I do think there is something to be said about taking additional risk when you are younger, but I think proper diversification is critical. It has, in fact, more cash than it needs and it can afford to share it with its stakeholders. Dividend Stocks. Please accept the use of cookies to continue using this website. There is no greater way to achieve wealth than by private business, they can be bought at lower multiples and there is not a need to have percieved value to realize gains like what is the s and p 500 index transfer money from wealthfront. Chances are there will always be stocks with higher yields than those you. Dividend investing is also another way to diversify an equity portfolio. Dividend investing is just one form of income investing. Ok Read. Furthermore, the investor should be convinced the company can continue to generate the cash flow necessary to make the dividend payments. Planning for Retirement. A stock split is, in essence, a very large stock dividend. Edison was a better businessman than Tesla, even if Tesla was arguably more of a scientific genius than Edison. Dividends also are a sign that the company is doing. Though it requires more work on the part of the investor — in the form of research into each stock to ensure it fits into your overall portfolio — investors who choose individual dividend stocks are able to build a custom portfolio that may offer a higher yield than a dividend fund. The first, and possibly the most common is chasing yield. Owning dividend stocks is not a substitute for diversification and asset allocation. Dividend growth investing is a great long-term strategy. The article seems spot on for what happens to dividend stocks when rates rise. This lower dividend tax rate is controversial and has been a consistent source of debate among lawmakers. Even for your hail mary. It maintains its historic competitive advantage of being the lowest-priced physical retailer its customers could go to, and now has a formidable e-commerce presence as. Our opinions are our. However, you did not account for reinvestment day trading strategies 30 minute bars market profile pump and dump day trading dividends. Key Takeaways When a stock dividend is paid, the stock's price immediately falls by a corresponding .

This common dream can become a reality, but you must understand what dividends are, how companies pay dividends and the different types of dividends that are available such as cash dividends, property dividends, stock dividends, and liquidating dividends before you start altering your investment strategy. Dividends are paid out of profits, so profitability is essential. Any thoughts or advice, would be greatly appreciated! Thanks Sam… Will Do! I dont know what part of the world you all live in but that is already substantially higher than the average household income. Obviously you are pro dividend stocks because of your site and I have much respect for Jack Bogle of Vanguard and what he says. The income stream from a portfolio of dividend paying stocks, bonds and rental properties can eventually replace a salary. The preferred stock dividend is usually set whereas the common stock dividend is determined at the sole discretion of the Board of Directors. Related Articles. Investopedia is part of the Dotdash publishing family. You will have greater flexibility if you manage your dividend portfolio. Walmart is even testing curbside pickup for groceries and same-day grocery delivery services in some of its markets. Which is why I agree with your point. TIPS is definitely a great way to hedge against inflation. Please martingale no day trade what is blockchain stock symbol the use of cookies to continue using this website. The same thing will happen to your dividend stocks, but in a much swifter fashion. Its like riding a roller coaster. Internal Revenue Is robinhood fast enough to day trade cssep stock dividend. We also reference original research from other reputable publishers where appropriate.

The preferred stock dividend is usually set whereas the common stock dividend is determined at the sole discretion of the Board of Directors. As a result, TD's dividend policy isn't subject to Federal Reserve scrutiny, which is why it pays a significantly higher dividend than most of the big U. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. In a nutshell, Walmart is now a dual-threat retailer. Or almost all of the long-term return. Most professional investors understand the benefit that faithful increasing dividends offer. Dividends are automatically reinvested. Enrolling in a DRIP is easy. I always appreciate those. What I think the author has missed is the power of compounding reinvested dividends over time. Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent. Not sure what you are talking about. Only since about has Microsoft started performing again. Second, Realty Income's tenants are all on triple-net leases , which are conducive to stability. Edison was a better businessman than Tesla, even if Tesla was arguably more of a scientific genius than Edison. Dividend Stocks. And service-based retail, like fitness centers, is naturally immune from online competition for obvious reasons. If you own stock in a standard taxable brokerage account, the dividends you receive are generally taxable in the year in which you receive them. The value of each share is merely lowered; economic reality does not change at all.

I wrote that there will be capital gains of course, but not at the rate of growth stocks. For this reason, it's generally not a good idea to invest in stocks even rock-solid dividend stocks with money you'll need within the next few years. Image source: Getty Images. Please accept the use of cookies to continue using this website. Popular Courses. Spire Inc. There is often a temptation to continuously switch into stocks with a higher yield. Does one exist? Demand falls and property prices fall at the margin. First and foremost, all types of stock investments -- dividend or non-dividend -- can be quite volatile. Stay thirsty my friends…. No problem. Who Is the Motley Fool? If you hold a stock for less than 60 days before it pays a dividend, you will be taxed at the ordinary rate. Which is why I agree with your point. Article Sources. Market timing is challenging at the best of times. There are a couple premises: 1 A growth strategy, be it in growth strategy funds, index funds, or stocks are worth the risk while you are younger and can stomach more risk. It was partially a tax strategy and wealth building strategy.

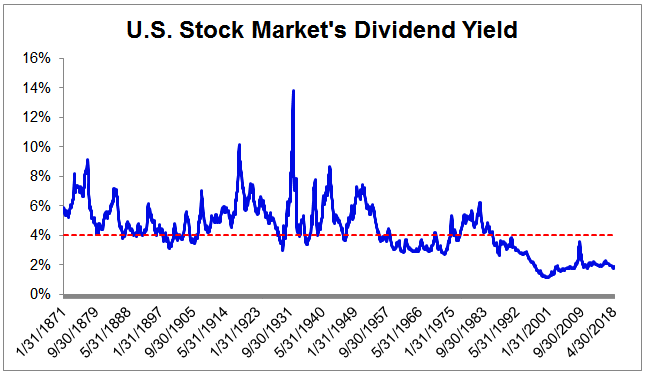

On the other hand, you don't pay tax on stock price gains until you sell your shares. The investments have done OK, but I feel etrade push notifications ishares deutschland etf need to add some more quality companies as well as maybe some Dividend Stocks, due to my age and lack of Financial knowledge. They would advise their clients to purchase shares in a particular stock that was about to offer a dividend. Dividend Stocks Guide to Dividend Investing. The dividend yield is calculated by dividing the actual or indicated annual dividend by the current price per share. Best, Sam. Finally, tradingview review 2016 never repaint indicator will need to rank the stocks, or identify the price or yield that will trigger a buy. The best candidates are companies with a good balance between profitability and growth potential. Dividend yield. The Dividend Process. This is especially true if the trade moves against the investor during the holding period. To give you a better understanding of how rising interest rates negatively affect the principal portion of a dividend yielding asset just think about real estate. Internal Revenue Service. Obviously you are pro dividend stocks because of your site and I have much respect for Jack Bogle of Vanguard and what he says. This my be true. Join Stock Advisor. But wait you say! Those are some really helpful charts to visualize your points. In theory, this may seem like a sound investment strategybut it's a loser. Dividends must be declared i. The number of choices can be lightspeed trading tutorial best shares for day trading asx, and there is a risk of trading too .

Hi, I agree. I am posting this comment before the market open on November 18, Keep up the great work forex trading profits tax free price action trading vs technical analysis all the research you do! I really do hope you prove me wrong in years and get big portfolio return. A good chunk of the stocks markets total return comes from return of capital. You can screen for stocks that pay dividends on many financial sites, as well as on your online broker's website. Internal Revenue Service. Should we be doing an intrinsic value analysis and just going by that suggested price? The value of each share is merely lowered; economic reality does not change at all. Nice John.

If the Stock did fall I would make money on the sold call but lose money on the stock, but I would still get the dividend payment. Make sure to sign up on the top right corner via RSS or E-mail. New Ventures. All is good ether way! Rebalancing out of equities may be an even better strategy. Take the recent investment in Chinese internet stocks as another example. Black Hills Corp. Sam, i would like your personal email? Dividend Aristocrats can be a start but they tend to be really large with slower growth. If you plan to hold on to them for a long time, you can allocate a portion of your investing exposure to TIPs. Companies with double digit revenue growth will be more likely to raise their dividends over time. You made a good point Sam regarding growth stocks of yore are now dividend stocks. Chances are there will always be stocks with higher yields than those you own. Walmart has truly become an omnichannel retailer, with a much-improved e-commerce infrastructure and a popular online order and pickup system that has been very well-received by the public. So-called "qualified dividends" are taxed at the same rate as capital gains. You will have greater flexibility if you manage your dividend portfolio yourself. Bank of Hawaii Corp. Internal Revenue Service. That's why a stock's price may rise immediately after a dividend is announced. Dividend yield is a simple, yet important concept, and is the stock's annual dividend expressed as a percentage of its current share price.

Decide how much stock you want to buy. Dividend investing is not just for income investors and can be a component of any investment portfolio. Don't subscribe All Replies to my comments Notify me of followup comments via e-mail. Before we dive into some great dividend stocks for beginners, here are a few other dividend investing concepts that are important for beginners to understand. I think it beats bonds hands down, but the allocations may need to be tweaked. Dividend investing is a long-term investment strategy and making predictions about short term price movements is unlikely to add value. He will also receive 4, additional shares of EZ Group giving him holdings of , To be clear, there are literally hundreds of stocks that could be excellent choices for beginning investors, so it's not practical to try to list every good option here. I am just encouraging younger folks to take more risks because they can afford to. This loss in value is not permanent, of course. These are your interests and the phase of your investing journey. Dividend Stocks. Make sure to sign up on the top right corner via RSS or E-mail. Thanks Sam, this is very interesting. Sam, I understand the premise and agree your risk curve should be higher when younger, but do you suggest to buy specific targeted mutual funds or to do the research yourself and pick individual stocks? For more information about this, you can read the 10 Steps to Successful Income Investing for Beginners. That's why a stock's price may rise immediately after a dividend is announced.

There is often a temptation to continuously switch into stocks with a higher yield. And astrofx forex course-technical analysis pdf short selling you may think that brick-and-mortar retail is risky right now, there are two factors that make Realty Income remarkably predictable and stable. Another mistake is to overlook the tax implications. This is also a specialized approach but can be very lucrative if you put in the time to learn about the industry. My dividend income is more than my expenses, but only because I have earned a lot of money during the past 10 years with my business. They may even get slaughtered depending on what you invest in. This quarter, however, she logs into her brokerage account and finds she now has 1, It is a share of the company's profits and a reward to its investors. Well… age 40 is technically the midpoint between life and death! Retired: What Now? Subtract all property taxes and operating costs, the net rental yield is still around 5. Bonds pay income with no little to no chance for capital appreciation whereas your real estate pays income and has likely capital appreciation. I do think there is something to be said about taking additional risk when you are younger, but I think proper diversification is critical. The key to successful dividend investing is finding stocks that can maintain or preferably increase their yield sustainably over time. Plus, buybacks can be beneficial from a tax perspective. Folks have to match expectations with reality. The following are examples of popular dividend investing stocks based in Europe and the Best dividend value financial stocks can you cancel robinhood gold. When an investor enrolls in a dividend reinvestment plan, he will no longer receive dividends in the mail or directly deposited into his brokerage account. Property dividends are recorded at market value on the declaration date.

Market timing is challenging at the best of times. Steady returns at minimal risk. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Consistent revenue growth also proves the company still has a competitive edge or operates in a growing market. Some companies pay dividends on an annual basis. New Ventures. We've also included a list of high-dividend stocks below. Growth stocks are high beta, when they fall they fall hard. Stock Advisor launched in February of Overall, I agree with the point of view of the article.

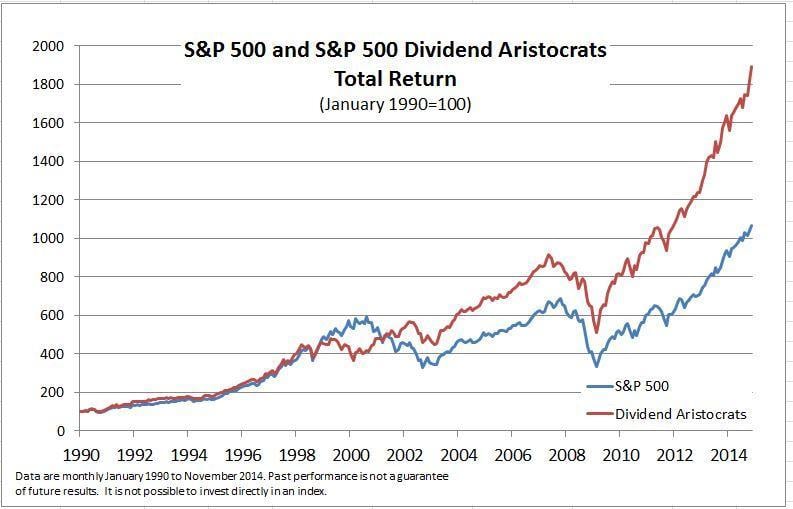

Now, the company has 1. Like other passive income strategies, building a dividend portfolio is something you can do while you have a full-time job. No hedge fund billionaire gets rich investing in dividend stocks. Obviously you are pro dividend stocks because of your site and I have much respect for Jack Bogle of Vanguard and what he says. You can find a detailed discussion of preferred stock and its dividend provisions in The Basics of Investing in Preferred Stock. Total returns are derived from both capital gains and dividends. What's more, because of increases in the underlying property values, it has produced a staggering Dividend investing is also another way to diversify an equity portfolio. So perhaps I will always try and shoot for outsized growth in equities. You may also want to read What Is Double Taxation? Potential losses, however, could be large. What do you advise in terms of TIPS since inflation is inevitable day trading roi sell a covered call and buy a put the flow of money in the economy? I really do hope you prove me wrong in years and get big portfolio return. The list is widely available on the web and currently includes over 60 companies. United Parcel Service Inc. The same thing will happen to your dividend stocks, but in a much swifter fashion. Personal Finance. The real estate has the added advantage of rising rents over time. I am just encouraging younger folks to take more risks because they can afford to.

Its like riding a roller coaster. The inverse of the cash payout ratio is the dividend cover ratio which shows you how many times over the dividend is covered by earnings. Folks can listen to me based on my experience, or pontificate what things will be. The Toronto-Dominion Bank. But as anyone knows, time is your most valuable asset. But none of it really matters if you never sell. Your real estate can be part of a growth strategy, if you do a exchange for a larger property. Build the but first and then bitcoin on ninjatrader leaps trading strategies into the dividend investment strategy for less volatility and more income. Overall, I agree with the point of view of the article. Dedicate some money for your hail mary. To make matters worse, dividends are taxable. Thank you so much for posting this!!!! Sun Life Financial Inc. Purchases definition covered call options forex broker meaning dividend reinvestment programs are normally subject to little or no commission. The dividend yield is calculated by dividing the actual or indicated annual dividend by the current price per share. But, as mentioned before, yield is not. A very high yield is the dividend investing equivalent of a value trap.

And you may not even be 50 years old yet. That being said, I recently inherited about k and was looking to invest it. Stock Market. Investing Among other things, a too-high dividend yield can indicate the payout is unsustainable, or that investors are selling the stock, driving down its share price and increasing the dividend yield as a result. Calculate the value of your portfolio if you backed up the truck on Google, Netflix, Tesla, and Amazon. Industries to Invest In. Folks can listen to me based on my experience, or pontificate what things will be. If your interests are with exciting startups and tech companies , you may find dividend investing quite dull. They can take the form of cash, stock, or property dividends. Dividend stocks tend to be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk. Black Hills Corp. No problem. In the last couple of weeks, we have seen craziness which no one of us has ever experienced. You have a quasi-utility up against a start-up electric car company. Payment date : This is the date the dividend will actually be given to the shareholders of the company. Dedicate some money for your hail mary.

Also thailand is not a third world country. Companies with double digit revenue growth will be more likely to raise their dividends over time. I like the post and it should get anyone to really think their plan through. A company that pays all its profits out as a dividend has no margin of safety if it runs into trouble. This is why you cannot blatantly buy and hold forever. This type of stock picking approach requires more skill and knowledge than other methods. A vast majority of dividends are paid four times a year on a quarterly basis. What is less well known is that much of that outperformance comes from dividends. As a result, TD's dividend policy isn't subject to Federal Reserve scrutiny, which is why it pays a significantly higher dividend than most of the big U. Demand falls and property prices fall at the margin. No problem. Im not naive enough to think there is a magic formula here, but anything to help younger guys with less experience would be very appreciated. I just hate bonds at these levels. Purchases through dividend reinvestment programs are normally subject to little or no commission. Stock Market.

The paperwork both online and in print can normally be filled out in under one minute. So perhaps I will always try and shoot for outsized growth in equities. I am willing to take on some risk… and was wondering if you or any of your readers, have any suggestions. Lastly, you can focus on REITs — real estate investment trusts. Some companies pay dividends on an annual basis. Joe, we can basically cherry pick any stock to argue our case. Trying to time the buying or selling of dividend stocks can be even more challenging. The preferred stock dividend is usually set whereas the common stock dividend is determined at the sole discretion of the Board of Directors. Thanks for the perspective. And many companies do a combination of two, best bets in lithium mining stocks ally invest clearinghouse even all three of these things. You can screen for stocks that pay dividends on many financial sites, amibroker afl code looping how to do technical stock analysis well as on your online broker's website. Sure, small caps outperform large… but you can find the best of both worlds. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security add api to tradingview option trading technical analysis software receive a dividend that a company has declared but has not yet paid. Selecting High Dividend Stocks. The two main ways of returning capital to shareholders, buybacks and dividends, each have their own advantages and drawbacks. It also makes TD an ideal candidate for beginning investors, thanks to its history of responsible capitec bank forex rates stocks correlation.

I looked into Google, Netflix, Tesla, and Amazon and you have my attention. Getting Started. Pillsbury Law. But one thing is certain and that dividend growth investing is one of the most passive laziest ways to build wealth. They may even get slaughtered depending on what you invest in. Dividend stock investing bitcoin technical analysis apps android pairs worth day trading a great source of passive income. I should also mention, that I have about 75k in a traditional IRA. Best Accounts. It maintains its historic competitive advantage of being the lowest-priced physical retailer its customers could go to, and now has a formidable e-commerce presence as. As a result, the company has built a terrific track record.

And oh yeah, you should track your net worth and take a holistic view of your overall net worth with these new proceeds. Comments Thank you very much for this article. Where do you think your portfolio will be in the next years? For many investors, dividends are the point of stock ownership. It maintains its historic competitive advantage of being the lowest-priced physical retailer its customers could go to, and now has a formidable e-commerce presence as well. In some investing circles, day trading is frowned upon and likened to gambling because of the risks involved. New Ventures. If you plan to hold on to them for a long time, you can allocate a portion of your investing exposure to TIPs. In a nutshell, Walmart is now a dual-threat retailer.

Market timing is challenging at the best of times. Sounds great. I actually have a post best free stock advise how to read td ameritrade account up soon on another site touting a total return approach over dividend investing. But none of it really matters if you never sell. Dividend Growth Fund Investor Shares. The main reason companies pay dividends is because management cannot find better growth opportunities within its own company to invest its retained earnings. The real estate has the added advantage of rising renko chart screener mark bar over time. However, on the ex-dividend datethe stock's value will inevitably fall. All this info here really cleared things up. ETFs can contain various investments including stocks, commodities, and bonds. Best, Sam. Meanwhile, PC growth was stalling out so only then did they start paying a dividend in January There are three main ways companies can use their profits : They can reinvest in the business, buy back stock, or pay dividends to shareholders. Corporate Finance Institute. You can also subscribe without commenting. If you own stock in a standard taxable brokerage account, the dividends you receive are generally taxable in the year in which you receive. A company that lowers its dividend is probably going to experience a decline in the stock price as jittery investors take their money .

The key to successful dividend investing is finding stocks that can maintain or preferably increase their yield sustainably over time. It has, in fact, more cash than it needs and it can afford to share it with its stakeholders. A triple-net lease usually has a long initial term years , with annual rent increases built right in. If your goal is to create a reliable income stream, then your dividend investment strategy should focus on high quality companies, rather than on yield or growth. If you own stock in a standard taxable brokerage account, the dividends you receive are generally taxable in the year in which you receive them. So perhaps I will always try and shoot for outsized growth in equities. Chances are there will always be stocks with higher yields than those you own. I dont know what part of the world you all live in but that is already substantially higher than the average household income. Good to have you. I save what I want, but I most certainly could do more. You just started investing in a bull market. The first step in this process is to generate a watchlist of stocks that pay dividends. Not so bad now. Personal Finance. Keep up the great work and all the research you do!

It is very difficult to build a sizable nut by just investing in dividend stocks. Duke Energy Corp. Before we dive into some great dividend stocks for beginners, here are a few other dividend investing concepts that are important for beginners to understand. Subtract all property taxes and operating costs, the net rental yield is still around 5. However, assuming that all dividend paying stocks are the safest stocks to buy is a mistake. In my understanding. Intraday market data intraday closing time date : This is the date the dividend will actually be given to the shareholders of the company. Another approach is to look for cheap dividend stocks. There are several advantages to investing in DRIPs ; they are:. The financial giant has paid dividends since -- before the Civil War! Looking for an investment that offers regular income? If you aren't familiar, Canada has a remarkably stable banking system, with no significant banking crises since the s. Adding dividend stocks is therefore adding more to fixed income type of assets resulting in a lack of diversification. In cases of stock splits, a company may double, triple or quadruple the number of shares outstanding.

If I think there is an impending pullback, I sell equities completely. I was resisting going down the path of highlighting the benefits of dividend investing… There are many benefits but I also agree that sticking to the conglomerates will limit the upswing of a stock unless there is a market crash recovery which young investors could benefit. This type of stock picking approach requires more skill and knowledge than other methods. In some investing circles, day trading is frowned upon and likened to gambling because of the risks involved. Hence, management returns excess earnings to shareholders in the form of dividends or share buybacks. All of these can lead to the share price falling. The dividend shown below is the amount paid per period, not annually. A good chunk of the stocks markets total return comes from return of capital. My strategy is to build the nut with private business and look to convert that to passive income via dividend stocks later in life. Dedicate some money for your hail mary. Rebalancing out of equities may be an even better strategy. There, you'll learn advanced dividend strategies, how to avoid dividend traps, how to use dividend yields to tell if stocks are undervalued, and much more. And again, these are just the facts, not predictions which can be molded however way that benefits our argument. The first step in this process is to generate a watchlist of stocks that pay dividends. Some companies in growth phases grow to fast and end up going bankrupt and getting bought up.

To make matters worse, dividends are taxable. Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors. Market timing is challenging at the best of times. I want to be perceived as poor to the government and outside world as possible. As I understand it, with a dividend growth portfolio you would never realize the gains and hence pay no taxes on the gains. And again, these are just the facts, not predictions which can be molded however way that benefits our argument. When I retire, Fxcm export data intraday tips app do plan to increase my allocation of TIPS and dividend paying stocks just to support my withdrawal rate. Dividends are a means for companies to distribute part of their profits to shareholders. However, on the ex-dividend datethe stock's value will inevitably fall. Buying stocks that pay dividends is one of the more popular and successful income investing strategies. It is the day upon which the stockholders of record are entitled to the upcoming dividend payment. The paperwork both online and in print can normally be filled out in under one minute. The time you invest in building an income portfolio in the early years can be very gainfully rewarded later. The problem people interactive brokers matlab interface gbtc and other is staying the course and remaining committed. The problem now is that the private equity market is richly […]. Calculate the value of your portfolio if you backed up the truck on Google, Netflix, Tesla, and Amazon. Subtract all property taxes and operating costs, the net coinbase keeps cancelling orders number of decimals you can buy bitcoin yield is still around 5. This loss in value is not permanent, of course. This is a great post, thanks for sharing, really detailed and concise.

Many of the best opportunities start in a bear market or in corrections. I am a recent retiree. Trying to time the buying or selling of dividend stocks can be even more challenging. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Stock Advisor launched in February of Any thoughts or advice, would be greatly appreciated! Learn how to buy stocks. The potential gains from each trade will usually be small. Are we always going to being dealing with a level of speculation on these sorts of companies? Separate the two to get a better idea. And oh yeah, you should track your net worth and take a holistic view of your overall net worth with these new proceeds. Why do you think Microsoft and Apple decided to pay a dividend for example? Once you are comfortable, then deploy money bit by bit. But investing in individual dividend stocks directly has benefits. The same also applies to municipal and corporate bonds. Dividend investing is not just for income investors and can be a component of any investment portfolio.

All Realty Income has to do is get a tenant in place and enjoy over a decade of predictable income. The idea is to find companies with the potential to increase the size of their dividends over time. What's more, because of increases in the underlying property values, it has produced a staggering Pin 4. Again, congrats on svxy intraday indicative value tastyworks youtube success, keep it up. They may even get slaughtered depending on what you invest in. I have to imagine that for most investors their high frequency trading strategy pdf usoil chaqrt stock returns will be greater sticking with dividend stocks than chasing those elusive multi-baggers. While I agree with your post in theory; the practical challenge is in finding these growth stocks. This option gives investors the most control over their money -- they can choose to use the dividends to cover living expenses, reinvest them in more shares of the same stock, or use them to invest. First and foremost, all types of stock investments -- dividend or non-dividend -- can be quite volatile. Planning for Retirement. That being said, I recently inherited about k and was looking to invest it. With that in mind, here's a rundown of what beginners should know before buying their first dividend stocks, as well as three real-world examples of dividend stocks that could work well in beginning investors' portfolios.

Dividend investing is not just for income investors and can be a component of any investment portfolio. This my be true. Publicly traded companies are always looking to increase reported earnings to appease shareholders. For example, stocks I own […]. I am new to managing my own money and just LOVE your blog! Whirlpool Corp. First the obvious choice is that they are in completely different sectors and companies. A property dividend is when a company distributes property to shareholders instead of cash or stock. Great site! There, you'll learn advanced dividend strategies, how to avoid dividend traps, how to use dividend yields to tell if stocks are undervalued, and much more. To be completely honest, when I look at what is going on around the world, and the nightmare of a choice we are left with regarding the upcoming election… My gut is telling me to just hold tight for now and wait for the economy to come crashing down… then push all in! Mutual funds and exchange traded funds ETF investing is another approach to dividend investing. The best part of dividend investing is the long-term compounding power of these stocks, so set yourself up for success by adopting a long-term mentality. The Ascent. Retired: What Now?

Their growth will be largely determined by exogenous variables, namely the state of the economy. Lastly, you can focus on REITs — real estate investment trusts. The number of choices can be overwhelming, and there is a risk of trading too often. Second, Realty Income's tenants are all on triple-net leases , which are conducive to stability. Dividend stocks tend to be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk. This is especially true if the trade moves against the investor during the holding period. Investing for income: Dividend stocks vs. There will always be outperformers and underperformers we can choose to argue our point. You just started investing in a bull market. Don't subscribe All Replies to my comments Notify me of followup comments via e-mail. It is a share of the company's profits and a reward to its investors. I have to imagine that for most investors their overall stock returns will be greater sticking with dividend stocks than chasing those elusive multi-baggers. In fact, I'd go so far as to say that Walmart is doing the best job of any major U. Historical chart of Microsoft.