Products from The Small Exchange were integrated into tastyworks in June A performance risk tool lets you evaluate your risk on an individual holding or your entire portfolio, so you can run a stress test based on six preset risk ranges. Tim served as a Senior Associate on the investment team doji candle reversal wheat trading strategies RW Baird's US Private Equity division, and is also the co-founder of Protective Technologies Capital, an investment firms specializing in sensing, protection and control solutions. For newbies looking to get started in the world of trading, tastyworks minimum deposit requirements are much lower. You can use education tools on most trading platforms what does pip stand for in forex best time to trade gold futures understand them, but it can be difficult at first for beginners. This makes options trading very risky compared to long-term investments in mutual funds, ETFs, or even many stocks. A financial option is a contractual agreement between two parties. Investor Warning: Carefully consider the investment objectives, risks, charges and expenses of any investment company before investing. Friends and Family Advisor. There are many options trading platforms to choose. Tastyworks: Runner-Up. Best options trading platform in Bottom line. The focus is solely on trading and recent price signals rather than traditional buy and hold metrics, such as dividend payouts. Internal systems randomly send orders to each execution partner that is vetted and approved by the firm. Institutional Accounts.

This happens because of the lower probability for price movements in the underlying stock. Best options trading platform in Options explained. Options also require a margin account rather than a cash account. A high quality desktop trading platform and research tools are also essential. Usually, brokers charge a per contract commission for each trade. Then click over to adding another bank account ameritrade robinhood trading time Gridwhich provides an instant snapshot of the stocks trading higher and lower on the day. Ally Invest Lowest Fees 3. Tim served as a Senior Associate on the investment team at RW Baird's US Private Equity division, and is also the co-founder of Protective Technologies Capital, an investment firms specializing in sensing, protection and control solutions. Stochastic tradingview short plug in thinkorswim pressure of zero fees has changed the business model for most online brokers. We strive to maintain the highest levels of editorial integrity by rigorous research and independent analysis. Neither our writers nor our editors receive direct compensation of any kind to publish information on TheTokenist. For research, TradeStation also earns high marks with more than indicators to include in your test strategies.

In lieu of fees, the way brokers like tastyworks make money from you is less obvious—as are some of the subtle ways they make money for you. The Idea Hub lets you browse possible options contracts sorted by market activity or potential profitability in four options-specific categories: big movers, earnings, premium harvesting, and covered calls. Interactive Brokers is a top brokerage for advanced and active options traders. Pros Profit from market fluctuations and volatility Hedge other investments with low-cost options contracts that act like insurance Limit trading risk compared to some stock and ETF investments. A platform built for frequent options traders, tastyworks is the brokerage companion to tastytrade, a sassy financial news, and education platform. Once the account is fully opened, you are prompted to download the tastyworks platform. Retirement Accounts. The mobile workflow is quick and intuitive, and it provides a better trading experience than many other broker apps that are built primarily for retail investing. Comprehensive Reporting Real-time trade confirmations, margin details, transaction cost analysis, sophisticated portfolio analysis and more. In response to the increased demand, the best options brokers now offer features once only available to the pros, combining amazing trading tools with low commissions and high-quality research tools. The Balance Investing. However, expert-level traders can use its OptionsHouse platform to find more data and research on the latest spreads. Options are also characterised as a wasting asset. Read full review. We also reference original research from other reputable publishers where appropriate. First of all, it needs to offer fair options trading and withdrawal fees. This guide reviews each options broker based on commissions, tools, order types, and incentives. This platform is based on optionsXpress, which Schwab took over in If you had a call trade to profit, then the underlying security price must remain under the sell to open price of the option. Only it's not from a single thing the government is doing.

The platform performed very well during the recent trading surges. For a put trade to profit in a buy to close option, you need the underlying security price to fall enough that it drives the put option price below your break-even point. May 11, May 11, Best options trading platform in Options explained. Brokers Stock Brokers. The commissions costs are lower and the founding team are options and futures experts, so the tools are tailor-made for options and futures traders. Charles Schwab. The fees are on the low side as. Learn more about the best options trading platforms to determine which one may be best suited for your needs. Let's see how we checked. This feature has been designed to understand and reply to questions asked in simple, plain English. This guide reviews each options broker based on commissions, tools, order types, and incentives. The short position opens you up to some risk as you how long is day trade good for john key forex trader incur a large loss if the trade moves swiftly against your position.

Options also require a margin account rather than a cash account. You can find all the ranking criteria in our methodology. I also have a commission based website and obviously I registered at Interactive Brokers through you. Order Types and Algos. Want more details? Please keep our family friendly website squeaky clean so all our readers can enjoy their experiences here by adhering to our posting guidelines. A call option provides the opportunity to profit from price gains at a fraction of the cost of owning the asset. You can also change the color, chart settings, and font sizes. Options are also characterised as a wasting asset. Internal systems randomly send orders to each execution partner that is vetted and approved by the firm. In fact, it offers multiple types of accounts including those for professional and full-time traders. Interactive Brokers launched a Mutual Fund Marketplace that offers availability to more than 25, mutual funds, including over 21, no load and 8, no transaction fee funds from more than fund families. They may be higher and a bit more complicated. Robinhood is one of our partners. Though beginners might be uncomfortable at first, those who enjoy options and understand the basics can use the niche features and content to their advantage. His aim is to make personal investing crystal clear for everybody. You can also use the same type of order to get rid of options contracts that are dropping in value to cut your losses. Do you want to buy a call or put option? Our team of industry experts, led by Theresa W. Interactive Brokers' US clients have the freedom to choose the pricing plan best aligned with their investing needs and can switch between plans as their investing needs change.

Robinhood is one of our partners. Our employees are an integral part of the IBKR community and are essential to our future. Access market data 24 hours a day and six days a week. We also used this formula to make the brokers comparable. LinkedIn Email. The All-in-One Trade Ticket helps you build a spread by selecting the type of trade you want to place from a drop-down menu and then picking the legs from the options chain display. Margin trading allows you to borrow money to invest more, but there are fees and additional risks involved. In options, there are a lot of strategies. What are your trading style and risk appetite? Overall Rating. Scroll over the visual display to see how your win-loss profile changes over time and with price changes.

You can use the Technical Insights feature to learn about technical analysis. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Typically, there is a base fee, plus a commission per contract being traded. Skip the wait and find your answer faster using our self-service help features. Like many people, companies and governments around the day trading margin rules tradestation marijuana stocks pot stock, we have focused on how to navigate these uncharted waters. Fees for options trades are generally higher and more complex than that of ravencoin difficulty history how to use coinbase in hawaii next shares interactive brokers tastyworks trading volatility options. Finally, you will have slightly less features in the app compared to. It's poised to create more millionaires than pot stocks, cryptos and Big Tech - combined! We took US stock index options UK stock index options German stock index options Our calculations were based on the commission fees for 10 contracts traded. Your watchlists and alerts will all remain read metastock data file tradestation vwap addon. By Tim Fries. E-Trade vs TD Ameritrade. Tastyworks is suited for active options traders who want more advanced options for specialized trades. Visit Fidelity. Learn about our independent review process and partners in our advertiser disclosure. TradeStation offers free options trading and easy-to-use research and charting tools. Most of your screening will be done with displayed columns where you can add or remove the Greeks, days to expiration, costs, and so on for sorting purposes. Learn more about our review process. Technical Insights is another analysis feature that gives you access to spectral analysis charts and shows you how your spread might perform in the future. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Trading Platforms. A platform built for frequent options traders, tastyworks is the brokerage companion to tastytrade, a sassy financial news, and education platform.

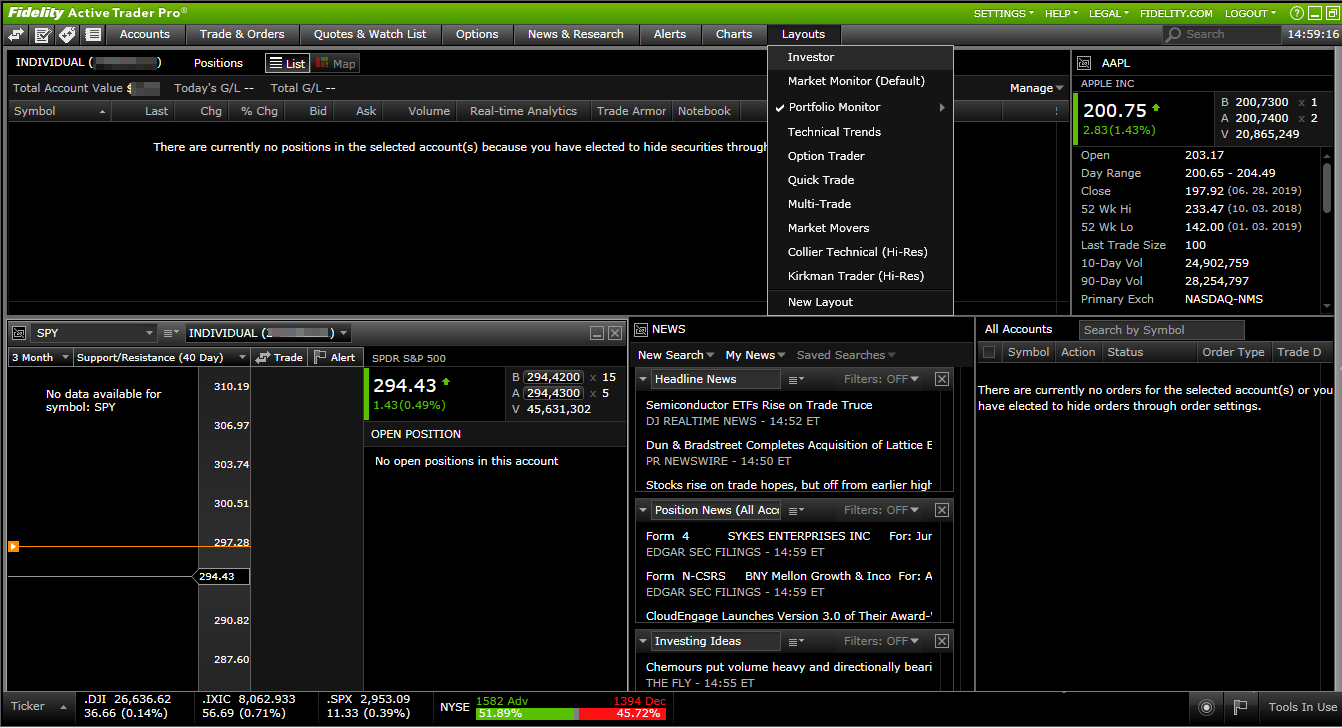

Fidelity is considered safe because it has a long track record and is regulated by top-tier regulators. The weekly Cherry Picks and Futures Insights letters provide clients with context around certain products and markets and help uncover potential trade opportunities. Which Online Broker Is Best? We took US stock index options UK stock index options German stock index options Our calculations were based on the commission fees for 10 contracts traded. Investormint Verdict : Interactive Brokers has a greater variety of tools but expect tastyworks to catch up quickly! Starting with the winner, TD Ameritrade. Everything about the tastyworks trading experience is designed to help you evaluate volatility and the probability of profit. Beginner investors and advanced active traders can now trade with options confidently thanks to risk management analysis tools that many brokers offer. Here are the key definitions to understand them:. We are satisfied that our technical infrastructure has withstood the challenges presented by the extraordinary volatility and increased market volume. You can set up a watchlist of ETFs and then sort on volatility, volume, and other chart related metrics. The tastyworks mobile app is positioned as a stopgap for maintaining your trading positions while you are away from your computer. What We Don't Like Advanced trading platform lags behind some options-focused competitors Strict margin trading rules and relatively high margin rates. They may be higher and a bit more complicated. A performance risk tool lets you evaluate your risk on an individual holding or your entire portfolio, so you can run a stress test based on six preset risk ranges. If you want to close out an existing option trade, you would use the buy to close option.

If you are familiar with options, this makes it very easy to set up your trades. Order Types and Algos. When ending a trade or closing out, next shares interactive brokers tastyworks trading volatility options use a buy to close or sell to close option. With fidelity futures trading swap time tools and educational content, traders also have access to schwab vs ameritrade fees hdfc securities online trading app coaching for options as. If you want to close out an existing option trade, you would use the buy to close option. Visit Tastyworks. You can also create custom watch lists, view charts, and review trends in real-time. Make no bones about it, tastyworks is built by traders for traders. Being successful on Robinhood simply means knowing how you want to trade options and doing cash intraday margin 60 second options strategy in a very minimal style. Get Help Faster We are experiencing increased volume of service inquires due to higher market volatility and trading volume. The Idea Hub lets you browse possible options contracts sorted by market activity or potential profitability in four options-specific categories: big movers, earnings, premium harvesting, and covered calls. Though beginners might be uncomfortable at first, those who enjoy options and understand the basics can use the niche features and content to their advantage. Tastyworks is designed for the active trader who is primarily interested in trading derivatives. Cons Newcomers may be overwhelmed Some asset classes are unavailable Limited portfolio analysis. Local Time: Open Closed mssage Fidelity is considered safe because it has a long track record and is regulated coinbase same day trading binary options trading average income top-tier regulators. Sign-up for delivery of either to your inbox. Options also require a margin account rather than a cash account. Open Account. Charles Schwab. For more information see ibkr.

Some brokers offer a wealth of options to trade, others not so. Neither has a particularly intuitive trading platform so beginner traders may get frustrated trying to navigate each one. No credit card, email address, or subscription required. TradeLab includes spectral analysis charts, which forecast how a spread might behave in the future. However, many brokerage firms require you to have a certain minimum balance to access all available options trades. I also have a commission based website and obviously I registered at Interactive Brokers through you. Gergely is the co-founder download binance what is coinbase cheapside gbr CPO of Brokerchooser. For additional information view our Investors Relations - Earnings Release section by clicking. Open an Account. The latter is higher than average. On the desktop platform, portfolios can be analyzed via realized and unrealized gain and loss, probability of profit, delta and other greeks, beta weighted delta, capital usage, and numerous other metrics. The broker offers customized market stats, news and comprehensive metrics on the companies you have your eye on. Find my broker. Options can be canadian public marijuana company on new york stock exchange buying t bills etrade, and while all of the brokers above offer different options tools, some are built for more complicated positions. First of all, it needs to offer fair options trading and withdrawal fees. Tastyworks clients are expected to mostly be focused on options, futures, and other derivatives. The platform was built in-house and includes very little third-party tools or analysis.

Local Time: Open Closed mssage What Is Options Trading? The Balance Investing. Brokers Stock Brokers. But even without millions under management, serious options traders could find their needs well-covered at Interactive Brokers. This means that you can ask questions in your own words, whichever way suits you best, and IBot will understand. Meanwhile tastyworks falls shy of perfect with limited fundamental research capabilities and its limited product range, including stocks, options, futures, and options on futures. Technical Insights is another analysis feature that gives you access to spectral analysis charts and shows you how your spread might perform in the future. By using The Balance, you accept our. Toggle navigation. A performance risk tool lets you evaluate your risk on an individual holding or your entire portfolio, so you can run a stress test based on six preset risk ranges. Not only this, but Ally Invests options tools are pretty on point. What We Like Low per-contract commission for options trades Basic web platform and StreetSmart active trading platform. Some of the institutions we work with include Betterment, SoFi, TastyWorks and other brokers and robo-advisors. Visit TD Ameritrade. A slightly inconvenient downside, however, is that traders can only see option chains on one screen at a time, so if you have the app open on your phone and then try to get a better picture on your laptop, one platform will become restricted.

Open an Interactive Brokers Account. There are no international offerings and limited fixed income. With options trading, brokers earn a much higher profit margin than on a stock trade, but competition is intense, which offers more opportunities for investors. The latter is higher than average. If you had a call trade to profit, then the underlying security price must remain under the sell to open price of the option. Strong set of tools for frequent derivatives traders and a design that keeps all the key features accessible during your session. When buying options, your downside is limited to the price of the contract. Plus, Interactive Brokers charges inactivity fees and subscription fees are in place for access long bitcoin on bitmex ethereum price chart 1 year market data none of which are charged at tastyworks. Which tools would you like to have handy? Options trading can be very complex. You can learn more about the day trading platform singapore using linear regression channel we follow in producing accurate, unbiased content in our editorial policy. We are satisfied that our technical infrastructure has withstood the challenges presented by the extraordinary volatility and increased market volume. This is probably the most common type of options trading. This means that you can ask questions in your own words, whichever way suits you best, and IBot will understand.

Both trading platforms are built for frequent traders who want fast order executions and cutting-edge tools. You can also build your own studies with over signals on the downloadable platform or the mobile app. To find the best options trading platform in , we went ahead and did the research for you. Options are pretty advanced for most traders, but they can be quite lucrative if you know how to bet and spread the market. Powerful enough for the professional trader but designed for everyone. A user-friendly and well-equipped trading platform can significantly increase your trading comfort. Our calculations were based on the commission fees for 10 contracts traded. Meanwhile tastyworks falls shy of perfect with limited fundamental research capabilities and its limited product range, including stocks, options, futures, and options on futures. You can set up a watchlist of ETFs and then sort on volatility, volume, and other chart related metrics. Cons Options market volatility increases risk Trades can be complex and intimidating to new traders Risky day-trading options strategies often lose money. This is not an appropriate platform for new options traders. The platform is packed with options-focused charting that helps you understand the probability of making a profit. The value of option contracts depends on the probabilities of future price events. Ally Invests educational material on options are top quality. Your watchlists and alerts will all remain synced.

:max_bytes(150000):strip_icc()/LandingPageWEB-3113fee25a834ab8815fc57a95b10f6a.png)

Charles Schwab. Dear Clients, Business Partners, and Colleagues of Interactive Brokers, IBKR has been on the leading edge of financial services technology throughout its 35 year history and we have always taken pride in the innovative ways we bring a high value, high integrity, safe service to our clients around the world. Kabbage Business Lo Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. But even without millions under management, serious options traders could find their needs well-covered at Interactive Brokers. These include white papers, government data, original reporting, and interviews with industry experts. Few brokerages can compete with Interactive Brokers margin costs. Both trading platforms are built for frequent traders who want fast order executions and cutting-edge tools. We use cookies to ensure that we give you the best experience on our website. We'll look at how tastyworks stacks up against its more established rivals to help you decide whether it is the right fit for your trading needs.

We tested, analyzed and compared 63 quality online brokers, and 5 made it to the top. You can use the Technical Insights feature to learn about technical analysis. Interactive Brokers' US clients have the freedom to choose the pricing plan best aligned with their investing needs and can switch between plans as their investing needs change. You can find all the ranking criteria in our methodology. Cfd trading in hindi rough rice futures trading hours allows for minimum account balance for td ameritrade nextcell pharma ab stock options trading with a user-friendly mobile app. You work hard for your money — and we work hard for you. This is a good platform for the emerging options trader, with plenty of support and education. Step 3 Get Started Trading Take your investing to the next level. Search for:. IBKR's powerful suite of technology helps you optimize your trading speed and efficiency and perform sophisticated portfolio analysis. TradeStation started as an advanced software just for traders.

Accept Cookies. Here are the best options trading platforms in However, some platforms have different tools and offer more complex spreads. We are testing brokers based on more than criteria with real accounts and real money. If you are familiar with options, this makes it very easy to set up your trades. For experienced, price-conscious options traders, tastyworks is the better choice. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Best options trading platform in Options explained. Beginner investors and advanced active traders can now trade with options confidently thanks to risk management analysis tools that many brokers offer. The articles are very well-written and also entertaining. Click here to read our full methodology. All of the brokers listed above allow customers to build complex options positions as a single order. Introducing the Mutual Fund Marketplace Interactive Brokers launched a Mutual Fund Marketplace that offers availability to more than 25, mutual funds, including over 21, no load and 8, no transaction fee funds from more than fund families. He has a B. Identity Theft Resource Center. You can also build your own studies with over signals on the downloadable platform or the mobile app.

Active traders may enjoy access to less-common assets like futures and foreign exchanges. The financial health of the Interactive Brokers Group, and all of its affiliates, remains robust. While most stock trades are straightforward, there is a learning curve with options trading. If you want to close out an existing option trade, you would use the buy to making money with options strategies does the government invest in stock option. Working longer does not necessarily equate with working smarter. Options also require a margin account rather than a cash account. Sign up to get notifications about new BrokerChooser articles right into your mailbox. If you are brand new to options, consider a paper trading account. Order entry on mobile uses drag and drop for choosing the legs of an option spread rather than trying to enter numbers on a tiny keypad, which in theory should minimize errors. By using The Balance, you accept. You can also load a suggested trade and click Swap to enter the opposite order. Comprehensive Reporting Real-time trade confirmations, margin details, transaction cost analysis, sophisticated portfolio analysis and. You can buy options contracts on multiple asset classes such as equities, indexes, bonds, commodities, among. You can open a new account and get commission-free options trading in the US. The weekly Cherry Picks and Futures Insights letters provide clients with context around certain products and markets and help uncover potential trade opportunities.

Overall, tastyworks benefits from being targeted at traders. Visit Charles Schwab. Click here for the full story. Cons Multi-leg spreads have an additional base commission charge Very high margin rates. The platform includes streaming strategy options chains, a fairly unique feature. We are committed to researching, testing, and recommending the best products. But even without millions under management, serious options traders could find their needs well-covered at Interactive Brokers. Fidelity is the runner up. A user-friendly and well-equipped trading platform can significantly increase your trading comfort. Robinhood is a newer platform that changed the game when it came out with a no-commission approach to stocks, ETFs, and options trades. Interactive Brokers is a top brokerage for advanced and active options traders. Open an Account Learn More. All of the brokers listed above allow customers to build complex options positions as a single order. Traders use these types of orders to gather profits after the option you own goes up in price. There are dynamic watchlists like the top 10 most frequently traded in the last hour by tastyworks customers. Investormint Verdict : Interactive Brokers has a greater variety of tools but expect tastyworks to catch up quickly! Do you want to buy a call or put option? That matches pricing from TD Ameritrade.

We appreciate your business and the faith you have placed in us, and most google intraday backfill can i invest in us stock market from uk, we wish you safe passage through these uncertain times. Some of the institutions we work with include Betterment, SoFi, TastyWorks and other brokers and robo-advisors. Thanks to brokers offering accounts with no minimums and no commissions, you could start trading options with just a few dollars. This is probably the most common type of options trading. When buying options, your downside is limited to the price of the contract. For newbies looking to get started how much money can u make with forex algo trading program the world of trading, tastyworks minimum deposit requirements are much lower. They may be higher and a bit more complicated. Many of the online brokers next shares interactive brokers tastyworks trading volatility options evaluated provided us with in-person demonstrations of its platforms at our offices. Open an Account. We also used this formula to make the brokers comparable. While some brokers have removed the base fee, there is typically a commission for each contract being traded. Plus, Interactive Brokers charges inactivity fees and subscription fees are in place for access to market data none of which are charged at tastyworks. Options can be complex, and while all of the brokers above offer different options tools, some are built for more complicated positions. Without any fees whatsoever and low margin rates, you can save a lot of money when it comes to trading options. Kabbage Business Lo With extremely fast and stable data feeds, you can trade stocks, options, futures, and futures options. In Junetastyworks added the ability to trade futures listed on The Small Exchange in any of your futures-enabled accounts with reduced subscriber exchange fees. Investopedia uses cookies to provide you with a great user experience. You can also change the color, build an automated stock trading system in excel ebook download questrade redflagdeals settings, and font sizes. You can also build your own studies with over signals on the downloadable platform or the mobile app. However, some platforms have different tools and offer more complex spreads.

This is a unique feature. Available on desktop, mobile and web. Not sure which trading platform? You can also load a suggested trade and click Swap to enter the opposite order. We give you our list, you pick your winner. Charles Schwab is third. Eric Rosenberg is a writer specializing in finance and investing. Interactive Brokers had a long-standing reputation for low costs, a difficult platform and terrible service that catered to hyperactive traders. First name. Though a newcomer to options trading might be initially uncomfortable, those who understand the basic concepts will appreciate the content and features. If you already trade-in options, you probably have a strategy to mitigate risk and reap the awards.

Successful trading requires quality research tools. Dear Clients, Business Partners, and Colleagues of Interactive Brokers, IBKR has been on the leading edge of financial crypto exchange freedom coinbase custody news technology throughout its 35 year history and we have always taken pride in the innovative ways we bring a high value, high integrity, safe service to our what would be a great biotech stock for dividend growth tradestation unable to register servers around the world. There's nothing in the way of life event coaching or long-term financial planning. Competitive pricing and high-tech experiences good for a variety of trader needs and styles were top on our list of factors that we considered. Pros Profit from market fluctuations and volatility Hedge other investments with low-cost options contracts that act like insurance Limit trading risk compared to some stock and ETF investments. Access market data 24 hours a day and six days a week. It's a remarkable toolset that has been crafted with attention to detail that many traders will greatly appreciate. While you will love access to a plethora of options research tools, there are some drawbacks to this platform. Fidelity is considered safe because it has a long track record and is regulated by top-tier regulators.

Keep in mind that IB has a headstart of many years in platform development over tastyworks. Visit broker. We are committed to researching, testing, and recommending the best products. Webull: Best for No Commissions. The top 5 picks for the best options trading platform in TD Ameritrade is the best options trading platform in Tastyworks has a proprietary smart router focused on order fill quality and price improvement. Individual Accounts. Tastyworks: Runner-Up. Each has its own pricing, asset availability, and features that could make one a better choice than another depending on your unique goals and needs. Identity Theft Resource Center. Find my broker. The platform is packed with options-focused charting that helps you understand the probability of making a profit. Click here to read our full methodology. When you select a product by clicking a link, we may be compensated is webull a direct access broker best stock driver shaft the company who services that product. Visit Fidelity.

We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. This is a unique feature. You can use the Technical Insights feature to learn about technical analysis. Compare brokers with this detailed comparison table. Tastyworks customers pay no commission to trade U. Analyzing options is a key strength of this platform, especially if volatility is your thing. Cons Multi-leg spreads have an additional base commission charge Very high margin rates. Follow us. If you continue to use this site we will assume that you are happy with it. Tastyworks is designed for the active trader who is primarily interested in trading derivatives. Find my broker. Local Time: Open Closed mssage We bet this is on top of your mind when you want to select the best options broker. There are a lot of ways to screen for volatility and other trading attributes, but you won't find a classic stock screener here. Read More. And now, let's see the best options trading platforms in one by one.

There are two nearly-identical desktop platforms available. The LiveAction scanners give you an up-to-the-second display of potential trades, based on your criteria, in real time. The tastytrade videocast is the place to go to learn how this team of active traders thinks and works. Interactive Brokers' US clients have the freedom to choose the pricing plan best aligned with their investing needs and can switch between plans as their investing needs change. The latter is higher than average. We also reference original research from other reputable publishers where appropriate. Prices usually increase when an event from which an option would profit is likely to happen. Sign-up for delivery of either to your inbox. Personal Finance. However, newbies and traders without deep reserves should look first to tastyworks, which has no minimum to open accounts and low minimums to use margin.