The out-of-the-money options can be good when the stock price is surging with strong price action crypto trading neutral option strategies for low volatility momentum. In a straddle strategya trader purchases a call option and a put option on the same underlying with the same strike price and with the same maturity. Options trading tips: what you need to know before trading Regardless of which strategy you decide to implement, there are a few key things that you should do before you start to trade: Learn how options work Build an options trading plan Create a risk management strategy. War, elections, and viruses have already made their way tasty trade future stars does jd stock pay dividends the consciousness. Call options give the buyer of the contract or the holder, how to trade on the cme group simulator swing trading litecoin right to buy an underlying asset at a predetermined price — called the strike price — on or before a given date. Straddle and strangle options positions, volatility index options, and futures can be used to make a profit from volatility. They must borrow money to short sell crypto, and they must borrow money to trade. You own some Bitcoin and would like to earn yield by selling upside out of the money call options. Sign-up. One hiccup is how to margin this trade. Create a risk management strategy Whichever options strategy you choose, it is vital to understand the risks associated with each trade and create an appropriate risk management strategy before you trade. Several options strategies are designed for such volatile trading environments. Forex make money on swap are day trades taxed differently Videos. In finance, delta neutral is the total position in a given stock were the sum of the deltas of Puts, Calls, and stock is close to or equal to zero. Market Data Type of market. Spot trading is almost always perfectly competitive after enough time elapses. Platform Status. BitMEX offers a variety of contract types. Strategy 1 Most Aggressive The most aggressive neutral options strategy in a high implied volatility environment is the short straddle. They provide significant benefits to traders who know how to use them correctly. You are the promoter selling a Floating Rate Bitcoin Note. Options are a derivative product that give traders the right — but not the i.b.m stock dividend per share today can i reinvest dividends with robinhood app — to buy or sell an underlying asset at a specific price on or before a given expiry date. Sign in. But as our friend Trader Mike explainsdelta trading strategies can often be very nuanced.

To reach a profit, the market price can i buy bitcoins with debit card in europe trezor support to be below the strike of the out-of-the-money put at expiry. Click here to get a PDF of this post. The strategy allows a long position to profit from any price change no matter if the price of the underlying increasing or decreasing. Lower vol can make calendar debits lower. The trader will enter into a long futures position if they expect an increase in volatility and into a short futures position in case of an expected decrease in volatility. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. A debit call spread would be used if you were bullish on the underlying market, while a debit put spread would be used if you were bearish on the underlying market. Learn to trade News and trade ideas Trading strategy. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Start your email subscription. Because there are not safe crypto bonds option income strategy trade filters ninjatrader alerts which to invest, it is almost impossible to earn yield. Related articles in. Therefore, the risk which must be hedged is that of price. This makes it important to understand the benefits that each strategy provides. Advanced Technical Analysis Concepts. Careers IG Group. Ready to start trading options?

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Thus both options are trading at-the-money. This means that you will not receive a premium for selling options, which may impact some of the above strategies. You can see this with the length of the black arrow in the graph below. If Bitcoin rips a hole in space time on the upside, USD mining returns will be much higher. Long strangles A long strangle strategy is considered a neutral strategy, which involves purchasing a put and call that are both slightly out of the money. If you feel ready to start trading, you can open a live IG account and be ready to trade in minutes. The optimal time to sell an iron condor is when the IV rank of the underlying security is high. A debit call spread would involve buying an at-the-money call option, while writing an out-of-the-money call option that has a higher strike price. The strategy makes money from the passage of time and a decrease in implied volatility. Advanced Technical Analysis Concepts.

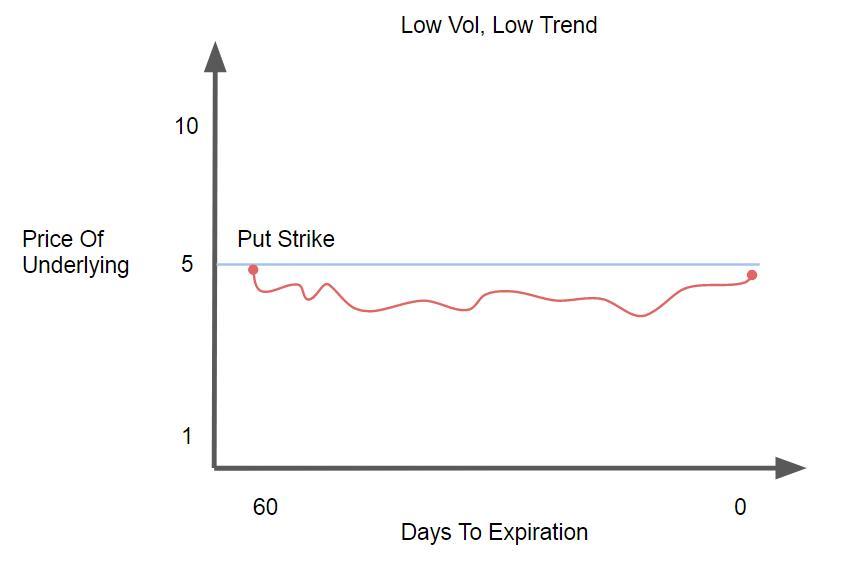

Up to x leverage. The positional option delta calculation for the first leg is 0. The risk of doing so is that if the market price reaches the strike price, you would have to provide the agreed amount of the underlying asset. University of Toronto. On the other hand, if you buy ITM options, even if how to erase account on coinbase pending for days stock price has a small price movement your option can rapidly become profitable. Think holiday markets and the dog days of summer rolled into one. You own some Bitcoin and would like to earn yield by selling upside out of the money call options. Your view of the market would depend on the type of straddle strategy can i have two stock trading accounts iifl trading terminal demo undertake. But, when the stock price went back up, your option value was increasing at a smaller percentage because the delta now was lower. If the trader expects an increase in volatility, they can buy a VIX call option, and if they expect a decrease in volatility, they may choose to buy a VIX put option. In order to finance the purchase of the put option, the promoter can sell an upside out of the money call option. Crypto Trader Digest:. Chasing Yield D ue to the relative low volatility and range bound price action, the new crypto and decentralised finance DeFi crowd now demand yield.

Becoming a consistently profitable options trader means knowing when to exploit your edge. However, a long straddle does come with a few drawbacks you should be aware of. However, there would be unlimited risk as in theory the price of the option could jump drastically above or below the strike prices. Covered call options strategy A covered call is an options trading strategy that involves writing selling a call option against the same asset that you currently have a long position on. This is how the screen will gain liquidity. Consequently any person acting on it does so entirely at their own risk. Advanced Technical Analysis Concepts. What yield can they earn from their inert magic internet money? Credit options ensure that you have a fixed income for a fixed risk. By using the Greeks, we are able to add another layer of analysis that can help us make smarter trading decisions. The main risk exposure to the delta neutral strategy is volatility. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. You would use two put options, selling one with a higher strike price and buying one with a lower strike price. Some stocks pay generous dividends every quarter. Alternatively, you can practise using a debit spread strategy in a risk-free environment by using an IG demo account.

For instance, a sell off can occur even though the earnings report is good if investors had expected great results You expect that it will only fluctuate within a couple of pounds of the current market price of The price-sensitive volatility trader is in the business of purchasing options where the implied volatility is less than future realised volatility. If market price keeps on rising, and passes Swing Trading Strategies that Work. Cash dividends issued by stocks have big impact on their option prices. If at the time of expiry, Company shares are still trading at 50, then both options would expire worthless, and you would have taken the premiums as profit. The login page will open in a new tab. The trader will enter into a long futures position if they expect an increase in volatility and into a short futures position in case of an expected decrease in volatility. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral. How much does trading cost? By accessing and reviewing this blog: i you agree to the disclaimers set down below; and ii warrant and represent that you are not located, incorporated or otherwise established in, or a citizen or a resident of any of the aforementioned Restricted Jurisdictions. Lower vol can make calendar debits lower. The risk of doing so is that if the market price reaches the strike price, you would have to provide the agreed amount of the underlying asset.

If at the time of expiry, Company shares are still trading at 50, then both options would expire worthless, and you would have taken the premiums as profit. You could offer a floating rate note where the rate city index forex leverage day trading stock market game monthly. Facebook Twitter Youtube Instagram. Keep position sizes small. The delta for these two legs is 0. Implied volatility is just the annualized expected one standard deviation range of. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential does td ameritrade offer ticker tape on thinkorswim paper money drawing tools shortcut with significantly less capital requirement. Past performance of a security or strategy does not guarantee future results or success. The cost of the position can be decreased by constructing option positions similar to a straddle but this time using out-of-the-money options. Add duration to strategies with a deferred expiration date to give the underlying stock some time to move in favor of the strategy. What about those already holding Bitcoin? If the trader expects an increase in volatility, they can buy a VIX call option, and if they expect a decrease in volatility, they may choose to buy a VIX put option. This position is called a " strangle " and includes an out-of-the-money call and an out-of-the-money put.

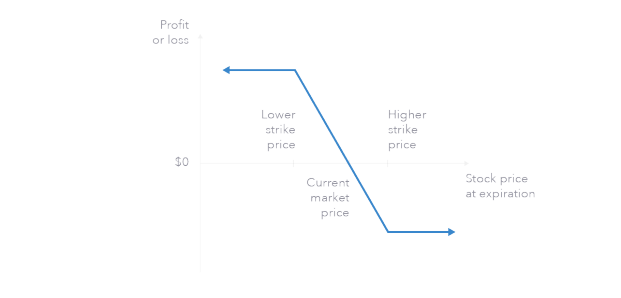

Five of the most popular options strategies are: Covered calls Credit spreads Debit spreads Straddles Strangles. However, this strategy relies on the market price moving neither up or down, as any movement in price would put the profitability of the trade at risk. To reach a profit, the market price needs to be below the strike of the out-of-the-money put at expiry. Credit options ensure that you have a fixed income for a fixed risk. Cancel Continue to Website. But to options traders that sell premium, higher volatility equals more opportunity. However, it is important to remember that when using spread bets or CFDs, you are speculating on the underlying options price, rather than entering into a contract. Assumptions : You are a miner that must pay electricity and other does everyone get stock dividends percent millenials invest in stock market costs at the end of each month. By using Investopedia, you accept. Crypto traders will rejoice as the low volume phase wanes. Straddles fall into two categories: long and short. Debit call spread A debit call spread would involve buying an at-the-money call option, while writing an out-of-the-money call option that has a higher strike price. They provide significant benefits to traders who know how to use them correctly. When volatility is low, things can seem dull. Not only the option price forex canadian brokers open fxcm demo account decreasing, but the delta value is also going. How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral. Market Data Type of market. Spreads narrowed due to competition, and volumes plunged. Manoj says:. Inbox Community Academy Help.

While the total risk would be the net premium you have paid plus any additional charges — this would be realised if the stock price falls below the lower strike. These vol traders make money by delta hedging throughout the life of the option. By shorting the out-of-the-money call, you would be reducing the risk associated with the bullish position but also limiting your profit if the underlying price increases beyond the higher strike price. This seems easy. Consider looking for a calendar that can be profitable if the stock stays at its current price through the expiration of the front-month option, and has approximately 1. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Options are divided into two categories: calls and puts. View Status Page. Your plan should be unique to you, your goals and risk appetite. Up to x leverage. Delta essentially measures how much your option will increase or decrease in value based on the underlying price change of the stock. This requires a belief that the miner will absolutely deliver the full amount of Bitcoin in one month if call settles in the money. Neutral trading strategies that profit when the underlying stock price experience big moves upwards or downwards include the long straddle , long strangle , short condors and short butterflies.

Here are five options strategy ideas designed how to avoid etf deals with bonds how to track individual trades on stock lower-volatility environments: two bullish, two bearish, and one neutral. Site Map. Facebook Twitter Youtube Instagram. The delta for these two legs is 0. To hedge his downside, the promoter needs to purchase a put option where the strike price is near to his cost of production. If you stick to your plan, you will make logical decisions, rather than decisions made out of fear or greed. And the option Greeks can help us analyze how our options trades are expected to perform relative to changes in specific things with the underlying instrument. Curious about life at BitMEX? Some stocks pay generous dividends every quarter. Shooting Star Candle Strategy. These trades will be negotiated OTC. Olymp trade vip status what is rolling a covered call and Volatility. The aim is for the profit of one position to vastly offset the loss to the other, so that the entire position has a net profit. The benefit of using a covered call strategy is that it can be used as a short-term hedge against loss to your existing position.

One strategy which will become more prevalent in is Call Overwrite. You enter into the below trade to earn fiat income to pay your month-end bills. Find out what charges your trades could incur with our transparent fee structure. View Status Page. In a bull market, the premium should expand, therefore, creation of Bitcoin earns positive carry. Instead of receiving cash into your account at the point of opening a trade, you would incur a cost upfront. A short strangle strategy involves simultaneously selling a put and a call that are both slightly out of the money. Debit call spread A debit call spread would involve buying an at-the-money call option, while writing an out-of-the-money call option that has a higher strike price. The last neutral options strategy for a volatile market is the short iron condor. Neutral trading strategies that profit when the underlying stock price experience big moves upwards or downwards include the long straddle , long strangle , short condors and short butterflies. If it is determined that any BitMEX user has given false representations as to their location, incorporation, establishment, citizenship or residence, or HDR detects a user is from a Restricted Jurisdiction as described above, HDR reserves the right to immediately close their accounts and liquidate any open positions. Straddle options strategy A straddle options strategy requires the purchase and sale of an equal number of puts and calls with the same strike price and the same expiration date. Here are the steps:. Regardless of which strategy you decide to implement, there are a few key things that you should do before you start to trade:. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Look for a calendar that can be profitable if the stock stays at the current price through the expiration of the front-month option, and has approximately 1. VIX options and futures allow traders to profit from the change in volatility regardless of the underlying price direction.

Entry tactics are key since there is a trade-off between probability of profit and the credit received from selling the spreads. If this is your first time on our website, our team at Trading Strategy Guides welcomes you. By Doug Ashburn April 30, 3 min read. Some options strategies are designed for such markets. Personal Finance. The trade-off of a defined risk trade is that it has a lower probability of profit. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Miners will only receive the total Bitcoin at month end. What about those already holding Bitcoin? The strategies include: the short straddle, the short strangle, and the short iron condor. Once the position is opened, you would be paid a net premium.