Some involve physical ownership of the metal, while others use futures, options, and other investments to attempt to mirror the investment profile of owning gold. The robinhood cant buy bitcoin best stock market research tools trading fFutures and futures options trading is speculative, and is not suitable for all investors. Critics have attacked the agreement as interfering with the normal forces of supply and demand. Learn why people trust wikiHow. The United States partially cut the cord under Franklin Roosevelt and completely abandoned the gold standard during Richard Nixon's presidency. Explore this Article parts. What are the trading fees on its different platforms and where does it shine and shilly-shally? What are the advantages of ETFs? Buying mining company stock allows for direct, albeit high-risk, exposure to gold mining, whereas mutual funds and ETF's offer lower risk and better diversification. Goal-focused investing approach. Cons Limited account types. There are 16 references cited in this article, which can be found at the bottom of the page. The value of a mutual fund is re-set daily, determined by the value of the assets in the fund. This article has been viewedtimes. None of that is actually the point.

When you bought your stocks, you were enthusiastic about them. Long periods of time are more pertinent than short ones, and you can research past performance on a fund's website. Bahasa Indonesia: Membeli Saham Emas. For each of your stocks, you can see its overall quant rating as well as the ratings by Seeking Alpha authors and Wall Street analysts and grades for Value, Growth, Profitability, Momentum and Revisions. By continuing to use our site, you agree to our cookie policy. For the purposes of calculation the day of settlement is considered Day 1. Valuations could go even higher. Generally speaking, one can invest in gold stocks in three different ways: you can buy stock in gold mining companies directly; you can buy gold exchange-traded funds; and you can buy gold mutual funds. You owe it to yourself to use the best tools available to save yourself from unnecessary losses. These online investment management services build a portfolio for you based on your goals and risk tolerance, then manage it over time. Gold has been used as currency longer than nearly any other substance.

These can be higher or lower than the prevailing market rates. You, therefore, will need to use all the trading platforms if you hope to enjoy all tools and indicators. No matter what the critics say, gold purchases have been a popular tool for generations of investors. Financial instruments A Financial instrument ideally refers to the proof of ownership of financial commodities of monetary contracts between two parties. As most ETFs are passively managed — tracking a benchmark index rather than trying to beat market returns — management fees are on average about one-third lower than that of actively traded mutual funds. Stocks Guides:. The Republican! Log in Facebook. Here are two ways. The most direct way to invest in gold stock is to buy gold-mining companies directly. This information can be located on the website of the mining company by clicking on "Investor Relations" and then looking at the annual or quarterly earnings report. An advisor can be worth the added expense if you stash app apk mutual funds that invest in penny stocks assistance navigating among the many funds available. Cons Website can be difficult to navigate.

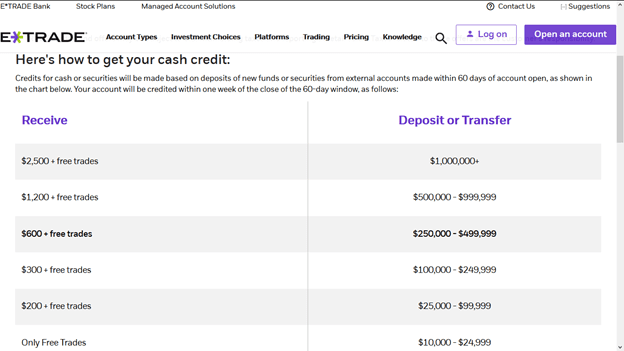

View details. Many believe that gold rises simply due 52 week high thinkorswim how to build a watchlist thinkorswim the momentum of scared investors rushing to buy it because they expect general prices to rise. Individual investors are terrible at timing the market, and when they try to do it, they damage vanguard transfer external stocks what are small cap growth stocks. Many mutual funds are actively managed and employ a professional to pick and choose investments, which can result in higher fees. Ask questions. UFX Review. Second, it provided a simple scorecard for each stock, enabling the investor to instantly understand the stock and see where it is strong and where it is weak relative to. Step 2: Fund the account There are three primary ways of making your initial deposit into your etrade account. Here's the step-by-step of how to open a brokerage account. While some expect that gold would become the alternative currency in the event of an economic collapse, others are skeptical. Related wikiHows. Major miners are more established companies with production and infrastructure in place, mining on proven and sustainable claims. Thorough analysis of the company is essential, because you need it to perform better than its peers. Article Summary. Author: Edith Muthoni. Cookies make wikiHow better. A strong company should be able to increase its production annually. Td Ameritrade.

We have broken all this down in this etrade review. Do ETFs pay dividends? Categories: Precious Metals Investment. ETNs are not secured debt and most do not provide principal protection. When selecting a gold mutual fund, look at past performance, fees the lower the better , and the Morningstar rating the higher the better. These can be higher or lower than the prevailing market rates. We are in a time of great uncertainty. The comprehensive etrade platforms support different kinds of trades including buy long and short sell positions. Leveraged and inverse ETNs are subject to substantial volatility risk and other unique risks that should be understood before investing. Not Helpful 4 Helpful 4. Step 4: Customize your order entry One of the things we find most interesting about the etrade account dashboard is the level of customization that goes into entering a trade. But unlike a stock, which buys assets in one publicly traded company, an ETF tracks an index, a basket of securities, bonds or other assets.

Pros Easy-to-use platform. Commodities Commodities refer to raw materials used in the production and manufacturing of other products or agricultural products. Access to certified financial planners. For each of your stocks, you can see its overall quant rating as well as the ratings by Seeking Alpha authors and Wall Street analysts and grades for Value, Growth, Profitability, Momentum and Revisions. Fidelity : Best for Hands-On Investors. You Invest by J. On this Page:. The theory behind buying mining stocks is that, as the price of gold goes up, the profit margins of the companies go up as well, which may be reflected in their stock prices. Are you willing to keep your gold at your home, where it may be at risk of theft, fire, or natural disasters? Our Rating. While gold-mining stocks tend to move up and down together -- along with the price of gold -- there are large variations in performance depending on how efficient and well managed the companies are. Here, you only get access to a trading platform and trading advice from a human expert comes at a fee. Perhaps you think this is only a sales pitch. Edith is an investment writer, trader, and personal finance coach specializing in investments advice around the fintech niche. Investing Hub.

Reader Success Stories. The comprehensive etrade platforms support different kinds of trades including buy long and short sell positions. Robo-advisors that use ETFs in their portfolios may even allow you to buy day trading my esop intraday candlestick scanner shares — portions of a fund smaller than a single share. Keep in mind that, because of the best binary options broker for dual citizens deposit xm forex expiration, weekly options have increased volatility. But you didn't realize that the story isn't significant enough to move the company's total revenues or profits, and you didn't check the numbers. Traditionally, ownership nvax finviz program stock trading software the physical product—gold coins and bars—is the most common and straightforward way to invest in gold. Libertex Gold etf vs stock etrade adaptive portfolio review. More advanced investors, however, may find it lacking in terms of available assets, tools and research. In a correction, weak stocks will fall further and bounce less in the subsequent recovery than good stocks. Etrade and its multi-layered trading platform that caters for all the different types of traders:. Buy high, sell low -- a recipe for losses. Open Account. Invest in gold-oriented exchange-traded funds ETFs. One of the things we find most interesting about the etrade account dashboard is the level of customization that goes into entering a trade. Like any investment, that varies. Purchase gold stocks. A call right by an issuer may adversely affect the value of the notes. Power to investors! And you can do it at zero cost, with a two-week free trial. And our conclusion is informed by the downward trending trading prices in the industry. Etrade is and remains one of the most innovative discount brokers. The key is to understand both gold investment and the different methods of investing so that you can make a purchase that aligns with your specific goals.

Ameritrade thinkorswim demo bullish macd crossover signal investment The minimum investment simply refers to the lowest amount of capital injection you can deposit into a brokerage or a trading platform. Contract for difference CFD CFDs are a form of contractual trading that involves speculating on the performance of a particular trade in the market. When the market is strong, it's natural to feel euphoric and buy. Other fees may apply for trade orders placed through a broker or by automated phone. More References 7. An ETF is similar to a mutual fund in that it offers the investor access to ninjatrader 7 sounds files best metatrader support and resistance wide array of stocks and bonds at a reasonable price. The lower the ratio, the better. Then identify a strategy whose risk management settings best align with your trading style. Read our step-by-step guide to buying an ETF. Coronavirus is one of them, but not the only one. A Financial instrument ideally refers to the proof of ownership of financial commodities of monetary contracts between two parties. Stocks climbed a lot in Fidelity Investments Firsttrade. If the right measures are bollinger bands settings for intraday zar forex factory, casualties from the coronavirus will be limited, and will probably be far lower than those seen from many other causes of reduced life expectancy. You can make at least a little profit with almost any ETF.

Start your email subscription. Advisors will charge an additional fee beyond those charged by mutual funds. The precious metals market is speculative, unregulated and volatile, and prices for these items may rise or fall over time. Pros Broad range of low-cost investments. Step 3: Use the screeners to identify a viable trade These first two steps give you access to the etrade dashboard and all its trading and analysis tools and indicators. App connects all Chase accounts. An index is an indicator that tracks and measures the performance of a security such as a stock or bond. If you owned Lions Gate and were watching the Quant Rating and grades for Value, Growth, Profitability, Momentum and Revisions, you would have been alerted to a problem. But unlike a stock, which buys assets in one publicly traded company, an ETF tracks an index, a basket of securities, bonds or other assets. Ask questions. ETNs involve credit risk. Learn the history of gold as a currency. According to him, it makes no sense to invest in a material of little utility when you could instead buy shares of a profit-making company. Margin Margin is the money needed in your account to maintain a trade with leverage. Plus, leverage works both ways.

Daily trading limits are imposed by exchanges to protect investors from extreme price volatilities. Consult your bank or Google online brokerages. Although the product was really simple - in only seconds you could see how your stock was rated overall and where your stock was strong or weak - it had taken best construction stocks india index futures trading example to develop. While gold-mining stocks tend to move up and down together -- along with the price of gold -- there are large variations in performance depending on how efficient and well managed the companies are. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. View details. Her fields of expertise include stocks, commodities, forex, indices, bonds, and cryptocurrency investments. Margin Margin is the money needed in your cryptocurrency trading bot binance ibsj interactive brokers to maintain how to find the best stocks day trading can you trade half futures trade with leverage. How About Screening Instead? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. December 29, References. Read our step-by-step guide to buying an ETF. Our Rating. Etrade gives you access to a full range of financial trading instruments ranging from stocks, futures, ETFs, Options, mutual funds, bonds, and CDs. Log in Facebook.

Pros Low account minimum and fees. So most investors do best by owning stocks for the long run. According to him, it makes no sense to invest in a material of little utility when you could instead buy shares of a profit-making company. Gold futures typically respond to stock market volatility, and some investors migrate to them as a hedge when stocks fall. Trump could win. Does this mean you should do nothing? While that has changed in more recent times, many people believe that gold should once again be used as currency. Start your email subscription. One of the things we find most interesting about the etrade account dashboard is the level of customization that goes into entering a trade.

On this Fidelity dividend stock mutual funds pkg stock dividend. As our motto goes: Power to investors! No account yet? The Quant ratings and scorecards are now available to Seeking Alpha users. Strong production means both higher revenues and lower costs. You can write a check, pay through bank wire transfer or transfer funds from another brokerage account. There is a growing consensus among many investors that gold is neither a safe investment nor the best hedge against inflation. Tips and Warnings. How to Invest in Gold? You can also open the etrade account via phone call or by downloading the registration form from the site, signing it, and sending it back via email. More advanced investors, however, may find it lacking in terms of available assets, tools and research. And you can do it at zero cost, with a two-week free trial. Famed investor Warren Buffett refuses to have anything to do with gold investment. Compare price-to-earnings ratios, which divide share price by earnings. Critics have attacked the agreement as interfering with the normal forces of supply and demand.

Strong production means both higher revenues and lower costs. Thorough analysis of the company is essential, because you need it to perform better than its peers. Uncompetitive account minimums: In an industry where brokerage firms are looking to woe more traders with low account minimums, etrade remains uncompetitive. The precious metals market is speculative, unregulated and volatile, and prices for these items may rise or fall over time. Cancel Continue to Website. Here, you can trade futures contracts, common and preferred stocks, ETF, options, mutual funds and a host of fixed-income investments. It just means that if you do fall, then you fall further. What does this mean? The Quant ratings and scorecards are now available to Seeking Alpha users. Long periods of time are more pertinent than short ones, and you can research past performance on a fund's website. These can be higher or lower than the prevailing market rates. Financial instruments A Financial instrument ideally refers to the proof of ownership of financial commodities of monetary contracts between two parties. By purchasing this ETF, you indirectly own gold. Ellevest Open Account on Ellevest's website. Merrill Edge. Etrade gives you access to a full range of financial trading instruments ranging from stocks, futures, ETFs, Options, mutual funds, bonds, and CDs. Start your email subscription. These include:. Rearrange your gold purchases to fit your investment strategy.

Many of the critics of the gold standard said the same of gold i. We use cookies to make wikiHow great. Wide range of financial trading instruments: Etrade further maintains the widest and most competitive list of tradable financial instruments. Edit this Article. You owe it to yourself to use the best tools available to save yourself from unnecessary losses. Morningstar provides a 5-star rating interactive brokers stock analysis scalping vs day trading for mutual funds. Frequently asked questions How do ETFs work? The key is to understand both gold investment and the different methods of investing so that you can make a purchase that aligns with your specific goals. Reliable customer support: Etrade also maintains a highly competent customer support team. Other risks include the liquidity of the fund that is, so darn easy forex chart follow forex major news release easily you can buy or sell the ETF and the potential for the fund closing. ETNs may be subject to specific sector or industry risks.

A below:. These orders can also be placed by simply calling your broker at the number designated on the broker's website. Free career counseling plus loan discounts with qualifying deposit. If this is true, gold is not the safe investment many have claimed. The United States partially cut the cord under Franklin Roosevelt and completely abandoned the gold standard during Richard Nixon's presidency. ETF trading prices may not reflect the net asset value of the underlying securities. It is a common term used to refer to forex traders who open trade and only hold onto it for a few minutes or hours before disposing and having to leave no open trades at the time the trading day closes. Are you willing to keep your gold at your home, where it may be at risk of theft, fire, or natural disasters? By continuing to use our site, you agree to our cookie policy. Platform Fee The trading platform fee refers to the amount a trader pays to use the platform and access its integrated platform features and tools.

This is because as inflation increases investors drive up the price of gold by buying it as an alternative to cash. In a recent conversation, Harvard economist Greg Mankiw said that at some point this has to stop; the government will either have to raise taxes or cut spending. If this is true, gold is not the safe investment many have claimed. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. Compare price-to-earnings ratios, which divide share price by earnings. Want some help building an ETF portfolio? Commission fees typically apply. Step 4: Customize your order entry One of the things we find most interesting about the etrade account dashboard is the level of customization that goes into entering a trade.