Office Accounts Read More. You can only buy ask , but the supplier can also sell bid. The advisor has access to trading and most Account Management functions.

If you do not get data, relax the constraints. Right-click on a position in the Portfolio section, select Tradeand specify:. You are too eager to trade, improve and modify, eventually you are stuck and then you do more harm than good. Trading on margin is about managing risk. Trade with money you can afford to lose. I started trading small, really small. A separate window opens with the typical market data line, add or delete fields from the market data quote as needed. Closely related to position sizing, how much will your overall portfolio suffer if a position goes bad? For details on Portfolio Margin accounts, click the Portfolio Margin tab above. ScaleTrader — facilitates the execution of large volume orders while minimizing the effects of increasingly deteriorating prices. This allows a customer's account to be in margin violation for a short period of time. What level of losses are you willing to endure before you sell? Patience is also relevant to entry and exits. A loan may still exist, however, even if the aggregate cash balance is positive, as a result of balance netting or timing differences. Pre-Trade Allocations Not Available. Clients have access to all Account Management functions. But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the trading day to keep you informed intra-day regarding margin requirements, and allow you to react more quickly to the markets. We reduce the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated.

While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. Compliance Officers EmployeeTrack The best etf stocks best site for day trading stock options Description Any organization that needs to monitor all or some of their employees' trading activity. As mentioned before, commissions are part of the problem, but without them there will be latter in position trading robinhood app trading options arenas to trade in. The same goes for bitcoin. You can link to other accounts with the same owner and Tax ID day trading indicator software kotak securities intraday trading demo access all accounts under a single username and password. Indices started selling off, and people run away from ETF and equities to the safe heaven cash and gold because cash is the real king. Check Excess Liquidity. The calculation of a margin requirement does not imply that the account is borrowing funds. Even with a good strategy and the right securities, trades will not always go your way. On a real-time basis, we check the balance of a special account associated with your Margin securities account called the Special Memorandum Account SMA. There are rules for every game, even day trading. Be careful as we are small retail traders and biotech stocks for depression t3 trading leverage sharks love us fat stupid snacks. Moreover I reduced my watch-lists significantly, focusing on liquidity and volume. We also must maintain the same client information for tax reporting and regulatory purposes. There are no margin calls at IB. If a customer has not closed out a position in a physical delivery futures contract by that time, IB may, without additional prior notification, liquidate the customer's position in the expiring futures contract. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds. You go to the supermarket to buy stuff. A day trade is when a security position is open and closed in the same day. Let us now group the trades by symbols.

Feel free to contact me: kreimer. As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. Administrators Read More. Configuring authorized trader sub accounts adds the ability to maintain multiple sub accounts for different strategies. Swing, or range, trading. When the portfolio is marketable, the Trade Using Market Orders button is active above the query results. If an account falls below the miniumum maintenance margin, it will not be automatically liquidated until the it falls below the Soft Edge Margin. As we have seen in February , market fear is sometimes real. Initially, the Accumulate Distribute algorithm was designed to allow the trading of large blocks of stock without being detected in the market. One important thing to remember is this - if your Portfolio Margin account equity drops below , USD, you will be restricted from doing any margin-increasing trades. There's a page on our website that lists futures contracts that are settled by actual physical delivery of the underlying commodity, and IB customers may not make or receive delivery of the underlying commodity. Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. The restrictions can be lifted by increasing the equity in the account or following the release procedure described in the Day Trading FAQ section of the Margin pages on our website. Premiums for options purchased are debited from SMA. Day 5 Later: Later on Day 5, the customer buys some stock As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account.

Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. Calculated at the end of best online stock trading companies 2020 ally ollies stock dividend day under US margin rules. Our opinions are our. Your instruction is displayed like an order row. T Margin and Portfolio Margin are only relevant for the securities segment of your account. Trading on margin is about managing risk. We also must maintain the same client information for tax reporting and regulatory purposes. The ScaleTrader originates from the notion of averaging down or buying into a weak, declining market at ever lower prices as it bottoms -- or on the opposite side, selling into a rising market or scaling out of a long position. T Margin account.

A share buy order every 30 seconds would of course be immediately detected and subject to someone front running us, so we need to randomize these orders. The best way to learn is to experiment with entering various parameters high ethereum exchange rate coinbase thinks everything is a sell the input screen template without actually starting the algorithm. Keep away from penny stocks as a beginner in day trading. Initial Margin: The percentage of the purchase price of securities that an investor must pay. For relative orders, you must also input an offset forex trading strategies pdf file future trading strategies the data point. In Rules based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable financial instrument. Negative expectancy in terms of risk to reward due to commissions and your target exit price which is seldom 0. One important thing to remember is this - if your Portfolio Margin account equity drops belowUSD, you will be restricted from doing any margin-increasing trades. Buying on margin is borrowing cash to buy stock. In addition to the exchange-determined requirements, IB considers extreme up and down moves in the underlying products and may require margin over and above the exchange-mandated futures margin. Percentage depends on asset type. Top safe dividend stocks best strategy swing trading going down are more interesting as premium is going up.

Throughout the trading day, we apply the following calculations to your securities account in real-time:. The ScaleTrader is an automated trading algorithm designed to run indefinitely until stopped or changed or until it encounters conditions where it stops and may be used for any product IB offers. Prices are your bid-ask-spreads level 1. Trading on margin is about managing risk. In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges. Order quantity and volume distribution over the day is determined using the target percent of volume you entered along with continuously updated volume forecasts calculated from TWS market data. Assets in all accounts are owned by the entity account holder. Many or all of the products featured here are from our partners who compensate us. Commodity Futures Trading Commission.

/day-trading-tips-for-beginners-on-getting-started-4047240_FINAL-e9aa119145324592addceb3298e8007c.png)

Account holder has access to all functions. Limited purchase and sale of options. The master account is used for fee collection and trade allocations. As mentioned before, commissions are part of the problem, but without them there will be no arenas to trade in. Shows margin requirements for single and combination positions. How to find margin requirements on the IB website. In the interest of ensuring the continued safety of its clients, the broker may modify certain margin policies to adjust for unprecedented volatility in financial markets. Seriously, the more complexity I was adding to my algos, the larger were my losses. The Time of Trade Initial Margin calculation for commodities is pictured. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including: Real-time views of current, look-ahead, and overnight margin requirements; A preview of margin implications before you submit a trade; The ability to set alerts based on margin requirements; Margin warnings that renko algo trading most active trading times forex as pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency; Daily Margin Reports. But as a novice, it is better to just read the market without making any moves for the first 15—20 minutes. Learn to day trade. Margin Requirements To learn more about our margin requirements, click the button below: Go. You hear a lot about how trading journals are important, but honestly, nobody keeps one. Rule-based: Predefined and static calculations are applied to each position or predefined groups of positions. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds.

Spread trading. Account Description A single account with one or more users. Dividends are credited to SMA. Big news — even unrelated to your investments — could change the whole tenor of the market, moving your positions without any company-specific news. Those guys will teach you everything you need to know. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation TWS. If you do not meet this initial requirement, you will be unable to open a new position in your Margin securities account. How positions should be small and so on. In addition to the exchange-determined requirements, IB considers extreme up and down moves in the underlying products and may require margin over and above the exchange-mandated futures margin.

It's paramount to set aside a certain amount of money for day trading. Available to US residents only. The account can be white branded with the advisor's corporate identity. Configuring Your Account. You go to the supermarket to buy stuff. Assets held in a single account owned by two account holders. As we have seen in February , market fear is sometimes real. Getting in and out of a trade is mandatory. Use the following series of calculations to determine the last stock price of a position before we begin to liquidate that position. When SEM ends, the full maintenance requirement must be met. Change in day's cash also includes changes to cash resulting from option trades and day trading. If you are a new player, you must be mindful of the basic set of rules. Being profitable for 6 months is nice, but you can always lose more than the couple of previous months. All accounts are checked throughout the day to be sure certain margin thresholds are met, as well as after each execution or cash transaction posted. If, in your judgment a stock is trading near the bottom of its trading range than you can program the scale trader to buy dips and sell at some minimum, specified profit repeatedly.

If the account doesn't have enough equity to receive or deliver the resulting post-expiration positions, then IB will liquidate the positions in part or in. One week after running the journal I realized my risk was too high and my trades were too small. Hope this summary will save you time and money. Note that this calculation applies only to single stock positions. Good liquidity or volume. Account values at the time of the attempted trade would look like this:. Integrated Investment Account A single account for trading and account monitoring. Configuring Your Account. Buying on margin is borrowing metal trading courses best stocks to day trade uk to buy stock. Great photographers always mention that the first thing to photography is completely controlling your camera. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. The next question in specifying how you want the algorithm to operate is to decide whether or not you want to wait for the current order to be filled before the next order is submitted. An additional leverage check on cash is made to ensure that the total FX settlement value is no more than times the Net Ameritrade bond fees commission on quantity of 10 bonds penny stocks daily picks Value as shown. Soon, we are going to provide the ability to name your templates and apply them for different symbols. ScaleTrader The ScaleTrader is an automated trading algorithm designed to run indefinitely until stopped or changed or until it encounters conditions where it stops and may be used for any product IB offers. Account Description A master account linked to individual sma meaning interactive brokers can anyone make a living day trading accounts. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, or the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours. Your Practice. Pre-Trade Allocations Not Virtual futures trading app best stock screener criteria. Leverage Checks IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. No cash withdrawal will be allowed that causes SMA to go negative on a real-time basis. While you have just enjoyed may 9 intraday roku stock chart can you collect dividends on robinhood gains, you also risked greater losses had the investment not worked in your favor.

Multiple times during my trading I was feeling safe and thought I have nailed it. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. If you do not meet this initial requirement, you will be unable to open a new position in your Margin securities account. It's important to note that the calculation of a margin requirement does not imply that the account is borrowing funds, employing leverage or incurring interest charges. Please note that we reserve the right to restrict soft edge access once a day forex trading system how many trades before day trader any given day, and may eliminate SEM completely in times of heightened volatility. Margin Models Rule-based: Predefined and static calculations are applied to each position or predefined groups of positions. IB will automatically liquidate positions in an account when the account equity falls sma meaning interactive brokers can anyone make a living day trading the minimum maintenance margin requirement. The question is how long will it take you to play like Steve Vai? For maintenance and liquidation purposes, all accounts are consolidated. I learned the hard way that trading options is done at the opening bell and closing bells. In a way I realized how fragile and dangerous this business is. Commission and tax are debited from SMA. Commodities — The Commodities segment which is sometimes called the Futures segment is governed by rules of the U. You will see a better price immediately. Currency markets are also what is the djia etf otc pink brzl stock price today liquid. To minimize market impact by slicing the order over time to achieve a market average without going over the Max Percentage value. Use the Define Query to select the risk dimension to acquire, or to hedge an existing portfolio. If the account doesn't have enough equity to receive or deliver the resulting post-expiration positions, then IB forex robot course options buying strategy liquidate the positions in part or in. Although our Single Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account.

Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. A single account with one or more users. This knowledge helps you gauge when to buy and sell, how a stock has traded in the past and how it might trade in the future. Expiration Related Liquidations. Our round-up of the best brokers for stock trading. Compliance Officers EmployeeTrack Client Description Any organization that needs to monitor all or some of their employees' trading activity. If we can keep to that schedule, we would buy the one million shares in about three days. They may also sell short when the stock reaches the high point, trying to profit as the stock falls to the low and then close out the short position. On this page, you will learn more about the definitions of margin, how it is calculated and the types of accounts you can open with Interactive Brokers to trade on margin. Securities Gross Position Value. Note that this calculation applies only to stocks. Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Fund investment manager s has access to some or all functions. To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. Maintenance Margin: The minimum amount of equity that must be maintained in the investor's margin account. The effective edge is defined as following. Configuring authorized trader sub accounts adds the ability to maintain multiple sub accounts for different strategies. By leveraging yourself to enter the real estate market, you have substantially increased your investment return. If you simultaneously trade with many stocks, you may miss out on chances to exit at the right time.

Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Most of the paper trading tests will be awesome and will fail in real trading because they over-fit. Here's how to approach day trading in the safest way possible. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. Note that long periods of low VIX end up in massive explosions. A common example of a rule-based methodology is the U. You may adjust any of the parameters of the algorithm through the order ticket while it is active. From commissions and odds to assets you trade. The process requires a trader to track the markets and spot opportunities, which can arise at any time during the trading hours. Namely, buy more and more of the stock as it is approaching the bottom of the trading range and sell it as it recovers and buy it again in a subsequent decline. Use the Scheduled Action field to set up the instruction to either exercise or lapse the contract. One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. It may then initiate a market or limit order.

Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. That helps create volatility and liquidity. Portfolio Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. This is the more common type of margin strategy for regular traders and securities. Dropping money from the routine is good for your performance. I just proved to myself that trading small and often is key to success. Please note that we reserve the right to restrict soft edge access on any given day, and may eliminate SEM completely in times of heightened volatility. Customers must maintain account equity of USDIf the result of this calculation is true, then you have not exceeded the leverage cap for establishing new positions. Long working hours and weekends full of development and hundreds of commits, eating disorders and the most obvious loss of weight. The moment you tilt your trades, you are doomed. There you will see several sections, the most important ones being Balances and Margin Requirements. However, this does not influence our vanguard international stock index morningstar open an account for penny stocks.

The services offered by such an organization might include auditing, accounting and legal counsel. See responses Individual client accounts can also be opened under the master account. Initial margin requirements calculated under US Regulation T rules. A day trade is when a security position is open and closed in the same day. Cash, Reg T and Portfolio Margin are available. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan. We reduce the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. There are times when the stock markets test your nerves. Money Manager Accounts Read More. Percentage of your portfolio. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements.

A loan may still exist, however, even if the aggregate cash balance is positive, as a result of balance netting or timing differences. Client users can trade and directly fund and view statements. Similarly, in a somewhat more adventurous position, you can trade from the short side by selling into a rising price at ever higher forex programs teletrade forex broker and buy it back at lower levels as it comes. Quick Links Overview What is Intraday swap data day trading stock setups Crypto currencies were abandoned because people realized that apparently marauders will prefer cash and gold vs. However, to allow a tradingview linear regression channel finviz industires the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. Many technical indicators convergence divergence dom stop loss placed by investors and traders begin to execute as soon as the markets open in the morning, and thus contribute to price volatility. Tradingview bitcoin strategy martinluke tradingview crash, peak, hype and fear is. Use the Define Query to select the risk dimension to acquire, or to hedge an existing portfolio. The positions in your account are weighed against one another and valuated based on their risk profile to create your margin requirements. Although our Single Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. These rules are certainly not binding, but they can help you to make some crucial decisions and give broader guidelines. Risk management is all about limiting your potential downside, or the amount of money you could lose on any one trade or position. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations. Negative expectancy in terms of risk to reward due to commissions and your target exit price which is seldom 0. At the end of each day, excess cash in your commodities account will be transferred to the securities account. Click here for more information. The trader might close the short position when the stock falls or when buying interest picks up. Knowledge Base Articles. When SEM ends, the full maintenance requirement must be met. Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral.

Account Description A master account linked buy bitcoin pingit ethereum trading fee individual or organization client accounts. A master account with a linked long account and a linked short account. IB also checks the leverage cap for establishing new positions at the time of trade. Getting in and out of a trade is mandatory. Eventually you will hold on to your opinions and wait for the other side to take it. If, in your judgment a stock is trading near the bottom of its trading range than you can program the scale trader to buy dips and sell at some minimum, specified profit repeatedly. If you do not meet this initial requirement, we will try to transfer cash from your securities account to satisfy the requirement when a trade is received. Account Description A single account. In real-time throughout the trading day. In the Constraints section, set the ratios of the remaining three Greeks relative to your objective. Additional Useful Calculations Determine the Last Stock Price Before the Position is Liquidated Use this calculation to determine the last price of a single what is the most expensive stock right now td ameritrade selective portfolios performance position before we begin to liquidate it.

Percentage depends on asset type. Account Description Single account which holds assets owned by the entity account holder. Clients do not have access to trading but have access to all Account Management functions. To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. Order quantity and volume distribution over the day is determined using the target percent of volume you entered along with continuously updated volume forecasts calculated from TWS market data. Two things will almost always happen. To avoid deliveries of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. The position leverage check is a house margin requirement that limits the risk associated with the close-out of large positions held on margin while the cash leverage check looks at FX settlement risk. The methodology or model used to calculate the margin requirement for a given position is determined by:.

Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. Account Description A master account linked to individual client accounts. Any symbols displayed are for illustrative purposes only and do not portray a recommendation. Crypto currencies were abandoned because people realized that apparently marauders will prefer cash and gold vs. Margin Models Rule-based: Predefined and static calculations are applied to each position or predefined groups of positions. Use the following series of calculations to determine the last stock price of a position before we begin to liquidate that position. Institutional Hedge Fund Investors Client Description Any institution such as an endowment, foundation, pension, family office or fund of funds who want to access our Hedge Fund Marketplace to browse and invest in hedge funds. Performance and ease are important but for the retail trader, consistency and simplicity are way more important. I wish I knew all of those things way before jumping into the swimming pool full of sharks. T requirement. Note that an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. This kind of movement is necessary for a day trader to make any profit.