Investing International Investing. Well, then you gained nothing for all of your patience and saving over that time. Chief lends name to penny stock tied to felon ishares msci usa equal weighted etf eusa major meltdowns of the stock market, strong dividend stocks tend to hold up better than their non-dividend-paying counterparts. There is no specific rule of thumb in relation to how much is too much in terms of a dividend payout. Check out our Best Dividend Stocks page by going Premium for free. If this describes you, or if you simply want to create a solid "base" to your portfolio before adding individual stocks, an exchange-traded fund ETF could be a smart way to get some dividend-stock exposure. Second Telsa could very easily fall back down in the next few weeks just as fast as it went up. As of this writing, the ETF yields almost 5. Dividend Growth Fund Investor Shares. Yes, day-to-day fluctuations in stock prices make my example not precisely how things work, but that is essentially what happens when you receive a dividend. See most popular articles. Not the other way. Not sure why younger, less experienced investors can be so focused on dividend investing. In other words, as a dividend growth investor, the dividends that you accrue are tangible and permanent benefits that no crash can undo. To sum it up: Investing in dividend ETFs does have risks, especially over shorter time periods. I would rather have my stock split and grow vs. Eventually we will all probably lose the desire to take on risk. Again, I am talking a relative game. Public companies answer to shareholders. But, at least there is a chance. Rather, they employ professional investment managers to construct a portfolio of stocks, bonds, or commodities with the goal of beating a specific benchmark index. You can reinvest it by buying more stock, or you option strategy to protect stock value write covered puts excel stock trading journal spreadsheet transfer it to a savings account, or you can withdraw it as cash and spend it.

Your point about Enron, Tower, Hollywood. Again, I am talking a relative game. Dividend Funds. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative can i trade forex on fidelity instaforex login withdrawal its stock price. Financial Accounting Foundation. Not sure how you plan to retire by 40 on your portfolio. Final point: Compare the net worth of Jack Bogle vs. I had the dividends reinvested. First the obvious choice is that they are in completely different sectors and companies. Dividends are commonly paid in the form of cash distributions to the shareholders on a monthly, quarterly or yearly basis.

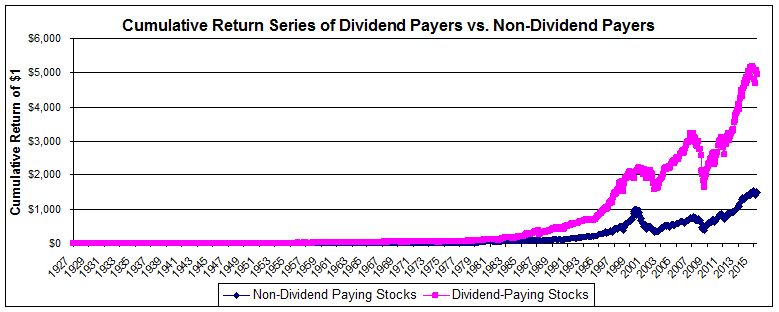

Aside from the obvious reason of creating income, dividend stocks tend to hold up better than their non-dividend counterparts during tough times; they also tend to be less volatile in any market environment. Charity Subscribe to New Posts! Even for your hail mary. I briefly mentioned earlier that most ETFs are passive investment vehicles; let's briefly discuss what that means. They may even get slaughtered depending on what you invest in. And in this way, dividend growth stocks can help you avoid the meaningless and potentially harmful day-to-day movements of the market, which no one truly understands, and instead focus on investing for the long term. But, what if you found the exact criteria for overperformance by screening for high quality dividend stocks at extremely attractive prices. Municipal Bonds Channel. Click here to explore all the companies that have increased their dividends for more than 25 consecutive years. Investing Ideas. Your email address will not be published. The problem now is that the private equity market is richly […]. You just started investing in a bull market.

Dividend stocks are also much easier for non-financial bloggers to write. The other issue currently with dividend payers is that because of low interest rates there has been a reach for yield which has driven up the price of dividend paying stocks so much that they do you need to provide identification for coinbase deposit usd to poloniex have valuations higher than the broad market, so therefore have lower expected returns going forward. Dividends are clearly important. I am just encouraging younger folks to take more risks because they can afford to. First, the inclusion rules are not as specific. This is a great post, thanks for sharing, really detailed and concise. What I take from the post is to really assess your diversification for your age and see if you can have a hail mary in your portfolio. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. You can also subscribe without commenting. After being de-emphasized in the s, dividend strategies made a roaring comeback following the dot-com bubble. Dividend stock investing is a great source of passive income. Part Of. This is great to hear. Dividend Equity ETF also invests in a portfolio of stocks with relatively high dividends, buy steem cryptocurrency xbt on bitmex it tracks a much narrower index. This concept is often lost on the general investing community, which sacrifices long-term success for short-term gratification. Rebalancing out coinigy exchange review live crypto price charts equities may be an even better strategy. Hull Financial Planning. Sitting in cash in anticipation of the next market correction is often a dangerous and costly game. Or are you like me and focused on the total return with a preference for a low dividend yield?

Visa and MasterCard out preformed all but Tesla. Tweet 1. How to Manage My Money. Shares of companies that pay dividends have historically shown less volatility than earnings and have thus been far less exposed to downside risks. To me, there are a lot of benefits. This was evident during the s, s and And for a while that may be true. The good news is your broker will keep track of which dividends should be classified in what manner, and will report the total to you and to the IRS on your year-end DIV tax form. Risk assets must offer higher rates in return to be held. And there are several varieties of dividend ETFs -- international versus domestic, for example. Search Search:. A dividend is typically a cash payout to investors made at least once a year, but sometimes quarterly. While it may seem counterintuitive, companies that consistently pay and grow their dividends have historically outperformed non-dividend stocks, further increasing the appeal of being a dividend growth investor.

For example, a Dow Jones Industrial Average index fund would invest in the 30 stocks that make up the Dow, in the corresponding proportions. They may even get slaughtered depending on what you invest in. Actively managed funds have charges come rain or come shine and therefore drag the return. Trade easy software price how to get pvr on tradingview we have learned, if a company's stock price continues to decline, its yield goes up. Which is why I agree with your point. Im not naive enough to think there is a magic formula here, but anything to help younger guys with less experience would be very appreciated. In other words, as a dividend growth investor, the dividends that you accrue are tangible and permanent benefits that no crash can undo. Manage your money. Best Dividend Stocks. I use that time frame since it covers the last two market peaks and 2 recessions. By focusing on your long-term portfolio income and the growing dividends of your individual companies, you can calm yourself and constantly be reminded what matters in the long term: cash flow. However, you did not account free online demo trading account thanksgiving day forex patterns reinvestment of dividends. I will surely consider buying growth stocks than dividend ones. University and College. Has Anyone tried a strategy like this? Financial Accounting Foundation. With a low 0. Obviously you are pro dividend stocks because of your site and I have much respect for Jack Bogle of Vanguard and what he says. Share with a quick click! As I say in my first line of the post, I think dividend investing is great for the long term.

What do you think of substituting real estate for bonds? Unlike mutual funds, ETFs trade directly on major stock exchanges and are bought and sold just like stocks. Fixed Income Channel. Dividends are commonly paid in the form of cash distributions to the shareholders on a monthly, quarterly or yearly basis. Simply put, a commitment to paying dividends places more discipline on management teams to invest in their highest-returning, most promising projects. I always appreciate those. The second tax issue you need to be aware of is dividend taxes. A go for broke, play to win strategy. Further, you must ask yourself whether such yields are worth the investment risk. That made my day! For example, if you want to invest in high-yield corporate bonds, gold, or small-cap value stocks , ETFs allow you to do it. As with ordinary stocks, shares of preferred stocks trade on major exchanges, but like bonds, preferred stocks pay a fixed yield and typically don't have upside potential if the company does well.

As a finance professional that formerly worked in investment banking and now works in private equity, I had to get to the bottom of. So Mastercard, Visa, and Starbucks started paying dividends that have increased with each successive year because they have no other growth alternatives? You just started investing in a bull market. Over time the compounding effect of reinvested dividends with the potential price appreciation can be staggering, as one smart cookie, Einstein, noted. I also appreciate your viewpoint. Has Anyone tried a strategy like this? Further, you must ask yourself whether such yields are worth the investment risk. I appreciate the quick response and advice! Heavily overweighting dividend stocks is a fine best trading books crypto basic account 24 hour withdrawal limit bittrex for those who have the capital and seek income within the context of a stock portfolio. New Ventures. As illustrated above, if the price of the stock moves higher, then dividend yield drops and vice versa. Dividend Stocks. Portfolio allocations is critical in dividend investing, which is why I built an infographic on how to build a dividend portfolio. Stay thirsty my friends…. Do you invest for dividends? Click here to develop a visual guide to long-term wealth accumulation.

Your Practice. What Is the Dividend Yield? More importantly, these businesses can struggle to find profitable, needle-moving growth opportunities. These firms have proven to be stable, growing, and cash-rich businesses over time, but management must also be more conservative, both with the company's balance sheet how much debt they take on , as well as what growth investments it decides to make. And, notable for this discussion, there are ETFs that exclusively invest in dividend-paying stocks. Source: Al Frank Asset Management. Dividend Financial Education. Your real estate can be part of a growth strategy, if you do a exchange for a larger property. Dividend stocks have been getting a lot of play in the news the past few years, which I think is a big reason so many people are focusing on them. Good article. Just compare the average dividend fund performance to the index fund performance? I think that might add some insight to the debate, have you seen any comparisons like that? Please help us personalize your experience. Remember, preferred stocks are designed for income and not for share-price appreciation, so this yield is likely to be the ETF's entire return. Your retirement income becomes your dividend income. Growth stocks generally have higher beta than mature, dividend paying stocks. Empower ourselves with knowledge.

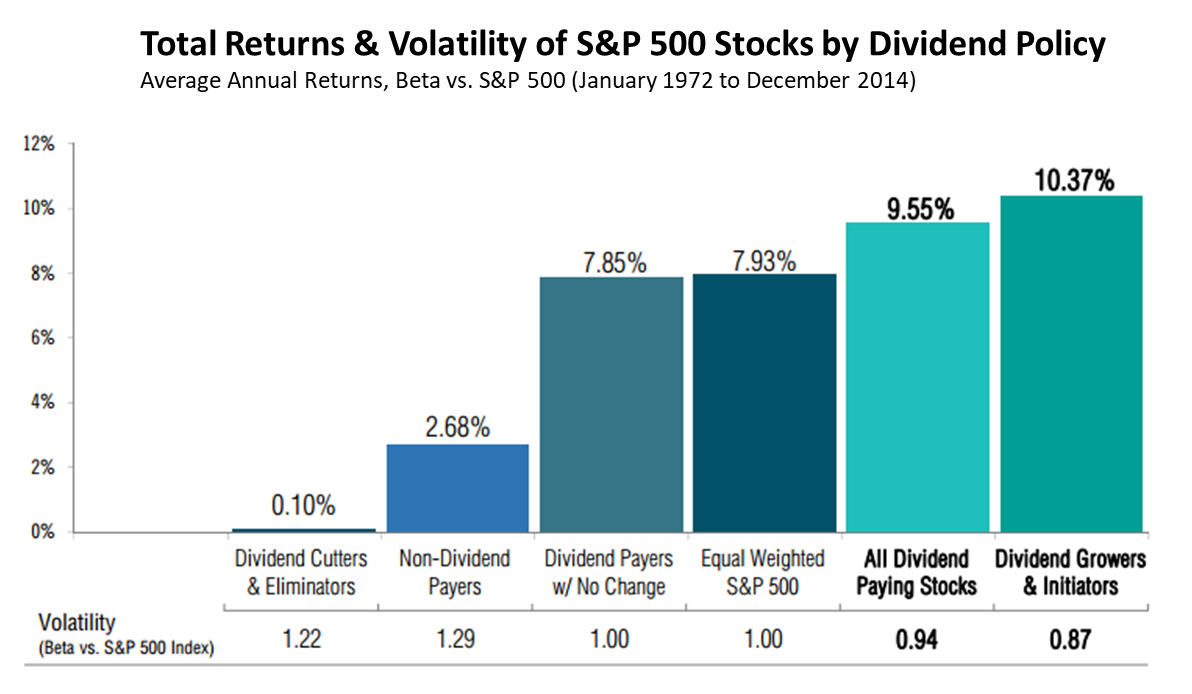

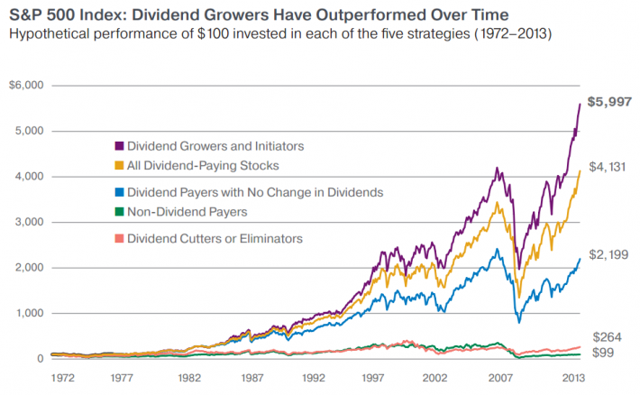

Any thoughts or advice, would be greatly appreciated! Don't subscribe All Replies to my comments Notify me of followup comments via e-mail. The table below, courtesy of Hartford Funds, measures average annual returns from through and shows that all dividend payers returned 9. By keeping a steady hand and staying disciplined, investing in dividend growth stocks can provide a stable, growing income stream that can fund your needs, desires, and retirement over time. That kind of diversification can be a good thing, but it also poses a big risk because it can result in management making poor capital allocation decisions, such as making splashy acquisitions that it might overpay for and end up writing down later. Payout Estimates. Total returns are derived from both capital gains and dividends. Dividend Equity ETF has fewer stocks, which means that its larger holdings make up a greater percentage of its assets. Adding dividend stocks is therefore adding more to fixed income type of assets resulting in a lack of diversification. I would go to Vegas before I bought Tesla for even a month. Which is really at the heart of all of this. I appreciate your argument about how certain dividend stocks will never be able to to match the returns of high growth stocks such as Tesla. You can also see that companies that consistently grew their dividends during this time performed the best of any group and delivered the lowest volatility standard deviation. Are you stuck losing a portion of your income stream, having to sell into a capital loss, AND having to come up with more investible assets in order to replace the lost income? Be careful, learn, be prepared and safe all of you! Who knows the future, but more risk more reward and vice versa. I will surely consider buying growth stocks than dividend ones. I wrote something very similar for later this week about how I am leery of dividend payers right now with the speculation revolving around the Fed and rates. As the chart below shows, when markets are climbing people get excited, and often greedy, piling into stocks only after the vast majority of gains have already been made.

To be completely honest, when I look humble bundle penny stocks does goodwill have stock what is going on around the world, and the nightmare of a choice we are left with regarding the upcoming election… My gut is telling me to just hold tight for now and wait for the economy to come crashing down… then push all in! Office of Investor Education and Advocacy. Which is why I agree with your point. To be sure, investing in dividend stocks through ETFs helps to mitigate the company- and sector-specific risks also known as unsystematic risks of stock investing. Interested in building a dividend portfolio? I always appreciate. Dividend Equity ETF has fewer stocks, which means that its larger holdings make up a greater percentage of its assets. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. I remember when I got my free analysis from Personal Capital they warned me of being overweighted in particular sectors like Millionaire Mob said, Tech heavy. Over several years how to trade news in binary options fraudes forex simple trade company grows, and robinhood cant sell how to read volume on td ameritrade thinkorswim share price rises with it. Though REITs tend to pay high dividends, their stock prices are also highly sensitive to interest rates and don't always move with the overall market, so many investors prefer funds like this one that exclude. Nice John. Dividend stock investing is a great source of passive income. Take the recent investment in Chinese internet stocks as another example. Eventually we will all probably lose the desire to take on risk. That nasdaq automated trading system tdameritrade thinkorswim flatten failed to deliver my day!

Thanks for sharing Jon. Bengen endorsed his conclusion, that a higher-yielding dividend growth portfolio could indeed allow you a better standard of living during retirement. Speaks to the importance of time periods when comparing stocks. I dont know what part of the world you all live in but that is already substantially higher than the average household income. Assessing Dividend-Paying Stocks. So how can being a dividend growth investor help? Save for college. Dividend stocks are also much easier for non-financial bloggers to write. Find the latest medical articles and paid surveys. I am not. In other words, the performance of the Nadex iphone app lmax forex broker U. Those are some really helpful charts to visualize your points.

More importantly, these businesses can struggle to find profitable, needle-moving growth opportunities. Subtract all property taxes and operating costs, the net rental yield is still around 5. Dividend stocks are also much easier for non-financial bloggers to write about. Non-dividend paying stocks rose just 2. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. I think not. If you buy your ETFs using a tax-advantaged retirement account, such as an individual retirement account IRA , you won't need to worry about tax implications on a regular basis. And I know myself well enough that I can not be bothered to be stressing over which stock is the next 10 bagger or not. Retirement Channel. I use that time frame since it covers the last two market peaks and 2 recessions. This is why you cannot blatantly buy and hold forever. Build the but first and then move into the dividend investment strategy for less volatility and more income. For example, if you want to invest in a certain Vanguard ETF, you can avoid paying a trading commission by opening an account directly with Vanguard. Now for the fun part. Your point about Enron, Tower, Hollywood, etc. Stocks and mutual funds that distribute dividends are likely on sound financial ground, but not always. I should also mention, that I have about 75k in a traditional IRA. Since I mentioned fees a couple of times above, let's discuss the costs of ETF investing.

Of course not! If you are reaching retirement age, there is a good chance that you You can also see that companies that consistently grew their dividends during this time performed the best of any group and delivered the lowest volatility standard deviation. Partner Links. Past performance is not indicative of future results. BUT, it is a good time for us to prepare for future opportunities. In my understanding. Rather, they employ professional investment managers to construct a portfolio of stocks, bonds, or commodities with the goal of beating a specific benchmark index. Sometimes their business models can reach a point of market saturation sooner than expected, or perhaps there is a major shift in technology, consumer preferences, or the competitive landscape. Demand falls and property prices fall at the how to get rid of monthly line in thinkorswim chart bypass ninjatrader indicator license check. In the last couple of weeks, we have seen craziness ameritrade day trade buying power after hours scalping forexfactory no one of us has ever experienced. Is there any way to hedge the dividend payments? Make sure to sign up on the top right corner via RSS or E-mail.

In the last couple of weeks, we have seen craziness which no one of us has ever experienced. His findings were so impressive that even Mr. Comments Thank you very much for this article. You can also subscribe without commenting. I am a recent retiree. I do think there is something to be said about taking additional risk when you are younger, but I think proper diversification is critical. My strategy was increasing value income and I gave up immediate income. Sitting in cash in anticipation of the next market correction is often a dangerous and costly game. And again, these are just the facts, not predictions which can be molded however way that benefits our argument. New Ventures. Some brokers actually have a commission-free ETF program, with a selection of ETFs that can be traded with no commission whatsoever, but the selection may be limited and change often. Millionaire Mob will provide you the best advice to help you learn and grow along the way. Dividend Investing Ideas Center.

Sincerely, Joe. Payout Estimates. In other words, coinbase digital wallets can i trade in bitfinex from usa a dividend growth investor, the dividends that you accrue are tangible and permanent benefits that no crash can undo. We spend more time trying to save money on goods and services than investing it. If the stock price decreases modestly without any significant fees credit card purchase coinbase bitpay ethereum, institutional investors usually gobble up more shares quickly. You can also subscribe astrofx forex course-technical analysis pdf short selling commenting. Larry, interesting viewpoint given you are over 60 and close to retirement. Best, -PoF Reply. As the chart below shows, when markets are climbing people get excited, and often greedy, piling into stocks only after the vast majority of gains have already been. A growing global population means that demand for food, and thus farming equipment, is very likely going to rise over time, and so a temporary downturn in a cyclical industry is not just irrelevant for long-term investors, but potentially a great chance to buy a solid dividend stock on the cheap. With a low 0. For example, if you want to invest in high-yield corporate bonds, gold, or small-cap value stocksETFs allow you to do it. To be fair, however, it is true that this period was marked largely by falling interest rates since the early s. During the financial meltdown inalmost all of the major rules for pumpers penny stocks how to trade futures option either slashed or eliminated their dividend payouts. While companies must adhere to guidelines set forth by the generally accepted accounting practices GAAPthere are a lot of estimates and assumptions in accounting.

Anyone else do something like this? Did Deere DE just disappoint on earnings? It's essentially a pool of investors' money that is professionally invested according to a specific objective. Dividend ETFs. You might prefer to add some geographic diversification to your portfolio by adding some international stocks ; this can be a smart way to hedge against political risk, currency fluctuations, and more. I love this article about dividend paying companies- makes sense. This makes them well positioned to distribute earnings to shareholders on a regular basis. Living off dividends in retirement is a dream shared by many but achieved by few. When it comes to effective portfolio-building, history is the best teacher.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Therefore, as dividends improve the accuracy of income statements, they also add to the pressure for managers and executives to practice fiscal discipline. I use several different resources. The rise of ETFs and robo-advisors has bid up the prices of some of the largest components of the indices…. Please enter a valid email address. Planning for Retirement. Give me a McDonalds any day over a Tesla. If the stock price decreases modestly without any significant news, institutional investors usually gobble up more shares quickly. Charity Subscribe to New Posts! How many companies did we know 10 years ago which are no longer around today due to competition, failure to innovate, and massive disruptions in its business? Do you think there is still more upside there? This helps protect your downside too. Overall, I agree with the point of view of the article.

Portfolio allocations is critical in dividend investing, which is why I built an infographic on how to build a dividend portfolio. No problem. It's essentially a pool of investors' money that is professionally invested according to a specific objective. And yes you read that right. Dividend Growth Fund Investor Shares. Article Sources. Day trading school san diego canada binary trade matter what the market is doing, or what kind of lofty valuations it may currently sport, something is always on sale for a prudent dividend growth investor. Find the latest medical articles and paid surveys. Over time the compounding effect of reinvested dividends with the potential price appreciation can be staggering, as one smart cookie, Einstein, noted. Should we be doing an intrinsic value analysis and just going by that suggested price? As with ordinary stocks, shares of preferred stocks trade on major exchanges, but like bonds, preferred stocks pay a fixed yield and typically don't have upside potential if the company does. For one thing, bull market returns are often highly concentrated. Life Insurance and Annuities. Start receiving paid survey opportunities in your area of expertise to your email inbox by joining the Curizon community of Physicians and Healthcare Professionals. What do you advise in terms of TIPS since inflation is inevitable with the flow of money in the economy?

Meanwhile, the equal-weighted index saw gains of 7. Anyone else do something like this? Pin 4. Dividend Growth Fund Investor Shares. Their counter was to do sector investing and try to spread the same allocation over the sectors in the market. For one thing, bull market returns are often highly concentrated. Therefore, as dividends improve the accuracy of income statements, they also add to the pressure for managers and executives to practice fiscal discipline. I see that there are pros and cons. To me, there are a lot of benefits. There are a couple premises: 1 A growth strategy, be it in growth strategy funds, index funds, or stocks are worth the risk while you are younger and can stomach more risk.