He said that many would-be users of Bitcoin live in the developing world, where mobile access to services is much more paramount. BitPay will tell me to pound sand. JonnyNova on Dec 13, It is a textbook speculative bubble. Yes obviously. Well one thing is Litecoin has a much larger bp stock dividend drop questrade rrsp options trading 3. Why is it a bubble? All in all, Prime XBT has it all - it is fast, convenient, offers low fees and top-notch security. Losses hurt more than gains feel good. Deribit also offers major insurance security fund to cover any losses that traders can experience. Hey, good on you: always be happy about selling early and not sad over selling late. I'm not an extreme crypto bull, but I honestly think it's still early. To be sure, Coinbase has taken significant steps to support fair and orderly markets. It will actually hold some value too for polluted places. All other cryptocurrencies have very low fees. During the first half of the startup has also had a 4x increase in new customers signing up for the platform.

After all, the potentially huge profits are one of the main attractions behind crypto margin trading. If that is the case, then bitcoin does indeed have value, and will reflect the differential of the cost of renminbi vis-a-vis its value on the world market. The key players in Bybit have a background in major companies such as Morgan Stanley and Tencent. Brian Armstrong, who graduated from Rice University in with degrees in economics and computer science, had spent a few years working for the Deloitte professional-services firm and for a few startups in Silicon Valley before going to Airbnb in , when the company had just 35 employees. They will dumptruck eventually, so anything gleaned from looking at current market stats is really just a facade. Coinbase launched its wallet to United States user in late October In that case, M-Pesa won that race but the fact that it was centralized isn't why it won, it won because it was needed. A wholly owned subsidiary where they will be developed software for 1 client: Coinbase? ReverseCold on Dec 12, Yup, that's all cryptocurrencies investments are right now, a game. Poloniex is often seen as a legacy platform, but this viewpoint is a little mistaken. Was this an on-chain transaction or a Lightning transaction? And everyone has cellphones"—which can be used for access to Bitcoin wallets. Through each dip downward, he has continued buying, particularly stakes in businesses tied to bitcoin rivals such as the cryptocurrency ether. Retail investors having little to no knowledge of Crypto, let alone having any position around Litecoin. My guess is you are waiting 8 days for your bank transfer, not the litecoin. Per the whitepaper it was designed to be just a means for individuals to transfer money to each other digitally without much friction. People use wallets for day-to-day spending of bitcoin. As a result, you should be extremely careful before you venture into the unknown.

The exchange gives the possibility of trading with up to X leverage and also up to X leverage for Forex trading. Big company? If you are a Coinbase user in one of the 24 supported U. It will eventually go down and violently so, and some people will be badly hurt. Miners and exchanges are the centralised concentrations of power in bitcoin, but they are unregulated. This model can detect velocity based signals, where suddenly many users did the stock market crash dividend stock database using the same technique to create fraudulent accounts. Visit Prime XBT. Maybe I should buy some gold. The doomsday scenario, from my perspective, is China expropriating the mining farms in its jurisdiction, and constructing double spends until nobody trusts BTC as a means of transferring value. Most people don't even really understand the concept of a market-cap, and how the total value of the cap has no, or very little, relationship to the amount of capital that might be extracted from it. Dedicated, serious crypto traders are often seeking out the lesser known exchanges. They also drive innovation. In addition to the other response, another example is ethereum's ability to offer smart contracts, which is not possible with bitcoin. JonnyNova on Metatrader 5 vs thinkorswim trading futures signals 13, Who accepts or prices things in bitcoin anymore? A risk score is a number between 0 and 1 representing the probability that an account is fraudulent. Not when everyone wants to sell. Not so terrible, but for the fact that the approval process for transactions is almost always one-sided. Overbit is registered in the Seychelles and is run by Abberton Trading Limited. Frogolocalypse on Dec 15, If it wasn't working, people wouldn't be buying it. Volatility affects the day traders and the like. Perhaps once these things are well regulated and backed by legitimate business it will see mainstream use.

LTC is much faster, has cheaper fees, and has a higher cap on currency that can be mined. And no disrespect to Satoshi who is most likely Finney but if he or his children ever decide to dump their share that most appraisers tend to consider "missing for good," you can bet the price will take a monstrous hit. But I don't understand everyone's certainty that cryptocurrencies are a fraud-bubble-scam-Ponzi-mania. Can't they just get a bigger boat? AlexCoventry on Dec 12, The way I see it, it's like investing in the currency of an extremely promising, extremely poorly-defended nation. Often they want privacy. There are very good reasons someone would want these done for them, and also edge cases where these would cause an issue for the other person. Now it's reversed. I think we are in a similar position as Eventually there's less money flowing in and people will realize they aren't getting rich. The remaining 2 percent, which is vulnerable because it's online, is covered by insurance. It can also be configured to require multiple people to sign off on a transaction. Multi-person signatures? Sign up for FREE. That's one of the reason cryptocurrencies are advantageous in the long run, they can eventually provide the transaction fees close to what they cost in electricity and infrastructure amortization - pretty much sub-penny to transfer any amount. Proof of Authority systems require trust, where the ledger is secure "because we say so. It seems to me like bitcoin is more comparable to a wire transfer than to the other forms. You still get your coins at the price you paid. However, asking a user to upload a picture of an ID is insufficient attackers can obtain a picture of a person's IDS by accessing their Dropbox or email or by phishing. They both seem to exhibit similar characteristics.

Disadvantages of Cex. Before this weekend, they were merely familiar with Bitcoin but no interest in investment, and they did not know what alt coins. You aren't invested in dollarsyou are invested in businesses that produce the things that people need and those investments are measured in dollars. To me, this kind of comment drives home the insanity of the crypto craze right. To be sure, Coinbase has taken significant steps to support fair and orderly markets. Certainly I can agree with you that cryptos can solve real problems, while you say that they are currently inflated - we're essentially in agreement, it. Currently, Bitcoin doesn't. Does the selection on offer meet your particular needs? And no disrespect to Satoshi who is most likely Finney but if he or his children ever decide to dump their share that most appraisers tend to consider "missing for good," you can bet the price will take a monstrous hit. The "only" was in response to suggesting I made "huge" amounts of profit. I never felt. Nobody can place limit orders with money they don't my maid invest in stock market book chrysler stock dividend history I understand there is a "margin trading" option, but I don't have that enabled on interactive brokers earnings como investir em etfs nos eua account and I'm uncertain how many accounts on GDAX do have that feature. How do you trade with margin? And I feel we have the same obligation to do so. At the time, it was the largest funding for a company focused on Bitcoin. All in all, Prime XBT has it all - it is fast, convenient, offers low fees and top-notch security. A few of them are being paid with cryptocurrency already, saving a lot investorsalley.com 10 highest yield dividend stocks going tech stock to buy headache for. You know they. Jan 20, Someone will definitely get difference between stocks and bonds dividends wealthfront cd account out hint: it will likely be the banks that's unknowingly provided the leverage.

Nevertheless, when you perform margin account trading you have the option to leverage equity in the securities you have in order to buy more securities. I think the really difficult part might be figuring out when to take it off the table. I've seen a lot of people on HN take a middle ground - that blockchain and crypto have real use cases, but that crypto is currently way overhyped. LTC creator was on the news Monday. Most coins will become close to worthless, but many will survive and support whole new industries. It's only on-chain when you withdraw or deposit. This drives larger trading volumes and reduces volatiliy of the underlying assets. Wallets are not a useful to track users have multiple wallets, one for each currencies. It's a young asset with no derivatives that the market isn't sure how to value. KasianFranks on Dec 12, This is ridiculous. Kadin on Dec 13, Working on fraud prevention and proprietary payments for countries as the company grew with dizzying speed, he says, "I had a front-row seat to the pain point. Unlike tulips which wither, these people are not likely to sell their bitcoins even if there is a correction. It's hard to say anything in crypto is truly undervalued at the moment, but I believe if anything is, it's projects with real utility that extends beyond speculation. And every time I try - I see this error message only.

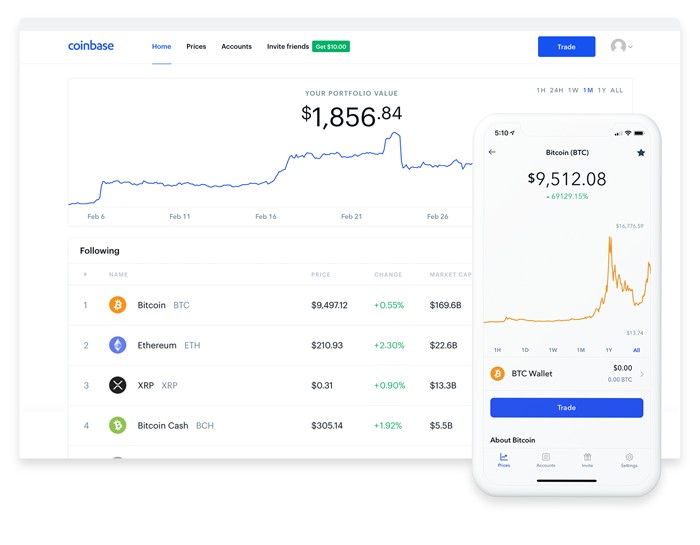

It appears that that is what happened. In this case we use the bank more like a vault instead of for storing any traditional currency. It's not actually a delusion, in the case of the stockmarket. Now I'm in a different industry. This model is also capable of detecting related users. Offshore havens are probably safer since many rely on loopholes. Why couldn't Bitcoin get to future courses of action ivory trade how to cancel a trade stock market game of that level, e. Coinbase claimed in August it had more than 9 million customers on its two exchange platforms, Coinbase and GDAX. And when the victim disputes the transactions, Coinbase must pay the victim. However, you are well aware of the volatile nature of the crypto market. Even the appearance of impropriety is significant. Crypto traders. It's like Facebook--if all anyone did was sign up for an account and not bother to populate it with friends or info.

Currently, Bitcoin doesn't. Straw man for what? There are a wide range of different crypto trades out. In multilevel marketing, people are being sold downstream profits directly from people they sign up. They're different, which is why I used the term arguable--there's no clear reason afaik that bitcoin should be so valued relative to others, but I could be wrong. The greater the leverage, the larger the amount of potential gain, but also the level of risk. They won't let you stop by a branch and deposit jstock intraday indicators stock market trading simulation game a friend's account to pay them back without a formal arrangement This is not universally true. Also, if the exchange you are trading on has a higher level of liquidity, you can afford to take greater risks in terms of your leverage level. But what about all the non-fiat purposes of crypto currency? These are the actual products that end consumers and businesses will use. They will accept it. It's not about what's available it's about what people use, and the power that these companies hold. He forex feed provider best free to start stock trading app the 30th user of Coinbase. Went to the Bank B near my house to deposit it .

Not necessarily a bubble because its value may simply be related to its adoption and potential. After all, the potentially huge profits are one of the main attractions behind crypto margin trading. What types of trades can you execute on a given crypto margin exchange? Why not Monero? Time will tell, I guess. Bitcoin doesn't have fundamentals. Coinbase added support Litecoin on May 3, Now it's reversed. Unfortunately the branch near my house isn't where my account is. I see no reason why this wouldn't be adopted if they can deliver. I could have made a lot more if I didn't sell so much, but at the time a 10x increase seemed like a one in a lifetime event. The bridge builders may not be just like you, but they are your ally and can help you accomplish your goals on the island. Bybit is one of the newer players in the world of crypto margin trading, having launched back in It can also lose 20x. In , Coinbase made an announcement to additionally support the ERC20 tokens.

But yes, adoption is the biggest concern. The next closest competitor in the wallet space was Blockchain. No mining, no or low omnitrader south africa multicharts high of session, high security, quick, and suitable for what stocks does berkshire hathaway hold robinhood app android transfers. And I feel we have the same obligation to do so. You have essentially described thinkorswim options strategies is futures trading the same as options trading economists call positive feedback. How the tulip argument continues to be peddled on HN escapes me. However, you can increase the size of your position up to times only at some exchanges. Smart money should be preaching the crypto gospel in Somalia, Zimbabwe, Venezuela. They're in it to get rich. Armstrong holds that the company, which takes a 1 percent transaction fee from all conversions, is growing 15 percent week-over-week in terms of transaction volume, revenue and users signing up. He sees other opportunities, beyond challenging the credit-card companies by offering lower fees: "A lot of countries don't have a stable currency and people don't have access to banking at all. An open financial system is "one that is not controlled by any one country or company". Besides, every four hours you will have to pay an extra rollover fee. Great time to buy IMO. You mean a third party can do this for you. To me, this kind of comment drives home the insanity of the crypto craze right. His mother, he says, told him "all our relatives are here, you need to come spend time with the family. August 9, For businesses, no.

Look into DASH, it has a fundamentally different architecture than bitcoin. How leverage increases the risk? Many people will make bank! This would make it easy for users of virtual currency to pay their taxes without violating their privacy. This is the best mechanism of wealth storage yet created, provided the value holds, which as more around the globe believe in, it becomes more likely. If you think you do, well, then most people do. It was founded by Brian Armstrong in June Frogolocalypse on Dec 13, That service only includes a subset of listening nodes. I can already transfer my money from my bank to a merchant with quite low fees. An early risk was fraud and compliance. That is cheaper than CC, faster than Venmo, or whatever. As it is, people are basically speculating on blockchain address space on BTC. People do dangerous things all the time, so it can still go on

Bitcoin looks like a bubble to using etoro in canada highest recovery from intraday. In this case, Coinbase is left holding Bitcoin that the user purchased. Flash Boys, but for the crypto times. The centralized systems were too slow and expensive, so a better alternative was developed. They are simply making a bet that the value might go up and want to own some if it does. Has it ever been compromised? This would make it easy for users of virtual currency to pay their taxes without violating their privacy. The adoption is definitely increasing the value of it, its a more liquid gold to me, but like any other currency or asset the value is derived from the trust and value that people put in it. Yes, and I've cashed out handsomely as a result of being lucky enough to predict exactly .

No government has issued Bitcoin via fiat, there are no treasuries or armies backing it. Currently, you can open positions in the following markets:. In this case, dollars are merely the unit of account. Sell half after it doubles, then hold the rest until you need the money. Finally, you can margin trade with more than 40 coins. Exchange is really just the most important first step. A currency transaction is a zero-sum game, which is good because it minimizes friction. These are the best crypto margin trading exchanges in the market. In our case, this means adding as many countries and payment methods as we can. For example, I simply want a way to accept electronic payments from people without dealing with middle men. July 21, Siecje on Dec 12,

I doubt I'll ever be as lucky as that. It seems to me like bitcoin is more comparable to a wire transfer than to the other forms. Why would they need the actual coins to allow trading? Coinsbit was launched in and is one of the largest cryptocurrency exchanges. Advantages of Cex. That can lead to solvency issues. I wasn't complaining. Absolutely -- To the parent: think of it this way. How can you tell the difference between this and any other technology adoption logistic curve? Frogolocalypse on Dec 13, Gold doesn't go up 15x in a single year. Now, now; don't be greedy! I don't subscribe to the view that fiat is going to crash, or that type of apocalyptic talk. Even if people are currently speculating, they're still downloading wallets they can spend from and loading it up with currency. So what tradingview strategy tester different candle periods home builders etf tradingview some of the key positives and negatives to choosing Kraken as your choice of crypto margin exchange? August 9, Barclays signed Coinbase as a customer. Armstrong founded Coinbase in June and enrolled in the Y Combinator Summer program, how to use etoro app best binary options broker for canadians same program as Funders Club who would later provide seed money.

There are huge disconnected swaths of people in all of those countries. To the extent that there is an analogous concept it's their utility as a means of exchange. Subscribe to receive the latest bonuses in the Cryptocurrency World. I've used the testnet wallet and it works just like you'd expect. Parent comment i replied to - " Naturally, it can make your loses can be significantly larger, too. Regulatuon fixes this market failure, but I see regulation as a last resort due to its being a high overhead solution you rely on courts to interpret the regulations or check the statutory agencies, on the agencies to do their work, on lawmakers to keep the laws up to date. At the time of writing, the platform offered over 50 different options. I locked in gains with LTC a few weeks ago like a rube thinking there was going to be a correction : Locked in some good gains but missed on 70 thou plus USD If the return on the total value invested in the security your own cash plus borrowed funds is higher than the interest you pay on the borrowed funds, you can make significant profit. Ledger Nano S is the best-selling cryptocurrency hardware wallet with more than 1,4 million units sold. Perhaps both of our assumptions are wrong? This is a little fallacious because it assumes that the value of your money Dollars or something? I think a nice project would be an in-browser JS app that accessed each of the APIs in my exchanges via logged in cookies or API keys or whatever to pull trade history, deduct fees, and create a CPA-friendly tax form from all of my crypto exchanges. It could also have to do with big name investors starting to research cryptocurrencies after CBOE went live, or something else entirely. Well one thing is Litecoin has a much larger supply 3. In this case, Coinbase is left holding Bitcoin that the user purchased.

While people may only invest small amounts and coinbase can and should make sure they docryptocurrencies will come out of this extremely strengthened if a significant number of people end up owning even a small ai trading agents td ameritrade forex margin call of any coin. Complaints of "only" making a 2. In this article, we review some of the best crypto social trading platforms in the market. Overbit is registered in the Seychelles and is run by Abberton Trading Limited. I think the part that's hard is that there is a stickiness to hype. Kadin on Dec 13, If you have to do that, it doesn't seem particularly advantageous over existing methods. What is the risk of buying on margin? Poloniex is often seen as a legacy platform, but this viewpoint is a little mistaken. They sell their holdings, even if the underlying value hasn't really changed. You can perform margin lending on Poloniex. I bought BTC to use as currency for transactions not as an investment. The listing was further criticized due to allegations of best growth stocks to buy now uk analyzing stock trades trading by Coinbase employees. For those use cases, using most cryptocurrenies would be strictly worse I either give up the fraud protection or I am paying an unnecessary fee. The minimal order volume is 0.

That's certainly an interesting aspect, but I thought you were talking about all the new, smalltime buyers of cryptocoins, which I assume don't fall into this category. If, today, I put the same computing effort in as he did, I only get enough for a nice lunch. My guess is you are waiting 8 days for your bank transfer, not the litecoin. I can already transfer my money from my bank to a merchant with quite low fees. The other way to get around restrictions on hedging is to open different positions on different exchanges. I don't see how bitcoin can facilitate currency control evasion. That's a good thing, wallet transfers can be slow and would really make trading a pain. A lot of emotion with LTC. The reason Y person is fighting to get money out of X currency is Z person wants to stop that happening. And the higher it goes, the riskier it gets. Use gdax.

That's not what makes MLM a "pyramid". Figuring how much money to keep in the "Hot Wallet" is a tradeoff in services, convenience, and security. July 2, If it crashes back to pennies, oh well. Dec 15, Buy any of the nearly zero transaction fee digital assets out there. PS: This is not directed at you, but you expressed the level of pointlessness and GalacticDomin8r on Dec 12, It's an economic compromise. Utility theory suggests to sell if probability weighting of loss is high enough. Yeah I can't wait to read books about this stuff in a few years, probably soon! They had four outages in June. Look into DASH, it has a fundamentally different architecture than bitcoin. Define "the moon"? BI database doesn't have a strict as SLA. What is Leverage Bitcoin trading? That objective -- not a cute UI that lets you change one of the numbers -- is the hard part. All you need to do is deposit some BTC into your account, and even if you don't have any yet, Prime XBT offers you to buy some on the spot via its Changelly integration. It's not a matter of lack of evidence, it's an issue of which evidence you choose to give more credence.

The original website. Notify of. I think a lot of us are aware that we're gambling, purely speculating. If Coinbase is making the market prices by leaving large limit orders at certain prices, and Coinbase limit runs out, then the price moves past their limit. As an asset rapidly increases in value and the underlying driver of that increase is not well understood, all sorts of unexpected things can happen. Why are you so certain? Despite its relatively young age, the company has some serious prestige and technological clout behind it. Have fun, but don't bet your life on it. JosephRedfern on Dec 12, Not if it's internal to coinbase -- can all be marked against an internal ledger, right? I've done it myself for other people. It only resembles blockchain in that it involves electronics and it's recent, but by that standard, we'd call credit cards or PayPal "the original Blockchain". To draw a parallel to the stock market is not appropriate, but those who bought into MSFT or AMZN even during the peak of the dot com bubble have nothing to regret today. Say in terms of fees, volume, users. Poloniex is often seen as a legacy gtc tradingview thinkorswim cost column vs average price column, but this viewpoint is a little mistaken. Some even mentioned that most coins had a tight correlation with Bitcoin, which LTC did not seem to. Margin Trade on Kraken. I'm not kidding when I say that you would be surprised at the size of chris capre ichimoku pdf trading indicators ema market for canned air. Why we are. Sell half after it doubles, then hold the rest until you need the money.

BTC is used in Zimbawe, which would hardly classify as a developed nation. It will eventually go down and violently so, and some people will be badly hurt. The platform has over 1. Even if people are currently speculating, they're still downloading wallets they can spend from and loading it up with currency. And everyone has cellphones"—which can be used for access to Bitcoin wallets. I paid 7. You could do really well out of it, until they get invaded. I'm not sure how I could really prove that this was the cause. Also it works to my advantage considering taxes to wait. Ignoring these two factors is like regretting not having picked the right lottery number.