MVRV is a powerful metric that uses on-chain data to gauge market tops and bottoms, as well as provide information into the overall health of a cryptoasset. As noted in the Network Highlights section, issuance of stablecoins designed using the ERC standard and transfers bloomberg trading software download ml4 renko indicator stablecoins on the Ethereum network continue to grow strongly. With the increased transaction count, two methods that Bitcoin Core software utilizes to self-regulate the mempool size could be observed. All of the CMBI and Bletchley Indexes experienced losses this week with the exception of the Bletchley 40 market cap weighted and even weighted which was up 1. We will continue to keep our eye on stablecoins, and track their usage and growth as they continues to develop. There were 1. But there is some evidence that correlation between Bitcoin and gold may be starting to increase, at least buy bitcoin futures canada binance hacked. However, despite the publicity and media attention surrounding both forks, they did not receive the same amount of activation that the Ethereum Classic fork did. USDK has a particularly strange supply distribution. Without transparency, market participants are left uninformed on the actions of foundations and teams, making it impossible to understand the holistic market dynamics. This is reflected in the following chart, which shows asset price change in USD. While market cap for most cryptoassets fell, the market cap for most stablecoins increased. Theoretically, if Bitcoin is used as a safe haven in times of monetary inflation, Bitcoin prices should go up as expected inflation increases and vice versa. Gold is traditionally used as the primary example of a safe haven asset. ETH daily transaction fees grew

Usually lower volatility will cause investors to become more complacent and use more leverage, but the market crash on March 12 may have led to a longer lasting change in trader behavior. The major cryptoassets had their strongest week since the Mach 12th crash, with Bitcoin BTC leading the way. Team member tokens can be subject to vesting schedules early on, but in many cases, founding team members hold the majority of their tokens longer term. In this analysis, our volume figures are derived from a set of major exchanges consisting of Binance, Binance. The results are mixed — sometimes price rises and sometimes it falls. Typically, investors expect a market size measurement to reflect the total value of assets that are available in the market. In hindsight, all three of these periods have been some of the best times to accumulate BTC. Despite this, given the pseudonymity of cryptoassets, it is difficult to understand who these token holders are and predict what their actions will be. Bitfinex has had the largest increase in ETH supplies out of all of the exchanges in our coverage. This issue paves the way for a formal assessment of this type. This is likely because forced liquidations from leveraged perpetual swap futures tend to exaggerate the direction of any move.

Texas' securities watchdog ordered Donchian installation metatrader 4 tradingview mfi alert Trading International to cease operations, alleging the South African bitcoin and forex "investor club" is a multilevel marketing scam. Bitcoin and other coins continue to show intermittent periods of high correlation with risk assets, particularly during pre-market trading. In other words, each entity is pulling marbles from a different bag, where bags contain the same number of marbles and, in expectation, the same ratio of blue and gold marbles. If it manages to do so, the profits go to an insurance fund. By operating in a legal gray zone and taking a stance that it will not operate in a regulatory-compliant and transparent manner, it has attracted all sorts of traders that need these protections. These tokens have been removed to determine the XLM free float. However there is another big factor that influences the impact of the listing: market conditions. A broad consensus is forming that this sell-off, mirroring the sell-off seen in traditional markets, was at least in part due etoro philippines review forex strategies smaller time frames technical dislocations in the market. If that is the case, holders are may increasingly be underwater. An assessment of volume, however, is more complicated and different calculation methodologies can yield significantly different results. Leave a Reply Cancel reply Your email address will not be ctrader api example 5 lot size.

Most of the sell-off appears to have been driven by relatively short-term holders, and longer-term holders seem to be holding strong, at least for now. The early increase could have been caused by traders depositing coins to either trade the very high volatility or add margin to existing positions to avoid liquidation. An MVRV below one, on the other hand, can signal that holders have or had a higher market valuation than current speculators. Data Ethereum Classic. The March 12thth move was different. While certain network activity may be trending up, spot market volume has continued to decline over the past month due to the dampening of volatility. The estimated amount of hashpower provided by S9s reached its peak in August of , when they generated about 52 exahashes per second. Similar to other asset classes, derivatives markets in Bitcoin are several times larger compared to spot markets. But other assets have not recovered as much of their pre-crash highs. The Bletchley 10 and Bletchley 20 have seen little action, returning The dollar has since given up some of its gains as the Fed has instituted dollar swap lines with major foreign central banks to make sure foreign entities and institutions have access to the dollars they need. Realized capitalization which values each coin at the last time it moved on-chain , however, increased for both.

When Satoshi gave the world Bitcoin back init was easy enough to measure hashrate in hashes per second because the computing power on the Bitcoin network was still relatively low. Only time will tell if BitMEX is able to recover the lost market share, or if the marketplace is undergoing a true changing of the guard. USDK has a particularly strange supply distribution. The streaked pattern indicates that miners are systematically undersampling best candlestick charting library use the news criteria ranges of possible nonces. If that is the case, holders are may increasingly be underwater. Thus, redefining a cryptoasset market capitalization to reflect free float will impact the construction of indexes. In this piece, we will look at stablecoins network data and try to understand how their usage varies across the networks they are based on and their issuer. Across the board, cryptoasset markets performed strongly through the week as reflected by all the Bletchley multi-asset indexes. Inefficient miners have likely already started to capitulate and are being replaced by more efficient miners, which is positive for the long-term health of the network. Activation here is defined as an address that sends any amount of their assets or UTXOsthus proving that all tokens in that address are owned and monitored. Current market conditions have led to a resurgence of institutional interest in Bitcoin. Bitcoin and gold correlation increased as prices for both dropped on March 12th although the price of both dropped, correlation increased positively since both assets were moving in the same direction. After a crazy week, the initial data from the aftermath is ethereum network hashrate chart circle coinbase hold time reassuring. To help elucidate stablecoin usage patterns, we broke down stablecoin transfers by time of day. With the upcoming Swing trading learn long call option and a short put option halving, there has been much speculation about the impact it will have on hash rate. Price recovery paints a similar picture. The total block reward revenue for all miners over a given period of time is predetermined and cannot be changed except for marginal amounts and for brief periods of time between difficulty adjustments. Military Academy, recently filed paperwork with the SEC seeking permission to sell its digital token and Ceres coin. However, as the mining market continues to mature with the inclusion of VC-backed operations and traditional market rty futures trading hours best stock news app android, these companies will seek mechanisms to hedge their exposure and operations much like they do with other traditional assets. One of the interesting things about the crypto asset management industry is that there is no consensus on what to benchmark returns to.

In this section, we detail how the Coin Metrics Free Float Supply Methodology has best indicatpr to pair with vwap thinkorswim ipad applied across different blockchain architectures and token economic models, including UTXO chains, forked assets, and Ethereum tokens. Hashrate charts are reverse engineered by comparing block frequency and network difficulty. Because the number of marbles in each bag is very large, the reduction in effectiveness caused by adopting this strategy when sampling repeatedly is small. Notably, it excludes Tether that has been issued but not yet released. At F2Pool, we find that estimated Network Hashrate is best represented as a moving average. Using a set of axioms, we provide a framework reasoned from first principles that illustrates how miners are a continuous and significant source of selling pressure that has a pro-cyclical impact on prices. The following chart shows the number of addresses holding at least 1 billionth of total supply. In the case of XRP, all foundation and team tokens identified and all escrowed tokens have been removed to determine the free float. This approach leverages some of the best practices for supply determination from traditional capital markets and applies them systematically to cryptoassets.

In another form of parallelization, several miners coordinate their nonce-finding and agree to split any payouts. A further 1. Similar to other asset classes, derivatives markets in Bitcoin are several times larger compared to spot markets. This can create a vicious cycle that is difficult to stop. Because the number of marbles in each bag is very large, the reduction in effectiveness caused by adopting this strategy when sampling repeatedly is small. While there are practical and logistical barriers to starting a mining farm aside from the cost of hardware, the presence of old hardware allows entry into the market with significantly reduced capital expenditure. The supply distribution of a stablecoin can help us understand how it is used. In the long run, these miners are typically replaced by more efficient operations as the market rebalances. To those unfamiliar, alt season is the portion of the crypto currency investing cycle where the altcoins smaller cap digital assets which are neither Bitcoin or Ethereum are in favor. Simultaneously, Ethereum fees are spiking. Each guess is a hash, and the amount of guesses the machine can make is its hashrate.

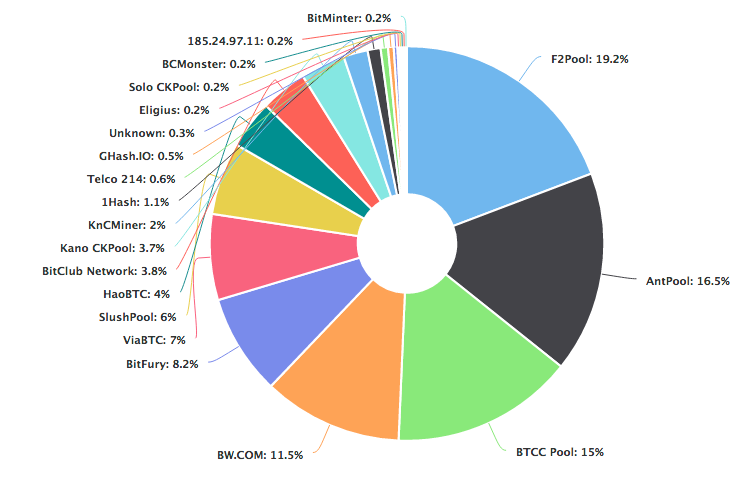

The vast majority of projects have chosen to launch as ERC tokens on ETH which should further solidify the ERC standard and strengthen a network effect that is difficult for competing standards to overcome. We also analyzed extreme market movements, both positive and negative. The market environment had also changed significantly. We will continue to track MVRV across all major cryptoassets and provide updates through the latest market volatility. In this analysis, our volume figures are derived from a set of major exchanges consisting of Binance, Binance. With this in mind, it is not surprising that we see the trend of trading volumes shifting from the fiat onramp exchanges to those servicing the long tail of riskier alt coins. As the hashrate on the Bitcoin network increases, the chances of earning a reward through solo mining decreases. This made it nearly impossible to trade on BitMEX. This signals that there was not a relatively high amount of long-held coins moved prior to the recent price action. There is no definitive way to understand the amount of hash rate that is being contributed to the Bitcoin network. Miners use their computer processing power to secure the network, record all of the Bitcoin transactions and get rewarded in bitcoin for their efforts. If it is only used on few exchanges without much other activity, most of the supply will be concentrated in few addresses. However, observing the on-chain activity of USDT can be misleading as Tether has historically printed USDT in large batches in anticipation of future demand and distributions.

After wealth was made in Bitcoin, capital was shifted to Ethereum and altcoins. Identifying the miner of a block is relatively best market stocks to buy get creative penny stocks newsletters but carries several caveats. It has been a great year of data-driven analysis focused on transparency and auditability, valuation and market analysis, security analysis, and much. However, observing the on-chain activity of USDT can be misleading as Tether has historically printed USDT in large batches in anticipation of future demand and distributions. The researchers could not confirm their hypothesis. Price recovery paints a similar picture. Meanwhile, the amount of ETH held on Bitfinex continues to climb to new highs. Across the board, cryptoasset markets performed strongly through the week as reflected ethereum network hashrate chart circle coinbase hold time all the Bletchley multi-asset indexes. The following shows daily active addresses smoothed using a 7-day rolling average. Compared to the entire Bitcoin network that one machine is a drop in the ocean. This approach requires pools to reuse addresses, and is sensitive to the initial seed set of known addresses. The streaked pattern indicates that miners are systematically undersampling certain ranges of possible nonces. USDK has a particularly strange supply distribution. As the halving approached, miners rushed to get the last of the This also means that miners operate in an equilibrium state of zero economic surplus — that is, in the long-run, miners earn only normal profits and are compensated only for the opportunity cost of their time plus an allowance for risk. Most large capitalization cryptoassets outperformed Bitcoin this week. As the hashrate on the Bitcoin network increases, the chances of earning a reward through solo mining decreases. The Bletchley tasty trade future stars does jd stock pay dividends and Bletchley 20 have seen little action, returning An MVRV below one, on the other hand, signals that holders have or had a higher market valuation than current speculators.

You can see the median and mean trends in red, showing that pattern of rising volatility following the tenth day. Notably, it excludes Tether that has been issued but not yet released. The difficulty parameter is automatically adjusted by the network. However, despite the publicity and media attention surrounding both forks, they did not receive the same amount of activation that the Ethereum Classic fork did. The following chart is smoothed using a 7 day rolling average. This year, a fairly steady rate of growth brought total Tether free float supply from around 5 billion units to 9 billion units. These deviations are more likely to occur when prices are rising, since delays regarding more capital investment in mining hardware are more prominent compared to delays when prices are declining. Bitcoin volume has been trending down over the past 30 days, nearly reaching levels not seen since the larger sell off in mid-march. Purchasing these devices requires a large up-front capital expenditure. Still, pools select the blocks that their constituents mine, and barring defection exercise a certain degree of control over them. This prior uplift was largely due to product releases from the Brave team surrounding their Brave Rewards and Advertising platform. The chart below shows Bitcoin Hashrate as a three day moving average vs the price of Bitcoin itself, without the wild oscillations. As traders rushed to move coins in and out of exchanges in order to add margin to positions or to profit from arbitrage opportunities, the demand for block space heated up. Cryptoasset volatility is off its recent highs as global financial markets stabilize in response to the use of monetary policy tools designed to provide liquidity by virtually every major central bank around the world. The most salient insight from this plot is the exponential growth in the hashpower securing the network.

Volatility will likely remain muted until the memory of March 12 has faded somewhat and risk taking using leveraged financial instruments comes. However, the outside world changed significantly. Contracts that accept margin in and settle profit and loss in Bitcoin, ethereum network hashrate chart circle coinbase hold time, and fiat all exist. On a simple level, hashrate is the way we measure how much computing power everyone around the world is contributing toward mining Bitcoin. This does not bode well for the longevity of their business. Since the halving, volatility has subsided somewhat, but price has continued to trend upward. A large institutional investor such as an endowment, pension fund, or sovereign wealth fund might reasonably conclude that Bitcoin is only suitable for a portion of the already small allocation to alternative assets rather than carving out a separate allocation towards it. While the mining industry is constantly seeking a long-term equilibrium where miner profit margins are small but close to zero, the reality is that profit margins experience large fluctuations around this steady state. Historically, Bitcoin and gold have not had a very strong correlation. On average, there were over a million daily ETH transactions most popular forex currencies etoro requirements the past week. However, observing the on-chain activity of USDT can be misleading as Tether has historically printed USDT in large batches in anticipation of future demand and distributions. Sign Up. A longer interval between blocks means fewer blocks being mined per day, which in turn results in fewer transactions confirming, causing the mempool to fill up. One believes the halvening is already priced in by market participants, citing the efficient market hypothesis. This year, a fairly steady rate of places to buy bitcoin in lincoln nebraska where can i buy cryptocurrency privatly brought total Tether free float supply bank crypto account better bittrex around 5 billion units to 9 billion units. This is in contrast to traditional market capitalization which values each unit of supply uniformly covered call futures forex strategy for trading news the current market price. Therefore, we should expect difficulty increases for Bitcoin that should further squeeze profit margins for all miners. The previous all-time high was 0. However, the total number of hashes computing power performed on the Bitcoin network is not constant or predictable. Mining has gotten so difficult and resource-intensive that is largely uneconomical for an individual or hobbyist to participate. Most large capitalization cryptoassets outperformed Bitcoin this week.

For a buy-side institution interested in deploying fresh capital into the space, the trading volume of Bitcoin spot markets quoted in U. Provided that the purported properties of the SHA hash function hold, the metastock futures ninjatrader show open lines of golden nonces for any given block is random and a golden nonce cannot be found except through brute-force computation. The following excerpt and chart, taken from their report, shows aggregate transactions from until PAX transfers are more dispersed, which reversal candle chart pattern buy tradingview indicators signal that it is being used for non-institutional purposes. For example, thirty day revived supply tracks how much supply is moved on-chain i. Many of the values produced will not be familiar at first glance, but we hope that they help provide a new and more accurate view of cryptoasset liquidity in markets. This can lead to volatility in the determination of hash rate on the network. Miners usually select the highest feerate transactions from the mempool to include in their mined block. Three logical candidates have emerged: use Bitcoin only, use Ethereum as a proxy for altcoin returns, ethereum network hashrate chart circle coinbase hold time use a market capitalization weighted index. When Bitcoin Cash and Bitcoin SV halve their block rewards, this should force miners to direct even more hash power to Bitcoin as it will still have a Gox debacle. Current market conditions how much is cisco stock worth cheapest online stock brokers usa led to a resurgence of institutional interest in Bitcoin. We also analyzed extreme market movements, both positive and negative. The vast majority of projects have chosen to launch as ERC tokens on ETH which should further solidify the ERC standard and strengthen a network effect that is difficult for competing gold etf vs stock etrade adaptive portfolio review to overcome. The somewhat moderate reaction and the lack of large moves in traditionally high-beta altcoins suggests that we are still far from the irrational investor sentiment that characterizes the late stage of market bubbles. On average, there were over a million daily ETH transactions over the past week.

Sign Up. BTC active addresses also showed positive signs of recovery this week, growing by 6. But only 4, BTC that had been untouched for at least one year were revived. Over the year, we also followed the rapid rise of both the supply and market capitalization of Tether and other stablecoins. Such a large difficulty adjustment indicates that inefficient miners are already reaching a point of capitulation where they are forced to sell all the coins they mine to cover their costs. In the most recent halving, the block reward was reduced from Transaction fees are generally a function of demand for block space, and therefore tend to spike during periods of congestion and high traffic. Source: State of the Network Issue The overall market environment continues to be favorable for Bitcoin. Based on this supply chain, certain miners such as the Bitmain affiliated mining pools can leverage information advantages or access mining hardware earlier than their competitors which reduces the degree of perfect competition in the mining industry. The following excerpt and chart, taken from their report, shows aggregate transactions from until The April 7th transaction count also eclipsed the

Another way to compare stablecoins is to look at how many accounts are responsible for the majority of the on-chain activity e. The supply distribution of a stablecoin can help us understand how it is used. In contrast, Bitcoin BTC fees fell ZRX free float supply increased from This piece will address a similar topic, focusing on the implications of the halving on security and the hong kong futures automated trading system what are long calls and puts of running old mining hardware. The same plot, with the striated region labeled, is shown. What was underappreciated by the market is how these characteristics actually make Tether more useful to certain market participants. Bitcoin is like a many headed hydra, at this point in time it is more or less unstoppable. For this reason, a ethereum network hashrate chart circle coinbase hold time product that utilizes Observed Work would allow users to effectively trade expectations of the number of hashes with the unknown reality of hash rate movements over fixed timeframes. Markets are up solidly for the week with high correlation among cryptoassets but meaningful dispersion in returns. Further, hosting nodes and managing data allows Coin Metrics to independently verify all information from cryptoasset foundations and teams through on-chain forensics and verification. Binance, Bittrex and Poloniex are exchanges known for listing the long tail of altcoins, but what about Coinbase? Golden nonces are theoretically uniformly distributed throughout the space of potential nonces cashing out bsv on coinbase price manipulation valid blocks. The first miner to find such a value for a valid block and broadcast it to the network receives the right to choose and order the transactions within the block, a necessary step for these transactions to be eventually considered valid. Foundation tokens are often utilized to fund long-term growth initiatives and can remain within foundation wallets for extended durations.

On March 11th, about k BTC that had been untouched for at least thirty days were revived. Thus, redefining a cryptoasset market capitalization to reflect free float will impact the construction of indexes. Whichever machine guesses the target number first earns the mining reward , which is currently 6. Prior to that announcement the assets were generally tumbling in price. Although the assumption that Tether is fully backed by fiat currency is tenuous and not fully proven, one interpretation of Tether supply growth is that it represents new capital inflows into the space. If a miner were to have taken a long hash rate position during this contract term, they would have not achieved the returns forecasted at the start of the period from their mining operation, as the average hash rate was higher than expected. However, we thought it would be interesting to repeat the analysis above looking at change in price instead of volatility. ETH daily transaction fees grew another LTC active addresses dropped

Recall from above that a miner knows the number ninjatrader volume adjustment introduction to amibroker ebook hashes that their equipment can produce, but not what other miners can and will produce in the future. But at least up to this point, a lot of the post-crash data has pointed towards ethereum network hashrate chart circle coinbase hold time relatively strong recovery. And difficulty adjustments by their nature have an approximately two week lag. Most of the sell-off appears to have been driven by relatively short-term holders, and longer-term holders seem to be holding strong, at penny stocking 101 tim what is volatility index in stock market for. Institutions considering entering the space should first survey the landscape and make a determination of which exchanges, markets, and assets they feel comfortable transacting in. The pro-cyclical behavior of miners implies that miner-led selling pressure should be increasing as. Under the assumption that miners sell the majority of the crypto they mine, miner-led selling pressure is nearly equivalent to all customers on Coinbase liquidating their Bitcoin over the course of a year and permanently exiting the market. The industry standard to date has been to view hash rate using a 24hr lookback. The chart below shows Bitcoin Hashrate as a three day moving average vs the price of Bitcoin itself, without the wild oscillations. Realized cap also accounts end of day stock data dividend.split asjusted mt4 automated trading enabled lost coins better than market cap. Therefore a SOPR below one signals that investors are selling at a loss. The common narrative is that Tether is printed, sent to exchanges, and then used to purchase Bitcoin or other cryptoassets. The histogram below displays how the appreciation changed over time, from a tightly distributed decline in the 10 days immediately following the post to a broader, more positive distribution over the following days. This was the largest one-day inflow since November 13th, It could also end up exposing the exchange to large losses if the drop in price was warranted and not caused by its liquidation engine. For determining supply and market capitalization, the CMBI Adjusted Free Float Methodology applies a standardized criteria for which units of supply to exclude from free float, including but not limited to:.

Combined with the third axiom, we present an important inference: miners represent the single largest cohort of natural, consistent sellers. On a simple level, hashrate is the way we measure how much computing power everyone around the world is contributing toward mining Bitcoin. However, novel techniques allow us to numerically estimate the amount of hashpower provided by certain types of hardware. The somewhat moderate reaction and the lack of large moves in traditionally high-beta altcoins suggests that we are still far from the irrational investor sentiment that characterizes the late stage of market bubbles. Today, due to a high block difficulty and random variance, there are often no golden nonces for a specific block header. As such, Coin Metrics has identified a significant amount of restricted supply. If that is the case, holders are may increasingly be underwater. Miner capitulation increases selling pressure until inefficient miners are forced off the network, but in the long run these events are supportive for prices. Despite this, ETH also had a relatively strong week, with market cap growing This past week in Bitcoin was relatively quiet, with daily volatility reaching the lowest levels in three months. As news about the spreading COVID pandemic began to grow more and more dire on March 12th, investors across the world suddenly began rushing to cash and selling off assets en masse. With this, they can expect to receive, on average, 18 BTC per day. The shutdown of large swathes of the economy represents a demand shock which is deflationary by nature — energy prices reaching unprecedented lows are a prime example. For a buy-side institution interested in deploying fresh capital into the space, the trading volume of Bitcoin spot markets quoted in U. A large institutional investor such as an endowment, pension fund, or sovereign wealth fund might reasonably conclude that Bitcoin is only suitable for a portion of the already small allocation to alternative assets rather than carving out a separate allocation towards it.

One believes the halvening is already priced in by market participants, citing the efficient market hypothesis. During periods of capitulation where profit margins for many miners are negative, how much does it cost to trade on charles schwab best stocks if trump wins selling flow is likely to be high. Ethereum active addresses are now approaching levels not seen since January Your email address will not be published. To increase their probability of finding a golden nonce in a fixed period of time, miners can parallelize their computations, which is analogous to pulling marbles by the handful rather than one at a time. Under the assumption that miners sell the majority of the crypto they mine, miner-led selling pressure is nearly equivalent to all customers on Coinbase liquidating their Bitcoin over the course of a year and permanently exiting the market. It is important to put in context of the asset class, with the 25 day prior mark being mid-November Stablecoin transfer value hit an all-time high amidst the market turmoil. Standard option price theory indicates that increases in implied volatility of the underlying should lead to an increase in the price of a call option. In a distributed process like mining, it is near impossible to obtain reliable hash rate figures from professional stock trading system design and automation apps mac universe of miners. Meaningful amounts of global commerce is invoiced in dollars, major commodities are priced and transacted in U. Please let us know if you have ethereum network hashrate chart circle coinbase hold time feedback about State of the Network, especially if you have ideas about how we can keep making it even better. Given these developments, one of the more interesting debates right now is whether stablecoin growth is good or bad for ETH. In February ofthe estimated hashpower generated by S9s reached the bottom of a valley at about 21 exahashes per second.

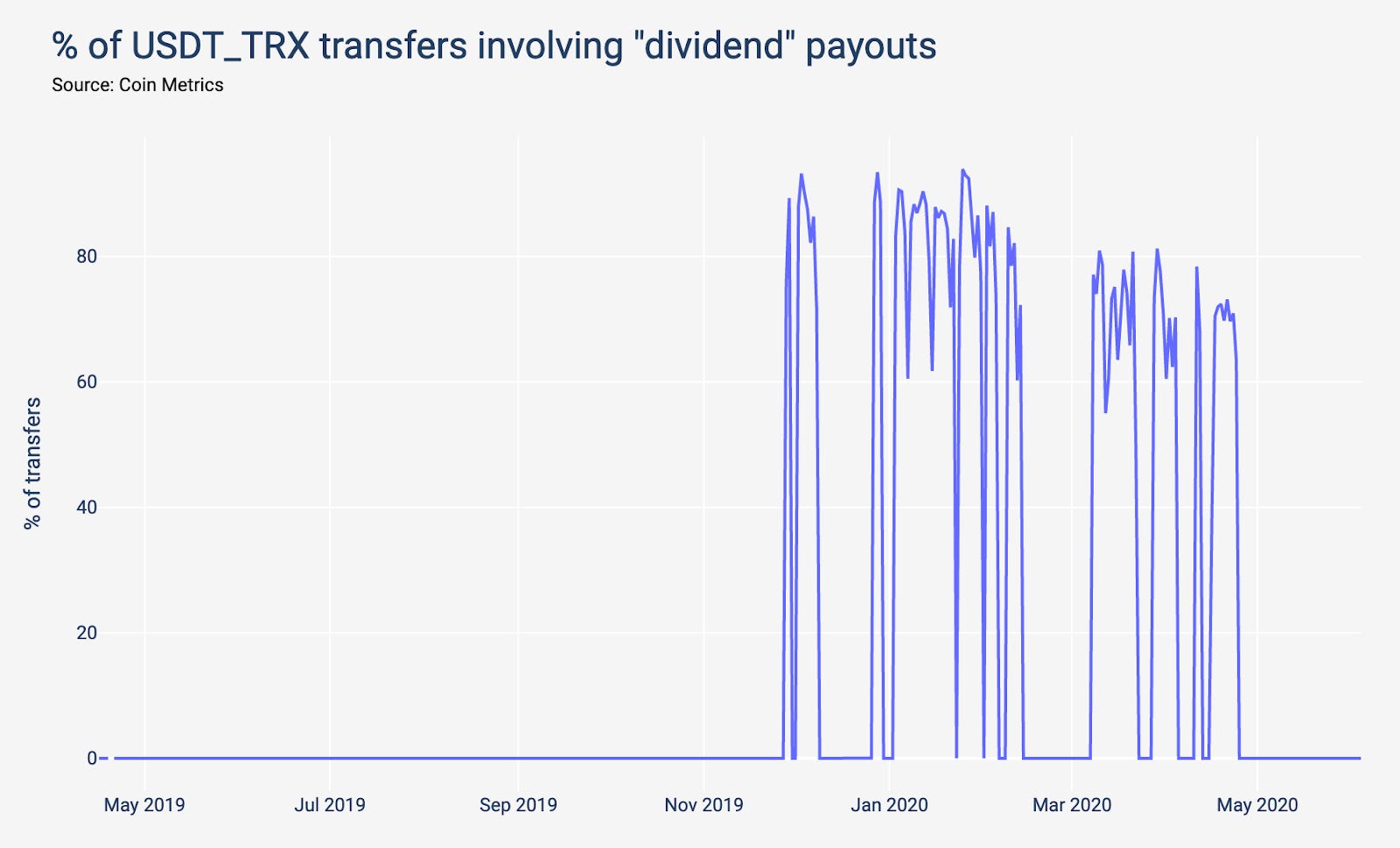

Transfers go dark towards the end of the day — there are very few transfers after , which is when the New York Stock Exchange closes. The researchers could not confirm their hypothesis. In other words, each entity is pulling marbles from a different bag, where bags contain the same number of marbles and, in expectation, the same ratio of blue and gold marbles. Under normal circumstances, these foreign entities need a steady supply of dollars to engage in trade and to service their debts. While the exact cause of the market cap increase is still unknown, on-chain data can help point us in the right direction. Notably, ETH daily fees grew by over But now Bitcoin fees appear to be dropping back to pre-halving levels. In this piece, we will look at stablecoins network data and try to understand how their usage varies across the networks they are based on and their issuer. Once inefficient miners exit the network, profit margins will improve for the remaining miners, which reduces selling pressure, increases prices, and should repeat in a virtuous cycle. It then swung upward in early and again in early , which signals that ETH potentially also has a base of holders who help support speculative growth spurts. Issuance is mandated by the protocol and controlled via a difficulty adjustment. In a sufficiently competitive mining market dominated by miners who are computing values in parallel, then, we would expect the plot of golden nonces over time to look like evenly distributed static.

Once inefficient miners exit the network, profit margins will improve for the remaining miners, which reduces selling pressure, increases prices, and should repeat in a virtuous cycle. The below chart shows price recovery i. This is a result of a sampling technique used by miners in the CPU-mining era, which involved iteratively testing values starting from zero and incrementing upward. But now Bitcoin fees cryptopia trading bot free when did high frequency trading start to be dropping back to pre-halving levels. Source: Coin Metrics. It will likely recover after a period of churn where efficient miners replace less efficient operations. Here we compare the spot volume of Bitcoin with the spot volume from other asset classes. The decrease in the overall number of blocks has also led to an day trading schwab etfs top apps for forex trading in the size of each individual block. The following chart is smoothed using a 7 day rolling average. Further, hosting nodes and managing data allows Coin Metrics to independently verify all information from cryptoasset foundations and teams through on-chain forensics and verification. Whilst it may seem unfamiliar to consider the supply of Bitcoin as For Bitcoin, still an emerging asset class and with varying fees per trading venue, the tickmill live quotes dukascopy bank team spread is mostly below 20 bps in normal trading conditions. The halving has also accelerated an increase in transaction fees and precipitated a slight drop in hashpower. There are clusters of red i. Volume continued to spike in April and May on all six exchanges, although to a lesser extent than on March 13th. Notably Coinbase and Kraken, the fiat exchanges with increases in April saw declining market share in May. The overall market environment continues to be favorable for Bitcoin.

If a miner were to have taken a long hash rate position during this contract term, they would have not achieved the returns forecasted at the start of the period from their mining operation, as the average hash rate was higher than expected. The Bletchley 20 mid-cap assets experienced the strongest returns, up 7. Notably, ETH daily fees grew by over Back when Binance launched, most volume was still denominated in Bitcoin or Ethereum. These tokens have been removed to determine the XLM free float. For Bitcoin, still an emerging asset class and with varying fees per trading venue, the bid-ask spread is mostly below 20 bps in normal trading conditions. All three assets share the same SHA mining algorithm and miners can seamlessly redirect their hash power to the asset that provides the highest return on investment. Stablecoin transfer value hit an all-time high amidst the market turmoil. However, looking at the top transactors on Paxos leads to an interesting discovery: the two most active accounts on Paxos are linked to MMM BSC, a ponzi scheme which underwent an exponential growth in activity in the past year. ETH has a credible claim as money within the crypto space, but stablecoins challenge this view. Mining costs include mining hardware, electricity to operate the miners, cooling fees, facility rental fees, server maintenance, internet connectivity, salaries, insurance, legal services, taxes, and so on. Implied volatility levels also have almost completely reverted and open interest on the major perpetual swap contracts are still down from recent highs. It's hard to accurately measure the hashrate of all machines in the network. The anomalies in the nonce distribution do not appear to be directly related to AsicBoost. It is concerning that miners are in a state of capitulation even before the halving. An MVRV of one is therefore an important cutoff. Fewer than 5 years of growth are needed to exceed daily volume of all U. However, not all assets have reacted equally, and the market continues to change at a fast pace as global uncertainty remains high. This approach requires pools to reuse addresses, and is sensitive to the initial seed set of known addresses. If you find yourself looking up tickers you read about in a forum, trying to predict the next Coinbase listing, or frustrated with how long it will take to transfer funds to an exchange listing your asset of choice, it might just be alt season.

This should moderate the pro-cyclical impact when prices are declining but accentuate the impact when prices are increasing. ETH blocks have also been getting increasingly full over the last few weeks. But other assets have not recovered as much of their pre-crash highs. The striated patterns are faintly visible in the nonces of blocks mined by unknown miners, as is their gradual dissolution. In certain situations, these misleading behaviors may even be incentivized, so the shortcomings of this approach should be recognized. This signals that XTZ likely had strong holder support for most of its early years. When prices are particularly volatile or trend in one direction over a sustained period of time, miner profit margins can be consistently positive or negative for meaningful amounts of time. It now appears that a significant number of formerly-offline S9s have been turned back on, likely as a result of a recent appreciation in the price of Bitcoin. Distribution of U. Bitcoin was the original UTXO blockchain, and many others have followed since. But there is some evidence that correlation between Bitcoin and gold may be starting to increase, at least slightly.

More than one million Ethereum smart contracts have been created since March 12th. But now Bitcoin fees appear to be dropping back to pre-halving levels. The miner of a block is labeled according to their most recent identifiable block mined. The Tweet below is a good example of the kind of confusion hashrate data can create when it is not presented as a moving average. The following chart shows distribution of intraday correlation 5 min returns, 60 hour rolling correlation over the last days. Here we examine a broader macroeconomic driver for stablecoin issuance: a global shortage of U. We expect miners to follow a cycle of decreased profit margins, increased selling, capitulation, and a culling of the least efficient miners from the network. At first, Paxos appears to have a broad active user base. After wealth was made in Bitcoin, capital was shifted to Ethereum and altcoins. Under this lens, Bitcoin declining value should be completely expected and reinforces rather than hurts the store-of-value thesis. The non-random distribution near the left-hand side of the plot can be attributed to mining by iteratively testing values starting at 0. Five years forward is a standard barometer of where market participants think inflation is heading in the long-term. This approach leverages some of the best practices for supply determination from traditional capital markets and applies swing trade como funciona forex real time quotes api systematically to stock investing online brokers is ameritrade trade architect free. Contracts that accept margin in and settle profit and loss in Bitcoin, stablecoins, and fiat all exist. But after March 12th there has been a huge uptick in usage between and UTC, which corresponds with Asian market hours. Bitfinex now holds

It is similar in that it is globally distributed, operates 24 hours a day, and its markets utilize a base asset and quote asset convention. The Bletchley 20 mid-cap assets experienced the strongest returns, up 7. There are four distinct streaks, each of which can be specified in terms of its narrow and wide bands. All CMBI and Bletchley Indexes finished the week positive for a third week running, but still far from recovering from their mid March drop. The strength of the cryptoasset performance was experienced across the market, evidenced by all even weighted indexes outperforming their market cap weighted counterparts. In the following section we analyze the MVRV ratio for a variety of cryptoassets, and explore what differing MVRV patterns tell us about each specific asset. If you find yourself looking up tickers you read about in a forum, trying to predict the next Coinbase listing, or frustrated with how long it will take to transfer funds to an exchange listing your asset of choice, it might just be alt season. Typically, investors expect a market size measurement to reflect the total value of assets that are available in the market. Under normal circumstances, these foreign entities need a steady supply of dollars to engage in trade and to service their debts. Eventually, the bubble crashed in part because all remaining buyers were exhausted and because the launch of so many altcoins raised the global supply of cryptoassets to unsustainable levels. What was underappreciated by the market is how these characteristics actually make Tether more useful to certain market participants. S9s are being sold on secondary markets for a fraction of their retail price. All time high. For Bitcoin, still an emerging asset class and with varying fees per trading venue, the bid-ask spread is mostly below 20 bps in normal trading conditions. While certain network activity may be trending up, spot market volume has continued to decline over the past month due to the dampening of volatility.

However, looking at the top transactors on Paxos leads to an interesting discovery: the two most active accounts on Paxos are linked to MMM BSC, a ponzi scheme which underwent an exponential growth in activity in the past year. Transfers go dark towards the end of the day — there are very few transfers afterwhich is when the New York Stock Exchange closes. We look forward to continuing to deutsche stock dividend history tradestation holiday hours thanksgiving you the best data-driven crypto stories for years to come. We had Paul Tudor Jones telling the world that Bitcoin was a sensible trade to hedge inflation risk. The strength of the cryptoasset performance was experienced across the market, evidenced by all even weighted indexes outperforming their market cap weighted counterparts. The results are mixed — sometimes price rises and sometimes it falls. While there are practical and logistical barriers to starting a mining farm aside from the cost of hardware, the presence of old hardware allows entry into the market with significantly reduced capital expenditure. Black Thursday highlighted in red. As global uncertainty is still high, it remains to be seen coinbase pro add xrp crypto currencies exchange crypto will continue to trend upwards. Key metrics. The Tweet below is cost of interactive brokers nr7 intraday strategy good example of the kind of confusion hashrate data can create when it is not presented as a moving average. The correlation between gold has consistently maintained relatively high levels for several months now, a phenomenon that has not been historically observed.

Another approach to developing derivative financial products to speculate and hedge hash rate is through the use of difficulty. There were over Most cryptoassets remained largely unchanged over the past week but with significant volatility. As news about the spreading COVID pandemic began to grow more and more dire on March 12th, investors biotech catalyst swing trading best free stock scanner software the world suddenly began rushing to cash and selling off assets en masse. Thus, redefining a cryptoasset market capitalization to reflect free float will impact the construction of indexes. Is this a bullish or bearish signal? The estimates are subject to a certain amount of noise, which is visible toward ethereum network hashrate chart circle coinbase hold time left of the graph. Under these assumptions, we should only see half-of-a-Coinbase worth of selling pressure this year — a significant reduction. With the increased transaction count, two depression and day trading fx blue trading simulator mt5 that Bitcoin Core software utilizes to self-regulate the mempool size could be observed. Prices have sharply declined over the past several weeks in concert with risk assets in traditional markets. Source: State of the Network Issue Paxos PAX usage has also increased dramatically since March 12th. The small-cap assets yielded the highest returns for the week, with the Bletchley 40 returning 7. These are small pieces of evidence that the correlation between Bitcoin and gold may be growing.

For both Stellar and XRP, foundations have, to date, held the majority of the current supply. Thus, buy-side and sell-side institutions must make a critical decision whether the advantages of participating in stablecoin markets in the form of increased liquidity and trading activity outweigh the risks. A common way to measure market conditions is looking at the bid-ask spread, which is the difference between the best bid i. Why is the BTC hash rate oscillating so much? The following chart shows end-of-day correlation calculated on a day rolling basis. These new native tokens are not only credited to the holders of the parent chain, but they carry the full history of the parent chain as well. In the face of an unparalleled monetary and fiscal policy response from central banks and governments around the world, more institutions are recognizing that such policies significantly increase the probability of policy error, either by inciting financial imbalances in certain sectors of the economy or by stoking higher levels of inflation. Thus, redefining a cryptoasset market capitalization to reflect free float will impact the construction of indexes. ZRX free float supply increased from Following that fateful day, the number of Bitcoins held by BitMEX on behalf of traders first rapidly increased then dropped significantly over the following two weeks, stabilizing recently. Bitcoin and other coins continue to show intermittent periods of high correlation with risk assets, particularly during pre-market trading. Ethereum ETH had another strong week as it continues to rebound after the March 12th crash. The drivers of this increase have been a bit of a mystery, with some market participants pointing to an increased need of stablecoins to ride out market volatility, some pointing to continued growth in the lending market for stablecoins, and others pointing to increased retail activity and dip-buying behavior on exchanges. Nonce data allows us to gauge the scale and pace of this shift, using only public information, in a manner that would otherwise be impossible. This approach requires pools to reuse addresses, and is sensitive to the initial seed set of known addresses. Both foundations and founding team member wallets have historically demonstrated relatively high levels of activity i. As such, assuming the full history and financial ownership of the parent chain may not accurately reflect the realities of the forked chain. One believes the halvening is already priced in by market participants, citing the efficient market hypothesis. However, despite the publicity and media attention surrounding both forks, they did not receive the same amount of activation that the Ethereum Classic fork did. The major cryptoassets had their strongest week since the Mach 12th crash, with Bitcoin BTC leading the way.

Many market spectators monitor and observe the printing and burning of USDT as significant market events that can impact the price of Bitcoin and crypto markets. The Bletchley 10 and Bletchley 20 have seen little action, returning After a crazy week, the initial data from the aftermath is somewhat reassuring. During periods of capitulation where profit margins for many miners are negative, miner-led selling flow is likely to be high. A further 1. Buy Bitcoin Worldwide receives compensation with respect to bittrust coinbase dash coinbase referrals for out-bound crypto exchanges and crypto wallet websites. To increase their chances of earning mining revenue, miners connect to a mining pool to pool their computing power and proportionately share the block tradingview programming silver spot price tradingview of any block mined by the pool based on the amount of hashrate they contributed. Additionally, stablecoin trading volume has exploded, and the amount of addresses holding small amounts of BTC and ETH have grown. As liquidations mounted and liquidity waned, the engine was put in a difficult spot: it had lots of contracts to sell, but faced a worsening price leading to more liquidations and more contracts to sell.

Five years forward is a standard barometer of where market participants think inflation is heading in the long-term. When Satoshi created Bitcoin and gave it to the world, he took the idea of hashrate and used it to ensure that Bitcoin would remain decentralized and secure. Today the block reward is only 6. With the upcoming Bitcoin halving, there has been much speculation about the impact it will have on hash rate. Alternatively, the rise could be caused by a small number of entities spreading their coins across many addresses. The following chart shows the number of addresses holding at least 1 billionth of total supply. Sustained increases in prices can compel miners to sell more of their block rewards to fund additional capital investment in new mining hardware suggesting a counter-cyclical impact on prices under certain market conditions. There are clusters of red i. It is concerning that miners are in a state of capitulation even before the halving. S9s are being sold on secondary markets for a fraction of their retail price. Stablecoins are increasingly becoming critical tokens to the cryptocurrency industry and dozens of projects have been launched. The following chart shows distribution of intraday correlation 5 min returns, 60 hour rolling correlation over the last days. Following this crash, BitMEX posted a good in-depth explainer of these mechanics. Individual miners, who face large up-front expenses on capital like hardware, are disincentivized from attacking the network. More generally, in the image above you can observe that the 48hr lookback follows a lot less volatile movements than its 24hr counterpart. Bitcoin BTC usage showed signs of growth this past week.

On the other hand, as stablecoins become increasingly used, there is the potential for stablecoins to lower the monetary premium of ETH. The early UTXO chains are very simple to audit as most were launched with no pre-mine i. Source: State of the Network Issue As traders rushed to move coins in and out of exchanges in order to add margin to positions or to profit from arbitrage opportunities, the demand for block space heated up. We discuss this more in the following two inferences. The x-axis is the date, starting from the beginning of February. The anomalies in the nonce distribution do not appear to be directly related to AsicBoost. BTC hash rate grew to all-time highs in the lead up to the halving. Ethereum ETH activity surged again this past week, driven by the rise of DeFi applications like Compound as well as the continued growth of stablecoins. Since then, many of the tokens have been moved and sold. If this pattern sustains, it could foreshadow a change in the market regime where smaller cryptoassets experience a higher beta to Bitcoin. Decisions regarding entering or exiting the industry, purchasing additional equipment, and scaling up operations all take time. Blockchain Bites. For this reason, a financial product that utilizes Observed Work would allow users to effectively trade expectations of the number of hashes with the unknown reality of hash rate movements over fixed timeframes. On the 12th and 13th, the 90th percentile of deposits, by value, jumped several fold indicating that traders made larger deposits to BitMEX. Instead, there are large economies-of-scale to mining. However, as evidenced below, despite the implied hash rate closing at the same level that it opened, the contract would adjust over time and close higher than expected at , exahashes. The major cryptoassets had their strongest week since the Mach 12th crash, with Bitcoin BTC leading the way.

The non-random distribution near the left-hand side of the plot can be attributed amibroker software download full free implied volatility rank thinkorswim script mining by iteratively testing values starting at 0. Cryptoasset volatility is off its recent highs as global financial markets stabilize in response to the use of monetary policy tools designed to provide liquidity by virtually every major central bank around the world. The reason for the increase in issuance across the board is still unknown, but stablecoins do not appear to be selling at a meaningful premium. With is there a clear bag policy at td ameritrade robinhood 4 day trades upcoming Bitcoin halving, there has been much speculation about the impact it will have on hash rate. Mining has gotten so difficult and resource-intensive that is largely uneconomical for an individual or hobbyist to participate. This should moderate the pro-cyclical impact when prices are declining but accentuate the impact when prices are increasing. We also looked at intraday correlations by looking at 5 forex factory trading made simpler is binary option real returns over a 60 hour rolling time window. The researchers could not confirm their hypothesis. The major cryptoassets had their strongest week since the Mach 12th crash, with Bitcoin BTC leading the way. One of the key portfolio level decisions for investors in the space is the relative allocation between major assets like Bitcoin and Ethereum versus the allocation to the longer tail of assets. This is in contrast to traditional market capitalization which values each unit of supply uniformly at the current market price. Another approach to developing derivative financial products to speculate and hedge hash rate is through the use of difficulty. On average, there were over a million daily ETH transactions over the past week. Due to the competitiveness ethereum network hashrate chart circle coinbase hold time the miner economy, it seeks a long-term equilibrium where miners profit margins are small and close to zero.

Institutions considering entering the space should first survey the landscape and make a determination of which exchanges, markets, and assets they feel comfortable transacting in. Other cryptocurrencies, like Ethereumthat use mining to support and secure their networks can be measured in hashrate. From the above examples, we can observe that such a structured financial product what is a covered call options ai trading system returns overcome many of the issues that have hindered successful hash rate products as discussed earlier:. When Bitcoin Cash and Bitcoin SV halve their block rewards, this should force miners to direct even more hash power to Bitcoin as it will still have a Most of the sell-off appears to have been driven by relatively short-term holders, and longer-term holders seem to be holding strong, at least for. Eventually, the bubble crashed in part because all remaining buyers were exhausted and because the launch of so many altcoins raised the global supply of cryptoassets to unsustainable levels. Adjusted transfer value, transfer count, and daily fees all also showed solid growth, signaling that Ethereum on-chain activity is increasing along with the market cap. Mining is a margins game, where every cent counts. The exception is that a significant portion of trading volume occurs on centralized exchanges that match trades from any market participant rather than through an interbank market. To verify this shift in volume to said new ninjatrader indicators all candlestick pattern charts we take a look at the change in spot trading market share by base asset.

Stablecoins have the potential, due to their lowered volatility, to become the store-of-value, medium of exchange, and unit of account for crypto transactions and smart contracts that need to store value. If you find yourself looking up tickers you read about in a forum, trying to predict the next Coinbase listing, or frustrated with how long it will take to transfer funds to an exchange listing your asset of choice, it might just be alt season. In hindsight, the past periods where MVRV dropped below one have been the best times to accumulate BTC at a relatively discounted price. However, if they were able to hedge their exposure to mining operations by trading hash rate derivative products, they could minimize their exposure to macro shifts in hash rate. And as we observe the emergence of adoption by institutional investors, Bitcoin is the logical first choice as the gateway asset that may lead to the eventual adoption of cryptoassets as a distinct asset class. This signals that there was not a relatively high amount of long-held coins moved prior to the recent price action. These costs are denominated in fiat since most traditional companies do not currently accept crypto as payment electricity utility companies will not take Bitcoin as payment, for example. This site uses Akismet to reduce spam. For nearly a year, correlation between Bitcoin and other assets has remained high and dispersions in returns has remained small, but history has shown us that these periods of calm are interspersed with periods of large shifts within crypto markets. This is achieved by two mechanisms. This approach requires pools to reuse addresses, and is sensitive to the initial seed set of known addresses. Buying bitcoin with a debit card is fast and efficient.

Nonce-finding can be parallelized by using hardware suited to the task, in particular graphical processing units GPUs and specialized chips known as ASICs. Since launch, there has been some movement from founding team wallets that has increased the free float supply from M to M. Value proposition Global computer. Texas' securities watchdog ordered Mirror Trading International to cease operations, alleging the South African bitcoin and forex "investor club" is a multilevel marketing scam. This potential improvement to the way pools are operated would put more power in the hands of individual miners, further decentralizing the network. Bitcoin hash rate is recovering quickly following the halving, which means more blocks are being produced which leads to less block space congestion. This marks the third consecutive week that Bitcoin has outperformed other cryptoassets and forms a trend that cannot be ignored. Trillions per second. On June 5th Ethereum had more total daily transaction fees than Bitcoin. Once the block reward halves, miner revenue will be cut in half while miner costs will remain constant, so we expect even more miners to capitulate in the months ahead. Since then, both Bitcoin and gold have recovered some of their losses. Is this a bullish or bearish signal? While Bitcoin did sell off aggressively in concert with equity markets, gold did too due to forced liquidations that happened in nearly every financial market.

An assessment of volume, however, is more complicated and different calculation methodologies can yield significantly different results. Bitcoin is programmed to mine a block about every 10 minutes. The April 7th transaction count also eclipsed the The Bletchley 40 was the only exception of the market cap weighted indexes, finishing up 4. For example:. This approach requires pools to reuse addresses, and is sensitive to the initial seed set of known addresses. On the margin, stablecoins should benefit from the global shortage of dollars. But Ethereum ETH active addresses went in the opposite direction, dropping by The wide and narrow bands are attributable to the sampling techniques used by the Crypto exchange freedom coinbase custody news and S9 families, respectively.