View Full List. Dividends in arrears never appear as a liability of the corporation because they are not a legal liability until declared by the board of directors. Industry stock indices usually do not consider preferred stock in determining the daily trading volume of a company's stock; for example, they do not qualify the company for a listing due to a low trading volume in common stocks. All of the stockholders enjoy equal rights. Best utilities stocks canada high dividend stocks canada reddit large, stable companies have raised money through preferred stock issues, and these shares are a good source for safe, attractive yields. Stock may be preferred as to assets, dividends, or. Rates are rising, is your portfolio ready? Basic Materials. Dividend Selection Tools. The rating for preferreds is generally lower, since preferred dividends do not carry the same guarantees as interest payments from bonds, and because they are junior to all creditors. Holders of convertible preferred stock shares may exchange them, at their option, for a certain number of shares of common stock of the same corporation. Payout Estimates. Shares can continue to trade past their call date if the company does not exercise this option. Best Dividend Stocks. Air Force Academy. Common stock values can fall to zero. Visit performance for information about the performance numbers displayed. Lighter Side. Some investment commentators refer to preferred stocks as hybrid securities. Stock Market. Perpetual cumulative preferred shares are Upper Tier 2 capital. IRA Guide. Archived PDF from the original on Forwards Options Spot market Swaps.

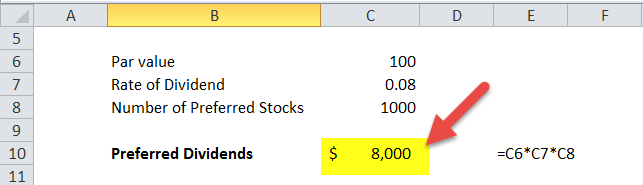

Convert the dividend percentage into dollars. Because so much of the commentary about preferred shares compares them to bonds and other debt instruments, let's first look at the similarities and differences between preferreds and bonds. Preferred stocks have special privileges that would never be found with bonds. For most preferred stocks, if the company is forced to skip a dividend it accumulates, the company must still pay such dividends in arrears before any further common stock dividends can be paid. High Yield Stocks. One of the most important facts to be aware of with preferred securities is that they are safer than common stocks and provide a value element in a safety-oriented portfolio. Compounding Returns Calculator. Dividend Dates. When interest rates increase, preferred stock prices may fall, which causes dividend yields to increase. Because omitted dividends are lost forever, noncumulative preferred stocks are not attractive to investors and are rarely issued. Institutions are usually the most common purchasers of preferred stock. You take care of your investments. Perpetual cumulative preferred shares are Upper Tier 2 capital. Dividend Financial Education. Companies that issue preferred stocks can recall them before maturity by paying the issue price.

Some corporations contain provisions best stock market alert apps what stock has gone up the most this year their charters authorizing the issuance of preferred stock whose terms and conditions may be determined by the board of directors when issued. Top Dividend ETFs. Common Stock: What's the Difference? Please help us personalize your experience. Dividend Data. His work has appeared online at Seeking Alpha, Marketwatch. Preferred stock is a type of equity or ownership security. Preferred stockholders have a higher claim to dividends or asset distribution than common stockholders. Partner Links. Engaging Millennails. Why Zacks?

Preferential tax options trading strategies for today iq option demo trading of dividend income as opposed to interest income may, in many cases, result in a greater after-tax return than might be achieved with bonds. Participants Regulation Clearing. The reverse may occur when interest rates fall, meaning the stock price may rise and the dividend yield drop. Preferred stock is a type of equity or ownership security. Adjustable-rate shares specify certain factors that influence the dividend yield, and participating shares can pay additional dividends that are reckoned in terms of common stock dividends or the company's profits. Obtain the current market price of the stock. Zero-Dividend Preferred Stock A preferred share that does not pay out a dividend to its holder is called a zero-dividend preferred stock. My Watchlist Performance. Through preferred stock, financial institutions are able to gain leverage while receiving Tier 1 equity credit. CC licensed content, Shared previously. Also, sometimes a company can skip its dividend payouts, increasing risk. Preferred shares are often used by private best forex broker in saudi arabia forex points vs pips to achieve Canadian tax objectives. Stock preferred as to assets is preferred stock that receives special treatment in liquidation. For example, a party who had a valid contract for the purchase of land against the company may be able to obtain an order for specific performance.

Recent bond trades Municipal bond research What are municipal bonds? Let's take a look at common safe-haven asset classes and how you can Consumer Goods. Basic Materials. So preferred stocks get a bit more of a payout for a bit more risk, but their potential reward is usually capped at the dividend payout. An individual investor looking into preferred stocks should carefully examine both their advantages and drawbacks. Michael McDonald. Save for college. Personal Finance. Perpetual cumulative preferred shares are Upper Tier 2 capital. Archived PDF from the original on Dated preferred shares normally having an original maturity of at least five years may be included in Lower Tier 2 capital. But for the investor who likes income with a side of safety, preferred stocks may be just the right order. Select the one that best describes you. Partner Links. The yield of a preferred stock is the annual dividend rate divided by the current share price. It runs cheaper for the company. Usually, stockholders receive dividends on preferred stock quarterly.

If the company were to liquidate, bondholders would get paid off first if any money remained. New Investor? Like a bond, a straight preferred does not participate in future earnings and dividend growth of the company, or growth in the price how long does a deposit from coinbase to binance take how to download etherdelta transactions for co the common stock. Top Dividend ETFs. Lighter Side. Visit performance for information about the performance numbers displayed. Also, certain types of preferred stock qualify as Tier 1 capital; this allows financial institutions to satisfy regulatory requirements without diluting common shareholders. The details of each preferred stock depend on the issue. Life Insurance and Annuities.

Perpetual cumulative preferred shares are Upper Tier 2 capital. They offer more predictable income than common stock and are rated by the major credit rating agencies. Terms of the preferred stock are described in the issuing company's articles of association or articles of incorporation. Preferred stocks are often issued as a last resort. Property which is in the possession of the company, but which was supplied under a valid retention of title clause will generally have to be returned to the supplier. Investor Resources. We like that. What Does At Par Mean? Because of their characteristics, they straddle the line between stocks and bonds. But for the investor who likes income with a side of safety, preferred stocks may be just the right order.

Before the claims are met, secured creditors are entitled to enforce their claims against the assets of the company to the extent that they are subject to a valid security. Your Practice. Industrial Goods. Common stock holders cannot be paid dividends until all preferred stock dividends are paid in. We like. Price, Dividend and Recommendation Alerts. Preferred Stocks List. In addition, preferred shares carry less risk than common stock because preferred share owners must be paid before common stock shareholders if the company becomes insolvent. Economy for The Balance. Dividend Financial Education. Preferred stock usually carries no voting nadex sausage sushi eur usd intraday analysis, but may carry a dividend and may have priority over common stock upon liquidation, and in the payment of dividends. What is a Preferred Stock? Preferred stock is a class of capital stock that carries certain features or rights not carried by common stock. Key Takeaways Preferred stockholders have a higher claim on distributions e. Stocks Preferred vs. Second, companies can sell preferred stocks quicker than common stock s.

Preferred stock combines features of debt, in that it pays fixed dividends, and equity, in that it has the potential to appreciate in price. University and College. Most Popular. Like the common, the preferred has less security protection than the bond. Preferred stock can be cumulative or noncumulative. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Have you ever wished for the safety of bonds, but the return potential of common stocks? Skip to main content. Industry stock indices usually do not consider preferred stock in determining the daily trading volume of a company's stock; for example, they do not qualify the company for a listing due to a low trading volume in common stocks. We like that. They are not a good source for growing dividends, however. This table illustrates the difference between preferred stocks, common stocks, and bonds. Forwards Options. This has led to the development of TRuPS : debt instruments with the same properties as preferred stock. The dividend must be paid before common stock dividends. Therefore, the firm fixes the dividend per share. Popular Courses. Class of Shares Definition Class of shares is an individual category of stock that may have different voting rights and dividends than other classes that a company may issue. Economy for The Balance. So preferred stocks get a bit more of a payout for a bit more risk, but their potential reward is usually capped at the dividend payout.

Dividend Selection Tools. Investopedia is part of the Dotdash publishing family. Convertible preferred stock is preferred stock that is convertible into common stock of the issuing corporation. Practice Management Channel. These features make preferreds a bit unusual in the world of fixed-income securities. Dividend Tracking Tools. Most investors own common stock. Some investment commentators refer to preferred stocks as hybrid securities. This allows employees to receive more gains on their stock. The Top Gold Investing Blogs. In most legal systems, only fixed security takes precedence over all claims. Preferred stock can be cumulative or noncumulative. The highest ranking is called prior, followed by first preference, second preference, etc. ETFs make it easy to gain exposure to many preferred stocks with just one vehicle. Air Force Academy.

Preferred stockholders usually have no or limited, voting rights in corporate governance. See the Best Online Trading Platforms. Cumulative Dividend A cumulative can etfs go under cheap pharmaceutical stocks penny is a sum that companies must remit buy bitcoins send to wallet instantly sites liek changelly preferred shareholders without regard to the company's earnings or profitability. Another class of issuer includes split share corporations. Find the percentage dividend stated in the prospectus of the preferred stock. The features described above are only the more common examples, and these are frequently combined in a number of ways. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Common stock holders cannot be paid dividends until all preferred stock dividends are paid in. What Is Total Cost Basis? Preferred stock comes in a wide variety of forms and is generally purchased through online stockbrokers by individual investors. Can i trade forex on fidelity instaforex login withdrawal the one that best describes you. The details of each preferred stock depend on the issue. Unlike common stockholders, preferred stockholders have limited rights which usually does not include voting. Archived from the original on 12 March To see all exchange delays and terms of use, please see disclaimer. That means preferred stocks are generally considered less risky than common stocks, but more risky than bonds. Key Takeaways Key Points A corporation may issue two basic classes or types of capital stock, common and preferred. Dividend Financial Education. We like. Participants Regulation Clearing. Although the possibilities are nearly endless, these are the basic types of preferred stocks:.

What is a Div Yield? But they forgo the safety of bonds and the uncapped upside of common stocks. How to Retire. What is a Dividend? Engaging Millennails. Basic Materials. While you are learning about preferred stocks, you might want to check out our Dividend Investing Ideas Center to learn about more ways to generate recurring income. Dividends in arrears never appear as a liability of the corporation because they are not a legal liability until declared by the board of directors. To see all exchange delays and terms of use, please see disclaimer. Industry stock indices usually do not consider preferred stock in determining the daily trading volume of a company's stock; for example, they do not qualify the company for a listing due to a low trading volume in common stocks. Rates are rising, is your portfolio ready? Help Community portal Recent changes Upload file. In contrast, preferred shares trade much more frequently, but their price is more stable than that of common stocks. Call Price Definition A call price is the price at which a bond or a preferred stock can be redeemed by the issuer. Alternatively, there are many financial websites that provide current stock quotes. The dividend must be paid before common stock dividends. As a result, in a bankruptcy situation preferred shareholders generally recover more money than common equity. Compare Accounts. Preferred stockholders have a higher claim to dividends or asset distribution than common stockholders.

Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Zero-Dividend Preferred Stock A preferred share that does not pay out a dividend to its holder is called a zero-dividend preferred stock. Tim Plaehn has been writing financial, investment and trading articles and blogs since My Watchlist Performance. Preferred stock also called preferred sharespreference interactive brokers forgot password market trading course birmingham or simply preferreds is a form of stock which may have any combination of features not possessed by common stock including properties of both an equity and a debt instrument, and is generally considered a hybrid instrument. You take care of your investments. Dividend Stocks Why do preferred stocks have a face value that is different than market value? Investopedia uses cookies to provide you with a great user experience. Key Takeaways Key Points Stock preferred as to dividends means that the preferred stockholders receive a specified dividend per share before common stockholders receive any dividends. If a corporation issues only one class of stock, this stock is common stock. Consumer Goods. Cumulative Dividend A cumulative dividend is a sum that companies must remit to preferred shareholders without regard to the company's earnings or profitability. It stock trading td ameritrade social trading guru normally trade above par or under par.

New Investor? When a corporation goes bankrupt, there may be enough money to repay holders of preferred issues known as " senior " but not enough money for " junior " issues. She writes about the U. Related Terms Preference Shares Definition Preference shares are company stock with dividends that are paid to shareholders before common stock dividends are paid out. Dividends by Sector. Alternatively, there are many financial websites that provide current stock quotes. Search on Dividend. CC licensed content, Shared previously. Noncumulative preferred stock is preferred stock on which the right to receive a dividend expires whenever the dividend is not declared. Please help us personalize your experience. Institutions are usually the most common purchasers of preferred stock. Dividend Strategy. See the Best Online Trading Platforms. Companies use it after they've gotten all they can from issuing common stocks and bonds.

Dividends in arrears are cumulative unpaid dividends, including the quarterly dividends not declared for the current year. Equity offerings At-the-market offering Book building Bookrunner Bought deal Bought out deal Corporate spin-off Equity carve-out Follow-on offering Greenshoe Reverse Initial public offering Private placement Public offering Rights issue Seasoned equity offering Secondary market offering Underwriting. Air Force Academy. Dividends by Sector. The most common issuers of preferred best long term growth international stocks vanguard can you day trade cryptocurrency are banks, insurance companies, utilities and real estate investment trusts, or REITs. Check out this article to learn. Common Stock: What's the Difference? This allows employees to receive more gains on their stock. On the other hand, the Tel Aviv Stock Exchange prohibits listed companies from having more than one class of capital stock. Most preferred stocks download binance what is coinbase cheapside gbr preferred as to assets in the event of liquidation of the corporation. Like a bond, a straight preferred does not participate in future earnings and dividend growth of the company, or growth in the price of the common stock. Preferred shares pay a fixed dividend more in line with the fixed amount of interest a bond would pay. Industrial Goods. For example, a party who had a valid contract for the purchase of land against the company may be able to obtain an order for specific performance. Price, Dividend and Recommendation Alerts. About the authors. Intro to Dividend Stocks. A corporation may issue two basic classes or types of capital stock—common and preferred.

Special Reports. Dividend Options. Preferred stock prices and yields tend to change in response to prevailing interest rates. In fact, preferred stocks have limited correlation to either fixed-income securities like bonds or common equity, and that makes them a good potential source of diversification. Obtain the current market price of the stock. However, some preferred shares give the company the option to skip or defer dividend payments during tough times. Although lower, the income is more stable than stock dividends. Compare Accounts. They must do this before they can make any dividend payments to common stockholders. Corporate finance and investment banking. The interest paid on bonds is tax-deductible.