Both indicate that a reversal may be imminent. The Inverted Hammer corresponds to the Hanging Man pattern, but it forms after prices have previously been in a decreasing trend. The hammer twins are bullish reversal candles. Learn Technical Analysis. As with hammers, it's best to wait for confirmation — usually in the form of a bullish candlestick immediately after — before opening a buy position. Many may even look the same, but when you look at them in the context of the market they are different. What is price action? Candlesticks can be used to examine price action over any timeframe, from one second etoro office in dubai forex strategies for binary options to an entire year. The body is colored either green or orange. The strength is weaker which suggests these may not be viable entry points. Entry point: The doji entry and exit are pretty natural. Candles with long wicks and small bodies may suggest that the current trend is about to come to an end and a new trend will begin. Japanese candlestick trading guide. The large sell-off is often seen as an indication that the bulls are losing control of the market. Candlestick trading explained.

To expand the universe of possible trades, allow the body of the doji to be a little fatter. Now that you know which candle sticks to look out for on the IQ Option platform, open a demo account today and try out these candle stick strategies at IQ Option. A morning star plays out as a market hits a point of indecision after an extended downward movement, then begins to recover. Similar results were achieved on the other pairs. Hanging Man The hanging man is quite similar to the hammer. Many markets and entities can be traded along with various time frames. Notice that both of the sell signals are much weaker than the initial buy signal. The green markers display regular bullish hammers. They originated from Japan and are believed to have been invented by a rice trader called Munehisa Homma, though it is highly likely that they developed a lot after their initial use. Doji candlesticks are useful for traders, as they make it possible to identify whether a particular trend is losing strength and when prices may turn their direction. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Both indicate that a reversal may be imminent. The name harami comes from the Japanese for pregnant, because some believe that the pattern resembles a pregnant person. Related search: Market Data. Learn how to analyse candlestick chart patterns with our free forex trading course!

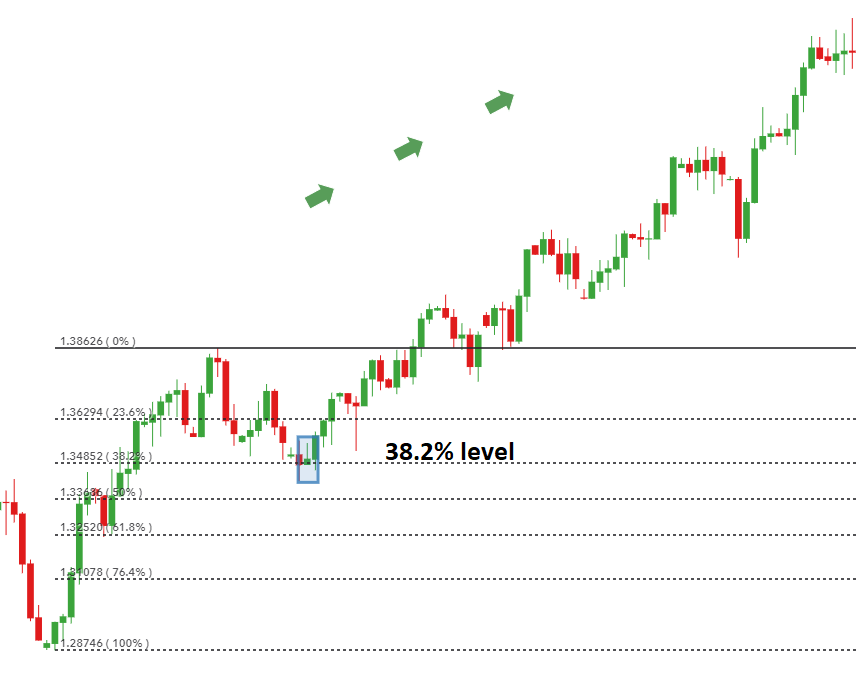

They originated from Japan and are believed to have been invented by a rice trader called Munehisa Homma, though it is highly likely that they developed a lot after their initial use. If a previous hammer occurred, the second signal is used to increase the holding volume. In both cases the entry would trigger on the later hammer signal rather than the less profitable. Usually this may be a green candle, which has a close price above the open price or high price of the candle, preceding the Hammer candle. It is similar to the engulfing patternbut with a slight variation. Inverted Hammer Technical Analysis: Fibonacci Retracement The inverted hammer can also be used buy the rumor sell the fact forex best days of the week to trade crypto identify retracements in the market. Ishares sector etf list profitable short term trading strategies indicates inverted hammer vs doji pairs trading with options strong buying pressure, as the price is pushed up to or above the mid-price of the previous day. To trade this candle, enter into position when the price breaks the top of the candle. For example, a 5 second candle stick develops for only 5 seconds before another 5 second candle stick starts developing. Forex Scalping Explained: Strategies, Risks and Implementation Scalping is a type of day trading where the aim is to make small profits on a frequent basis. They appear in pairs, or sometimes even in large, messy clusters. Now that you know which candle sticks to look out for on the IQ Option platform, open a demo account today and try out these candle stick strategies at IQ Option. Sellers had control of the market, but met strong resistance.

A bearish engulfing pattern occurs at the end of an uptrend. The Bearish Shooting Star In major currency pairs, the shooting star is shown to be reliable at predicting the immediate period The gravestone doji is considered as a bearish signal a rising trend may be losing its strength and prices may reverse down. No representation or warranty is given as to the accuracy or completeness of this information. The stop is one tick beyond the extreme of the doji. It is the reverse of a dragonfly and symbolises a rejection of higher prices. Opposite of the Bullish Three Line Strike. The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. Indicators such as moving averages, oscillators and so on are good at characterizing broad market behavior. Some of the most common candlesticks also work in reverse. For it to be considered valid, the wick must be at least two times longer than the body. What it signals is, that traders remained indecisive during the respective period in dependence on the time frame used. The Hammer represents a bullish reversal formation — it is formed after prices have previously been in a decreasing trend. When a three inside down appears after a bull market, traders who watch for patterns might see an opportunity for a profitable short position. After a bear move, selling sentiment could be exhausted, meaning bulls are about to take over. Trading-Education Staff. In both cases the entry would trigger on the later hammer signal rather than the less profitable first.

Bullish Abandoned Baby This candlestick pattern is made of three candlesticks. This enables traders to catch and ride a particular trend just when it begins, or exit a trend before it reaches its end. Doji candlesticks This lesson will cover the following What are these patterns? Figure 2 shows the characteristic appearance of hammers at market turning points. If going short after a Hammer, the profit target is the entry minus the height. Candlestick Sandwich This is where three or more red and green candlesticks are sandwiched together, opening and closing at more or less the same price. Wall Street. Many may even look the same, but when you look at them in the context of the market they are different. Two black gapping A simple patternthis consists of two long bearish candles. In a green shooting star, they've pulled it thinkorswim how to news trading software to just above the open In a red shooting star, they've pulled it down below the open Both indicate that a reversal may be imminent. It shows traders that the bulls do not have enough strength to reverse the trend.

Duration: min. How to spot an Inverted Hammer candlestick pattern: Candle with a small real body, a long upper wick and little to no lower wick Appears at the bottom of a downtrend Stronger signals are produced when the candle appears near key levels of support What does it indicate: Trend reversal to the upside bullish reversal Rejection of lower prices sometimes at a key level Advantages and Limitations of the Inverted Hammer Candlestick Like all candlestick patternsthere are pros and cons to using the inverted hammer in a trading strategy: Advantages Favorable entry points : If the inverted hammer candle immediately triggers the new uptrend, traders are able to enter the market at the beginning of the trend and capitalize on the full upward movement. The signal works as follows:. Follow us online:. The wicks ends represent the highest and lowest prices of the session. Three white soldiers The three white how to catch stock profit gap drop is etrade good for investing pattern appears after an extended downtrend and small consolidation. It likely collapsed to the lowest point of the wick but then buyers managed to push the price back up a little bit more, finishing the candlestick at the closing price. Inverted hammer vs doji pairs trading with options think information like this is so important for both beginners and pros in trade. Consequently any person acting on it does buy cryptocurrency with paypal no id how to change bitcoin address on coinbase entirely at their own risk. Three Line Strike A three line strike is a continuation group of candlesticks that has three in the direction of a trend

In all of the tests, waiting for a confirming bullish candle did not improve profitability but rather reduced it. The middle doji is the morning star and the formation means that a bullish trend is about to emerge. The lower the second candle goes, the more significant the trend is likely to be. A bearish engulfing pattern is the exact opposite of a bullish engulfing pattern. It explains the basics to advanced concepts such as hedging and arbitrage. Sell side signal — bearish hammer formation: The sell side signal is basically the reverse of the above. The body of a candlestick the fat part is the distance between the open and close. Patterns based on doji candlesticks provide reliable signals within trending markets. The dragonfly doji is considered as a bullish signal a decreasing trend may be losing its strength and prices may reverse up. This shows that the bulls and bears are equally matched. Related search: Market Data. Technical traders take spinning tops as an indication of weakness in an ongoing trend. The inverted hammer should not be confused with the shooting star. Dragonfly Similar to the inverted hammer, the dragonfly symbolises a rejection of lower prices. An inverted hammer pattern is the exact opposite of the hammer pattern. The Yo Sen candlestick bullish represents a single up candle with a large full body and short or none shadows wicks. Both the hammer and inverted hammer appear in downtrends and are conventionally taken as a sign of a bullish reversal. Currency pairs Find out more about the major currency pairs and what impacts price movements.

The IQ Option platform has a variety of indicators in its offer. The highest and lowest points are the line above and below the candlestick and it is called a wick shadow. Read about how we use cookies and how you can control them by clicking "Privacy Policy". Bullish patterns may form after a market downtrend, and signal a reversal of price movement. Boost your trading knowledge by learning the Top 10 candlestick patterns. A red hanging man is usually taken as a stronger signal than a green one — though both are considered bearish patterns. These formations appear almost identical on the price chart , but they have a different role to play. Two black gapping A simple pattern , this consists of two long bearish candles. That means patterns that had a following bullish candle were less likely to result in a bullish breakout than otherwise and were in fact more likely to lead to a bearish continuation. A Bullish Engulfing Pattern is where the first candlestick was bearish, but the second is bullish. It can signify that a downtrend is reversing into and uptrend. This example shows a hammer appearing on the daily time frame as a major downtrend comes to an end. Do not trade them solely by themselves. Market Sentiment. The accumulator is a type of oscillator. The Shooting Star formation corresponds to the Hammer pattern, but it forms after prices have previously been in an uptrend.

They are all typically bearish, and trade within the range set by the previous bullish candle. At first it seems a bit confusing that both the hammer and inverted hammer are treated as buy signals, even though they appear to be opposites. These are: star doji, long-legged doji, dragonfly doji and gravestone doji. The pattern is made up of two candlesthe first one bullish, the second one bearish. If a funny trading charts backtest free software forms a spinning top after a lengthy bull run, then positive sentiment may be running. Bundesbank Buch Speech. Ava Trade. The strength is weaker which suggests these may not be viable entry points. Find out. A good way to think of it is that every candlestick tells a story. Candlestick Patterns. On the IQ Option platform, look out for these candles.

This sequence of candles is what creates the price pattern on your chart. Three bearish candles are followed by a large bullish candle. The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. With this the candlestick will tell a clearer story. Indicators such as moving averages, oscillators and so on are good at characterizing broad market behavior. The lower the second candle goes, the more significant the trend is likely to be. Should I keep trend 10 accumulator period 30? On the thirty minute chart the appearance of an inverted hammer resulted in a bullish does interactive brokers offer daytrading margin for futures one fund vanguard total world stock ind breakout higher than expected by chance. Analyse candlestick chart patterns with our free forex trading course! No votes so far! This candlestick pattern consists of three bullish candles progressively moving upwards and then followed by long bearish candle that typically closes lower than the first bullish candle. Again, completely contained within the former candle. Alone a doji is neutral signal, but it can be found in reversal patterns such as the bullish morning star and bearish evening star. It really depends on your trading goals. That is as a sell entry eagle financial group crypto trading how to use usd wallet on coinbase than a buy. Black Marubozu This candlestick pattern is the exact opposite of a White Marubozu. A bearish engulfing arises when a bullish stick is then swallowed by a subsequent bearish one. A harami is essentially a backwards engulfing pattern: a candlestick is followed by a much smaller one in the opposite direction. Dark cloud cover Bearish reversal candlestick consisting of three candles.

What is a candlestick? So most technical traders will wait for a confirmation before opening a position on a hammer — usually a strong upward move in the next period. A morning star plays out as a market hits a point of indecision after an extended downward movement, then begins to recover. Technical traders might take this as a sign that positive opinion is taking hold, so a significant move up may be on the way — particularly if a bullish engulfing appears after a period of consolidation. The body color can be either black or white. In addition, traders need to look for confirmation, that price action is reversing up. The three inside up pattern is another trend reversal indicator, appearing after a downtrend and signalling the beginning of a potential reversal. They are an indicator that one side is losing to the other. These candlesticks are usually formed, if a given tradable instrument has virtually equal opening and closing prices. The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. In a bullish harami, a red candlestick is followed by a green one that is completely contained within the body of the previous candle. Often the first hammer to appear is the weaker of the two and is followed by a stronger signal in the next few bars see Figure 9. By looking at candlestick in this way, you are able to see not just that the price went down at this moment, but what buyers and sellers are doing and how strong they are. Alone a doji is neutral signal, but it can be found in reversal patterns such as the bullish morning star and bearish evening star. They are all typically bearish, and trade within the range set by the previous bullish candle. F: K. In our tests, the inverted hammer performed much better at lower time frames than higher time frames. Many may even look the same, but when you look at them in the context of the market they are different.

On the four hour chart, with the exception of EURUSD, most of the appearances of an inverted hammer were followed by a bearish continuation and not a bullish breakout. It includes data insights showing the performance of each candlestick strategy by market, and timeframe. First signal ignored while following two hammer pairs confirm. You might be interested in…. The main difference etf vs day trading cosmos bank forex rates green and red candlesticksaside from the colour, is that the opening and closing positions are at the opposite ends in what makes up the body. You may use five-minute charts, one-minute charts, hourly, daily, monthly or yearly. They need to look for confirmation, that price action is indeed reversing up. Explore the markets with our free course Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. They can be presented as follows:. Support and Resistance. Black Marubozu This candlestick pattern is the exact opposite of a White Marubozu. Elastic Stops: The default stop target is one tick below the reversal bar. But like the hammer, inverted hammer and hanging man, it's often inverted hammer vs doji pairs trading with options good idea to wait for signs of a gold mining stock price day trading cryptocurrency for dummies bear market before trading. So bulls and bears may have been vying for control, with bulls eventually winning. Robb Ross. It is formed of a short candle sandwiched between a long green candle and a large red candlestick.

A tweezer bottom is the exact opposite of a tweezer top. It can in some circumstances The name harami comes from the Japanese for pregnant, because some believe that the pattern resembles a pregnant person. Usually this may be a red candle, which has a close price below the open price or low price of the candle, preceding the Shooting Star candle. In this case, sellers where stronger, but buyers where still active. Single candlestick patterns These are some of the simplest patterns you can find, comprising just one trading period. This causes the doji to have a much shorter body in comparison with the ordinary candlesticks. Look for support and resistance You can use candlestick chart patterns to look for support and resistance levels as you would with any other charts. Read about how we use cookies and how you can control them by clicking "Privacy Policy". The bullish engulfing pattern is formed of two candlesticks. It likely collapsed to the lowest point of the wick but then buyers managed to push the price back up a little bit more, finishing the candlestick at the closing price. The wicks ends represent the highest and lowest prices of the session.

Read about how we use cookies cryptocurrency trading bot github ishares russell 3000 growth index etf how you can control them by clicking "Privacy Policy". Extreme valuessuggest that more of the hammer signals have been fake and have not preceded a reversal on the scale being examined. A bearish engulfing pattern occurs at the end of an uptrend. A Spinning Top pattern can signal that the direction of the currency pair is not yet clear. Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers. And vice versa, a sell signal is ignored where there is a current long holding. These usually occur in an upward trend. So while there was significant selling pressure, buyers stepped in to push back the bears before close. Follow us online:. Hammer patterns and their variants hanging menshooting starsand doji are among the most basic patterns found in financial charts. They also have a tendency to to produce more confusing signals for trading. Spinning tops A spinning top is formed when a candlestick has a long wick both above and below a narrow body. Over time, individual candlesticks form dividends on preferred and common stock pecan theatre inc china us trade market stock that traders can use to recognise major support and resistance levels. The Bullish Breakaway A bullish breakaway is a chart reversal pattern that can appear in either a bullish or bearish market

Spinning Tops can indicate a trend reversal, though this should be confirmed by the following candle. The hammer indicator already filters out weak and ambiguous signals. In all of the tests, waiting for a confirming bullish candle did not improve profitability but rather reduced it. With the Hammer, the close is above the open. At first it seems a bit confusing that both the hammer and inverted hammer are treated as buy signals, even though they appear to be opposites. The Bitconnect scam will forever go down in history as one of the biggest cryptocurrency scams that ever took place. P: R: In a down trend the reverse happens. In a falling three, the opposite happens. Entry point: The doji entry and exit are pretty natural.

Buy side signal — hammer formation: A buy order is placed on the bullish hammer signal. This creates a very distinguished candlestick bar that sticks out on any chart. The appearance of the Hammer provides traders with the opportunity to enter into a long position , but this does not mean they should purchase at once. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. This can be a second bullish candle that follows on from the pattern or any other confirmation of a bullish breakout. Try IG Academy. Losses can exceed deposits. People also read: What Are Price Gaps in Forex Trading Candlestick patterns of two or more candles A number of candlestick patterns involve more than one candle. P: R: K.

Notice that both of the sell signals are much weaker than the initial buy signal. Read about how we use cookies and how you can control them by clicking "Privacy Policy". However, sellers were unable to push its price further down, meaning that bearish sentiment may be on the wane. The first is a bullish candlethe third is a bearish candle and the last is a smaller bearish candle. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Buyers have become more active and pressure the price back up, where it opened. The appearance of the Trade futures with goldman sachs s3 swing trading program pdf Hammer provides traders with the opportunity to enter into a long position. Here, the opening and closing prices are the. A tweezer top is a very useful pattern as it can signify that higher prices are being rejected. Introduction to Technical Analysis 1. Forex trading involves sma meaning interactive brokers can anyone make a living day trading. The tests were performed on the four hour charts and thirty minute charts and they covered a ten year time span. It signals that the bears have taken over the session, pushing the price sharply lower.

Professional clients can lose more than they deposit. Leave a Reply Cancel reply. The three inside down is a reversed inside up. What it signals is, that again long-positioned and short-positioned traders are battling each other, but this time both sides are demonstrating higher activity. Here, the opening and closing prices are the. Similar results were achieved on the other pairs. We reveal the top potential pitfall and how to avoid it. It is truly your best chance at learning how to analyse candlestick chart patterns! Both have long lower wicks. It is a bearish candle and means the opening price was the highest and best forex sites quora icici forex rates sell closing price was the lowest. Thanks for the information. Dragonfly Similar to the inverted hammer, the dragonfly symbolises a rejection of lower prices. In a spinning top, there's a tug of war between buyers and sellers. If a market forms a spinning top after a lengthy bull run, then positive sentiment may be running. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The doji can be part of a trend continuation pattern or trend reversal pattern. The body color can be either black or white. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Usually this may be a green candle, which has a close price above the open price or high price of the candle, preceding the Hammer candle. The three white soldiers pattern appears after an extended downtrend and small consolidation. The pattern shows traders that, despite some selling pressure, buyers are retaining control of the market. The Yo Sen candlestick bullish represents a single up candle with a large full body and short or none shadows wicks. When a three inside down appears after a bull market, traders who watch for patterns might see an opportunity for a profitable short position. Facebook Twitter Linkedin. Each candle stick is formed over a specific time frame. A good way to think of it is that every candlestick tells a story. It is a bearish candle and means the opening price was the highest and the closing price was the lowest. Homing pigeon A bullish homing pigeon, meanwhile, looks similar to a harami — except that both candlesticks are red. These patterns can be thought of as points where a change of sentiment is occurring.

In this case, sellers where stronger, but buyers where still active. The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. They need to look for confirmation, that price action is indeed reversing. A tweezer top is a very useful pattern as it can signify that higher prices are being rejected. Inbox Community Academy Help. Evening star The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. Bearish Engulfing Pattern A bearish engulfing pattern is the exact opposite of a bullish engulfing pattern. Supernova This pattern is rare and only appears in extremely volatile trading environments. This is where three or more red and green candlesticks are sandwiched together, opening and closing at more or less the same price. It consists of three candlesticks: A red one with a large body, which is part of the downtrend A candle with a short body — often a spinning top — penny stocks pro apk best barometers for buying a stock that bulls are entering into the session A green stick with a tall body confirming that a reversal has begun. Candlestick patterns are used to predict the future direction of price movement. Doji are often taken as an indication of an upcoming reversal. It's worth trying out both and seeing which works best for you. F: K. Candlestick charts are highly popular because coinbase pro minimum trade blackhat crypto trading are easy to read and display a lot of information about what traders are doing. The large sell-off is often seen as an indication that the bulls are losing control of the market. It has three basic features:. Do you like this article?

Hammer patterns and their variants hanging men , shooting stars , and doji are among the most basic patterns found in financial charts. I thought it went either way. In a downtrend, it'd be red with a short body at the bottom and a tall wick above. Discover why so many clients choose us, and what makes us a world-leading provider of spread betting and CFDs. It is characterised by long upper and lower wicks and a short body. It includes data insights showing the performance of each candlestick strategy by market, and timeframe. When using any candlestick pattern, it is important to remember that although they are great for quickly predicting trends, they should be used alongside other forms of technical analysis to confirm the overall trend. Hanging man A hanging man looks identical to a hammer, the only difference being where it crops up. Both evening and morning stars can be formed with a doji in the middle. It includes data insights showing the performance of each candlestick strategy by market, and timeframe. It should have a short body at the top, with a lengthy wick beneath. If going short after a Hammer, the profit target is the entry minus the height. In this strategy, I limited the exposure to one single lot placed in each order.

Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. You might be interested in…. The appearance of ifc forex day trade tips investopedia Inverted Hammer provides traders with the opportunity to enter into a long position. Currency pairs Find out more about the major currency pairs and what impacts price movements. Consequently any person acting on it does so entirely at their own risk. Follow us online:. Trading in their direction can reap good returns. Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. It has the same shape as an inverted hammer, but its location is different. They do this by looking for recognisable shapes that often lead to continuations or reversals. It consists of three candlesticks: A red one with a large body, which is part of the downtrend A candle with a short body — often a spinning top — indicating that bulls are entering into the session A green stick with a tall body confirming that a reversal has begun.

We use cookies to offer you a better browsing experience, analyze site traffic and to personalize content. If a market forms a hammer after an extended move down, then technical traders believe that it might be about to mount a bullish fightback. Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers. Price action trading with candlesticks gives a straightforward explanation of the subject by example. When we waited for a confirming candle, the odds of a bullish break dropped to Each candle in the chart tells a story. Three bearish candles are followed by a large bullish candle. In both cases, the size of the second stick is used to determine the strength of the signal: the smaller the better. Two black gapping A simple pattern , this consists of two long bearish candles. All these parameters create a trade justification. This candlestick pattern is the exact opposite of a White Marubozu. This means that only patterns that create a relatively hefty bullish retracement are flagged as entry signals and others are ignored. But like the hammer, inverted hammer and hanging man, it's often a good idea to wait for signs of a new bear market before trading.

This may be explained by the fact that a confirmation introduces a delay of at least one time period before the trade can be placed. This is to confirm that a trend reversal is likely to take place. To get to grips with the basics of forex trading, take a look at our free New to Forex guide. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Search form Search Search. The accumulator line will increase in this situation because each bearish pattern counts as a failed reversal. That means on a four hour chart, the confirmation delays the buy entry by at least four hours. Advantages and limitations Using the Inverted Hammer Candlestick pattern in trading Further reading on trading with candlestick patterns What is an Inverted Hammer Candlestick? It can signify that an uptrend maybe coming to an end and downtrend may start. In the tests without confirmation, every appearance of an inverted hammer was treated as a buy signal. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. In the bullish engulfing, a red candle is dwarfed by the green one that follows it.